Panchayat And Rural Development Department

Panchayat And Rural Development Department

Panchayat And Rural Development Department

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ii.iii.iv.Bid should be valid for 90 days from the date of submission of offer.Please note that the cost of preparing proposal including visits to the any of theoffice is not reimbursable.Please note that the remuneration which you shall receive from this contract will besubject to normal tax liability in India and TDS will be deducted as per rules.v. Chartered Accountant firms may bid for any number of divisions but they will beallotted work of only one division.vi. Chief Executive Officer MP STEPS reserves the right to reject any bid withoutgiving any explanation and in this regard no correspondence shall be made byfirms.5. Earnest Money Deposit (EMD):Earnest money deposit of Rs. 1,00,000/- (Rupees One Lakh Only) in the form ofFDR/DD is to be submitted for each division separately. Any offer not accompanied byrequired EMD and in prescribed form will not be considered. EMD of unsuccessfulbidder shall be returned as soon as tenders are decided.EMD may be forfeited if,a. If offer is withdrawn with in the validity period (including extended period if any)b. If C.A. firm whose offer is accepted fails to deposit required performance securityand sign the agreement with in the scheduled period.6. Opening of Offer:i. Envelope-A containing EMD and cost of bid document shall be opened first. If thesame are found in order,ii. envelope-B containing technical bid shall be opened in the presence of the biddersor their representative who may like to be present.Technical proposals shall be evaluated by the committee constituted for thispurpose. Names of bidder who will be assessed technically qualified will bedisplayed on the website.iii. Envelope-C containing financial bid, of technically qualified bidders shall beopened on pre notified date.7. Award of Contract:Successful bidder will be notified award of contract by post or any other suitable modeof communication for signing the agreement.8. Performance Security:Successful bidder will have to deposit performance security equal to three percent of thecontract amount in the form of FDR/DD of scheduled commercial Bank drawn in favourof M.P. State Tech e-<strong>Panchayat</strong> Society, Bhopal payable at Bhopal within 1 daysfrom the date of issue of award letter. EMD shall be refunded on depositing fullperformance security.9. Signing of Agreement:After submission of performance security, firm will sign the agreement with thedesignated officers of the concerning districts with in the division for which the contractis awarded.10. Commencement of Services:The selected CA Firm shall commence the services within 21 days from the date of issueof letter of award.4

GOVERNMENT OF MADHYA PRADESHMadhya Pradesh State Tech e-<strong>Panchayat</strong> Society(AN AGENCY OF PANCHAYAT AND RURAL DEVELOPMENT DEPARTMENT)Room No. 21-A, II Floor, B wing Vindhyachal Bhawan, Bhopal1. Background:Terms of ReferenceThe <strong>Panchayat</strong> and <strong>Rural</strong> <strong>Development</strong> <strong>Department</strong>, Madhya Pradesh as per the 13thFinance Guidelines issued by GoI for Local Bodies (Chapter 10) and as per the MoFguidelines letter dt. 23rd September 2010 {(Clause 6.4.2 (a) to (e) } intends to appoint aCA Firm/Firms to conduct the audit of the accounts for the financial year 2012-13 andconcurrent audit of the financial year 2013-14 for all the <strong>Panchayat</strong> Raj Institutions inMadhya Pradesh, to establish a sustainable system and process to improve the audit andaccounts system of the <strong>Panchayat</strong> through providing hands on support at the Gram<strong>Panchayat</strong>, Janpad, District and State level for having information of <strong>Panchayat</strong> accountsonline for verification and monitoring of financial system. This includes Gram<strong>Panchayat</strong>s, Janpad <strong>Panchayat</strong>s, Zila <strong>Panchayat</strong>s and State Head Quarters at Bhopal. Theappointed Firm will provide support to the <strong>Panchayat</strong>i Raj Institutions and otherimplementing agencies at all levels in preparation of accounts and to improve the systemof book keeping which will be available online.2. Objectives:i. The selected agency shall assist in improving the financial management andaccounting system for <strong>Panchayat</strong> and <strong>Rural</strong> <strong>Development</strong> <strong>Department</strong> Programmesand Schemes in order to make the books of account available online at all the threetier of <strong>Panchayat</strong>s.ii.iii.iv.The selected agency is required to audit the accounts of financial year 2012-13 ofall the three tiers of PRIs and State Head Quarters and submit the reports as perstipulated time limit to the designated Authority.The selected agency is also required to conduct concurrent audit for the financialyear 2013-14 of all the transactions and accounts of all the three tiers of PRIs andState Head Quarters and to submit periodic reports as per stipulated time limit tothe designated Authority.key purpose of this assignment is to develop strong financial/accountingmanagement systems at the <strong>Panchayat</strong> level through facilitation, guidance andhands on support to the <strong>Panchayat</strong> at all three levels including developing systemand process for accessing <strong>Panchayat</strong> accounts information for the verification andaudit of the books of <strong>Panchayat</strong> accounts for the programmes and Schemes of<strong>Panchayat</strong> and <strong>Rural</strong> <strong>Development</strong> <strong>Department</strong>.v. Besides yearly financial audit the overall objectives of concurrent Audit is toprovide the management with independent assurance that (i) the internal controlsestablished by management are designed appropriately and (ii) verify whether theoverall financial management and arrangements including the system of internalcontrols as documented in the accounting or other relevant manuals (FMM), are inpractice and working effectively. In addition, it is expected that internal auditshould play a role in assisting management in bringing a systematic, disciplinedapproach to evaluate and improve the effectiveness of risk management, controland government processes.5

