SINGAPORE â¦. MONTHLY COMMERCIAL REPORT â MAY 2012 ...

SINGAPORE â¦. MONTHLY COMMERCIAL REPORT â MAY 2012 ...

SINGAPORE â¦. MONTHLY COMMERCIAL REPORT â MAY 2012 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

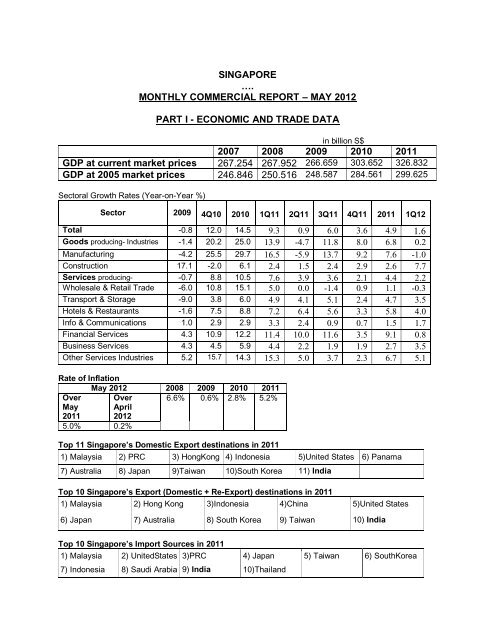

<strong>SINGAPORE</strong><br />

….<br />

<strong>MONTHLY</strong> <strong>COMMERCIAL</strong> <strong>REPORT</strong> – <strong>MAY</strong> <strong>2012</strong><br />

PART I - ECONOMIC AND TRADE DATA<br />

in billion S$<br />

2007 2008 2009 2010 2011<br />

GDP at current market prices 267.254 267.952 266.659 303.652 326.832<br />

GDP at 2005 market prices 246.846 250.516 248.587 284.561 299.625<br />

Sectoral Growth Rates (Year-on-Year %)<br />

Sector 2009 4Q10 2010 1Q11 2Q11 3Q11 4Q11 2011 1Q12<br />

Total -0.8 12.0 14.5 9.3 0.9 6.0 3.6 4.9 1.6<br />

Goods producing- Industries -1.4 20.2 25.0 13.9 -4.7 11.8 8.0 6.8 0.2<br />

Manufacturing -4.2 25.5 29.7 16.5 -5.9 13.7 9.2 7.6 -1.0<br />

Construction 17.1 -2.0 6.1 2.4 1.5 2.4 2.9 2.6 7.7<br />

Services producing-<br />

-0.7 8.8 10.5 7.6 3.9 3.6 2.1 4.4 2.2<br />

Industries Wholesale & Retail Trade -6.0 10.8 15.1 5.0 0.0 -1.4 0.9 1.1 -0.3<br />

Transport & Storage -9.0 3.8 6.0 4.9 4.1 5.1 2.4 4.7 3.5<br />

Hotels & Restaurants -1.6 7.5 8.8 7.2 6.4 5.6 3.3 5.8 4.0<br />

Info & Communications 1.0 2.9 2.9 3.3 2.4 0.9 0.7 1.5 1.7<br />

Financial Services 4.3 10.9 12.2 11.4 10.0 11.6 3.5 9.1 0.8<br />

Business Services 4.3 4.5 5.9 4.4 2.2 1.9 1.9 2.7 3.5<br />

Other Services Industries 5.2 15.7 14.3 15.3 5.0 3.7 2.3 6.7 5.1<br />

Rate of Inflation<br />

May <strong>2012</strong> 2008 2009 2010 2011<br />

Over Over 6.6% 0.6% 2.8% 5.2%<br />

May<br />

2011<br />

April<br />

<strong>2012</strong><br />

5.0% 0.2%<br />

Top 11 Singapore’s Domestic Export destinations in 2011<br />

1) Malaysia 2) PRC 3) HongKong 4) Indonesia 5)United States 6) Panama<br />

7) Australia 8) Japan 9)Taiwan 10)South Korea 11) India<br />

Top 10 Singapore’s Export (Domestic + Re-Export) destinations in 2011<br />

1) Malaysia 2) Hong Kong 3)Indonesia 4)China 5)United States<br />

6) Japan 7) Australia 8) South Korea 9) Taiwan 10) India<br />

Top 10 Singapore’s Import Sources in 2011<br />

1) Malaysia 2) UnitedStates 3)PRC 4) Japan 5) Taiwan 6) SouthKorea<br />

7) Indonesia 8) Saudi Arabia 9) India 10)Thailand

Singapore’s total Trade with India for top 10 items (in thousands S$)<br />

May 2011 May <strong>2012</strong><br />

Imports Exports to Total Imports from Exports to Total Trade<br />

from India India<br />

Trade India<br />

India<br />

1,480,806 740,052 2,220,858 1,128,657 344,095 1,472,752<br />

Principal five global import items of Singapore in May <strong>2012</strong><br />

OTHER PETROLEUM OILS & OILS FROM BITUMINOUS<br />

MINERALS NOT CRUDE & PREPARATIONS NES<br />

CONTAINING BY WEIGHT 70% OR MORE OF<br />

PETROLEUM OILS OR OF OILS OBTAINED FROM<br />

BITUMINOUS MINERALS EXCL THOSE CONTAINING<br />

BIODIESEL & WASTE OILS (HS 271019)<br />

PETROLEUM OILS & OILS FROM BITUMINOUS<br />

MINERALS CRUDE (HS 270900)<br />

OTHER ELECTRONIC INTEGRATED CIRCUITS (HS<br />

854239)<br />

LIGHT OILS & PREPARATIONS CONTAINING BY WEIGHT<br />

70 % OR MORE OF PETROLEUM OILS OR OILS FROM<br />

BITUMINOUS MINERALS (HS 271012)<br />

PROCESSORS & CONTROLLERS CONVERTERS LOGIC<br />

CIRCUITS AMPLIFIERS CLOCK TIMING CIRCUITS OR<br />

OTHER CIRCUITS (HS 854231)<br />

Principal five global domestic export Items of Singapore in May <strong>2012</strong><br />

OTHER PETROLEUM OILS & OILS FROM BITUMINOUS MINERALS<br />

NOT CRUDE & PREPARATIONS NES CONTAINING BY WEIGHT<br />

70% OR MORE OF PETROLEUM OILS OR OF OILS OBTAINED<br />

FROM BITUMINOUS MINERALS EXCL THOSE CONTAINING<br />

BIODIESEL & WASTE OILS (HS 271019)<br />

SHIPS & AIRCRAFT BUNKERS & STORES LOADED ON BOARD FOR<br />

OWN CONSUMPTION (HS 989300)<br />

LIGHT OILS & PREPARATIONS CONTAINING BY WEIGHT 70 % OR<br />

MORE OF PETROLEUM OILS OR OILS FROM BITUMINOUS<br />

MINERALS (HS 271012)<br />

OTHER ELECTRONIC INTEGRATED CIRCUITS (HS 854239)<br />

PARTS & ACCESSORIES OF MACHINES OF 8471 (HS 847330)

Principal five domestic export items of Singapore to India in May <strong>2012</strong><br />

OTHER PETROLEUM OILS & OILS FROM BITUMINOUS MINERALS<br />

NOT CRUDE & PREPARATIONS NES CONTAINING BY WEIGHT<br />

70% OR MORE OF PETROLEUM OILS OR OF OILS OBTAINED<br />

FROM BITUMINOUS MINERALS EXCL THOSE CONTAINING<br />

BIODIESEL & WASTE OILS (HS 271019)<br />

STYRENE (HS 290250)<br />

PARTS & ACCESSORIES OF MACHINES OF 8471 (HS 847330)<br />

SHIPS & AIRCRAFT BUNKERS & STORES LOADED ON BOARD FOR<br />

OWN CONSUMPTION (HS 989300)<br />

P-XYLENE (HS 290243)<br />

Principal five import Items of Singapore from India in May <strong>2012</strong><br />

