s&n says - Medical Device Daily

s&n says - Medical Device Daily

s&n says - Medical Device Daily

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MEDICAL DEVICE DAILY <br />

JP Morgan Healthcare Conference<br />

Panel investigates more firms<br />

pursuing ‘private phenomena’<br />

By HOLLAND JOHNSON<br />

<strong>Medical</strong> <strong>Device</strong> <strong>Daily</strong> Associate Managing Editor<br />

SAN FRANCISCO — What does a company do that for<br />

some reason has fallen out of favor with the public markets<br />

One, it can elect to tough it out and maintain its public<br />

status or, two, it can find a private buyer and attempt to<br />

reinvent itself outside the public eye.<br />

A panel at last week’s JP Morgan Healthcare Conference,<br />

titled “The Going Private Phenomena in Healthcare,”<br />

investigated what some have seen as a growing shift<br />

towards companies taking the road more private.<br />

Panel moderator John Coyle, a managing director at JP<br />

Morgan, said that especially in 2006 “we’ve seen a significant<br />

level of private equity activity across just about every<br />

industry with the most noticeable trait being the [large]<br />

size of the transactions.”<br />

THE DAILY MEDICAL TECHNOLOGY NEWSPAPER<br />

TUESDAY, JANUARY 16, 2007 VOL. 11, NO. 10 PAGE 1 OF 9<br />

Despite rising healthcare costs,<br />

consumer share relatively flat<br />

By MARK McCARTY<br />

<strong>Medical</strong> <strong>Device</strong> <strong>Daily</strong> Washington Editor<br />

WASHINGTON — The Centers for Medicare & Medicaid<br />

Services has tracked a wealth of data regarding<br />

healthcare expenditures, and while those numbers indicate<br />

rising costs, the increase has lost a little steam of late. Still,<br />

as employers and government feel the continuing pinch,<br />

they pass along some of the “ouch” to employees in the<br />

form of higher premiums and co-pays, which is often seen<br />

as making healthcare increasingly unaffordable.<br />

Unaffordable or not, the numbers suggest that household<br />

income has not felt the bite of added healthcare costs<br />

that is so readily assumed.<br />

Aaron Catlin, an economist with the National Health<br />

Statistics Groups at CMS, in an agency briefing last week,<br />

said that while healthcare spending in the U.S. rose 6.9% to<br />

a total of $2 trillion in 2005, that year’s total was nonethe-<br />

See Private, Page 5 See Costs, Page 6<br />

RoundTable aquires Advantis,<br />

forming Avalign Technologies<br />

A <strong>Medical</strong> <strong>Device</strong> <strong>Daily</strong> Staff Report<br />

RoundTable Healthcare Partners (Lake Forest, Illinois)<br />

reported that it has completed the acquisition of<br />

Advantis <strong>Medical</strong> (Greenwood, Indiana), a manufacturer<br />

of medical case/tray systems for surgical instruments,<br />

implants and devices.<br />

Advantis will be combined with Instrumed International<br />

(Roswell, Georgia), in which RoundTable acquired a<br />

majority interest in 2005, which specializes in manufacturing<br />

and sourcing of surgical instruments. The companies<br />

will form a new medical device outsourcing platform<br />

named Avalign Technologies.<br />

Financial terms of the transaction and RoundTable’s<br />

See RoundTable, Page 8<br />

Holiday notice<br />

The offices of <strong>Medical</strong> <strong>Device</strong> <strong>Daily</strong> were closed yesterday<br />

in observance of the Martin Luther King Day holiday<br />

in the U.S.<br />

International report<br />

Sequenom, Qiagen collaborate<br />

on fetal diagnostics program<br />

A <strong>Medical</strong> <strong>Device</strong> <strong>Daily</strong> Staff Report<br />

Sequenom (San Diego) reported a collaboration with<br />

Qiagen, a wholly-owned subsidiary of Qiagen NV (Venlo,<br />

the Netherlands), to jointly develop a “gold standard” preanalytical<br />

solution for small-molecule (fetal) DNA enrichment<br />

for prenatal diagnostics.<br />

Sequenom will retain exclusive distribution rights to<br />

the technology for enriching short nucleic acids developed<br />

under the collaboration.<br />

The companies said the collaboration will combine<br />

Qiagen’s expertise in preanalytical sample preparation<br />

technologies in life sciences and molecular diagnostics<br />

with Sequenom’s capabilities in genetic analysis technology.<br />

The goal of the collaboration is to develop what<br />

Sequenom termed “a robust and reliable set of reagents<br />

that optimize the enrichment of small nucleic acid fragments,<br />

such as circulating free fetal nucleic acids in<br />

See International, Page 7<br />

INSIDE:<br />

S&N SAYS DENIAL OF STAY TENDS TO SUPPORT PATENT BREACH ..................2<br />

MONOGRAM TO SELL $30M OF NOTES FOR NEW ASSAY ROLL-OUTS .....................3<br />

To subscribe, please call MEDICAL DEVICE DAILY Customer Service at (800) 688-2421; outside the U.S. and Canada, call (404) 262-5476.<br />

Copyright © 2007 AHC Media LLC. Reproduction is strictly prohibited. Visit our web site at www.medicaldevicedaily.com.

TUESDAY, JANUARY 16, 2007 MEDICAL DEVICE DAILY PAGE 2 OF 9<br />

Court report<br />

S&N <strong>says</strong> judge’s denial of stay<br />

tends to support patent breach<br />

A <strong>Medical</strong> <strong>Device</strong> <strong>Daily</strong> Staff Report<br />