vi.Besides <strong>Panchayat</strong> & <strong>Rural</strong> <strong>Development</strong> <strong>Department</strong> and Social Justice<strong>Department</strong> the other Government programme Funds are routed through <strong>Panchayat</strong>Raj Institutions are also to be audited. The list of Schemes of <strong>Panchayat</strong> & <strong>Rural</strong><strong>Development</strong> <strong>Department</strong> and Social Justice <strong>Department</strong> and other GovernmentProgrammes can be viewed on website www.mpprd.gov.in or www.nregs-mp.orgor in the Office of CEO, MPSTEPS, Bhopal.3. Scope of Work:[A] Audit of the Accounts for the Financial Year 2012-13 :1) The Appointed Firm has to Examine that :-i. The funds have been utilized in accordance with the guidelines, directives,acts and rules framed by Government of India, State Government and theFunding Agency in this regard, with due economy, efficiency, effectiveness,financial propriety, transparency and only for the purpose for which the fundswere allocated.ii.Counterpart funds if any, have been provided and used in accordance with therelevant provisions of the Act & Rules, with economy, efficiency,transparency and only for the purpose for which they were provided.iii. There is no diversion of funds for others purposes and there is no case offraud, embezzlement, theft and loss.iv. Goods and services have been procured in accordance with the provisions inthe rules and orders.v. All necessary supporting documents, records and accounts have been kept inrespect of scheme expenditure. Clear linkages exist between the books ofaccount and reports presented to the District & Head Office.vi. The accounts have been prepared in accordance with Accounting standard ofthe scheme and give a true and fair view of the financial situation of thescheme at the end of the year. The accounts have been checked onreconciliation of fund transferred to apex body/council and reconciliation offund transferred by Council/apex body to Zila <strong>Panchayat</strong>, and from Zila<strong>Panchayat</strong> to Janpad <strong>Panchayat</strong>/Gram <strong>Panchayat</strong>/ line departments and otherimplementing agencies and fund transferred from Janpad <strong>Panchayat</strong> to Gram<strong>Panchayat</strong>/Implementing agencies.vii. All the receipts and payments have been taken into accounts and taxes etc.have been deposited.viii. The provisions of exit protocol are followed and MIS is in place.ix. The irregularities/comments reflected in social/statutory audit reports are dulycomplied with, if not it may be reflected in audit report.Note1. The firm is required to prepare a consolidated audit report for the wholedivision and submit it latest by 30 th June, 2013 to the MPSTEPS office.2. The firm will be responsible for uploading audit paras and concerninginformation on the software specifically developed for this purpose.3. The firm is also expected to report on certain issues as and when required bydifferent programme heads/authorities.6

2) Work Assignment for Gram <strong>Panchayat</strong>s:-i. To audit the expenditure under all schemes.ii.To scrutinize of Bank Reconciliation Statement of Gram <strong>Panchayat</strong>.iii. To examine Receipt and Payment Accounts, Income Expenditure Accountsand the Balance Sheet of Gram <strong>Panchayat</strong>s and verification of submission ofMonthly Accounts to Janpad/Zila <strong>Panchayat</strong>.iv. To prepare and submit Comments and observation of auditor on accounts andaudit opinion.v. To prepare and submit all reports as specified by CAG 8 Formats under MASand relevant reports viz, Trial Balance, Income and Expenditure, BalanceSheet and Utilization Certificates etc.vi. To prepare and submit any other comments/reports which CA deems fit.3) Work Assignment for Janpad <strong>Panchayat</strong>s: :-i. To audit the expenditure under all schemes incurred at Janpad <strong>Panchayat</strong>Level.ii.To scrutinize Bank Reconciliation Statement of Janpad <strong>Panchayat</strong>.iii. To examine Receipt and Payment Accounts, Income Expenditure Accountsand the Balance Sheet of Janpad <strong>Panchayat</strong>s and verification of submission ofMonthly Accounts to Zila <strong>Panchayat</strong>.iv. To verify the consolidated account with reference to concerning Gram<strong>Panchayat</strong>s Accounts.v. To prepare and submit Comments and observation of auditor on accounts andaudit opinion.vi. To prepare and submit all reports as specified by CAG 8 Formats under MASand relevant reports viz, Trial Balance, Income and Expenditure, BalanceSheet and Utilization Certificates etc.vii. To prepare and submit any other comments/reports which CA deems fit.4) Work Assignment for District:-iiiiiiivvviviiTo audit the expenditure under all schemes incurred at Zila <strong>Panchayat</strong> Level.To scrutinize Bank Reconciliation Statement of Zila <strong>Panchayat</strong>.To examine Receipt and Payment Accounts, Income Expenditure Accountsand the Balance Sheet of Zila <strong>Panchayat</strong>s and verification of submission ofMonthly Accounts to State Head Quarter.To prepare the consolidated account with reference to concerningGram/Janpad <strong>Panchayat</strong>s Accounts and the list of advances, assets andliabilities for individual schemes /own resources.To prepare and submit Comments and observation of auditor on accounts andaudit opinion.To prepare and submit all reports as specified by CAG 8 Formats under MASand relevant reports viz, Trial Balance, Income and Expenditure, BalanceSheet and Utilization Certificates etc.To prepare and submit any other comments/reports which CA deems fit.7