LIGHT OILS & PREPARATIONS CONTAINING BY WEIGHT<br />

70 % OR MORE OF PETROLEUM OILS OR OILS FROM<br />

BITUMINOUS MINERALS (HS 271012)<br />

OTHER PETROLEUM OILS & OILS FROM BITUMINOUS<br />

MINERALS NOT CRUDE & PREPARATIONS NES<br />

CONTAINING BY WEIGHT 70% OR MORE OF<br />

PETROLEUM OILS OR OF OILS OBTAINED FROM<br />

BITUMINOUS MINERALS EXCL THOSE CONTAINING<br />

BIODIESEL & WASTE OILS (HS 271019)<br />

OTHER MOTOR VEHICLES FOR TRANSPORTING GOODS<br />

WITH COMPRESSION IGNITION INTERNAL<br />

COMBUSTION PISTON ENGINE OF GVW OVER 20T (HS<br />

870423)<br />

OTHER ARTICLES OF JEWELLERY OF OTHER PRECIOUS<br />

METAL (HS 711319)<br />

WORKED NON-INDUSTRIAL DIAMONDS NOT<br />

MOUNTED OR SET (HS 710239)<br />

Monthly trade figures between India and Singapore (in thousands S$)<br />

Trade May 2010 May 2011 May <strong>2012</strong><br />

Total Trade 2,477,086 3,220,463 2,673,227<br />

Sgpr’s Imports 957,352 1,692,081 1,416,486<br />

Sgpr’s Exports# 1,519,734 1,528,382 1,256,741<br />

Sgpr’s Domestic Exports 682,812 651,238 627,043

Sgpr’s Re-Exports 836,922 877,144 629,698<br />

#Total Trade = Imports + Exports, Exports=Domestic Exports+Re-exports<br />

Monthly figures for Singapore’s Global Trade (in thousands S$)<br />

Trade May 2010 May 2011 May <strong>2012</strong><br />

Total Trade# 71,921,817 81,521,460 85,275,715<br />

Sgpr’s Imports 33,300,995 39,265,858 41,627,019<br />

Sgpr’s Exports# 38,620,822 42,255,602 43,648,696<br />

Sgpr’s Domestic Exports 20,140,404 22,849,299 25,150,706<br />

Sgpr’s Re-Exports 18,480,418 19,406,303 18,497,990<br />

Cumulative figures for Singapore’s Global Trade (in thousands S$)<br />

2008 2009 2010 2011<br />

Jan-May<br />

2011<br />

Jan-May<br />

<strong>2012</strong><br />

Total global Trade 927,654,759 747,417,400 902,062,584 974,396,345 396,887,687 419,461,520<br />

%change y-o-y 9.57% -19.43% 20.69% 8.02% 10.62% 5.69%<br />

Singapore's Imports 450,892,588 356,299,229 423,221,839 459,655,129 187,466,132 202,016,026<br />

%change y-o-y 13.87% -20.98% 18.78% 8.61% 10.46% 7.76%<br />

Singapore's Exports 476,762,172 391,118,171 478,840,745 514,741,216 209,421,555 217,445,493<br />

%change y-o-y 5.80% -17.96% 22.43% 7.50% 10.76% 3.83%<br />

Sgpr’s Domestic 247,617,959 200,003,141 248,609,828 281,349,653 113,030,098 123,291,865<br />

Exports %change y-o-y 5.41% -19.23% 24.30% 13.17% 15.29% 9.08%<br />

Singapore’s Re- 229,144,213 191,115,030 230,230,917 22.57% 233,391,563 96,391,457 94,153,628<br />

Exports %change y-o-y 6.22% -16.60% 20.47% 1.37% 5.89% -2.32%<br />

Cumulative figures for India and Singapore Bilateral Trade (In thousands S$)<br />

2008 2009 2010 2011<br />

Jan-May<br />

2011<br />

Jan-May<br />

<strong>2012</strong><br />

Total Bilateral Trade 28,756,963 21,585,714 30,667,496 35,424,915 15,955,483 14,294,029<br />

%change y-o-y 20.52% -24.94% 42.07% 15.51% 35.40% -10.41%<br />

Singapore's Imports 11,922,381 8,156,459 12,566,133 17,770,934 7,928,488 8,228,551<br />

%change y-o-y 35.26% -31.59% 54.06 % 41.42% 60.61% 3.78% %<br />

Singapore's Exports 16,834,582 13,429,255 18,101,363 17,653,981 8,026,995 6,065,477<br />

%change y-o-y 11.89% -20.23% 34.79% -2.47% 17.22%<br />

%$%<br />

-24.44%<br />

%<br />

Sgpr’s Domestic Exports 7,515,094 5,677,674 7,693,906 8,444,911 3,650,225 2,814,085<br />

%change y-o-y 21.38% -24.45% 35.51% 9.76% 21.26% -22.91%<br />

Singapore’s Re-exports 9,319,488 7,751,581 10,407,457 9,209,070 4,376,770 3,251,393<br />

%change y-o-y<br />

5.25% -16.82% 34.26% -11.51% 14.05% -25.71%<br />

Singapore’s Total Global Trade in May <strong>2012</strong><br />

Singapore’s Total global trade in May <strong>2012</strong> increased by 4.6 % on a year-on-year basis, after<br />

the 1.5% increase in the previous month.<br />

Total exports increased by 3.3%<br />

Total imports increased by 6.0%<br />

Non-oil domestic exports (NODX) increased by 3.2%.<br />

Electronic NODX Increased by 3.9%

Non-electronic NODX expanded by 2.8%<br />

Oil domestic exports increased by 22%<br />

Non-Oil Re-Exports (NORX) increased by 3.3%.<br />

Electronic NORX contracted by -1.4%<br />

Non-electronic Re-Exports increased by 8.4%<br />

ECONOMY<br />

PART II - INTERNAL<br />

Singapore's April PMI contracts despite order growth<br />

Singapore's manufacturing activity contracted in April after two months of expansion, hurt by drops in<br />

employment and order backlogs, the latest Purchasing Manager's Index (PMI) showed.But new orders<br />

and export orders continued to strengthen, indicating the pause could be temporary and a recovery in<br />

manufacturing is still on track. Singapore's PMI stood at 49.7 points in April, down from 50.2 points in<br />

March, as per the Singapore Institute of Purchasing & Materials Management (SIPMM). A reading below<br />

50 indicates a contraction in the sector. A separate PMI for Singapore's important electronics sector<br />

stayed in positive territory for the fourth straight month with an April reading of 51.5, unchanged from<br />

March, SIPMM said. The PMI for electronics has now been in positive territory for three straight months.<br />

Asia's factories have been hit by weak demand in the West, particularly from Europe, although conditions<br />

have begun to improve. The Global Manufacturing Purchasing Managers' Index (PMI), produced by<br />

JPMorgan with research and supply management organisations, rose to 51.4 in April from March's 51.1,<br />

as per a recent report.<br />

Singapore's central bank said earlier that the city-state's economic recovery is likely to be muted with<br />

continued weakness in electronics a drag on growth, painting a less rosy picture of the economy<br />

compared with other forecasters. Singapore's PMI is produced ahead of government data on<br />

manufacturing and exports. Economists who cover Singapore say the PMI does not appear to track<br />

activity in pharmaceuticals, which has been Singapore's fastest-growing manufacturing sector in recent<br />

years.<br />

Singapore's economy grows 1.6% in Q1 <strong>2012</strong><br />

The Ministry of Trade and Industry (MTI) announced that the Singapore economy grew by 1.6 per cent on<br />

a year-on-year basis in the first quarter of <strong>2012</strong>, compared to 3.6 per cent in the preceding quarter. On a<br />

quarter-on-quarter seasonally-adjusted annualised basis, the economy expanded by 10.0 per cent,<br />

reversing the 2.5 per cent contraction in the previous quarter. The improved growth momentum was<br />

largely attributable to the upturn in the manufacturing sector. The manufacturing sector expanded by an<br />

annualised rate of 19.8 per cent, reversing the 11.1 per cent contraction in the previous quarter. This<br />

turnaround was driven by increased production across all key manufacturing clusters, notably electronics<br />

and precision engineering. Going forward, the recovery in the global economy is viewed to remain fragile<br />

and vulnerable to downside risks. Considerable downsides for the global economy and Singapore's<br />

externally oriented industries may occur if the uncertainty surrounding the Eurozone's political climate and<br />

fiscal outlook materializes. MTI is maintaining the economic growth forecast for <strong>2012</strong> at 1.0 to 3.0 per<br />

cent.<br />

Q1 services sector receipts up 6.8%<br />

BUSINESS receipts in Singapore's services sector grew in the first quarter of <strong>2012</strong>, creating a more<br />

positive outlook for the sector compared to manufacturing activity data also released yesterday.<br />

Compared to the corresponding period last year, business receipts for the services sector expanded by<br />

6.8 per cent for the first three months of this year. In comparison with the first quarter of 2011, all services<br />

sectors did well this time around, with health & social services and recreation & personal services<br />

industries chalking up double-digit growth of 13.7 per cent and 11.3 per cent respectively. The showing by

the recreational & personal services industry was in particular noteworthy as its earnings grew<br />

significantly from the 3.9 per cent increase it had recorded in the previous quarter year-on-year.<br />

Business services, excluding real estate, rental & leasing, generated an 8.9 per cent increase in receipts<br />

in the first quarter of <strong>2012</strong>, while receipts for transport & storage rose by 8.4 per cent; financial and<br />

insurance by 5.1 per cent; real estate, rental & leasing by 4.7 per cent; information & communications by<br />