Smith & Nephew (Memphis, Tennessee) reported that<br />

a three-judge panel of the U.S. Court of Appeals for the Federal<br />

Circuit has denied a stay of injunction while appeals<br />

are heard in a patent infringement suit.<br />

S&N said that the permanent injunction was ordered<br />

on Sept. 28, 2006, and bars Synthes (Synthes USA, Westchester,<br />

Pennsylvania) and Synthes-Stratec (Oberdorf,<br />

Switzerland) from offering, selling or promoting Synthes<br />

Trochanteric Fixation Nail (TFN) and Proximal Fixation Nail<br />

(PFN) products in the U.S. for use in repairing<br />

intertrochanteric fractures.<br />

“Once again the court has clearly affirmed the severity<br />

of this patent breach,” said Mark Augusti, president of S&N<br />

Orthopaedic Trauma & Clinical Therapies. “Upholding the<br />

injunction, especially during any appeals process, strongly<br />

supports the defense of our intellectual property.”<br />

S&N filed the original suit against Synthes in November<br />

2002. A non-jury trial that began in December 2004<br />

concluded in March of 2005, with Judge Samuel Mays, Jr.<br />

issuing his findings supporting the injunction order on<br />

September 28, 2006.<br />

Smith & Nephew’s Trigen Nail system is used in the<br />

healing of proximal femoral fractures (upper leg bone fractures).<br />

Intramedullary nails are placed inside the bone to<br />

aid in the healing of bone fractures.<br />

In other legalities:<br />

• Brinks Hofer Gilson & Lione (Chicago) reported<br />

that its client, MarcTec (Effingham, Illinois) has reached a<br />

settlement with ArthroCare (Austin, Texas), in a lawsuit<br />

involving 10 patents related to suture anchors used in rotator<br />

cuff surgery and other arthroscopic procedures.<br />

Ralph Gabric, an attorney representing MarcTec, said<br />

ArthroCare will pay MarcTEc $2.75 million, plus future royalties,<br />

See Court Report, Page 8<br />

HealthSouth now set to pursue<br />

claims vs. Scrushy, auditors<br />

A <strong>Medical</strong> <strong>Device</strong> <strong>Daily</strong> Staff Report<br />

HealthSouth (Birmingham, Alabama) last week said<br />

that it is now in position to pursue its claims against its former<br />

CEO, Richard Scrushy, its auditors and others, during the<br />

period that its books were inflated by millions of dollars.<br />

HealthSouth said it received final court approval of<br />

agreements with the lead plaintiffs in the federal securities<br />

class actions and the derivative actions, as well as<br />

certain of its insurance carriers, to settle litigation filed<br />

against it, certain of its former directors and officers and<br />

certain other parties in the U.S. District Court for the<br />

Northern District of Alabama and the Circuit Court in Jefferson<br />

County, Alabama. The claims relate to financial<br />

reporting and related activity that occurred at the company<br />

during periods ended in March 2003.<br />

The settlement brought in the class action against<br />

HealthSouth and certain of its former directors and officers<br />

via payment of HealthSouth stock and warrants valued<br />

at $215 million and cash payments of $230 million.<br />

In addition, the federal securities class will receive 25%<br />

of any net recoveries from future judgments obtained by<br />

or on behalf of HealthSouth with respect to certain claims<br />

against Scrushy, Ernst & Young, the company’s former auditors,<br />

and UBS, the company’s former primary investment<br />

bank. The agreements were previously reported Sept. 27,<br />

2006 (<strong>Medical</strong> <strong>Device</strong> <strong>Daily</strong>, 2006).<br />

Jay Grinney, president/CEO of HealthSouth, said, “We<br />

now can focus our legal resources on asserting our claims<br />

against the company’s former chief executive officer; former<br />

auditors, Ernst & Young; and former primary investment<br />

bank, UBS, for the role each of them played in the fraud perpetrated<br />

against HealthSouth and its shareholders.”<br />

HealthSouth is a large provider of outpatient surgery,<br />

diagnostic imaging and rehabilitative healthcare services.<br />

MEDICAL DEVICE DAILY (ISSN# 1541-0617) is published every business day by AHC Media LLC,<br />

3525 Piedmont Road, Building Six, Suite 400, Atlanta, GA 30305. Opinions expressed are not necessarily<br />

those of this publication. Mention of products or services does not constitute endorsement.<br />

MEDICAL DEVICE DAILY is a trademark of AHC Media LLC, a Thompson Publishing Group company.<br />

Copyright © 2007 AHC Media LLC. All Rights Reserved. No part of this publication may be reproduced<br />

without the written consent of AHC Media LLC. (GST Registration Number R128870672)<br />

ATLANTA NEWSROOM: Executive Editor: Jim Stommen. Managing Editor: Don Long.<br />

Associate Managing Editor: Holland Johnson. Staff Writers: Amanda<br />

Pedersen and Karen Young. Washington Editor: Mark McCarty.<br />

Production Editor: Rob Kimball.<br />

BUSINESS OFFICE: Vice President/Group Publisher: Donald R. Johnston.<br />

Marketing Manager: Chris Walker.<br />

Account Representatives: Steve Roberts, Chris Wiley.<br />

REPRINTS:<br />

For photocopy rights or reprints, please call Stephen Vance<br />

at (404) 262-5511 or e-mail him at stephen.vance@ahcmedia.com.<br />

SUBSCRIBER INFORMATION<br />

Please call (800) 688-2421 to subscribe<br />

or if you have fax transmission<br />

problems. Outside U.S. and<br />

Canada, call (404) 262-5476. Our<br />

customer service hours are 8:30<br />

a.m. to 6:00 p.m. EST.<br />

EDITORIAL<br />

Don Long, (404) 262-5539<br />

Fax: (404) 814-0759<br />

VP/GROUP PUBLISHER<br />

Donald R. Johnston, (404) 262-<br />

5439<br />

INTERNET<br />

www.medicaldevicedaily.com<br />

To subscribe, please call MEDICAL DEVICE DAILY Customer Service at (800) 688-2421; outside the U.S. and Canada, call (404) 262-5476.<br />

Copyright © 2007 AHC Media LLC. Reproduction is strictly prohibited. Visit our web site at www.medicaldevicedaily.com.

TUESDAY, JANUARY 16, 2007 MEDICAL DEVICE DAILY PAGE 3 OF 9<br />

Upcoming med-tech meetings . . .<br />

• Hawaiian Eye Meeting, Jan. 14-19, Grand Hyatt Kauai<br />

Resort & Spa.<br />

www.vindicomeded.com<br />

• The Society of Thoracic Surgeons (STS) 43rd<br />

Annual Meeting, Jan. 29-31; exhibits: Jan. 28-30, San<br />

Diego Convention Center.<br />

www.sts.org.<br />

• Stroke Nursing Symposium, Feb. 6, Moscone West<br />

Convention Center, (San Francisco).<br />

www.strokeconference.americanheart.org<br />

• Merrill Lynch Global Pharmaceutical, Biotechnology<br />

and <strong>Medical</strong> <strong>Device</strong> Conference, Feb. 6-8, The<br />