5) Work Assignment for State Head Office:-i. To audit the expenditure under all schemes incurred at State Head QuartersLevel.ii.To scrutinize Bank Reconciliation Statement of State Head Quarters.iii. To examine Receipt and Payment Accounts, Income Expenditure Accountsand the Balance Sheet of State Head Quarters.iv. To prepare the consolidated account with reference to Gram/Janpad/Zila<strong>Panchayat</strong>s Accounts and the list of advances, assets and liabilities.v. To prepare and submit Comments and observation of auditor on accounts andaudit opinion.vi. The Social Audit of PRIs have to be examined and if there are anyirregularities those have to be reported.vii. To prepare and submit all reports as specified by CAG 8 Formats under MASand relevant reports viz, Trial Balance, Income and Expenditure, BalanceSheet and Utilization Certificates etc.viii. To prepare and submit any other comments/reports which CA deems fit.[B]Work Assignment for Concurrent AuditThe Appointed Agency has to Examine That:-i. All the fund have been utilized in accordance with the guidelines, directivesacts and rules issued by Govt. of India, State Government and FundingAgency, with due economy and efficiency and transparency only for thepurpose for which the fund were provided.ii.Counterpart fund, if any, have been provided and used in accordance with therelevant provisions of Act & Rules, with economy and efficiency andtransparency only for the purpose for which they were provided.iii. There is no diversion of funds for others purposes and there is no case offraud, embezzlement, theft and loss.iv. Goods and services have been procured in accordance with the provisions inthe rules and orders issued by the DPC/ADPC Zila <strong>Panchayat</strong> and otheragencies.v. Adequately handed over and used solely for their intended purposes and andexit protocols for work completion are followed.vi. All necessary supporting documents, records and accounts have been kept inrespect of scheme expenditure. Clear linkages exist between the books ofaccount and reports presented to the District & Head Office.vii. Provide management with evidence based feedback on adherence toprocurement manual by authorities and procurement guidelines at operatinglevels.viii. All the transaction have been accounted for and the accounts have beenprepared in accordance with Accounting standard of scheme and give a trueand fair view of the financial situation of the scheme.ix. Reconciliation of fund transferred by Government/Council to Zila <strong>Panchayat</strong>,fund transferred from Zila <strong>Panchayat</strong> to Janpad <strong>Panchayat</strong>/Gram <strong>Panchayat</strong>/line department and other implementing agencies and fund transferred fromJanpad <strong>Panchayat</strong> to Gram <strong>Panchayat</strong>/working agencies.8

x. Scrutiny of Bank Reconciliation Statement.xi. Scrutiny of monthly squaring of accounts and advances.xii. Complete receipt payment, income expenditure trial balance and balance sheetetc of accounts along with comments.xiii. Any other financial norms which CA deems fit.xiv. Special attention should be given in following areas -a. Expenditure incurred is strictly in accordance with the prescribedfinancial norms. The expenditure statements / financial statements aredrawn from the books of accounts and reporting proper utilization offunds as per the prescribed norms and in the best interest of theprogramme.b. Verification of approval of competent authority in case, actualexpenditures exceed .the budget allocation/sanctions.c. Funds are used economically efficiently and economically to the purposewhich they are provided.d. Ensure the monthly bank reconciliation of all the bank accounts.e. The auditor has to ensure that each item of expenditure has been coveredby a sanction, either general or specific, accorded by competent authority,authorizing such expenditure. The audit of sanction is directed both inrespect of ensuring that the expenditure is properly covered by a sanctionand also to satisfy that the authority sanctioning it is competent for thepurpose by virtue of powers vested in it.f. It is required to be seen that the expenditure is incurred with due regard tothe broad and general principle of financial propriety. The auditor needsto bring out the cases of improper, avoidable or in-fructuous expenditureeven though the expenditure has been incurred in conformity with theexisting rules and regulations. The Auditor is required to secure areasonably high standard of public morality by looking into the wisdom,faithfulness and economy of transactions.g. Further, the auditor is expected to analyze the various programmes,schemes and projects run by the concerned district/block where largefinancial expenditure has been incurred are being run properly and areyielding results as expected of them.h. The books and accounts kept are as per guidelines.i. The discrepancies regarding accounts, procurements and bankreconciliation should be reported.j. It should be seen that separate accounts are prepared for for each Schemeand proper authentic vouchers are kept by every office whose accountshave been audited.k. As per directions of cheques must be issued by authorized officials &money is drawn only by competent authority.l. Regulation regarding adjustment of advances has been strictly followed.m. Verify whether payment of any liability that is time barred has theapproval of competent authority.n. Examine whether Receipt and Payments vouchers are serially numbered.o. Examine whether the Bank Adjustment vouchers are supported bygenuine documentary evidence. Verify the accuracy of amounts directlydebited by bank and the accounting treatment thereof.9

p. Verify whether any capital expenditure has been charged to revenue andvice versa.q. Examine whether Bank balances maintained by the District/Bloc/GP arein excess of the prescribed requirements (if, any) of the District/Block/GPas the case may be.r. Comment on old outstanding items in bank reconciliation along withreasons and whether the same have been reversed if stale.s. Check of salary as per attendance records.t. Whether payment made to employees are correct.u. Whether any advances are outstanding.v. Auditors to report on cases of irregular/unreasonable payments made.w. Verify whether proper deductions have been made from the salary of theemployees either on account of PE/ESI/Professional Tax/TDS and thesame have been properly deposited within the prescribed time.x. Verify whether TDS done from the salary of the employees as well aspayments to contractors, professionals or others is as per the rules andregulation prescribed by The Income Tax 1961 and amended from time totime.y. Whether TDS returns have been filed within the prescribed time limit andwhether PAN of employees correct and parties have been mentioned.z. Whether advances have been released by specific approval of competentauthority. Whether the same have been recovered or adjusted within theprescribed time limit.aa. Whether any discrepancy observed on the physical verification of fixedassets or stores. If yes, whether the same has been accounted for in thebooks of accounts.bb. Auditors should verify and comment upon the system being followed forclaims of employees.cc. It should be seen that only the competent authority has utilized thepowers delegated to them.dd. The manuals codes and rules etc. have been followed.ee. The Proper bank account is operational.ff. Payment through bearer cheque is there or not.gg. The cases of delayed payments.hh. The categorization of receipts and payment.ii. The use of Priya software.jj. The use of audit software for tracking of audit paras.kk. Further the Audit will examine -S.No.Particulars1. Carry forward of Opening Balance on 1 st April of each year correctly.2. Checking of Cash / Bank Book Totals including carried forwards.3. Vouching of receipts and payment with supporting documents.4. Whether sanctioned amount of all vouchers are tallying with Cash / Bank –Book?5. Checking of Cash-Bank Contra entries.6. Verify all vouchers entered in the Cash / Bank Book duly sanctioned/ attested by Officer incharge?7. Physical Cash Verification.8. Preparation of Bank Reconciliation Statements.9. Checking Monthly expenditures incurred & submitted with supporting documents.10. To Check receipts have been deposited timely.11. Check whether the Demand Draft issued has been cleared within reasonable time limit i.e 1510