4.1 per cent; and education services by 3.3 per cent. Although revenue for the education sector grew the<br />

slowest among all other services sectors during this period, it was a marked improvement from its<br />

showing in the previous quarter when its earnings had contracted by 3.4 per cent year on year.<br />

Despite this, overall growth in business receipts in the services sector in the first quarter of <strong>2012</strong> from the<br />

previous quarter was only marginal at one per cent. On a quarterly basis, services industries which<br />

recorded higher business receipts from the last three months of 2011 included education services at 20.9<br />

per cent, recreation & personal services at 6.2 per cent, health & social services at 5.9 per cent, financial<br />

& insurance at 5.1 per cent and information & communications at a modest 1.4 per cent. Sectors that<br />

declined in receipts compared to the previous quarter were business services, excluding real estate,<br />

rental & leasing, by 6 per cent, transport & storage services by 2.4 per cent and real estate, rental &<br />

leasing services by 2 per cent.<br />

Trade Ministry keeps to forecast of 1-3% growth<br />

The risks of slower growth have intensified with another flare-up of the eurozone debt crisis, the Ministry<br />

of Trade and Industry (MTI) said , as it stuck to its forecast that Singapore will grow one to 3 per cent this<br />

year. Despite a good first quarter, the authorities "remain cautious" about Singapore's growth outlook as<br />

talk of a possible Greek exit from the eurozone fans fears of a disorderly sovereign debt default. Signs of<br />

fragility in the US recovery and lacklustre export growth in Asia add to that external uncertainty too, MTI<br />

permanent secretary Ow Foong Pheng said. The Singapore economy grew 1.6 per cent in Q1 from a<br />

year ago, below the consensus market forecast of 1.8 per cent but in line with April's advance estimates.<br />

Manufacturing anchored the pick-up in growth momentum. The economy grew 10 per cent quarter-onquarter<br />

in seasonally adjusted, annualised terms, reversing Q4's 2.5 per cent contraction. The 19.8 per<br />

cent q-o-q rise in industrial production beat advance estimates and reversed an 11.1 per cent drop in Q4,<br />

with notable jumps in electronics and precision engineering output. Construction too, outdid advance<br />

estimates to grow 32.1 per cent sequentially. But services grew 4 per cent in sequential terms, less than<br />

advance estimates suggested. Wholesale and retail trade shrank, while sluggishness in fund<br />

management activities led to a sequential contraction in the finance and insurance sector for a second<br />

straight quarter. Economists, whose forecasts mostly surpass or fill the top-end of the official forecast<br />

range, believe that positive growth momentum will hold up - for several reasons. The official composite<br />

leading index, which correlates with GDP performance of the next quarter, rose a stronger 2.9 per cent in<br />

seasonally adjusted quarter-on-quarter terms in Q1, up from 1.2 per cent in Q4. IE Singapore also<br />

reported a better-than-expected rise in April's non-oil domestic exports. While pencilling in gradual<br />

improvements in growth, some economists are now more cautious too. Developments in Spain, which slid<br />

back into recession yesterday, are also being watched closely, Mrs Ow added. Maybank economist<br />

Saktiandi Supaat's 3 per cent growth forecast does not account for a Greek default and, in fact, assumes<br />

faster exports growth in the second half on the back of some recovery in the eurozone core. But recovery<br />

there and elsewhere looks shaky, MTI said. As the drama over Greece unfolds, ongoing fiscal austerity<br />

and bank deleveraging will keep eurozone demand sluggish. US employment growth appears to be losing<br />

momentum and, this being an election year, an uncertain fiscal outlook may hit business confidence and<br />

investment, Mrs Ow said. These external headwinds mean Asia's exports are likely to suffer too, despite<br />

rising domestic demand, she added.<br />

Inflation to stay around 5%, taper off in H2<br />

Inflation is tipped to stay around 5.0 per cent in the next few months before reducing in the second half of<br />

the year to bring the rate to 3.5-4.5 per cent for <strong>2012</strong>, Trade and Industry Minister Lim Hng Kiang<br />

said.The Consumer Price Index (CPI) hit a 5.2 per cent high in March and 4.9 per cent for the first three<br />

months of the year. Mr Lim said the increase in prices in the coming months will in any case not hit

consumers hard because imputed rentals on owner-occupied accommodation and car prices are likely to<br />

be the two biggest contributors to the hike in the CPI. Together, the increase in rentals and COE<br />

(Certificate of Entitlement) premiums for vehicles are expected to account for over half of this year's<br />

inflation. The Monetary Authority of Singapore has tightened further its monetary policy stance through a<br />

stronger Singapore dollar to keep imported inflation in check and to ease external demand for Singapore<br />

exports. So steps have been taken to cool the property market and to raise productivity. The government<br />

will also be looking at ways to ease the Certificate of Entitlement supply. Mr Lim said the government will<br />

also soften the impact of the rising cost of living through cash grants.<br />

EMPLOYMENT<br />

Jobless rate inches up to 2.1% in March<br />

AFTER hitting a 14-year low of 2 per cent in December, the unemployment rate unexpectedly crept up in<br />

March to 2.1 per cent, according to the latest employment figures released by the Ministry of Manpower.<br />

The number of jobs created fell to 27,400 in the first three months of the year, from a seasonal high of<br />

37,600 in the final quarter of 2011 and 28,300 in the first quarter of last year, says the Employment<br />

Situation First Quarter <strong>2012</strong> report. Economists in the private sector had expected the jobless rate to stay<br />

unchanged at 2 per cent. The higher unemployment rate and lower employment creation led many to<br />

conclude that the tight market has finally begun to ease.<br />

While ongoing tightening of foreign worker inflows may have played a part in the jobs slowdown, a<br />

slowdown in demand for labour may have been the dominant factor. The good news is that the number of<br />

workers made redundant, including those laid off, came down to 2,700 after hitting 3,250 in the December<br />

quarter. The new figure is closer to the 2,750 displaced in the first quarter of 2011.<br />

With the unemployment rate at 2.1 per cent, Singapore is still in a full-employment situation - and better<br />

off than most countries.<br />

Construction still posted a strong increase of 800 jobs in the first quarter. Manufacturing jobs dipped 500,<br />

but the losses have eased from the 1,400 recorded in the previous quarter. Manufacturing also<br />

retrenched fewer workers (800) in the first quarter, after a big cutback in the fourth quarter (1,660) of<br />

2011. This more than offset the increases in layoffs in services (from 1,360 to 1,600) and construction<br />

(from 240 to 300). The jobless rate for residents rose from 2.9 per cent in December 2011 to 3 per cent in<br />

March, while the rate for citizens went up from 3 per cent to 3.2 per cent. "Even with the increase, the<br />

rates were still substantially lower than the high of 3.3 per cent overall and 4.9 per cent for residents and<br />

citizens experiences in September 2009 during the last recession," the Ministry of Manpower says in its<br />

report.<br />

MANUFACTURING<br />

Manufacturing sentiment positive for April-Sept: poll<br />

AFTER a slow first quarter, Singapore manufacturers expect business conditions to improve but service<br />

providers are less upbeat on the outlook for April to September <strong>2012</strong>. Some 19 per cent of the 414<br />

manufacturing establishments surveyed, weighted by output and employment, foresee an improved<br />

outlook in the next six months of <strong>2012</strong>. On the other hand, 4 per cent expect a deterioration in business<br />

conditions here, resulting in a net weighted balance of 15 per cent of manufacturers upbeat on conditions<br />

improving during this period. This is a vast improvement in sentiment from the previous quarter where 11<br />

per cent of manufacturers projected a deterioration in the business outlook. The positive business<br />

sentiment, as indicated by the Economic Development Board's (EDB) latest quarterly poll, is broad-based<br />

with all manufacturing clusters expecting better business conditions. The electronics sector is most<br />

upbeat, with a net weighted balance of 30 per cent projecting an improved business climate. It is led by<br />

the semiconductor segment, which sees stronger chip demand as inventory levels are revised<br />

downwards, EDB said.<br />

The general manufacturing sector is also optimistic with a net weighted balance of 19 per cent indicating<br />

an improving environment. This was buoyed by an expected increase in demand from the construction<br />

sector, according to EDB, which provided reason for optimism for the other manufacturing industries

cluster in particular. Similarly, some 9 per cent of firms in each of the precision engineering and chemical<br />

clusters project an improvement, with semiconductor equipment, bonding wire and connector makers the<br />

most optimistic within precision engineering. Firms in the chemical cluster expressed cautious optimism,<br />

however, as they are mindful of possible margin erosions due to high raw materials prices. The overall<br />

optimism is reflected in expectations for output and employment. Compared to Q1, a net weighted<br />

balance of 22 per cent expect output to increase in Q2 while a net weighted balance of 8 per cent plan to<br />

increase employment in the next three months. While a weighted 45 per cent reported no constraints in<br />

obtaining direct export orders in Q2, a weighted 47 per cent that indicated export constraints cited price<br />

competition from overseas competitors and economic and political conditions abroad as the most<br />

important limiting factors. Within the services sector, the 1,500 firms surveyed seem less upbeat across<br />

sectors, with only a net weighted 6 per cent seeing better prospects. While a weighted 21 per cent predict<br />

a better business outlook and a weighted 15 per cent expect the opposite, the majority expect the<br />

business situation to remain unchanged, the Department of Statistics said. Firms in the recreation,<br />

community & personal services industry are the most optimistic, with a net weighted balance of 26 per<br />

cent of firms reporting a positive business outlook, with firms in the accommodation, wholesale trade and<br />

information & communications also being significantly upbeat. Firms in the real estate industry are<br />

generally cautious while the retail trade expressed significant pessimism, with retailers of motor vehicles,<br />

in particular, expect the reduced Certificate of Entitlement quota to hit business. Overall, a net weighted<br />

balance of 9 per cent of firms in the services sector predicts higher employment for the second quarter<br />