Grand Hyatt (New York).<br />

www.events.ml.com<br />

• International Stroke Conference 2007, Feb. 7-9;<br />

exhibits, Feb. 7-8 (San Francisco).<br />

www.strokeconference.americanheart.org<br />

• American Academy of Orthopaedic Surgeons<br />

Annual Meeting, Feb. 14-18 (San Diego).<br />

www.aaos.org<br />

• Interdisciplinary Breast Center Conference, 17th<br />

Annual Conference, Feb. 24-28 (Las Vegas, Nevada).<br />

• Healthcare Information and Management Systems<br />

(HIMSS) Annual Conference & Exhibition, Feb. 25-<br />

March 1 (New Orleans).<br />

www.himss07.org<br />

• AACC: Clinical Applications of Pharmacogenomics<br />

(PGx), Feb. 26 – 27, Hyatt Regency Crystal City<br />

(Arlington, Virginia).<br />

www.aacc.org<br />

<strong>Medical</strong> <strong>Device</strong> <strong>Daily</strong> will periodically run “Upcoming<br />

med-tech meetings . . .” To make additions to this listing,<br />

contact Karen Young: phone, 404-262-5423; e-mail,<br />

karen.young@ahcmedia.com.<br />

Monogram to sell $30M of notes,<br />

add cash, for new assay roll-outs<br />

A <strong>Medical</strong> <strong>Device</strong> <strong>Daily</strong> Staff Report<br />

Monogram Biosciences (South San Francisco, California)<br />

said it will sell $30 million of 0% convertible senior<br />

unsecured notes, due 2026, to a qualified institutional<br />

buyer. Gross proceeds will be $22.5 million. Closing of the<br />

transaction is expected to occur later today.<br />

The principal amount of the notes will be convertible<br />

into shares of Monogram’s common stock at $2.52 a share.<br />

Proceeds of the convertible financing, together with<br />

more than $30 million in cash and investments held as of<br />

the end of 2006, are expected be used to support commercialization<br />

of HIV and oncology as<strong>says</strong> and for general corporate<br />

purposes.<br />

Monogram must file a registration statement registering<br />

the notes and the shares of common stock underlying<br />

the notes within 60 days of closing. Monogram then will<br />

have the option to cause all or any portion of the notes to<br />

convert into common stock at such time as the closing<br />

price of Monogram’s common stock is greater than $3.15<br />

for 20 out of 30 consecutive trading days and the satisfaction<br />

of certain other conditions.<br />

Subject to certain conditions, the notes may be<br />

redeemed by Monogram at any time following Dec. 31,<br />

2009, at their accreted value. The holders of the notes may<br />

cause Monogram to repurchase the notes on each of Dec.<br />

31, 2011, Dec. 31, 2016, and Dec. 31, 2021, at the principal<br />

amount thereof. The notes will be unsecured and subordinated<br />

to Monogram’s outstanding senior debt, including<br />

the $25 million 3% senior secured convertible note, due<br />

May 19, 2010, issued to Pfizer in May 2006 and the company’s<br />

line of credit with Merrill Lynch.<br />

Monogram has developed HIV tests designed to help<br />

make the complexities of antiretroviral therapy easier to<br />

manage. Its phenotype and genotype resistance tests, phenotype+genotype<br />

combination test, and viral fitness test<br />

help healthcare providers choose the drugs that will provide<br />

the greatest benefit and to help get the most out of<br />

antiretroviral therapy.<br />

In other financing news:<br />

• NNN Healthcare/Office REIT (Santa Ana, California),<br />

said it has accepted subscriptions for 200,846 shares of common<br />

stock, or $2,004,030, thereby exceeding the minimum<br />

offering of 200,000 shares required to be sold in its offering<br />

of up to 200 million shares. Having reached the minimum<br />

amount, the offering proceeds were released by the escrow<br />

agent and are available to the company for acquisition of<br />

properties and other purposes .<br />

On Oct. 4 the company’s board authorized acquisition of:<br />

the Crawfordsville <strong>Medical</strong> Office Park and Athens<br />

Surgery Center in Crawfordsville, Indiana, for $6.9 million;<br />

and the Southpointe Office Parke and Epler Parke I<br />

property in the Southport community of Indianapolis, Indiana,<br />

for $14.8 million. NNN said it expects to acquire the two<br />

properties about Jan. 19.<br />

Triple Net Properties, sponsor of NNN Healthcare/Office<br />

REIT, is a subsidiary of NNN Realty Advisors,<br />

a commercial real estate asset management and services<br />

firm. ■<br />

Access <strong>Medical</strong> <strong>Device</strong> <strong>Daily</strong> Archives Online!<br />

You have FREE access to articles dating back to 1997<br />

— perfect for company research or for finding supporting<br />

data for presentations and reports.<br />

Go to www.<strong>Medical</strong><strong>Device</strong><strong>Daily</strong>.com for access.<br />

To subscribe, please call MEDICAL DEVICE DAILY Customer Service at (800) 688-2421; outside the U.S. and Canada, call (404) 262-5476.<br />

Copyright © 2007 AHC Media LLC. Reproduction is strictly prohibited. Visit our web site at www.medicaldevicedaily.com.

TUESDAY, JANUARY 16, 2007 MEDICAL DEVICE DAILY PAGE 4 OF 9<br />

Around the Beltway<br />

FDA to bar BSE-linked materials<br />

from devices, drugs, biologics<br />

A <strong>Medical</strong> <strong>Device</strong> <strong>Daily</strong> Staff Report<br />