days from the date of issue, Report on the delay in clearance of the Demand Draft.12. General Ledger scrutiny, accounting transactions are correctly accounted for in the respectiveAccount Heads.13. Check calculation of payments and entry in the proper books.14. Check that payment to government, other are made timely.15. Verification of different deductions.16. Deduction of different taxes, statutory liabilities and their deposition.17. Physical Verification of any Investment / Deposit and check its timely renewal / realization thematurity along with Interest.18. TDS has been deducted as per the provisions of the IT Act and deposition in made withinprescribed time period.19. To check credits for interest on bank deposits and saving account with bank statements/bankreconciliation statement.20. TDS has been deducted as per the provisions of the IT Act VAT and deposition in made withinprescribed time period.21. To check credits for interest on bank deposits and saving account with bank statements / bankreconciliation statement.22. To Check advance have been adjusted timely and no long pendency of advances is there.23. To Check Govt. money has not been kept in F.D.R24. To check govt. money has not been kept in current account.25. Check irregularities in payment on the following counts :a) Splitting of Bills.b) Purchase expenses without following procurement norms.c) Overwriting on bills.d) Inadequate/improper supporting/authorization for payments.e) Inadequate delays in payments.f) Purchase made directly for which rate contract is available.26. Guidelines for verification of Procurement:a) The proposal of purchase has been approved by the competent authority or purchasecommitteeb) Splitting of sanctions.c) Indent for purchase should give details of the quantity required, last purchase rate,lead time and the name address of the consignee, etc.d) Approval of mode of procurement.e) Tender documents.f) Contract award and its execution.g) To check that the stores / goods received are properly recorded in the stock registers.h) The quality of the Goods / stores purchased are certified by the competent person andare as per the purchase order in terms of quality, quantity specification and price andstore register number is recorded on the bill /invoice. <strong>And</strong> Store verification is there27. Guidelines for verification of Procurement :a) Original bill duly signed by the supplier is submittedb) Supplier has put his initials in all cuttings/ corrections in the bill.c) All supporting documents are attached with the bills.d) Bills have been taken from authorized suppliers after following store purchase rulese) Bills are passed for payment as per the norms of mission.f) Before passing the bills it is to be checked that all the terms and conditions have beencomplied with.g) Every final bill is checked in details with the measurement books if required.28. Checking those legal recourses that have been taken in due course against defaultingcontractors or suppliers.29. Physical Verification of Fixed Assets with the Fixed Assets Register.30. To Check observance of store purchase rules.11

4. Standards:The audit will be carried out in accordance with the Indian Standards + <strong>Panchayat</strong>i RajAct + Government of India + Government of Madhya Pradesh for the ProfessionalPractice of Internal Auditing issued by the Institute of Chartered Accountants of India.The internal auditor should accordingly evaluate risk exposures relating to the unit’sgovernance, operations and information systems, and plan the examination to detectindicators of fraud and corruption.5. Requirement of PersonnelThe selected agency needs to recruit qualified personnel as per requirement which isgiven below:-S.No. Level Personnel Required Remark1. Gram <strong>Panchayat</strong> One auditor for each Auditor must be a C.A. article trainee or a(G.P.)cluster of 15 G.Ps. trained commerce graduate and haveworking knowledge of computerizedaccounting.2. Janpad <strong>Panchayat</strong>(J.P.)3. Zila <strong>Panchayat</strong>(Z.P.)4. State HeadQuarters Level6. Reporting:One qualified auditorwith ministerial supportfor each J.P.One C.A. having at leastyears of experience withministerial support foreach Z.P.A team leader who willbe a C.A. having at least15 years of experiencewith at least 3supporting staff havingat least 5 years workexperience in accountsand audit.[A] Audit of accounts for the financial year 2012-13 :–Qualified auditor must be at leastintermediate C.A. intern. Agency must setupa unit at Janpad Level with sufficientoffice space, hardware and softwarerequired.Agency must set-up an office at Zila Levelwith sufficient office space, hardware andsoftware required.Agency, selected for Bhopal division willalso be responsible for audit of StateHeadquarters accounts and finalconsolidation of accounts for the wholestate and preparation of consolidated auditreport. Firm must have an office at StateHeadquarters Level with sufficient officespace, hardware and software required.i. The audit report of Gram <strong>Panchayat</strong>s with a copy of audited accounts duly certifiedwill be sent to concerning GP with a copy to Janpad, Zila <strong>Panchayat</strong> and StateHeadquarters latest by 31 st May, 2013.ii.The audit report of Janpad <strong>Panchayat</strong> with a copy of audited accounts dulycertified will be sent to concerning JP with a copy to Zila <strong>Panchayat</strong> and StateHeadquarters latest by 31 st May, 2013.iii. The audit report of Zila <strong>Panchayat</strong> with a copy of audited accounts duly certifiedwill be sent to concerning ZP with a copy to State Headquarters latest by 31 st May,2013.iv. The consolidated audit report of the division on the accounts of 2012-13 will besubmitted latest by 30 th June, 2013.v. Consolidated audit report of the state along with the divisional consolidated reportswill be submitted latest by 31 st July, 2013.vi. Any other reports which may be required by the programme heads.12