<strong>2012</strong>, indicating that the sector will still be hiring during this period.<br />

AVIATION<br />

Changi Airport passenger traffic up 12.7% in April<br />

Singapore Changi Airport (Changi) announced an increase in April passenger traffic to 4.21 million, up<br />

12.7 per cent from 3.73 million a year ago. Passenger traffic improved year-on-year across all regions<br />

with routes to and from the Middle East, South Asia, Northeast Asia and Southeast Asia achieving strong<br />

results. Commercial aircraft movements increased correspondingly by 8.8 per cent to 26,410 movements,<br />

from 24,266 movements a year ago. Due to the current downturn faced by most export markets around<br />

the world, Changi handled a 4.9 per cent decrease in cargo volume to 148,243 tonnes, compared to<br />

155,812 tonnes a year ago.<br />

In the same media release, Changi announced a new shuttle bus service to terminal 3 from the Bedok<br />

MRT bus stop every weekend and during public holidays. This is in addition to the shuttle service that<br />

connects the airport to Sengkang MRT station also on weekends and public holidays.<br />

TRADE & INVESTMENT<br />

Update: Singapore April export rise hides weak regional outlook<br />

Singapore exports rose more than expected in April due to a surge in pharmaceuticals but softness in<br />

electronics, a mainstay of manufacturing in many Asian economies, points to a likely slowdown in<br />

regional growth as China's economy cools. In Singapore, electronics account for about one-third of its<br />

exports of domestically produced goods excluding oil. The city-state said its non-oil domestic exports<br />

grew 8.3 per cent in April from a year ago, beating the consensus forecast of 6.9 per cent growth and<br />

turning around from March's 4.3 per cent year-on-year contraction. Electronics, however, grew by just 1<br />

per cent last month, while electronics re-exports - an indicator of regional trade flows - shrank 5.2 per cent<br />

year-on-year following a 5.5 per cent decline in March. Singapore is one of the world's largest<br />

transhipment centres and many of the region's products are moved to Singapore before they are shipped<br />

further afield.

URA signs urban planning MOU with Abu Dhabi<br />

PART III - EXTERNAL<br />

The Urban Redevelopment Authority (URA) has signed a memorandum of understanding with the Abu<br />

Dhabi Urban Planning Council (UPC) to formalise co-operation in the areas of land use and urban<br />

planning. Under the agreement, the two agencies will organise mutual visits, training courses and staff<br />

exchange programmes to facilitate the sharing of ideas, best practices and experiences in urban planning<br />

and development. The MOU also covers organising forums that will provide opportunities for private<br />

sector companies in Singapore to participate in sharing and networking sessions with key stakeholders of<br />

the planning and development industry in Abu Dhabi. The MOU follows an official visit by the UPC to<br />

URA in February this year and a reciprocal visit by URA to the Abu Dhabi planning authority recently.<br />

Singapore signs air service deal with Colombia<br />

Under the ASA, airlines of both Singapore and Colombia will have the flexibility to operate any number of<br />

direct passenger services between both countries. In addition, both countries' airlines can also operate,<br />

under certain restrictions, up to seven weekly passenger services and seven weekly cargo services<br />

between and beyond both countries. The ASA was signed by Singapore's Acting Minister for Foreign<br />

Affairs and Minister for Transport, Lui Tuck Yew, and Colombia's Minister of Foreign Affairs, María Ángela<br />

Holguín Cuéllar, at the sidelines of Colombian President Juan Manuel Santos Calderón's State Visit to<br />

Singapore from 6 to 8 May <strong>2012</strong>.<br />

Singapore and Bogota to share transport know-how<br />

Singapore will share its traffic management experience and know-how with Bogotá. Under a<br />

Memorandum of Understanding (MOU) signed in the Colombian capital, by the International Enterprise<br />

(IE) Singapore and the Ministry of Transport of the Republic of Colombia, a study will be conducted to<br />

improve the integration and efficiency of Bogotá's transport system amid rapid urbanisation. Colombia's<br />

Minister of Transportation Germán Cardona Gutiérrez said the MOU would tap Singapore's experience in<br />

building an efficient transport system despite limited land resources. " A team of transportation experts<br />

from Singapore will examine traffic conditions in the Colombian capital and devise a Traffic Demand<br />

Management (TDM) action plan. At the end of the study, they will recommend policies, infrastructure<br />

development and TDM strategies. Bogotá has received international recognition for the transformation of<br />

the city's transport network, which started in the mid-1990s. Since 2005, governments from at least 200<br />

cities have visited the city to learn about its transportation initiatives. One of its initiatives is the<br />

introduction of the Bus Rapid Transit Systems, the only large transportation project with approval by the<br />

United Nations to generate and sell carbon credits.<br />

S'pore, China set up services work group<br />

Underscoring close economic relations, China and Singapore will now explore the setting up of a new<br />

work group to facilitate collaboration in the services sector. This agreement emerged from the third<br />

Singapore-China Investment Promotion Committee (IPC) Meeting which was chaired by Singapore's<br />

Minister for Trade and Industry Lim Hng Kiang and China's Minister of Commerce Chen Deming.<br />

At the Beijing meeting, both ministers also discussed ways to further cooperation, specifically in the area<br />

of trade in services, and facilitating Chinese enterprises to internationalise their businesses through<br />

Singapore. Singapore, too, is keen to participate in China's growing services sectors such as health care<br />

and education. Singapore and China enjoy strong bilateral economic relations. In 2011, bilateral trade<br />

grew 6.4 per cent from the year before to reach $101.4 billion. Trade in services export has grown<br />

significantly in recent years. Currently, China is Singapore's third largest services export destination by<br />

country, and a fast growing one. Export of services to China increased by nearly five times over the last<br />

decade from $1.3 billion in 2001 to $7.4 billion in 2010. Key sectors include transportation services,<br />

financial and insurance, and business services. During the IPC meeting, Singapore and China also

discussed the upcoming review of the China-Singapore Free Trade Agreement (CSFTA) in June, to<br />

further improve its quality and smoothen its implementation.<br />

SBF inks MOU with Sri Lanka business community<br />

The Singapore Business Federation (SBF) signed a memorandum of understanding with the Sri Lanka<br />

Singapore Business Council of the Ceylon Chamber of Commerce (SLSBC), to promote the development<br />

of closer trade and economic relations. This follows the MOU signed between SBF and Sri Lanka Board<br />

of Investment in February, aimed to deepen collaboration between the private sectors and strengthen<br />

institutional relations between both countries.<br />

Asean+3 set to double swap fund size<br />

CHINA, South Korea, Japan and the 10 members of the Association of Southeast Asian Nations (Asean)<br />

are expected to announce an agreement on doubling the size of their regional currency swap deal to<br />

US$240 billion. The finance ministers and central bank governors of these 13 countries met in Manila for<br />

a meeting, at the end of which they are likely to release a joint statement approving an earlier proposal by<br />

their deputies to increase the Chiang Mai Initiative Multilateralisation (CMIM) fund. The fund - launched<br />

two years ago in an attempt to avoid a repeat of the kind of liquidity crisis that struck South-east Asia in<br />

1998 - currently stands at US$120 billion. Singapore will be represented by Deputy Prime Minister and<br />

Finance Minister Tharman Shanmugaratnam, according to a joint statement yesterday from the Ministry<br />

of Finance and the Monetary Authority of Singapore (MAS). Collectively known as the Asean+3, the 13<br />

countries are also expected to agree on making themselves less dependent on larger entities such as the<br />