The FDA is proposing to limit the materials used in<br />

some medical products in order to keep them free of the<br />

agent thought to cause mad cow disease, also known as<br />

bovine spongiform encephalopathy (BSE).<br />

The agency said that this is the latest in a series of BSE safeguards<br />

that would bar material that has been found to harbor<br />

the highest concentrations of this fatal agent in infected cattle.<br />

These materials would be prohibited from use as ingredients in<br />

medical products or elements of product manufacturing.<br />

The proposed rule would cover medical devices, drugs<br />

(prescription, over-the-counter, and homeopathic) and biologics<br />

(such as vaccines) intended for use in humans, as well<br />

as drugs intended for use in ruminant animals such as cattle<br />

and sheep. Cattle can get mad cow disease, while sheep can<br />

get a similar disease known as scrapie.<br />

“These measures build on a series of barriers FDA and the<br />

U.S. Department of Agriculture have erected to further protect<br />

humans from exposure to the fatal agent linked to BSE,” said<br />

Andrew von Eschenbach, MD, commissioner of the FDA.<br />

The cattle materials prohibited in the proposed rule are<br />

those that pose the highest risk of containing infectious<br />

material and include: the brain, skull, eyes and spinal cords<br />

from cattle 30 months and older; the tonsils and a portion of<br />

the small intestines from all cattle regardless of their age or<br />

health; any material from “downer” cattle — those that cannot<br />

walk; any material from cattle not inspected and passed<br />

for human consumption.<br />

The FDA proposes to require that records be kept to<br />

demonstrate that any cattle material used as an ingredient<br />

in these medical products or as part of their manufacturing<br />

process meet the rule’s requirements.<br />

Transmission of the BSE agent to humans, leading to<br />

vCJD, is believed to occur via ingestion of cattle products<br />

contaminated with the BSE agent; however the specific<br />

products associated with this transmission are unknown.<br />

About 200 cases of vCJD have been identified worldwide,<br />

including three cases in the U.S. However, there is no evidence<br />

that those three patients contracted the BSE agent in the U.S.<br />

Obesity surgeries on the rise<br />

Obesity surgeries for patients between the ages of 55 and<br />

64 in the U.S. soared from 772 procedures in 1998 to 15,086 surgeries<br />

in 2004 — a nearly 2,000% increase, according to a new<br />

report by the Agency for Healthcare Research and Quality<br />

(Rockville, Maryland). The report also found a 726% increase<br />

in surgeries among patients age 18 to 54. A total of 121,055 surgeries<br />

were performed on patients of all ages in 2004.<br />

AHRQ said that among the reasons for the dramatic<br />

increase is that mortality outcomes from obesity surgery have<br />

sharply declined. It said that the national death rate for patients<br />

hospitalized for bariatric surgery declined 78%, from 0.9% in<br />

1998 to 0.2% in 2004. Collectively known as bariatric surgery,<br />

these procedures include gastric bypass operations, verticalbanded<br />

gastroplasty, and gastric banding or “lapband.”<br />

Doctors may recommend bariatric surgery for patients who<br />

have a Body Mass Index of 40 or greater — a person who is 5 feet<br />

2 inches tall and weighs 276 pounds, for example — or a BMI of<br />

35 or more for patients who have serious, obesity-related medical<br />

conditions such as Type 2 diabetes or severe sleep apnea.<br />

The report also found that:<br />

• Patients ages 18 to 54 still account for the highest<br />

number of surgeries: 103,097 bariatric surgeries, 85% of the<br />

total.<br />

• Adolescents ages 12 to 17 accounted for 349 bariatric<br />

procedures in 2004.<br />

• Women have bariatric surgery more often than men.<br />

They accounted for more than 99,000 operations, 82% of<br />

the total.<br />

• The in-hospital death rate for men in 2004 was only<br />

0.4%, but it was 2.8 times higher than that of women. In<br />

1998, the in-hospital death rate for men was six times<br />

higher than that of women.<br />

• Gastric bypass surgery — which reduces the size of<br />

the stomach and bypasses a section of the intestines to<br />

decrease food absorption — accounted for 94% of bariatric<br />

procedures.<br />

• The average hospital cost for a bariatric surgery<br />

patient stay, excluding physician fees, was $10,395 in<br />

2004 as compared with $10,970 in 1998, adjusted for<br />

inflation.<br />

• The vast majority (78%) of bariatric surgery patients<br />

were privately insured. Only 5% of patients were uninsured,<br />

but their numbers increased by 810 percent over the<br />

period.<br />

• The overall hospital costs for bariatric surgery<br />

patients increased more than eightfold — from $147 million<br />

in 1998 to $1.3 billion in 2004. However, the average cost<br />

per patient decreased by 5%. ■<br />

B RIEFLY<br />

N OTED<br />

Conference to explore 'nanomedicine'<br />

The nanotech community is invited to gather at Strategic<br />

Research Institute of ALM, for the “2nd Annual<br />

Nanomedicine: Commercializing Drug Delivery, Diagnostics<br />

and <strong>Medical</strong> <strong>Device</strong>s” conference March 26-27, in<br />

Arlington, Virginia.<br />

The event will consist of presentations, panels and networking,<br />

providing insights into trends and the commercial<br />

potential for nanomedicine.<br />

The conference website is: www.srinstitute.com/nano.<br />

The Strategic Research Institute is part of ALM's Conference<br />

and Trade Show Division.<br />

To subscribe, please call MEDICAL DEVICE DAILY Customer Service at (800) 688-2421; outside the U.S. and Canada, call (404) 262-5476.<br />

Copyright © 2007 AHC Media LLC. Reproduction is strictly prohibited. Visit our web site at www.medicaldevicedaily.com.

