The Professional's First Choice - CCH Australia

The Professional's First Choice - CCH Australia

The Professional's First Choice - CCH Australia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Tax and Accounting<br />

International Tax<br />

Superannuation &<br />

Financial Planning<br />

Corporations Law<br />

<strong>CCH</strong> ProSystem<br />

Software<br />

<strong>The</strong> Professional’s <strong>First</strong> <strong>Choice</strong>

Welcome<br />

to <strong>CCH</strong><br />

<strong>CCH</strong> has been an important part of the professional information<br />

services industry in <strong>Australia</strong> since 1969. Many of our publications<br />

have become industry benchmarks for quality, comprehensiveness<br />

and timeliness. Perhaps our best known publication, the <strong>Australia</strong>n<br />

Master Tax Guide, celebrates its 40th anniversary in 2010.<br />

Although we started out with books and our famous looseleafs,<br />

the majority of our customers now access our information via<br />

IntelliConnect, the market-leading online research platform that<br />

we launched in 2009.<br />

<strong>CCH</strong> has an information solution for all your tax and accounting<br />

needs, as well as a range of superannuation, financial planning<br />

and insolvency management products. We also have a range of<br />

legal, industrial relations, human resources and health, safety and<br />

environment products.<br />

Building on the launch of IntelliConnect, 2010 will see us launch<br />

Tracker, a customisable daily news service available to all online<br />

subscribers. We will introduce date stamping of commentary in<br />

IntelliConnect, so you will be able to see when the paragraph<br />

was last reviewed by one of our writers. And we will launch a<br />

range of calculators and other electronic tools that will help our<br />

customers solve problems and take action more quickly.<br />

We pride ourselves on helping our customers be more efficient<br />

and effective. Our in-house writers and external authors will<br />

continue to deliver information, workflow tools and services that<br />

ensure that our customers have what they need, when they need<br />

it, in the way they want it. We are <strong>The</strong> Professional’s <strong>First</strong> <strong>Choice</strong>,<br />