International Monetary Fund (IMF), according to a Dow Jones report that quoted portions of a draft of the<br />

joint statement.<br />

The plan is to increase the amount that each country can tap for support to 30 per cent this year, up from<br />

20 per cent currently, without having to have a parallel aid package in place from the IMF. Asian<br />

Development Bank president Haruhiko Kuroda said that he believed the worst of the eurozone debt crisis<br />

was over, adding that he did not expect any serious impact on Asian economies from Europe's financial<br />

problems in the near future. Therefore, he said that assistance measures for Asia such as the CMIM and<br />

the Asian Development Fund were "sufficient" to help Asian economies cope for the time being.<br />

PART IV BILATERAL<br />

Telenor may leave India as fee spat spurs write-off<br />

Telenor says it may have to exit India, the world's second-largest mobile market, after the country's<br />

telecommunications regulator proposed an 11-fold increase in licence fees. Fornebu, Norway-based<br />

Telenor will write down its remaining fixed and intangible assets in India amounting to 3.9 billion kroner<br />

(S$840 million) as a "precautionary measure", the company, the Nordic region's biggest phone operator,<br />

said in a separate statement. At stake is Telenor's 140 billion rupee (S$3.2 billion) investment in India,<br />

and the fate of its more than 40 million customers. Investors have called on Telenor to pull out of the<br />

country. Telenor's licences in India were cancelled in February, and the regulator later recommended<br />

reauctioning the spectrum at higher prices.<br />

West Bengal rolls out schemes to woo S'pore investments<br />

Underlining the appeal of Singapore in India, the state of West Bengal is courting more businesses and<br />

investments from here.

West Bengal's Minister for Industries Partha Chatterjee invited companies from Singapore to invest in<br />

infrastructure, information communication & technology, textile, engineering, energy, biotechnology,<br />

banking & finance and agro-food processing in his state.<br />

He said that his government has come up with several schemes to make it more attractive for<br />

Singaporean businesses to consider the state as an investment destination. He added that because of its<br />

location, the state is an entry point to markets in South-east Asia. The minister also stressed that the<br />

state government has introduced several initiatives in the last one year to provide a streamlined, focused,<br />

hassle-free and modern business environment. These include the "Shilpa Bandhu" or the State<br />

Investment Facilitation Centre (SIFC) as the nodal agency for single-window clearances in West Bengal.<br />

He called on the Singapore business community to look at West Bengal as the next investment<br />

destination.<br />

Bharti close to buying Qualcomm unit: sources<br />

Qualcomm Inc is asking Bharti Airtel Ltd, India's largest mobile-phone operator, to pay about 50 billion<br />

rupees (S$1.16 billion) for its Indian unit as the two companies seek to conclude talks in the next two<br />

weeks, according to two people with knowledge of the matter. Bharti may purchase the unit in instalments<br />

over two years, the people said, declining to be identified as the details are private. Under the plan, Bharti<br />

would initially purchase a 26 per cent stake in the unit, currently held by Tulip Telecom Ltd and Global<br />

Holding Corp, and Qualcomm will own 51 per cent of the division for at least two years after that.<br />

Qualcomm, the biggest maker of mobile-phone chips, bought frequency licences in cities including New<br />

Delhi and Mumbai in June 2010, paying 49.1 billion rupees for spectrum that allows handset users to<br />

download video at greater speeds. The San Diego, California-based company was allocated spectrum<br />

this month, two years after paying for the airwaves, people with knowledge of the matter said on May 8.<br />

Mobile-phone operators in India including Bharti Airtel and Vodafone Group Plc are trying to boost<br />

revenue by selling services such as video streaming as incomes rise. The number of smartphones sold in<br />

India almost doubled last year to 11 million, according to data compiled by Bloomberg. Tulip Telecom and<br />

Global Holding paid 1.4 billion rupees each for their 13 per cent stakes in Qualcomm's Indian unit in 2010.<br />

Qualcomm owns the remaining 74 per cent.<br />

ST Kinetics files writ petition against Indian authorities to challenge ban<br />

After being blacklisted from conducting any business with the defence authorities in India, Singapore<br />

Technologies Kinetics has hit back. It filed a writ petition in the High Court of Delhi against the Indian<br />

Ministry of Defence (MoD) and the Indian Ordnance Factory Board (OFB), challenging the ban.<br />

In a statement issued on the Singapore Exchange website, ST Kinetics, the land systems and specialty<br />

vehicles arm of Singapore Technologies Engineering, said the writ petition seeks, among other things, the<br />

quashing of the debarment order issued by OFB. As announced in March, the debarment order dated<br />

March 5 this year ordered "the cancellation of all agreements" with ST Kinetics, specifically a Non-<br />

Disclosure Agreement signed on Aug 11, 2008, with the OFB, and debarred ST Kinetics from entering<br />

into any contract with the OFB for a period of 10 years. On March 12, the OFB clarified that, instead of<br />

being debarred from entering into any contract with the OFB for a period of 10 years, ST Kinetics would<br />

be debarred from further business dealings with the OFB for a period of 10 years. In response to this, ST<br />

Kinetics had filed a petition in the Supreme Court of India to refer to arbitration a show cause notice dated<br />

Feb 4, 2011, issued by the OFB to ST Kinetics, which the company said is listed for hearing on Aug 13,<br />

<strong>2012</strong>. The company explained that, according to Indian counsel, in light of the debarment order and the<br />

new writ petition, the arbitration petition has now become irrelevant. This is because ST Kinetics will now<br />

pursue its remedies with regard to the debarment order under the writ petition, and therefore the company<br />

said in its statement that it will be withdrawing the arbitration petition due to its irrelevance. In a BT report<br />

in March, ST Kinetics had expressed concern over the fairness of the legal process after it was implicated<br />

in a corruption case involving a high-ranking Indian official. This eventually saw the company receiving a<br />

disbarment order from doing business with the Ordnance Factory Board (OFB). ST Kinetics was<br />

blacklisted following initial investigations conducted by India's Criminal Bureau of Investigation (CBI),<br />

which was probing Sudipta Ghosh, the former director-general of OFB, over the award of defence

contracts. Ghosh has since been charged with corruption. No charges have been levelled against ST<br />

Kinetics, but it found itself being barred from doing business with OFB according to the official order then.<br />

The company reiterated in its statement yesterday that it has never won any defence contracts in India<br />

and that this development has no impact on ST Kinetics' defence business as India has not been a<br />