TUESDAY, JANUARY 16, 2007 MEDICAL DEVICE DAILY PAGE 5 OF 9<br />

Private<br />

Continued from Page 1<br />

As examples of these transactions over the past year,<br />

he cited hospital operator HCA’s (Nashville, Tennessee)<br />

$33 billion acquisition, the acquisition of media giant<br />

Clear Channel (San Antonio) for $27 billion; casino operator<br />

Harrah’s (Las Vegas) for $26 billion, and the $11 billion<br />

buyout of orthopedics company Biomet (Warsaw, Indiana).<br />

“These mark some of the largest private equity transactions<br />

ever,” said Coyle.<br />

He noted that 30 of those transactions in 2006 in the<br />

U.S. were public-to-private “which dwarfs the number of<br />

public-to-privates that have occurred over the prior years<br />

and, again, they typically comprise the larger transactions.”<br />

Of those transactions, he noted about half as unsolicited<br />

— “and the vast majority of them, with very rare exceptions,<br />

have been successful. They have been met with acceptance<br />

by boards and shareholders and, on average, have commanded<br />

a 20% to 30% premium,” to there share price.<br />

He also noted that the market, from a multiples perspective,<br />

is now every bit as favorable to a private transaction<br />

as it is for going public.<br />

Coyle asked Tim Sullivan, who heads the healthcare<br />

practice at Madison Dearborn Partners, what public<br />

investors are missing that groups like his clearly see in the<br />

current environment.<br />

“We’re comfortable in leveraging the balance sheet of<br />

the companies [that we acquire].” Sullivan said. Secondly he<br />

noted that when it takes control of a company, the purchasing<br />

company is “bellying up to the bar and putting<br />

equity in the deal as well. The dialogue between ourselves<br />

and management is a very direct one.”<br />

If a company must reengineer, a private company has<br />

the advantage, he said.<br />

“To the extent that things don’t go as well as we<br />

planned, we’re going to be there to change and fix any<br />

problems. The public markets tend to have a more diffuse<br />

ownership, and I don’t think they can look to one person to<br />

enact those particular changes at the board level that we<br />

can do in a private realm.”<br />

Sullivan said that the premium prices paid for these<br />

companies are justified by the level of accountability that<br />

they can extract from management in a private situation,<br />

“particularly for companies that are typically out of favor.<br />

Everything today seems to be expensive, but the fact is<br />

we’re looking at businesses in many cases that the public,<br />

for whatever reason, has fallen out of favor with.”<br />

Jonathan Coslet, head of the healthcare practice at<br />

Texas Pacific Group, said that while there is accountability<br />

for private CEOs, their public counterparts have a much<br />

tougher time “and it should be difficult. The public companies<br />

have an imperative to perform and it’s incumbent<br />

upon the managing teams to deliver.”<br />

Many of the problems that these public officers have<br />

stem from the short-term shareholder expectations, particularly<br />

when hedge funds are thrown into the mix. So when<br />

these people come to manage private investments their<br />

mindset has to change.<br />

“When [officers] come into a private environment like<br />

ours, we have no ability to create value in a short time; we’re<br />

always going to be long-term investors and therefore, if it<br />

takes some time to make the investments in a long-term setting,<br />

we can do that, and quite frankly we have to do that.”<br />

Coslet also noted that private companies can avoid the<br />

inefficiencies that public companies deal with, particularly<br />

the hassle with Federal Trade Comission and accounting<br />

issues, allowing focusing on strategy and delivering results.<br />

Mike Michelson of Kohlberg Kravis Roberts & Co<br />

(KKR), agreed with other panelists in stressing the need for<br />

private equity firms to look at any acquisition as a longterm<br />

project.<br />

“We’re not constrained by current thinking and we’re<br />

not constrained by current earnings. In fact, we’re not really<br />

driven by earnings. Were driven much more by cashflow so<br />

I think we have a different lens that we can look through.<br />

We can work with management to set out a long-term<br />

strategic plan and execute along those lines.”<br />

In the healthcare sector, Michelson, a senior partner at<br />

KKR, said the private way of doing things can prove to be<br />

particularly advantageous, since there is less emphasis on<br />

long-term development goals vs. the short-term pressures<br />

of the public realm.<br />

Coslet characterized the healthcare sector as one of the<br />

“trickiest to invest in,” particularly if attempting to account<br />

for the ever shifting sands of Medicare reimbursement. At<br />

the end of the day, a company must determine its relative<br />

bargaining power within a local market dynamic, he said.<br />

Eventually, many of the going-private companies will<br />

return to the public sector, but Sullivan said this is not contradictory<br />

for the private equity firms, who are ultimately<br />

looking to gain cash liquidity from their investments.<br />

Michelson said that when contemplating a private investment,<br />

one must already be planning its best exit strategy. For<br />

HCA, for instance, there is strong likelihood that company will<br />

eventually be back in the public sector, he predicted. And he<br />

noted “multiple avenues,” from taking a company public, to<br />

selling to a strategic buyer, to recapitalizations.<br />

Michelson quipped that it doesn’t take “a genius to pay<br />

the most money for a company,” and that what happens<br />

after the buy is the most critical element for success. “Given<br />

the long holding periods [an average of seven years} that<br />

we have, it’s very difficult to generate the kind of returns<br />

that we’re looking for through simple financial engineering.<br />

You really have to work with the company to improve that<br />

company over time.”<br />

Sullivan said something in the range of “20% or better”<br />

defines a good investment. The trick, he said, is to<br />

be a diversified. A healthcare investment “is a very different<br />

kind of investment . . . from others that we are<br />

very active in.” ■<br />

To subscribe, please call MEDICAL DEVICE DAILY Customer Service at (800) 688-2421; outside the U.S. and Canada, call (404) 262-5476.<br />

Copyright © 2007 AHC Media LLC. Reproduction is strictly prohibited. Visit our web site at www.medicaldevicedaily.com.