and we will give you the Right Answer, Right Now.<br />

I appreciate the time you are taking to review this catalogue.<br />

I am sure it contains products that will help you do your business<br />

better. If you have any questions or comments for me, please get<br />

in touch at swensing@cch.com.au.<br />

All the best for 2010. I wish you every success.<br />

Staffan Wensing<br />

Managing Director<br />

<strong>CCH</strong> <strong>Australia</strong>

Why <strong>CCH</strong> 4-5<br />

Tax and Accounting 6<br />

<strong>Australia</strong>n Federal Tax Reporter 7<br />

<strong>Australia</strong>n Income Tax Guide 8<br />

Premium <strong>Australia</strong>n Master Tax Guide 8<br />

<strong>Australia</strong>n Tax Navigator for Business Activities 9<br />

<strong>Australia</strong>n Capital Gains Tax Planner 9<br />

<strong>Australia</strong>n Fringe Benefits Tax Guide for Employers 9<br />

<strong>Australia</strong>n Income Tax Legislation 10<br />

<strong>Australia</strong>n Income Tax Rulings 10<br />

<strong>Australia</strong>n Income Tax Bills 10<br />

<strong>Australia</strong>n Tax Cases 11<br />

<strong>Australia</strong>n GST Guide 11<br />

<strong>Australia</strong>n Master GST Guide – Online 11<br />

Tax Solution Finder 12<br />

Contents<br />

International Tax 13<br />

International Tax Planning – Expatriates & Migrants 14<br />

International Offshore Financial Centres 14<br />

<strong>Australia</strong>n International Tax Agreements 14<br />

Worldwide Business Tax Guide 15<br />

Superannuation & Financial Planning 16<br />

<strong>Australia</strong>n Superannuation Law & Practice 17<br />

<strong>Australia</strong>n Master Superannuation Guide – Online 17<br />

<strong>Australia</strong>n Superannuation Digest 18<br />

<strong>Australia</strong>n Superannuation Taxation Materials 18<br />

Practical Guide to SMSFs 18<br />

Financial Planning Navigator 19<br />

<strong>Australia</strong>n Superannuation Cases 19<br />

<strong>Australia</strong>n Superannuation LawLinks 19<br />

<strong>Australia</strong>n Accounts Preparation Manual 20<br />

<strong>Australia</strong>n Insolvency Management Practice 20<br />

<strong>Australia</strong>n Audit Manual/Audit Workpapers Plus CD 20<br />

Superannuation Solution Finder 21<br />

Corporations Law 22<br />

<strong>Australia</strong>n Corporations & Securities Law Reporter 23<br />

<strong>Australia</strong>n Corporate Practice Manual 23<br />

<strong>Australia</strong>n Corporations Act Partner Online 23<br />

Corporations & Securities Solution Finder 24<br />

<strong>CCH</strong> ProSystem Software 26<br />

<strong>CCH</strong> ProSystem Document 27<br />

<strong>CCH</strong> ProSystem Engagement 27<br />

<strong>CCH</strong> ProSystem Audit 28<br />

<strong>CCH</strong> ProSystem Portal 28<br />

<strong>CCH</strong> ProSystem Scan 28<br />

<strong>CCH</strong> ProSystem Knowledge Connect 29<br />

<strong>CCH</strong> ProSystem Workstream 29<br />

<strong>CCH</strong> ProSystem Tax 29<br />

Matrix<br />

Summary of products 30<br />

<strong>CCH</strong> contact information 32<br />

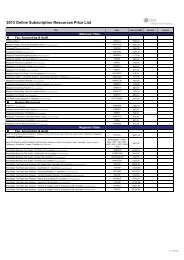

February 2010<br />

Note: prices in this catalogue are valid at the time of printing and are subject to periodic review. Special prices may be available for additional<br />

online licences and combinations of print and online versions of the same product. <strong>CCH</strong> reserves the right to charge for postage and handling.<br />

Call 1300 300 224 or speak to a Sales Consultant to ascertain the correct price for you.<br />

3

Why <strong>CCH</strong><br />

Why <strong>CCH</strong><br />

Investing in our products<br />

We know that your business or practice can’t stand still – it needs to get<br />

better every day. That’s why we’re always investing in improving our products<br />

and services.<br />

<strong>The</strong> IntelliConnect advantage<br />

In 2009 we launched IntelliConnect, our cutting edge online research<br />

platform. IntelliConnect was the result of many thousands of hours of<br />

customer research, many years of development and the investment of many<br />

tens of millions of dollars. It is a true next generation research platform and<br />

offers many unique features, including a level of customisation and workflow<br />

integration unequalled in the market.<br />

IntelliConnect is not a static platform. In the six months since launch we<br />

have added new features such as Perfect Print (pdf versions of cases) and a Last<br />

Reviewed Date for commentary. And in 2010 we will launch Tracker,<br />

a revolutionary news and alerting service (see facing page for more on Tracker).<br />

Even more new features will be added to IntelliConnect throughout 2010.<br />

Go to https://www.brainshark.com/cch/intelliconnectaustralia throughout the<br />

year to find out the latest developments.<br />

<strong>The</strong> best content gets even better<br />

<strong>CCH</strong> offers the best content on the best platform. And our content is getting<br />

even better: faster updates, better analysis, and more integration into your dayto-day<br />

workflow.<br />

We are now updating key major services in tax and company law on a daily or<br />

weekly basis, and giving you the comfort of a Last Reviewed date, telling you<br />

when the author or editor most recently reviewed the commentary.<br />

We continue to invest in our internal and external authors, with leading experts<br />

supplementing our expert internal teams.<br />

In 2010 we are rolling out a new range of calculators and decision trees to make<br />

our commentary more interactive and to help you get to the Right Answer,<br />

Right Now.<br />

Our commitment to you is that we will keep investing in our products and our<br />

platforms, giving you the highest quality analysis on the most intuitive and<br />

feature-rich platform.<br />

4

Keep track of change – introducing Tracker<br />

News that finds you<br />

Tracker is the new daily alerting service from <strong>CCH</strong> that will deliver the news to you in the format<br />

and topic of your choice. Tracker alerts you to change in a quicker and more flexible format.<br />

Current subscribers will receive a Tracker as part of their subscription, and at no additional cost.<br />

Trackers are also available as a stand-alone service.<br />

With Tracker, you own the news<br />

Get news and developments quickly – receive updates on news and developments as they happen<br />

via RSS feeds, IntelliConnect or as a daily email.<br />

Get superior, tailored news – we are committed to keeping you up-to-date with the latest<br />

changes that are the most relevant to you and your profession. You can even track news items<br />

containing specific words or phrases!<br />

Make Tracker your own – select alerts as either RSS feeds, via IntelliConnect or a daily email.<br />