market for its defence export sales.<br />

Annexures to MCR for the Month of May, <strong>2012</strong><br />

1. Trade enquiries received from Singapore (Annexure I)<br />

2. Trade enquiries received from India (Annexure II to IIA)<br />

3. Summary of India-Singapore Trade: Monthly trends<br />

4. Singapore’s Total Global Trade (Top 10 Products)<br />

5. Singapore Global Imports (Top 10 Products)<br />

6. Singapore Global Exports (Top 10 Products)<br />

7. Singapore’s Imports from India (Top 10 Products)<br />

8. Singapore’s Exports to India (Top 10 Products)

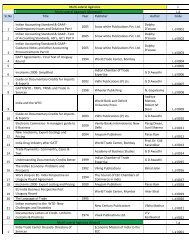

Annexure 1<br />

Singapore<br />

….<br />

Trade enquiries from Singapore for the month of May, <strong>2012</strong><br />

……..<br />

S.No. Nature of Enquiry No. of Enquiries<br />

1 Set up Branch Office in India (Logistics<br />

Business)<br />

1<br />

Mr H K Tan<br />

Morrison Express Logistics Pte Ltd<br />

7 Airline Road #04-09 Cargo Agents<br />

Building E, Singapore 819834<br />

Tel: 65456233<br />

Mobile: 65-96990444<br />

Email: hiongkuang_tan@morrisonexpress.com<br />

2 Others (investment, PAN, customs duties, setting up<br />

company, etc.)<br />

60<br />

Total 61

Annexure II<br />

Singapore<br />

Trade Enquiries received from India May <strong>2012</strong><br />

S.No Products Sector Code<br />

No. of<br />

Enquiries<br />

1 Business Chambers/Trade<br />

Associations<br />

2 Agricultural & Allied 18<br />

3 Marine<br />

4 Metals, Ores & Minerals/Stones 4<br />

5 Leather & Manufacturers 2<br />

6 Gems & Jewellery 5<br />

7 Sports Goods<br />

8 Chemicals & Pharmaceuticals 4<br />

9 Engineering Goods 2<br />

10 Electronics & Computers ( IT ) 2<br />

11 Building Material 2<br />

12 Textiles 6<br />

13 Handicrafts/Gifts 5<br />

14 Carpets<br />

15 Stationery & Paper Products 2<br />

16 Others 26<br />

17 Telephonic Enquiries 250

Total No of Enquiries 328<br />

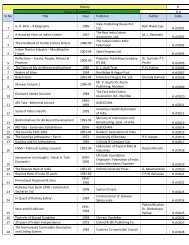

Annexure II A<br />

Enquiries for the Month of May <strong>2012</strong><br />

S.no Company Details Products Under Offer for Exports<br />

1 Mr. Kushal Tanwar Paper Products<br />

PUGMARK PRINTWORX PVT. LTD.<br />

New Delhi, India<br />

Email: 'kushaltanwar@pugmark.org.in'<br />

2 Mr. Kushal Tanwar Gift Items<br />

PUGMARK PRINTWORX PVT. LTD.<br />

New Delhi, India<br />

Email: 'kushaltanwar@pugmark.org.in'<br />

3 Mr. Kushal Tanwar Printing Companies<br />

PUGMARK PRINTWORX PVT. LTD.<br />

New Delhi, India<br />

Email: 'kushaltanwar@pugmark.org.in'<br />

4 Email: 'madhurakali25@yahoo.in' Organic Products<br />

5 Email: 'madhurakali25@yahoo.in' Fresh Fruis & Vegetables<br />

6 Email: 'madhurakali25@yahoo.in' Spices<br />

7 Mr. Kamlesh Khambhatta Pharmaceutical Machinery<br />

Sonus International<br />

Ahmedabad-6, India<br />

Email; info@sonus.in<br />

8 NeoTex Spinning Pvt Ltd Polyester Yarn<br />

Gandhinagar-7 (Gujarat), India<br />

Email:<br />

'aashaka@neoagrofoodsexports.com'

9 NeoTex Spinning Pvt Ltd Spices, Pulses<br />

Gandhinagar-7 (Gujarat), India<br />

Email:<br />

'aashaka@neoagrofoodsexports.com'<br />

10 NeoTex Spinning Pvt Ltd Indian Grocery Items<br />

Gandhinagar-7 (Gujarat), India<br />

Email:<br />

'aashaka@neoagrofoodsexports.com'<br />

11 Ms. Sanghvi Agro Commodities<br />

VIBGYOR AGRO COMMODITIES<br />

Email; 'peanuts@vibgyoragro.com'<br />

12 Mr. Pradeep Kumar Natural Stones<br />

Smartstone Private Limited<br />

Email;'pradeep@smartstoneindia.net'<br />

13 Mr. Abbas A Kassim Agri Commodities<br />

EmaiL; 'abbas_kassim2000@yahoo.com'<br />

14 K P Group of Companies Pesticide, Fungicide<br />

Ahmedabad-15 (Gujarat), India<br />

Email; 'kk.p.office@gmail.com'<br />

15 K P Group of Companies Dyes<br />

Ahmedabad-15 (Gujarat), India<br />

Email; 'kk.p.office@gmail.com'<br />

16 Mr. Hari Textiles, Garments<br />

GODAVARI VILLAGE CRAFTS<br />

Andhra Pradesh, India<br />

Email: 'challahari@rediffmail.com'<br />

17 Mr. Hari Fashion Accessories<br />

GODAVARI VILLAGE CRAFTS<br />

Andhra Pradesh, India<br />

Email: 'challahari@rediffmail.com'<br />

18 Email; 'hicureindia@yahoo.com' Personal & Health Care Products<br />

19 Mr. Shishir Kothari Plastic Closures<br />

Cap & Seal (Indore) Pvt. Ltd.<br />

Indore-1 (Madhya Pradesh), India

Email: 'shishir@capandseal.com'<br />

20 Mr. Joe Fresh Fruits & Vegetables<br />

Aruns International<br />

Trichy (Tamil Nadu), India<br />

Email; joeindia16@gmail.com<br />

21 Mr. Joe Flowers<br />

Aruns International<br />

Trichy (Tamil Nadu), India<br />

Email; joeindia16@gmail.com<br />

22 Mr. Selva RJ Handicrafts<br />

Shine International<br />

Email; smeshine@gmail.com<br />

23 Mr. Selva RJ Coconut Products<br />

Shine International<br />

Email; smeshine@gmail.com<br />

24 Mr. Selva RJ Knitted Garments<br />

Shine International<br />

Email; smeshine@gmail.com<br />

25 Mr. Selva RJ Spices<br />

Shine International<br />

Email; smeshine@gmail.com<br />

26 Mr. Selva RJ Candles<br />

Shine International<br />

Email; smeshine@gmail.com<br />

27 Mr. S.M.MUSHTHAQ AHMED Agri & Leather Goods<br />

Email; 'starexports786@yahoo.com'<br />

28 Email; 'sbossexports@yahoo.in' Agri Goods<br />

29 Mr. K M Jha Alcoholic Beverages<br />

Bhopal-21, India<br />

Email; 'jhakm@somindia.in'<br />

30 Mr. Dhaval Hiarapara Auto Parts<br />

Noble Impex

Rajkot-2 (Gujarat), India<br />

Email; nobleimpex88@gmail.com<br />

31 Email; 'jaggiexim@gmail.com' Agri Goods<br />

32 Email; 'jaggiexim@gmail.com' Jute Bags<br />

33 Mrs. Archana Garments<br />

Email; 'twinsexports<strong>2012</strong>@yahoo.com'<br />

34 Mr. Vinayak Rajpurohit Fabrics<br />

SONALE FABRICS PVT. LTD<br />

Email: 'sonalefabrics@yahoo.com'<br />

35 Mr. Vishal Tiwari Pharmaceuticals<br />

Elder Pharmaceuticals Ltd<br />

Email; vishaltiwari@elderindia.com<br />

36 Mr. Vishal Tiwari Personal & Health Care Products<br />

Elder Pharmaceuticals Ltd<br />

Email; vishaltiwari@elderindia.com<br />

37 Mr. John Jute Bags<br />

FLYMAX EXIM<br />

Ahmedabad-6, India<br />

Email: export@flymaxexim.com<br />

38 Mr. Nilesh Mehta Auto Parts<br />

Maruti International<br />

Email: export@marutiinternational.in<br />

39 Ms. Neha Gohar Fasteners<br />

Canco Fasteners<br />

New Delhi-29, India<br />

Email: nehagohar@hotmail.com<br />

40 Email; 'redocean008@aol.in' Fresh Fruits & Vegetables<br />

41 Mr. J P Gupta Wines<br />

Nirvana Biosys<br />

Email; 'pankaj@nirvanabiosys.com'<br />

42 Mr. Devaraju Fresh Onions & Potatoes

Dev International<br />

Coimbatore, India<br />

Email: info@dev-international.in<br />

43 Rk Exports Fresh Fruits & Vegetables<br />

Coimbatore, India<br />

Email: 'rkexports<strong>2012</strong>@gmail.com'<br />

44 Mr. Kailash Chand Soni Jewellery<br />

Best Gems<br />

Jaipur-2, India<br />

Email: bestgemsjaipur@gmail.com<br />

45 Leela Mony Bicycles<br />

Eastman Industries Ltd<br />

Ludhiana (Punjab), India<br />

Email: leela@eastmanglobal.com<br />

46 Mr. Agilam Jeyabalen Handicrafts & Textiles<br />

EmaiL; 'airnets@sify.com'<br />

47 Mr. Agilam Jeyabalen Indian Grocery Items<br />

EmaiL; 'airnets@sify.com'<br />

48 Mantra M Kansara Fresh Fruits & Vegetables, Rice, Wheat Flour<br />

Mukrash Exims<br />

Ahmedabad, India<br />

Email: exim.mukrash@gmail.com<br />

49 Mr. Mahalingam Edible Oil<br />

Email: 'aglobalconnector@gmail.com'<br />

50 Mr. Vijaya Baskaran Indian Grocery Items<br />

Siva Exports<br />

Madurai-9, India<br />

Email; sivaexportsindia@gmail.com<br />

51 Ms. Arpita Maheshwari Dried Fruits & Vegetables<br />

Shreeji Protein & Shreeji Dehydrates<br />

Exports<br />

Email: 'sales@shreejiprotein.com'<br />

52 Mr. V Ganesan Spices

Email; 'akilinternational@yahoo.com'<br />

53 Mr. Shashwat Devbrat Rapeseed Oil, Canola Oil & other Edible Oil<br />

iValue Consulting Pvt. Ltd.<br />

Gurgaon-2 (Haryana), India<br />

Email;sdevbrat@ivalueconsulting.com<br />

54 Nensi Khatri Textiles, Garments & Apparels<br />

Veer Import & Export<br />

Email: nensi.maniyar@gmail.com<br />

55 Vave globals Gift Items & Handicrafts<br />

Email; 'vaveglobals@gmail.com'<br />

56 Mr. A Srinivasan Stationery Products<br />

Chennai-8 (Tamil Nadu), India<br />

Email; 'asvimpex.<strong>2012</strong>@gmail.com'<br />

57 Mr. A Srinivasan Building Material<br />

Chennai-8 (Tamil Nadu), India<br />

Email; 'asvimpex.<strong>2012</strong>@gmail.com'<br />

58 Mr. A Srinivasan Spices<br />

Chennai-8 (Tamil Nadu), India<br />

Email; 'asvimpex.<strong>2012</strong>@gmail.com'<br />

59 Mr. G Jayaraman Auto Parts<br />

New Allenberry Works<br />

Faridabad-1211003, India<br />

Email; gj@nawgears.com<br />

60 Sunita Exports Agri Products<br />

Mumbai-92, India<br />

Email: 'sunitaexports@yahoo.in'<br />

61 Sunita Exports Veterinary Products<br />

Mumbai-92, India<br />

Email: 'sunitaexports@yahoo.in'<br />

62 Mr S K Jain Surgical & Medical Products<br />

Shree Shantinath industries<br />

Ambala Cantt-1, India<br />

Email: 'skj22678@gmail.com'