TUESDAY, JANUARY 16, 2007 MEDICAL DEVICE DAILY PAGE 6 OF 9<br />

Costs<br />

Continued from Page 1<br />

less “the third consecutive year of slower health spending<br />

growth,” largely driven by increased expenditures for prescription<br />

drugs.<br />

The total comes out to roughly $6,700 per person, and<br />

all healthcare spending consumed 16% of total GDP, a fine<br />

hair higher than the 15.9% of the previous year.<br />

Catlin said that the current economic theory explaining<br />

healthcare spending does a good job of accounting for the<br />

more rapid jumps in these costs seen in the relatively<br />

slower economic environment of 2001-03, “when the<br />

healthcare share of GDP increased 2%.”<br />

Healthcare spending trends ordinarily display “a lagged<br />

relationship with economic cycles,” Caitlin explained.<br />

Healthcare spending plays the traditional role of a deadening<br />

buffer to cyclical slowdowns in GDP growth “in part,” he<br />

said, “because public spending for health, particularly Medicaid,<br />

accelerates during recessionary periods. This counterrecessionary<br />

trend, combined with the labor-intensive nature<br />

of the healthcare industry, creates healthcare jobs at a time<br />

when employment in other industries is declining.”<br />

As this effect worked its way through the economy,<br />

overall spending slowed as the “lagged effects of the 2001<br />

recession that took time to work its way through the health<br />

sector’s institutional structure,” Caitlin said.<br />

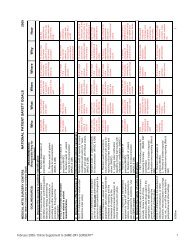

Catlin showed a slide that matched GDP growth against<br />

healthcare spending growth, which depicted a similar trend<br />

in their respective rates of growth.<br />

“What’s uncertain at this time is whether the convergence<br />

is temporary, as we saw before the 1990s — or a<br />

long-term trend, such as we saw in the mid-1990s.”<br />

Hospital care and physician and clinical services<br />

accounted for just over half of all spending in 2005, according<br />

to Caitlin’s numbers, and he pointed out that “hospital<br />

spending grew relatively quickly, and accounted for the<br />

largest share” of the increase in 2005 at more than 7.9%.<br />

Seemingly paradoxical — considering the boost in hospital<br />

spending — was that home healthcare also registered<br />

substantial growth. For the third consecutive year, home<br />

healthcare spending jumped by double digits, rising by<br />

more than 11% in 2005.<br />

Spending on pharmaceuticals, on the other hand, was<br />

not as rapid in 2005 as in previous years, climbing 5.8%<br />

after a jump of 8.6% in 2004 and double-digit rises in 2003<br />

and previous years.<br />

Catlin said that the smaller number of new drugs and<br />

increased co-pays were major factors in the drop in drug<br />

spending growth.<br />

Cathy Cowan, also an economist with the National<br />

Health Statistics at CMS, was the second presenter at the<br />

briefing, and she noted that “public spending did slow down<br />

slightly.” But she said that private insurance premiums went<br />

up 6.6% in 2005, which helped slow growth. “At this time, the<br />

effect of consumer-driven health plans is likely to be minimal,<br />

as less than 1%” of the population is enrolled.<br />

Medicare grew 9.3%, down from more than 10% the previous<br />

year, mostly because of lower growth in hospitals,<br />

Cowan noted, and much of that “was the result of increases<br />

in volume and intensity of services.”<br />

Medicaid was up 7.2% in 2005, part of four years of<br />

decelerating growth due to cost control programs such as<br />

fraud and abuse and disease management, but also, as<br />

alluded to in Catlin’s presentation, due to an improving<br />

economy that brought some enrollees off Medicaid.<br />

In 2005, governments financed 40% of healthcare services<br />

and supplies, and households coughed up 31%. And<br />

Cowan noted that “the share of federal receipts dedicated<br />

to healthcare has grown from 16% in 1990 to 30% in 2005.”<br />

On the other hand, the percentage of household income<br />

dedicated to healthcare “has been essentially flat,” Cowan<br />

said, rising from 5.4% in 2001 to only 6% in 2005,<br />

Sam Zuvekas, a senior economist at AHRQ, who coauthored<br />

the paper on prescription drug use patterns,<br />

noted that as always, “healthcare spending is highly concentrated<br />

among a small portion of the population,” but<br />

that concentration “has declined since 1996 after being<br />

“remarkably stable for decades.”<br />

“The first national study of this type found that the top<br />

5% accounted for 52% [of spending] in the 1920s,” while the<br />

top 5% generated 55% of spending in 1977, down to<br />

49% in 2003, he said.<br />

Much of this change was due to the fact that “more and<br />

more Americans are living with heart disease and other<br />

chronic conditions,” which helped generate especially rapid<br />

increases in drug spending, rising from 12% to 20% of all<br />

healthcare spending between 1996 and 2003. Drug spending<br />

will likely get a boost from Medicare Part D, but how<br />

much “will likely take a couple of years to fully work out.”<br />

Zuvekas said that he did not have any numbers that<br />

indicate whether the share of total healthcare expenditures<br />

incurred by use of medical devices has gone up because<br />

“we have not looked at this for this activity.”<br />

On the other hand, he pointed out that although the<br />

FDA is slower to clear devices than many other foreign<br />

agencies, “adoption of medical technology happens a lot<br />

faster in the U.S.” than in most other nations.<br />

But he provided a caveat to this observation: “Whether<br />

we’re getting what we pay for is another question.” ■<br />

IS YOUR COMPANY FEATURED IN<br />

THIS ISSUE<br />

Promote it on your website or in your investor kit!<br />

For high-quality reprints of articles about your<br />

company, please contact Stephen Vance at (404)<br />

262-5511, or stephen.vance@ahcmedia.com<br />

To subscribe, please call MEDICAL DEVICE DAILY Customer Service at (800) 688-2421; outside the U.S. and Canada, call (404) 262-5476.<br />

Copyright © 2007 AHC Media LLC. Reproduction is strictly prohibited. Visit our web site at www.medicaldevicedaily.com.

