Full RSDB annual report for 2008 - Roto Smeets Group

Full RSDB annual report for 2008 - Roto Smeets Group

Full RSDB annual report for 2008 - Roto Smeets Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

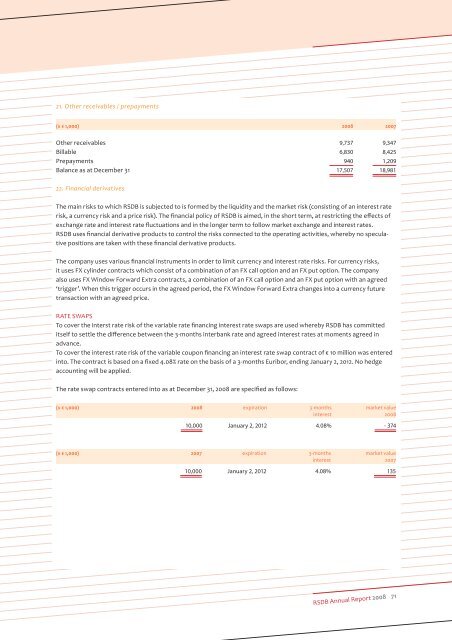

21. Other receivables / prepayments<br />

(x € 1,000) <strong>2008</strong> 2007<br />

Other receivables 9,737 9,347<br />

Billable 6,830 8,425<br />

Prepayments 940 1,209<br />

Balance as at December 31 17,507 18,981<br />

22. Financial derivatives<br />

The main risks to which <strong>RSDB</strong> is subjected to is <strong>for</strong>med by the liquidity and the market risk (consisting of an interest rate<br />

risk, a currency risk and a price risk). The financial policy of <strong>RSDB</strong> is aimed, in the short term, at restricting the effects of<br />

exchange rate and interest rate fluctuations and in the longer term to follow market exchange and interest rates.<br />

<strong>RSDB</strong> uses financial derivative products to control the risks connected to the operating activities, whereby no speculative<br />

positions are taken with these financial derivative products.<br />

The company uses various financial instruments in order to limit currency and interest rate risks. For currency risks,<br />

it uses FX cylinder contracts which consist of a combination of an FX call option and an FX put option. The company<br />

also uses FX Window Forward Extra contracts, a combination of an FX call option and an FX put option with an agreed<br />

‘trigger’. When this trigger occurs in the agreed period, the FX Window Forward Extra changes into a currency future<br />

transaction with an agreed price.<br />

RATE SWAPS<br />

To cover the interst rate risk of the variable rate financing interest rate swaps are used whereby <strong>RSDB</strong> has committed<br />

itself to settle the difference between the 3-months interbank rate and agreed interest rates at moments agreed in<br />

advance.<br />

To cover the interest rate risk of the variable coupon financing an interest rate swap contract of € 10 million was entered<br />

into. The contract is based on a fixed 4.08% rate on the basis of a 3-months Euribor, ending January 2, 2012. No hedge<br />

accounting will be applied.<br />

The rate swap contracts entered into as at December 31, <strong>2008</strong> are specified as follows:<br />

(x € 1,000) <strong>2008</strong> expiration 3-months<br />

interest<br />

market value<br />

<strong>2008</strong><br />

10,000 January 2, 2012 4.08% - 374<br />

(x € 1,000) 2007 expiration 3-months<br />

interest<br />

market value<br />

2007<br />

10,000 January 2, 2012 4.08% 135<br />

<strong>RSDB</strong> Annual Report <strong>2008</strong> 71