SINGAPORE â¦. MONTHLY COMMERCIAL REPORT â MAY 2012 ...

SINGAPORE â¦. MONTHLY COMMERCIAL REPORT â MAY 2012 ...

SINGAPORE â¦. MONTHLY COMMERCIAL REPORT â MAY 2012 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

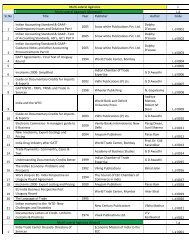

the recreational & personal services industry was in particular noteworthy as its earnings grew<br />

significantly from the 3.9 per cent increase it had recorded in the previous quarter year-on-year.<br />

Business services, excluding real estate, rental & leasing, generated an 8.9 per cent increase in receipts<br />

in the first quarter of <strong>2012</strong>, while receipts for transport & storage rose by 8.4 per cent; financial and<br />

insurance by 5.1 per cent; real estate, rental & leasing by 4.7 per cent; information & communications by<br />

4.1 per cent; and education services by 3.3 per cent. Although revenue for the education sector grew the<br />

slowest among all other services sectors during this period, it was a marked improvement from its<br />

showing in the previous quarter when its earnings had contracted by 3.4 per cent year on year.<br />

Despite this, overall growth in business receipts in the services sector in the first quarter of <strong>2012</strong> from the<br />

previous quarter was only marginal at one per cent. On a quarterly basis, services industries which<br />

recorded higher business receipts from the last three months of 2011 included education services at 20.9<br />

per cent, recreation & personal services at 6.2 per cent, health & social services at 5.9 per cent, financial<br />

& insurance at 5.1 per cent and information & communications at a modest 1.4 per cent. Sectors that<br />

declined in receipts compared to the previous quarter were business services, excluding real estate,<br />

rental & leasing, by 6 per cent, transport & storage services by 2.4 per cent and real estate, rental &<br />

leasing services by 2 per cent.<br />

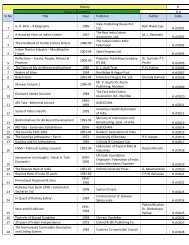

Trade Ministry keeps to forecast of 1-3% growth<br />

The risks of slower growth have intensified with another flare-up of the eurozone debt crisis, the Ministry<br />

of Trade and Industry (MTI) said , as it stuck to its forecast that Singapore will grow one to 3 per cent this<br />

year. Despite a good first quarter, the authorities "remain cautious" about Singapore's growth outlook as<br />

talk of a possible Greek exit from the eurozone fans fears of a disorderly sovereign debt default. Signs of<br />

fragility in the US recovery and lacklustre export growth in Asia add to that external uncertainty too, MTI<br />

permanent secretary Ow Foong Pheng said. The Singapore economy grew 1.6 per cent in Q1 from a<br />

year ago, below the consensus market forecast of 1.8 per cent but in line with April's advance estimates.<br />

Manufacturing anchored the pick-up in growth momentum. The economy grew 10 per cent quarter-onquarter<br />

in seasonally adjusted, annualised terms, reversing Q4's 2.5 per cent contraction. The 19.8 per<br />

cent q-o-q rise in industrial production beat advance estimates and reversed an 11.1 per cent drop in Q4,<br />

with notable jumps in electronics and precision engineering output. Construction too, outdid advance<br />

estimates to grow 32.1 per cent sequentially. But services grew 4 per cent in sequential terms, less than<br />

advance estimates suggested. Wholesale and retail trade shrank, while sluggishness in fund<br />

management activities led to a sequential contraction in the finance and insurance sector for a second<br />

straight quarter. Economists, whose forecasts mostly surpass or fill the top-end of the official forecast<br />

range, believe that positive growth momentum will hold up - for several reasons. The official composite<br />

leading index, which correlates with GDP performance of the next quarter, rose a stronger 2.9 per cent in<br />

seasonally adjusted quarter-on-quarter terms in Q1, up from 1.2 per cent in Q4. IE Singapore also<br />

reported a better-than-expected rise in April's non-oil domestic exports. While pencilling in gradual<br />

improvements in growth, some economists are now more cautious too. Developments in Spain, which slid<br />

back into recession yesterday, are also being watched closely, Mrs Ow added. Maybank economist<br />

Saktiandi Supaat's 3 per cent growth forecast does not account for a Greek default and, in fact, assumes<br />

faster exports growth in the second half on the back of some recovery in the eurozone core. But recovery<br />

there and elsewhere looks shaky, MTI said. As the drama over Greece unfolds, ongoing fiscal austerity<br />

and bank deleveraging will keep eurozone demand sluggish. US employment growth appears to be losing<br />

momentum and, this being an election year, an uncertain fiscal outlook may hit business confidence and<br />

investment, Mrs Ow said. These external headwinds mean Asia's exports are likely to suffer too, despite<br />

rising domestic demand, she added.<br />

Inflation to stay around 5%, taper off in H2<br />

Inflation is tipped to stay around 5.0 per cent in the next few months before reducing in the second half of<br />

the year to bring the rate to 3.5-4.5 per cent for <strong>2012</strong>, Trade and Industry Minister Lim Hng Kiang<br />

said.The Consumer Price Index (CPI) hit a 5.2 per cent high in March and 4.9 per cent for the first three<br />

months of the year. Mr Lim said the increase in prices in the coming months will in any case not hit