TUESDAY, JANUARY 16, 2007 MEDICAL DEVICE DAILY PAGE 7 OF 9<br />

International<br />

Continued from Page 1<br />

maternal plasma or serum, as well as short nucleic acids<br />

in blood, plasma or serum, for the analysis of cancer and<br />

other key disorders.”<br />

The reagents are expected to provide complete and<br />

validated preanalytical solutions for research use with<br />

compatibility for potential future use in conjunction with in<br />

vitro diagnostics.<br />

Fetal DNA enrichment is the process of increasing the<br />

concentration of fetal DNA relative to maternal DNA from<br />

blood plasma or serum obtained from a simple blood draw<br />

from a pregnant woman. The companies call robust fetal<br />

DNA enrichment “a key step” for enabling certain non-invasive<br />

prenatal diagnostics.<br />

While robust enrichment of fetal DNA is not necessary<br />

for many non-invasive prenatal nucleic acid tests such as<br />

tests for Rhesus D incompatibility, Sequenom said it is<br />

required for quantitative genomic tests such as tests for<br />

Down syndrome, cystic fibrosis and other phenotypes, conditions<br />

or disease states.<br />

“We are looking forward to contributing our expertise<br />

toward developing this important preanalytical<br />

technology for Sequenom’s prenatal diagnostics program,”<br />

said Peer Schatz, Qiagen CEO. “[Our] QIAamp<br />

product line is the clear standard for processing DNA<br />

from maternal plasma to analyze fetal Rhesus D.<br />

Through this collaboration with Sequenom, we expect<br />

to tailor and expand existing capabilities of our DNA<br />

processing expertise to provide a solution to routinely<br />

address tests for conditions such as cystic fibrosis,<br />

Down syndrome and Tay-Sachs, by non-invasive prenatal<br />

diagnostics.”<br />

Harry Stylli, PhD, president/CEO of Sequenom, said,<br />

“Non-invasive molecular diagnostics modalities will<br />

play an increasingly important role in supporting a new<br />

generation of diagnostic products for a range of critical<br />

disorders. Sequenom intends to develop a viable and<br />

robust platform initially for non-invasive prenatal diagnostics<br />

that can be leveraged to other applications<br />

based on the detection and characterization of small<br />

nucleic acids.”<br />

He said the company’s MassArray technology’s<br />

“acutely high sensitivity and precision should be advantageous<br />

for enabling the development of the challenging<br />

tests that we are currently working on and plan to work on<br />

in the future. We are excited by the potential of this collaboration<br />

with Qiagen.”<br />

Separately, Sequenom reported that through its South<br />

Korean distributor, Bioneer, the company sold three MassArray<br />

genetic analysis systems in the region during 1Q06,<br />

including a sale to the Republic of Korea’s National Cancer<br />

Center.<br />

Bioneer was named as the exclusive distributor and<br />

promoter of Sequenom’s genetic analysis products for<br />

South Korea in September. Bioneer also operates a core<br />

facility that provides contract services for human, livestock<br />

and agricultural applications throughout South<br />

Korea using Sequenom’s MassArray system and consumable<br />

products.<br />

Under its relationship with Sequenom, Bioneer offers<br />

MassArray-based product and service solutions for fine<br />

mapping genotyping, gene and biomarker discovery, validation,<br />

screening, DNA methylation marker pattern analysis<br />

(epigenetic studies) and quantitative gene expression<br />

analysis.<br />

“These sales represent the increased demand we are<br />

seeing in South Korea for fine mapping genetic analysis<br />

solutions and for life sciences research tools in general,”<br />

said Dr. Han-Oh Park, president/CEO of Bioneer.<br />

“Sequenom’s products and our service offerings . . . are<br />

especially well suited for fine mapping genotyping, a market<br />

that is emerging in South Korea as researchers complete<br />

their whole genome studies.”<br />

He added: “Sequenom’s products are similarly attractive<br />

for DNA methylation pattern and gene expression<br />

analysis projects being conducted by prominent cancer<br />

research centers.”<br />

Qiagen, U.S. firm in co-marketing plan<br />

In other Qiagen news, the company and Pathway<br />

Diagnostics (Malibu, California), a firm developing<br />

biomarker and testing services for the pharma industry,<br />

reported entering into a co-marketing partnership<br />

that allows customers in the biotech and<br />

pharma industries to use Qiagen’s sample and assay<br />

technologies in combination with Pathway Diagnostics’<br />

clinical development and testing service capabilities.<br />

The Dutch company’s global pharmaceutical sales<br />

channel and resource network will develop opportunities<br />

addressed together with the service capabilities of Pathway<br />

Diagnostics.<br />

The companies said the global pharma industry is<br />

accelerating its focus on the co-development and co-validation<br />

of biomarker as<strong>says</strong> intended to improve drug<br />

development via patient selection and clinical trial outcomes,<br />

accelerating time-to-market cycles for new drugs<br />

and reducing clinical trial costs.<br />

Biomarker development also may lead to companion<br />

diagnostic products used as a prerequisite for therapeutic<br />

intervention.<br />

“This partnership with Pathway Diagnostics . . .<br />

offers a novel and unique value proposition for our<br />

customers,” said Peer Schatz, CEO of Qiagen. “[We]<br />

share the vision that biomarker development and testing<br />

is at the forefront of accelerating drug development<br />

and providing clinical diagnostic value, leading<br />

to improved patient care and associated therapeutic<br />

intervention.” ■<br />

To subscribe, please call MEDICAL DEVICE DAILY Customer Service at (800) 688-2421; outside the U.S. and Canada, call (404) 262-5476.<br />

Copyright © 2007 AHC Media LLC. Reproduction is strictly prohibited. Visit our web site at www.medicaldevicedaily.com.

TUESDAY, JANUARY 16, 2007 MEDICAL DEVICE DAILY PAGE 8 OF 9<br />

RoundTable<br />

Continued from Page 1<br />

investment were not disclosed.<br />

“We are excited about the combination of Advantis and<br />

Instrumed to form Avalign,” said Joseph Damico, a founding<br />

partner of RoundTable and now chairman of Avalign. “We<br />

are impressed with Advantis’ design and engineering capabilities<br />

and its strong commitment to quality and customer<br />

service. These core competencies, combined with<br />

Instrumed’s expertise in manufacturing and sourcing precision<br />

surgical instruments, will position Avalign as a leading<br />

full-service provider of outsourced services to medical<br />

device OEM customers.”<br />

With the formation of Avalign, RoundTable reported<br />

that Forrest Whittaker has joined as Avalign’s CEO. Whittaker<br />

previously served as president/COO of Teleflex<br />

<strong>Medical</strong> and in various executive roles at Tyco Healthcare,<br />

