SEMI-ANNUAL REPORT - First Investors

SEMI-ANNUAL REPORT - First Investors

SEMI-ANNUAL REPORT - First Investors

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

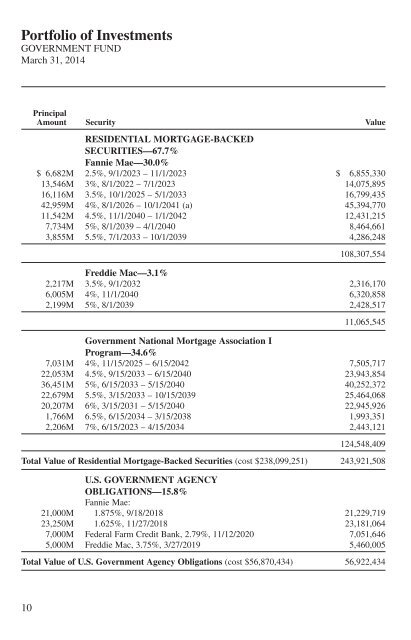

Portfolio of Investments (continued)<br />

GOVERNMENT FUND<br />

March 31, 2014<br />

Principal<br />

Amount Security Value<br />

RESIDENTIAL MORTGAGE-BACKED<br />

SECURITIES—67.7%<br />

Fannie Mae—30.0%<br />

$ 6,682 M 2.5%, 9/1/2023 – 11/1/2023 $ 6,855,330<br />

13,546 M 3%, 8/1/2022 – 7/1/2023 14,075,895<br />

16,116 M 3.5%, 10/1/2025 – 5/1/2033 16,799,435<br />

42,959 M 4%, 8/1/2026 – 10/1/2041 (a) 45,394,770<br />

11,542 M 4.5%, 11/1/2040 – 1/1/2042 12,431,215<br />

7,734 M 5%, 8/1/2039 – 4/1/2040 8,464,661<br />

3,855 M 5.5%, 7/1/2033 – 10/1/2039 4,286,248<br />

108,307,554<br />

Freddie Mac—3.1%<br />

2,217 M 3.5%, 9/1/2032 2,316,170<br />

6,005 M 4%, 11/1/2040 6,320,858<br />

2,199 M 5%, 8/1/2039 2,428,517<br />

11,065,545<br />

Government National Mortgage Association I<br />

Program—34.6%<br />

7,031 M 4%, 11/15/2025 – 6/15/2042 7,505,717<br />

22,053 M 4.5%, 9/15/2033 – 6/15/2040 23,943,854<br />

36,451 M 5%, 6/15/2033 – 5/15/2040 40,252,372<br />

22,679 M 5.5%, 3/15/2033 – 10/15/2039 25,464,068<br />

20,207 M 6%, 3/15/2031 – 5/15/2040 22,945,926<br />

1,766 M 6.5%, 6/15/2034 – 3/15/2038 1,993,351<br />

2,206 M 7%, 6/15/2023 – 4/15/2034 2,443,121<br />

124,548,409<br />

Total Value of Residential Mortgage-Backed Securities (cost $238,099,251) 243,921,508<br />

U.S. GOVERNMENT AGENCY<br />

OBLIGATIONS—15.8%<br />

Fannie Mae:<br />

21,000 M 1.875%, 9/18/2018 21,229,719<br />

23,250 M 1.625%, 11/27/2018 23,181,064<br />

7,000 M Federal Farm Credit Bank, 2.79%, 11/12/2020 7,051,646<br />

5,000 M Freddie Mac, 3.75%, 3/27/2019 5,460,005<br />

Total Value of U.S. Government Agency Obligations (cost $56,870,434) 56,922,434<br />

10