[B] Concurrent Audit for the Financial Year 2013-14 :–The flash concurrent audit report including Receipt & Payment account, BankReconciliation Statement and Trial Balance should be supplied to the designatedauthority on a monthly basis latest by the last day of the following month. This reportwill mainly address the following issues:i. Defalcation, theft, loss diversion of funds, misappropriation of funds.ii.Major financial irregularities.iii. Procedural laps.iv. Accounting issues.v. Non compliance of various reports.vi. Observation on compliance – Action taking report.vii. Status of creation of assets and liabilities.viii. Any other information which programme heads may require or CA deems fit andmay be reflected in statement of accounts.7. General Requirements:The selected agency needs to recruit required qualified personnel to achieve thefollowing results:i. Good tracking of fund utilization: Whether funds were utilized for the purposefor which they were drawn by Gram <strong>Panchayat</strong> and the beneficiaries, are to betracked which would help to monitor actual fund utilization and put in correctivemeasures where-ever needed.ii.iii.iv.Good Analysis of input/outcomes linkages: Funds tracking by inputs would alsolater allow comparison of outputs/outcomes with the inputs, which will enable toanalyse the cost effectiveness of the activities undertaken by the <strong>Panchayat</strong>.Transparency/Open information sharing with constituents on programmesand fund utilization: Transparency and accountability to the constituents arecritical to the success of <strong>Panchayat</strong> fund utilization for all the interventions. Anopen and transparent financial management is the key to achieve good governanceat all PRI levels.Staff mobilization: The agency will mobilize the competent personnel requiredfor placement at cluster of Gram <strong>Panchayat</strong>s, Janpad, District and State level toprovide hands on support for accounts and book keeping.v. Training and capacity building: The agency will provide the necessary trainingand capacity building to the concern PRI personnel responsible for accounts andbook keeping and also ensuring the accounts are maintained and available online.The Training of PRI personnel will be done by the State Government and thetraining for HR personnel of CA firm has to be provided by the CA Firm/agency.vi.Coordination: The agency will work in close coordiination with the set-up of the<strong>Panchayat</strong>i Raj Institution including and other implementing agencies and at theState level <strong>Panchayat</strong> and <strong>Rural</strong> <strong>Development</strong> <strong>Department</strong> social justicedepartment. The department will advise the PRIs to make suitable sittingarrangement for agency/CA firm's representative and cooperate for performingtheir duties.13

vii. Software <strong>Development</strong>: In order to provide online accounts of the <strong>Panchayat</strong>, theappointed agency needs to use the GoMP developed software for tracking of<strong>Panchayat</strong> accounts at all levels (<strong>Panchayat</strong>, Block, Zila Parishad and State) andshall be available on online for verification and information. The agency will alsobe responsible to provide computer literacy and training enabling PRI to managethe <strong>Panchayat</strong> accounts online. CA Firms/agency will develop their own softwarefor tracing HR personnel deployment and provide reports.viii. State level Audit: State level audit of different Schemes of <strong>Rural</strong> <strong>Development</strong>,<strong>Panchayat</strong> and Social Justice and other government programmes have to beconducted by the firm selected for Bhopal division who will also carry out audit ofall districts in Bhopal Division along with the state level nodal offices (HQ)accounts.ix. The auditors shall extend all necessary cooperation to the statutory auditor and ifrequired they may have to submit the information in the formats as suggested bythe department.x. The auditor shall submit necessary details as required.xi. The agency is to audit for all the scheme of rural development, <strong>Panchayat</strong> andsocial justice <strong>Department</strong> and other govt. programme funds routed through<strong>Panchayat</strong>s and other implementing agencies. The list of such schemes can be seenat the office of Chief Executive Officer MP STEPS.8. Coverage for the Audit:Gram <strong>Panchayat</strong>/Other implementing agencies/Block /District /Stat -The audit would cover the entire organization and the three levels PRI (<strong>Panchayat</strong>i RajInstitution) and work done by other implementing agencies and State level head quarteron a 100% basis.9. Penalty clause:If the successful bidder fails to complete the work and submit required reports within thegiven time frame a penalty of Rs. 5,000/- (Rupees Five Thousand Only) per weeksubject to maximum of percent of the total contract amount may be imposed. Decisionof the CEO, MPSTEPS in this regard will be final and binding on both the parties.10. Termination of Contract:If the CA firm fails to perform as per contract conditions and complete the assignment asper time schedule or found guilty of gross negligence, irregularity, laxity or misconducton part of the CA firm's personnel and where within one year of the Audit Report anymisrepresentation or any fraud (which on the reasonable basis can be detected by the CAFirm during the course of the Audit) is detected by any other authority the contract shallbe terminated and the ICAI will be informed for disciplinary action and the CA firm willbe blacklisted. In addition, performance security deposited by the firm shall standforfeited to the government. However, before taking any such action firm will be givenan opportunity to present his case, by giving 15 days show cause notice.11. Terms of payment:[A]Concurrent Audit:-i. Payment to the firm shall be released by concerning progarmme coordinator(Collector/CEO, Zila <strong>Panchayat</strong>) on receipt of bills duly verified by CEO, Janpad<strong>Panchayat</strong> with in 15 days of their submission to the payment authority. No piecemeal payment shall be authorized. On completion of audit of at least 60 percentGram <strong>Panchayat</strong>s in a Janpad, firm may submit the bill for payment with sufficientevidence of having completed the audit of concerning <strong>Panchayat</strong>s. This bill will bebased on the pro-rata rate derived from the total amount quoted by the firm for the14