Baxter Healthcare and American Hospital Supply.<br />

RoundTable facilitated completion of new senior credit<br />

facilities and a private placement of subordinated notes.<br />

The senior credit facilities were led by LaSalle Bank; GE<br />

Healthcare Financial Services also participated in the transaction.<br />

Avalign’s senior subordinated notes were purchased<br />

by RoundTable Capital Partners, RoundTable’s $200<br />

million captive subordinated debt fund.<br />

RoundTable is a private equity firm focused on healthcare.<br />

• AngioDynamics (Queensbury, New York) and Rita<br />

<strong>Medical</strong> Systems (Fremont, California) reported expiration<br />

of the Hart-Scott-Rodino waiting period in connection<br />

with AngioDynamics’ acquisition of RITA.<br />

Closing of the merger, about Jan. 29, remains subject to<br />

customary conditions, including adoption of the merger by<br />

holders of RITA’s common stock, and approval of the<br />

issuance of AngioDynamics common stock by holders of<br />

AngioDynamics’ common stock. The meetings of the companies’<br />

stockholders are set for 9 a.m. PST, Jan. 29, in Fremont.<br />

AngioDynamics is a provider of medical devices for the<br />

minimally invasive diagnosis and treatment of peripheral<br />

vascular disease. Its product line includes angiographic<br />

products and accessories, dialysis products, vascular<br />

access products, PTA products, drainage products, thrombolytic<br />

products and venous products.<br />

RITA makes products that provide oncology therapy<br />

options for cancer patients including radiofrequency<br />

ablation (RFA) systems and embolization products for<br />

treating cancerous tumors, as well as percutaneous vascular<br />

and spinal access systems for systemic treatments.<br />

The company’s oncology product lines include<br />

implantable ports, some featuring its Vortex technology;<br />

tunneled central venous catheters; and safety infusion<br />

sets and peripherally inserted central catheters used in<br />

cancer treatment. ■<br />

Court Report<br />

Continued from Page 2<br />

while not disclosing “the complete details of the settlement.”<br />

MarcTec had asked the court to declare that its<br />

patents are valid, enforceable and infringed, and<br />

requested a permanent injunction to stop the manufacture<br />

and sale of the infringing product, as well as damages,<br />

attorneys’ fees and costs.<br />

• Third Wave Technologies (Madison, Wisconsin)<br />

last week responded to a lawsuit filed against it by Digene<br />

(Gaithersburg, Maryland), alleging that Third Wave is<br />

infringing unidentified claims of U.S. Patent No. 5,643,715,<br />

relating to a single HPV type, 52, the prevalence of which is<br />

0.5% of HPV-positive specimens in the U.S., according to<br />

Digene’s package insert.<br />

The suit was filed in U.S. District Court for the Western<br />

District of Wisconsin in Madison.<br />

Kevin Conroy, president/CEO of Third Wave, said, “We<br />

took great care to create a detection method free from the<br />

limited scope of the ‘715 patent’s claims. Third Wave’s<br />

Invader chemistry operates differently from any other<br />

nucleic acid analysis chemistry and is well-protected by<br />

intellectual property rights of its own.<br />

He added: “Customers tell us that Digene’s test suffers<br />

from many challenges, and Third Wave’s dedicated<br />

team of scientists has developed HPV products, currently<br />

in clinical trials, that address those shortcomings<br />

and better meet the needs of clinical labs, physicians<br />

and their patients.”<br />

Third Wave develops molecular diagnostic reagents for<br />

DNA and RNA analysis applications.<br />

• Perry Hearn, MD, of Norwell, Massachusetts, has<br />

agreed to pay $150,000, and Affiliated Professional Services<br />

(APS; Wareham, Massachusetts), a medical billing<br />

company, has agreed to pay $100,000, to settle allegations<br />

that they submitted false claims to the Medicare and Medicaid<br />

programs for office and nursing home visits performed<br />

by nurse practitioners and physician assistants<br />

without any physician supervision.<br />

“We cannot permit healthcare providers to cause the<br />

Medicare and Medicaid programs to pay more than is<br />

necessary, or more than is deserved given the actual service<br />

provided,” said a U.S. attorney in charge of the case.<br />

According to the charges, while the nurse practitioners<br />

and physician assistants on Hearn’s staff commonly<br />

worked without any physician supervision, Hearn<br />

instructed APS to bill all of their services under his provider<br />

number, as if he had performed the services or had directly<br />

supervised them. APS allegedly did as instructed, even<br />

though it had information that Hearn’s nurse practitioners<br />

and physician assistants often did not work under physician<br />

supervision of a physician.<br />

Hearn has entered into a compliance program with the<br />

Office of the Inspector General for the Department of<br />

Health and Human Services. ■<br />

To subscribe, please call MEDICAL DEVICE DAILY Customer Service at (800) 688-2421; outside the U.S. and Canada, call (404) 262-5476.<br />

Copyright © 2007 AHC Media LLC. Reproduction is strictly prohibited. Visit our web site at www.medicaldevicedaily.com.

TUESDAY, JANUARY 16, 2007 MEDICAL DEVICE DAILY PAGE 9 OF 9<br />

P RODUCT B RIEFS P EOPLE IN P LACES<br />

• Iapyx <strong>Medical</strong> (San Diego) Thursday introduced<br />

its Iso-Line Suction Wand Holster System, an infection<br />

control product designed to isolate suction wands to<br />

minimize the transmission of pathogenic organisms<br />

(viruses, bacteria, and fungi) in a hospital setting.<br />

According to a study published in the American Journal<br />

of Infection Control, 80% of oral suction wands can be<br />

contaminated with highly pathogenic bacteria and fungi<br />

which can contribute to serious hospital-acquired infections.<br />

Typically, these wands are placed under the<br />

patient’s pillow or on other hospital equipment increasing<br />

the risk of infection to both patients and healthcare<br />

workers. The Iso-Line is mounted onto the patient’s<br />

bedrail, hospital stand or ventilator, and includes a rigid<br />

disposable holster that isolates the suction wand from<br />

surface contact, thereby reducing the transmission of<br />

infectious pathogens. The holster is designed with a<br />

secretion reservoir that allows blood and mucus to drain<br />

away from the tip of the suction wand. Iapyx <strong>Medical</strong><br />

produces single-use medical devices designed to combat<br />

hospital-acquired infections.<br />

• Illumina (San Diego) reports that the next Bead-<br />

Chip in its Infinium product family will profile over<br />

one million genetic variants. The Human 1M BeadChip<br />

combines a level of content for both whole-genome<br />

(WG) and copy number variation (CNV) analysis, along<br />

with additional unique, high-value genomic regions of<br />

interest – all on a single microarray chip. Illumina also<br />

announced that it plans to introduce the Human 450S<br />

BeadChip, which will enable customers using Illumina’s<br />

HumanHap550 BeadChip to further extend<br />

their genetic studies to include the one million content<br />

level. The Human 1M and Human 450S BeadChips<br />

will be powered by Illumina’s Infinium Assay. Both<br />

products are expected to enter the market by the<br />

close of the second quarter, 2007. Illumina makes<br />

tools for the large-scale analysis of genetic variation<br />

and function.<br />

• Medtronic (Minneapolis) reported the release of its<br />

newest version of the Paceart System. The latest edition<br />

of Paceart further supports clinicians with solutions<br />

designed for the management of patients with cardiac<br />

rhythm disease. The system consolidates detailed data<br />

from in-clinic device interrogations from the major<br />

implantable cardiac device manufacturers, and also<br />

remote management technologies. Paceart supports the<br />

management of data for more than 1,000 implantable cardiac<br />

devices. In addition, Paceart serves as a single integration<br />

point, reducing the number of interfaces and<br />

information technology resources needed to share information<br />

electronically with other systems.<br />

• Steven Wardell has been named executive VP of<br />

finance and corporate development of NorthPoint<br />

Domain (Boston). Wardell was previously with Apeiron<br />

Partners. NorthPoint Domain provides medical information<br />

services and informed care technology products.<br />

• William Osgood was named general manager, operations<br />

for ThermoGenesis (Rancho Cordova, California).<br />

Osgood previously served as senior VP of Sorin<br />

Group. ThermoGenesis makes automated blood processing<br />

systems and disposable products that enable the manufacture,<br />

preservation and delivery of cell and tissue therapy<br />

products.<br />

Cunniffe joins AdvaMed,<br />

will lead advocacy efforts<br />

A <strong>Medical</strong> <strong>Device</strong> <strong>Daily</strong> Staff Report<br />

Amy Cunniffe will join the Advanced <strong>Medical</strong><br />

Technology Association (AdvaMed; Washington)<br />

today as senior executive VP and director, government<br />

affairs. AdvaMed said she will be responsible for leading<br />

the association’s advocacy efforts with Congress, the<br />

administration and state governments. Cunniffe specializes<br />

in healthcare policy and has worked for congress<br />

and the Bush Administration.<br />

“Amy’s reputation as a leader in national health policy<br />

is exceptional,” said Steve Ubl, president/CEO of<br />

AdvaMed. “I am thrilled to have her on with us at a time<br />

when issues of critical importance to medical technology<br />

are being considered by Congress and the regulatory<br />

agencies.”<br />

Cunniffe joins AdvaMed from Quinn Gillespie and<br />

Associates, where she led the firm’s healthcare practice.<br />

Prior to that, she worked in the White House as special<br />

assistant for legislative affairs for President Bush. Earlier<br />

in her career, Cunniffe was health and social security policy<br />

advisor to then House Speaker Dennis Hastert (R-IL).<br />

Before joining the Speaker’s office, Cunniffe was a policy<br />

analyst for the Majority Whip. She also has trade association<br />

experience, having served as director, federal public<br />

policy at the National Federation of Independent Business.<br />

Ubl said Cunniffe will work with AdvaMed’s senior<br />

executive vice president, David Nexon, in leading the<br />

association’s government affairs strategy and policy priorities.<br />

“The combination of Amy Jensen Cunniffe and<br />

David Nexon is a powerful, bi-partisan force for<br />

AdvaMed,” said Ubl.<br />

To subscribe, please call MEDICAL DEVICE DAILY Customer Service at (800) 688-2421; outside the U.S. and Canada, call (404) 262-5476.<br />

Copyright © 2007 AHC Media LLC. Reproduction is strictly prohibited. Visit our web site at www.medicaldevicedaily.com.