63 Mr. Sivankutty Organic Fertilizer<br />

NATIONAL ORGANIC FERTILIZER<br />

Ahmedabad-54 (Gujarat), India<br />

Email; export@noforganic.com<br />

64 Mr. Arun Kumar Yarn & Fabrics<br />

TT Limited<br />

New Delhi, India<br />

Email; 'arunsharma@tttextiles.com'<br />

65 Mr. K S Shashidhar Incense Sticks<br />

Email: indialinguistic@live.com<br />

66 Mr. Abhishek Mishra Processed Food<br />

Swapna Overseas<br />

Ahmedabad, India<br />

Email: 'abh.iiftr@gmail.com'<br />

67 Email; 'exports@anjalifoods.com' Agri Products (Rice,Pulses,Spices,Pickles)<br />

68 Mr. Sudhir Bhilar Metal Products(Steel Pipes & Rods)<br />

Email; 'sudhirbhilar@gmail.com'<br />

69 Mr. Sudhir Bhilar Agri Commodities<br />

Email; 'sudhirbhilar@gmail.com'<br />

70 Mr. B Naik Handicrafts<br />

Email; 'sanjeev@mozartexports.com'<br />

71 Mr. Vipul Fresh Fruits,Vegetables,Spices<br />

PRACHI EXPORTS<br />

Ahmedabad-81, India<br />

Email; 'prachiexports0407@gmail.com'<br />

72 Ms. Heena Deshpande Spices, Sugar, Oil seeds<br />

AgriLink - India<br />

Mumbai-63, India<br />

Email: heena@agrilinkindia.com<br />

73 Ms. Heena Deshpande Raw Cotton<br />

AgriLink - India<br />

Mumbai-63, India

Email: heena@agrilinkindia.com<br />

74 Ms. Heena Deshpande Dried Fruits & Vegetables<br />

AgriLink - India<br />

Mumbai-63, India<br />

Email: heena@agrilinkindia.com<br />

75 Mr. Manish Auto Electric Parts<br />

Email; manish@latlmkt.com<br />

76 Mrs. Bharti More Herbal care products<br />

RESHLON COSMETICS (P) LTD<br />

Thane-2, India<br />

Email; rekha@reshlon.com<br />

77 Mrs. Bharti More Beauty Products<br />

RESHLON COSMETICS (P) LTD<br />

Thane-2, India<br />

Email; rekha@reshlon.com<br />

78 Dr. Arvind Aggarwal Metal scrap<br />

Email: esb080652@gmail.com

ANNEXURE III<br />

India-Singapore Trade-Monthly Trends<br />

(Value in S$ Millions)<br />

India-Singapore Trade<br />

March<br />

<strong>2012</strong><br />

April<br />

<strong>2012</strong><br />

May<br />

<strong>2012</strong><br />

Total Trade (% Change)<br />

2,770<br />

(-16.17%)<br />

2,652<br />

(-4.26%)<br />

2,673(+1%)<br />

India’s Exports to Singapore (% Change)<br />

1,501 (-30.03%)<br />

1,421<br />

(-5.33%)<br />

1,416(-1%)<br />

India’s Imports from Singapore (%<br />

Change)<br />

1,269(+9.49%)<br />

1,230<br />

(-3.08%)<br />

1,528(+25%)<br />

Singapore’s Domestic Exports (%<br />

Change)<br />

622(+21.25%)<br />

562<br />

(-9.65%)<br />

627(+12%)<br />

Singapore’s Re-Exports (% Change)<br />

647(+0.16%) 667<br />

(+3.10%)<br />

629(-6%)