ii.iii.audit of all <strong>Panchayat</strong>s in a division. On receipt of bill duly verified by CEO,Janpad <strong>Panchayat</strong> Programme Coordinator shall release 75 percent amount of suchbill. Remaining 25 percent amount will be released when audit of all Gram<strong>Panchayat</strong>s in that particular Janpad is completed and verified bill is submitted tothe payment authority.Payment for the audit of Janpad <strong>Panchayat</strong> will be released on receipt of billverified by CEO, Janpad <strong>Panchayat</strong>. This payment will be released when audit ofthat particular month of all Gram <strong>Panchayat</strong>s in that Janpad has been completed.Payment for the audit of Zila <strong>Panchayat</strong> will be released by the ProgrammeCoordinator.iv. Payment for the audit of State Head Quarters accounts shall be released byProgramme Coordinator of Bhopal district on the authorization by CEO,MPSTEPS. The firm will have to audit accounts relating to all schemes and obtaina certificate to that effect from the concerning Programme Head before submissionof bill.[B] Annual Audit for Accounts of FY 2012-13:–i. Payment to the firm shall be released by concerning progarmme coordinator(Collector/CEO, Zila <strong>Panchayat</strong>) on receipt of bills duly verified by CEO, Janpad<strong>Panchayat</strong> with in 15 days of their submission to the payment authority. No piecemeal payment shall be authorized. On completion of audit of all Gram <strong>Panchayat</strong>sin a Janpad, firm may submit the bill for payment with sufficient evidence ofhaving completed the audit of concerning <strong>Panchayat</strong>s. This bill will be based onthe pro-rata rate derived from the total amount quoted by the firm for the audit ofall <strong>Panchayat</strong>s in a division. On receipt of bill duly verified by CEO, Janpad<strong>Panchayat</strong> Programme Coordinator shall release 85 percent amount of such bill.Remaining 15 percent amount will be released when audit of whole division iscompleted and consolidated report with certified accounts submitted and acceptedby CEO, MPSTEPS.ii.iii.iv.12. Audit Records:Payment for the audit of Janpad <strong>Panchayat</strong> will be released on receipt of billverified by CEO, Janpad <strong>Panchayat</strong>. This payment will be released when audit ofall Gram <strong>Panchayat</strong>s in that Janpad has been completed and consolidated reportswith certified accounts are submitted. This payment will be limited to 85 percent ofthe bill amount and remaining 15 percent amount will be released when audit ofwhole division is completed and consolidated report with certified accountssubmitted and accepted by CEO, MPSTEPS.Payment for the audit of Zila <strong>Panchayat</strong> will be released by the ProgrammeCoordinator consolidated report with certified consolidated accounts of the wholedistricts are submitted. This payment will be limited to 85 percent of the billamount and remaining 15 percent amount will be released when audit of wholedivision is completed and consolidated report with certified accounts submitted andaccepted by CEO, MPSTEPS.CA firm entrusted with the audit of the accounts of Bhopal division will also auditthe accounts of State Head Quarters. Payment for the audit of State Head Quartersaccounts shall be released when audit of all schemes is completed and aconsolidated report with consolidated certified accounts is submitted and acceptedby CEO, MPSTEPS. Before submission of bill firm will obtain certificates fromconcerning Programme Officers and submit these certificates with the bill.Relevant records will be made available by the Programme Coordinator concerned andconcerning State authority. The final consolidation of reports will be done at the Districtlevel /State level as the case may be only.15

13. Dispute Resolution:i. In case of dispute related to district's audit, the matter shall be decided by theProgramme Coordinator (Collector <strong>Panchayat</strong>). CEO, MPSTEPS will be theappellate authority and his decision will be final.ii.14. Arbitration:In all other cases of dispute the matter will be referred to CEO, MPSTEPS fordecision.Any party not satisfied with the decision of CEO, MPSTEPS may appeal to thePrincipal Secretary/Additional Chief Secretary, <strong>Panchayat</strong>, <strong>Rural</strong> <strong>Development</strong> andSocial Justice <strong>Department</strong> and his decision will be final.All such disputes shall be referred to the competent authority stated above with in30 days of their occurrence.Any party not satisfied with the decision of the Principal Secretary/Additional ChiefSecretary may request for appointment of arbitrator under Arbitration and ConciliationAct 1996.15. Taxes and Duties:The CA Firm shall fully familiarize themselves about the applicable Domestic taxes(such as VAT, Sales Tax, Service Tax, Income Tax, duties, fees, levies etc.) on amountpayable by Client/Knowledge Partner under the contract. The CA Firm, their partnerfirm and personnel shall pay such domestic tax, duties, fees and other impositions(wherever applicable) levied under the applicable law.16. Review and meeting with CAs:A Quarterly meeting of concerning firms at CEO MP STEPS Office Bhopal will beconvened in case of concurrent audit as soon as the audit is completed, year end meetingwill be convened in case of financial audit for which no remuneration will be claimed.17. Legal Jurisdiction:All legal disputes between the parties shall be subject to the jurisdiction of the competentCourts situated in Bhopal, Madhya Pradesh only.18. Notice:Any notice, request or consent required or permission to be given or made pursuant tothis contract shall be in writing. Any such notice ,request or consent shall be deemed tohave been given or made when delivered in person to an authorized representative theparty to whom the communication is addressed, or when sent to such party at the addressmentioned in the project specific Contract/Agreement.Authorized Signatory of Firm (With Seal) Submitting the BidEnclosures:Annexure 1Annexure 2.Annexure 3.Annexure 4.Name of Signatory ---------------------------: List of Divisions.: Technical Bid.: Financial Bid and Cost Breakup Formats.: The information regarding PRI's of whole of MP.16

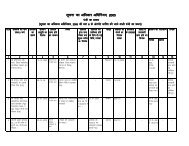

Annexure – IDivision Wise Summary of PRIs in Madhya PradeshSno Division Zilla No of Janpad <strong>Panchayat</strong> No of Gram <strong>Panchayat</strong><strong>Panchayat</strong>1 bUnkSj cqjgkuiqj 2 1672 bUnkSj bUnkSj 4 3353 bUnkSj cM+okuh 7 4164 bUnkSj [k.Mok 7 4225 bUnkSj [kjxkSu 9 6006 bUnkSj /kkj 13 7617 bUnkSj vfyjktiqj 6 2888 bUnkSj >kcqvk 6 37654 33659 gks'kaxkckn gks'kaxkckn 7 42810 gks'kaxkckn cSrwy 10 55611 gks'kaxkckn gjnk 3 21120 119512 Hkksiky Hkksiky 2 19513 Hkksiky lhgksj 5 49714 Hkksiky jktx

30 mTtSu nsokl 6 49731 mTtSu 'kktkiqj 8 55432 mTtSu mTtSu 6 60933 mTtSu jryke 6 41834 mTtSu eanlkSj 5 44035 mTtSu uhep 3 23934 275736 pEcy fHk.M 6 44737 pEcy eqjSuk 7 49038 pEcy ';ksiqj 3 22516 116239 tcyiqj ujflagiqj 6 45540 tcyiqj eaMyk 9 48641 tcyiqj tcyiqj 7 54242 tcyiqj flouh 8 64543 tcyiqj ckyk?kkV 10 69244 tcyiqj fNUnokM+k 11 80345 tcyiqj dVuh 6 40757 403046 Xokfy;j nfr;k 3 28047 Xokfy;j Xokfy;j 4 29948 Xokfy;j v'kksduxj 4 33549 Xokfy;j xquk 5 42550 Xokfy;j f'koiqjh 8 61424 1953TOTAL 313 2301018

Annexure – IITECHNICAL BID(Every point of information is to be provided in the same order in which they have been written.It is mandatory requirement otherwise the bid will be rejected. Every information is to besupported by self attested supporting documents failing which the bid will be rejected.)1. The firm should be in existence for more than ten years as on 01.01.2012.2. The firm should be empanelled with C & AG.3. The firm should have constitution certificate issued by ICAI as on 01.01.2012.4. The firm should be empanelled with Reserve Bank of India.5. The firm must have minimum 50 team members including partners, CAs, articles andassistants.6. Out of the team two CAs must have diploma in system audit.7. The firm should be registered with Service tax department.8. The firm must have PAN number.9. The firm should have an average annual turnover of minimum of Rs.50 lakh Per annumof last three financial years including financial year 2011-12.10. The firm is required to fulfill the above mentioned conditions independently and not inconsortium.11. Firm must be peer reviewed as per the policy of ICAI and the valid review certificate, onthe date of submission of bid, must have been issued.12. Firm must have Head Office / Branch Office in Madhya Pradesh as per ICAIconstitution certificate or give an undertaking that the branch office will be opened within one month of award of contract.13. The firm should not be black listed at any time.14. The firm should not have any disciplinary action initiated by ICAI at any time.15. The firm should not have any affiliation of any type with foreign firms.16. The firm should have experience in the field of concurrent audit.17. The firm must have government auditing experience.18. The firm must provide a declaration for adherence of the minimum wages act, labourlaws, EPF and ESI rules.Declaration1.Certified that above information is true and correct to the best of our knowledge and if anyinformation found to be incorrect the firm's bid is liable to be rejected and the legal actions can betaken against the bidder.2.It is also certified that we have never been issued notice for failure to submit deliverables andcancellation of work order, forfeiture of any SD/EMD etc. by any government or semi-governmentbody and we have never been barred from appointment by any government or semi-governmentbody.Date: .............................Authorized Signature of Firm (With Seal)Place : ........................... Name of Signatory --------------------------19

FINANCIAL BIDAnnexure -III1- Name of the Firm …………………………………………………………………………......2- Format of Financial Bid :Name of theDivision*Cost of Financial Audit for year2012-13 andConcurrent Audit 2013-14 for thewhole Division(Rupees in figures)Fees(Rupees in words)1 2 31 Chambal2 Gwalior3 Sagar4 Rewa5 Shadol6 Jabalpur*(Cost quoted in the bid will be on all inclusive basis viz., all expenses, all taxes, contingenciesetc.)Date:------------7 Narmadapuram8 Ujjain9 Indore10 Bhopal IncludingHead QuartersAudit andconsolidationThis is to Certify that I have read and understood the terms and conditions of the RFPdocument and the above rates have been quoted keeping in mind all the conditions,requirements and expenses related thereto. The above cost has been arrived at as perbreakup attached.Authorized Signatory of Firm (With Seal)Name of Signatory ---------------------------ICAI Registration No:--------------20

Enclosure to Annexure-IIICOST BREAKUP OF FINANCIAL BIDA. Audit of Accounts for 2012-13:Name of the Division …………1 2 3 4Level(Unit)GPTotal NumberRate Per AnnumPer Unit (In Rupees)Total(2*3) (In Rupees)JPZPHQ*Total Cost for Audit of 2012-13B. Concurrent Audit of 2013-141 2 3 4Level(Unit)GPTotal NumberRate Per AnnumPer Unit (In Rupees)Total(2*3) (In Rupees)JPZPHQ*Total Cost for Concurrent Audit of 2013-14Total Cost of the Financial Bid (A + B)Note : For State Head Quarters Audit Rate of FY 2012-13 and Concurrent Audit of FY2013-14 should be quoted with Bhopal division.Date:------------Authorized Signatory of Firm (With Seal)Name of Signatory ---------------------------ICAI Registration No:--------------21

e/;izns'k esa ftyk@tuin@xzke iapk;rAnnexure -IVØ-ftyk iapk;rdk uketuin iapk;rdk ukexzke iapk;rksa dhdqy la[;ks1 ckyk?kkV 1 - ckyk?kkV 772 - ykth 783 - fdjukiqj 834 - cSgj 565 - ijlokMk 576 - fojlk 627 - okjkflouh 608 - [kSjykath 629 - ykyojkZ 7710 - dVaxh 81;ksx 10 6932 cM+okuh 1 - cM+okuh 522 - ikVh 453 - Bhdjh 584 - jktiqj 675 - ikulsey 396 - ls/kok 1147 - fuokyh 42;ksx 7 4173 cSrwy 1 - cSrwy 772 - fppkSyh 343 - /kksMkMksxjh 564 - 'kkgiqj 405 - ewqyrkbZ 696 - izHkkriV~Vu 657 - vkeyk 688 - HkSlnsgh 509 - vkBusj 4510 - Hkheiqj 54;ksx 10 5584 Nrjiqj 1 - Nrjiqj 812 - jktuxj 863 - ukSxkWo 754 - ykSMh 655 - xkSjhgkj 736 - fctkoj 607 - cMkeygkjk 798 - cDlokgk 39;ksx 8 5585 /kkj 1 - /kkj 522 - ukyNk 673 - frjyk 524 - cnukoj 8922