Annexure-IV<br />

Singapore’s Total Global Trade (Top 10 Products)<br />

(Value in S$ Millions)<br />

Product<br />

May<br />

2010<br />

May<br />

2011<br />

May<br />

<strong>2012</strong><br />

1<br />

OTHER PETROLEUM OILS & OILS FROM BITUMINOUS<br />

MINERALS NOT CRUDE & PREPARATIONS NES CONTAINING<br />

BY WEIGHT 70% OR MORE OF PETROLEUM OILS OR OF OILS<br />

OBTAINED FROM BITUMINOUS MINERALS EXCL THOSE<br />

CONTAINING BIODIESEL & WASTE OILS (HS 271019)<br />

8,204 12,864 12,744<br />

2<br />

OTHER ELECTRONIC INTEGRATED CIRCUITS (HS 854239) 8,772 7,407 7,293<br />

3<br />

PETROLEUM OILS & OILS FROM BITUMINOUS MINERALS<br />

CRUDE (HS 270900)<br />

2,061 3,975 4,729<br />

4<br />

LIGHT OILS & PREPARATIONS CONTAINING BY WEIGHT 70 %<br />

OR MORE OF PETROLEUM OILS OR OILS FROM BITUMINOUS<br />

MINERALS (HS 271012)<br />

3,654 4,089 4,338<br />

5<br />

PROCESSORS & CONTROLLERS CONVERTERS LOGIC CIRCUITS<br />

AMPLIFIERS CLOCK TIMING CIRCUITS OR OTHER CIRCUITS<br />

(HS 854231)<br />

3,014 3,682 3,974<br />

6<br />

SHIPS & AIRCRAFT BUNKERS & STORES LOADED ON BOARD<br />

FOR OWN CONSUMPTION (HS 989300)<br />

2,557 3,140 3,632<br />

7<br />

PARTS & ACCESSORIES OF MACHINES OF 8471 (HS 847330) 2,195 1,807 1,619<br />

8<br />

TELEPHONES FOR CELLULAR NETWORKS OR FOR OTHER<br />

WIRELESS NETWORKS (HS 851712)<br />

833 1,168 1,181<br />

9<br />

OTHER PARTS OF AEROPLANES OR HELICOPTERS (HS<br />

880330)<br />

906 968 1,136<br />

10<br />

OTHER PARTS & ACCESSORIES OF PRINTING MACHINERY &<br />

PRINTERS COPYING & FACSIMILE MACHINES (HS 844399)<br />

1,054 1,072 1,001

TOTAL FOR THE ABOVE<br />

33,250 40,172 41,647<br />

TOTAL FOR OTHER PRODUCTS<br />

15,907 17,488 17,640<br />

GRAND TOTAL<br />

49,157 57,660 59,287<br />

Annexure-V<br />

Singapore’s Global Imports (Top 10 Products)<br />

(Value in S$ Millions)<br />

Product<br />

May<br />

2010<br />

May<br />

2011<br />

May<br />

<strong>2012</strong><br />

1<br />

OTHER PETROLEUM OILS & OILS FROM BITUMINOUS<br />

MINERALS NOT CRUDE & PREPARATIONS NES<br />

CONTAINING BY WEIGHT 70% OR MORE OF<br />

PETROLEUM OILS OR OF OILS OBTAINED FROM<br />

BITUMINOUS MINERALS EXCL THOSE CONTAINING<br />

BIODIESEL & WASTE OILS (HS 271019)<br />

4,149 6,906 7,248<br />

2<br />

PETROLEUM OILS & OILS FROM BITUMINOUS<br />

MINERALS CRUDE (HS 270900)<br />

2,061 3,974 4,729<br />

3<br />

OTHER ELECTRONIC INTEGRATED CIRCUITS (HS 854239) 4,451 3,777 3,854<br />

4<br />

LIGHT OILS & PREPARATIONS CONTAINING BY WEIGHT<br />

70 % OR MORE OF PETROLEUM OILS OR OILS FROM<br />

BITUMINOUS MINERALS (HS 271012)<br />

1,569 1,836 1,821<br />

5<br />

PROCESSORS & CONTROLLERS CONVERTERS LOGIC<br />

CIRCUITS AMPLIFIERS CLOCK TIMING CIRCUITS OR<br />

OTHER CIRCUITS (HS 854231)<br />

923 854 969<br />

6<br />

TELEPHONES FOR CELLULAR NETWORKS OR FOR<br />

OTHER WIRELESS NETWORKS (HS 851712)<br />

493 763 679<br />

7<br />

PARTS & ACCESSORIES OF MACHINES OF 8471 (HS<br />

847330)<br />

825 693 655

8<br />

NATURAL GAS (HS 271121) ----- 522 617<br />

9<br />

OTHER PARTS OF AEROPLANES OR HELICOPTERS (HS<br />

880330)<br />

420 452 569<br />

10<br />

PARTS OF TURBO JETS OR TURBO-PROPELLERS (HS<br />

841191)<br />

262 319 549<br />

TOTAL FOR THE ABOVE<br />

15,153 20,096 21,690<br />

TOTAL FOR OTHER PRODUCTS 8,335 8,712 8,945<br />

GRAND TOTAL<br />

23,488 28,808 30,635<br />

Annexure-VI<br />

Singapore’s Global Exports (Top 10 Products)<br />

Product<br />

May<br />

2010<br />

May<br />

2011<br />

(Value in S$ Millions)<br />

May<br />

<strong>2012</strong><br />

1<br />

OTHER PETROLEUM OILS & OILS FROM BITUMINOUS<br />

MINERALS NOT CRUDE & PREPARATIONS NES<br />

CONTAINING BY WEIGHT 70% OR MORE OF<br />

PETROLEUM OILS OR OF OILS OBTAINED FROM<br />

BITUMINOUS MINERALS EXCL THOSE CONTAINING<br />

BIODIESEL & WASTE OILS (HS 271019)<br />

4,054 5,958 5,496<br />

2<br />

SHIPS & AIRCRAFT BUNKERS & STORES LOADED ON<br />

BOARD FOR OWN CONSUMPTION (HS 989300)<br />

2,557 3,140 3,632<br />

3<br />

OTHER ELECTRONIC INTEGRATED CIRCUITS (HS<br />

854239)<br />

4,321 3,630 3,439<br />

4<br />

PROCESSORS & CONTROLLERS CONVERTERS LOGIC<br />

CIRCUITS AMPLIFIERS CLOCK TIMING CIRCUITS OR<br />

OTHER CIRCUITS (HS 854231)<br />

2,090 2,827 3,004

5<br />

LIGHT OILS & PREPARATIONS CONTAINING BY<br />

WEIGHT 70 % OR MORE OF PETROLEUM OILS OR<br />

OILS FROM BITUMINOUS MINERALS (HS 271012)<br />

2,084 2,253 2,516<br />

6<br />

PARTS & ACCESSORIES OF MACHINES OF 8471 (HS<br />

847330)<br />

1,369 1,113 963<br />

7<br />

MEMORIES (HS 854232) 865 625 690<br />

8<br />

OTHER PARTS & ACCESSORIES OF PRINTING<br />

MACHINERY & PRINTERS COPYING & FACSIMILE<br />

MACHINES (HS 844399)<br />

798 761 677<br />

9<br />

OTHER PARTS OF AEROPLANES OR HELICOPTERS (HS<br />

880330)<br />

485 516 567<br />

10<br />

PARTS OF BORING OR SINKING MACHINERY OF<br />

SUBHEADING 8430.41 OR 8430.49 (HS 843143)<br />

357 326 520<br />

TOTAL FOR THE ABOVE<br />

18,980 21,149 21,504<br />

TOTAL FOR OTHER PRODUCTS<br />

7,364 8,253 7,363<br />

GRAND TOTAL<br />

26,344 29,402 28,867<br />

Annexure-VII<br />

Singapore’s Export to India (Top 10 Products)<br />

(Value in S$ Millions)<br />

PRODUCT<br />

Jan - May<br />

2010<br />

Jan – May<br />

2011<br />

Jan - May<br />

<strong>2012</strong><br />

1<br />

OTHER PETROLEUM OILS & OILS FROM BITUMINOUS<br />

MINERALS NOT CRUDE & PREPARATIONS NES<br />

CONTAINING BY WEIGHT 70% OR MORE OF<br />

PETROLEUM OILS OR OF OILS OBTAINED FROM<br />

BITUMINOUS MINERALS EXCL THOSE CONTAINING<br />

BIODIESEL & WASTE OILS (HS 271019)<br />

1,067 1,924 651

2<br />

PARTS & ACCESSORIES OF MACHINES OF 8471 (HS<br />

847330)<br />

374 403 339<br />

3<br />

OTHER PARTS & ACCESSORIES OF PRINTING<br />

MACHINERY & PRINTERS COPYING & FACSIMILE<br />

MACHINES (HS 844399)<br />

200 195 257<br />

4<br />

STYRENE (HS 290250) 143 178 214<br />

5<br />

MACHINES FOR RECEPTION CONVERSION &<br />

TRANSMISSION OR REGENERATION OF VOICE<br />

IMAGES OR OTHER DATA (HS 851762)<br />

95 131 164<br />

6<br />

OTHER ELECTRONIC INTEGRATED CIRCUITS (HS<br />

854239)<br />

252 194 155<br />

7<br />

P-XYLENE (HS 290243) 64 86 134<br />

8<br />

SHIPS & AIRCRAFT BUNKERS & STORES LOADED ON<br />

BOARD FOR OWN CONSUMPTION (HS 989300)<br />

97 134 126<br />

9<br />

PARTS OF BORING OR SINKING MACHINERY OF<br />

SUBHEADING 8430.41 OR 8430.49 (HS 843143)<br />

77 76 101<br />

10<br />

OTHER POLYMERS OF ETHYLENE IN PRIMARY FORMS<br />

(HS 390190)<br />

80 71 97<br />

TOTAL FOR THE ABOVE<br />

2,449 3,392 2238<br />

TOTAL FOR OTHER PRODUCTS 1,256 1,290 899<br />

GRAND TOTAL<br />

3,705 4,682 3137

Annexure VIII<br />

Singapore’s Import from India (Top 10 Products)<br />

(Value in S$ Millions)<br />

PRODUCT<br />

Jan -<br />

May<br />

2010<br />

Jan –<br />

May<br />

2011<br />

Jan -<br />

May<br />

<strong>2012</strong><br />

1<br />

LIGHT OILS & PREPARATIONS CONTAINING BY WEIGHT<br />

70 % OR MORE OF PETROLEUM OILS OR OILS FROM<br />

BITUMINOUS MINERALS (HS 271012)<br />

1,116 2,779 3,535<br />

2<br />

OTHER PETROLEUM OILS & OILS FROM BITUMINOUS<br />

MINERALS NOT CRUDE & PREPARATIONS NES<br />

CONTAINING BY WEIGHT 70% OR MORE OF PETROLEUM<br />

OILS OR OF OILS OBTAINED FROM BITUMINOUS<br />

MINERALS EXCL THOSE CONTAINING BIODIESEL &<br />

WASTE OILS (HS 271019)<br />

2,144 3,341 2,788<br />

3<br />

OTHER ARTICLES OF JEWELLERY OF OTHER PRECIOUS<br />

METAL (HS 711319)<br />

190 220 190<br />

4<br />

OTHER MOTOR VEHICLES FOR TRANSPORTING GOODS<br />

WITH COMPRESSION IGNITION INTERNAL COMBUSTION<br />

PISTON ENGINE OF GVW OVER 20T (HS 870423)<br />

43 74 160<br />

5<br />

WORKED NON-INDUSTRIAL DIAMONDS NOT MOUNTED<br />

OR SET (HS 710239)<br />

156 123 87<br />

6<br />

WORKED INDUSTRIAL DIAMONDS NOT MOUNTED OR<br />

SET (HS 710229)<br />

65 67 86<br />

7<br />

OTHER ACYCLIC ETHERS & THEIR HALOGENATED<br />

SULPHONATED NITRATED OR NITROSATED DERIVATIVES<br />

(HS 290919)<br />

.004 .005 58<br />

8<br />

TELEPHONES FOR CELLULAR NETWORKS OR FOR OTHER<br />

WIRELESS NETWORKS (HS 851712)<br />

91 37 45<br />

9<br />

OTHER ELECTRO-DIAGNOSTIC APPARATUS (HS 901819) 2 .400 42

10<br />

PARTS OF BORING OR SINKING MACHINERY OF<br />

SUBHEADING 8430.41 OR 8430.49 (HS 843143)<br />

13 11 30<br />

TOTAL FOR THE ABOVE<br />

3,820 6,652 7,021<br />

TOTAL FOR OTHER PRODUCTS<br />

500 473 371<br />

GRAND TOTAL<br />

4,320 7,125 7,392