5 - ljnkjiqj 956 - eukoj 647 - /kjeiqjh 518 - xa/kokuh 669 - ckdkusj ¼mejou½ 6110 - dq{kh 3711 - fuljiqj 3412 - ckx 4813 - Mgh 46;ksx 13 7626 fM.Mksjh 1 - fM.Mksjh 702 - vejiqj 433 - djaft;k 424 - leukiqj 485 - ctkax 466 - esgnokuh 467 - 'kgiqjk 69;ksx 7 3647 >kcqvk 1 - >kcqvk 682 - jkek 553 - jkukiqj 474 - isVykon 775 - Fkknyk 676 - es?kuxj 62;ksx 6 3768 [k.Mok 1 - [k.Mok 602 - iquklk 733 - NsxkWoek[ku 594 - ia?kkuk 845 - gjlwn 406 - [kkyok 867 - cyMh ¼fdYyksn½ 21;ksx 7 4239 [kjxkSu 1 - [kjxkSu 472 - xkSxok 463 - Hkxokuiqjk 614 - lsxkWo 375 - HkhduxkWo 656 - f>jY;k 767 - egs'oj 718 - cMokMk 1149 - dljkon 83;ksx 9 60010 e.Myk 1 - e.Myk 812 - eksgxkWo 383 - /kq/kjh 464 - uSuiqj 745 - fofN;k 736 - eobZ 527 - fuokl 4023

8 - ujk;.kiqj 499 - chtkMkMh 40;ksx 9 49311 lruk 1 - lruk ¼lqgkoy½ 932 - fp=dwV ¼e>xaok½ 963 - jkeij c?ksyku 974 - ukxkSn 935 - mpsgjk 706 - vejikVu 747 - jkeuxj 598 - eSgj 121;ksx 8 70312 flouh 1 - flouh 1292 - oj/kkV 903 - dqjbZ 624 - dsoykjh 785 - y[kuknkSu 1086 - Nikjk 547 - /kalkSj 778 - /kukSjk 47;ksx 8 64513 'kgMksy 1 - lksgkxiqj 772 - xksgik: ¼ikyh½ 583 - C;kSgkjh 684 - cqkSyh 555 - jkeiqj uSfdu 89;ksx 5 40117 Vhdex

5 - trkjk 936 - iysjk 71;ksx 6 45918 mefj;k 1 - mefj;k ¼djdsyh½ 1072 - ekuiqj 833 - xksgik: ¼ikyh½ 44;ksx 3 23419 xquk 1 - xquk 832 - ceksjh 803 - pkpkSM+k 1064 - jk?ksx

;ksx 9 82725 eqjSuk 1 - eqjSuk 1162 - vackg 553 - iksjlk 534 - tkSjk 715 - igkM+x

7 - 'kqtkyiqj 718 - dkykihiy 77;ksx 8 55433 eUnlkSj 1 - eUnlkSj 1192 - lhrkem 1083 - eYgkjx< 784 - xjksB 915 - Hkkuiqjk 45;ksx 5 44134 uhep 1- uhep 652- tkon 763- euklk 98;ksx 3 23935 mTtSu 1 - mTtSu 762 - ?kfV;k 693 - cMuxj 1074 - [kkpjkSn 1305 - efgniqj 1206 - rjkuk 110;ksx 6 61236 bUnkSj 1 - bUnkSj 842 - egw 733 - lkaosj 784 - nsikyiqj 100;ksx 4 33537 cqjgkuiqj 1 - [kdukj 902 - cqjgkuiqj 77;ksx 2 16738 Hkksiky 1 - QUnk 922 - cSjfl;k 110;ksx 2 20239 lhgksj 1 - lhgksj 1462 - bNkoj 703 - vk"Vk 1354 - cq/kuh 635 - ul:Yykxat 85;ksx 5 49940 jk;lsu 1 - lkWph 772 - vkscsnqYykxat 723 - csxexat 604 - xSjrxat 545 - flyokuh 686 - okMh cjsyh 1037 - mn;iqjk 68;ksx 7 50241 fofn'kk 1 - fofn'kk 942 - X;kjliqj 713 - cklkSnk 1014 - uVsju 8527

5 - dqjokbZ 756 - fljksat 937 - yVsjh 61;ksx 7 58042 gks'kaxkokn 1 - gks'kaxkokn 492 - ckcbZ 593 - dslyk 494 - lksgkxiqj 665 - ou[ksMh 576 - fiifj;k 537 - flouhekyok 95;ksx 7 42843 gjnk 1 - gjnk 712 - f[kjfd;k 673 - fVejuh 73;ksx 3 21144 lkxj 1 - lkxj 862 - jkgrx

8 - fcPNqvk 519 - vejokMk 7110 - pkSjbZ 9111 - gjZbZ 67;ksx 11 80848 vuqiiqj 1 - vuqiiqj 522 - iq"ijktx< 1193 - dksrek 314 - tSrgkjh 80;ksx 4 28249 vyhjktiqj 1 - vyhjktiqj 532 - lks.Mok 743 - dfBokMk 494 - tkscV 385 - mn;x< 406 - Hkkejk 34;ksx 6 28850 flaxjkSyh 1 - nsolj 972 - fprjaxh 1153 - cS