Save your favourite articles, create your own newsletters, export them as PDF, send to print,<br />

distribute to colleagues via email. <strong>The</strong> choice is yours.<br />

Choose from a wide range of topics – 40 Trackers covering a wide range of business topics across<br />

the Asia-Pacific region.<br />

Access Tracker anywhere, any time – whether you are in the office or on a home computer,<br />

Blackberry or iPhone, Tracker is just a few clicks away.<br />

Topics include:<br />

Accounting<br />

Banking & Finance<br />

Duties & State Taxes<br />

FBT<br />

Financial Planning<br />

GST<br />

International Tax<br />

Income Tax<br />

Tax<br />

Superannuation<br />

Bankruptcy and Insolvency<br />

Business Law<br />

Consumer & Contract Law<br />

Conveyancing & Property<br />

Corporate, Company & Securities<br />

Family Law<br />

Intellectual Property<br />

Insurance Law<br />

Litigation & Court Practice<br />

Torts Personal Injury<br />

Trade Practices<br />

Employment & HR<br />

Environment<br />

Equal Opportunity<br />

Health & Medical<br />

Industrial Relations<br />

Occupational Health & Safety<br />

Workers Compensation<br />

For more information www.cch.com.au/tracker<br />

RIGHT ANSWER. RIGHT NOW. 5

Tax and<br />

Accounting<br />

Why <strong>CCH</strong><br />

<strong>CCH</strong> Tax and<br />

Accounting<br />

Are you prepared for the tax<br />

changes coming in 2010<br />

Despite the worldwide economic slow down, the rate of change in<br />

<strong>Australia</strong>’s tax laws keeps increasing.<br />

This year will see the start of the new tax agents’ regime and the<br />

continued rewrite of ITAA 1936 provisions, including collection and<br />

recovery, commercial debt forgiveness and luxury car leasing.<br />

Other new laws set to commence in 2010 include the R&D tax<br />

credit, changes to the rules dealing with thin capitalisation, managed<br />

investments trusts, CFCs and FIFs, and further changes to the TOFA<br />

regime. More changes can be expected when the Tax Design Advisory<br />

Panel begins its reviews. <strong>The</strong>n of course there are all the changes that<br />

can be expected as a result of the <strong>Australia</strong>’s Future Tax System Review<br />

Panel (the Henry Review).<br />

<strong>The</strong> best way to stay ahead of these changes, and to understand their<br />

impact, is with the <strong>CCH</strong> Tax and Accounting products.<br />

6

<strong>Australia</strong>n Federal Tax Reporter<br />

<strong>The</strong> <strong>Australia</strong>n Federal Tax Reporter is the most in-depth tax commentary service available. It is an essential<br />

working tool for the tax specialist requiring comprehensive coverage of all income tax and related tax issues.<br />

This 19-volume service provides complete coverage of various Acts, including:<br />

Income Tax Assessment Acts (1936 and 1997)<br />

Taxation Administration Act<br />

Fringe Benefits Tax legislation<br />

Ratings Acts, ABN legislation<br />

Crimes (Taxation Offences) Act<br />

Financial Transactions Reports Act<br />

Superannuation Tax Acts<br />

Did you know that when <strong>CCH</strong> started publishing this service 40 years ago it was only three volumes It now<br />

consists of 19 volumes with more than 9,000 new pages issued in a year.<br />

If you are a tax expert, then this is the service for you.<br />

Key features:<br />

Informed tax commentary discussing the legislation, relevant cases and rulings, with practical examples<br />

and useful observations.<br />

Annotated commentary that includes the text of the legislation followed by detailed commentary,<br />

usually on a section-by-section basis.<br />

<strong>The</strong> only service offering detailed annotated commentary on the Income Tax Assessment Act 1997.<br />

Includes the <strong>CCH</strong> Tax Week newsletter (approx 50 issues a year) and an annual copy of the <strong>Australia</strong>n<br />

Master Tax Guide (January edition).<br />

Electronic version includes smart calculators as well as tax legislation, Bills and Explanatory Memoranda.<br />

Online version allows direct access to commentary from individual sections and from commentary to<br />

individual sections with one simple hypertext link.<br />

Online version gives you access to archives of Master Tax Guides (back to 1999), Tax News (back to 1996)<br />

and Bills and Explanatory Memoranda (back to 1999).<br />

Also included in some Tax Solution Finders.<br />

Product Price: $3,873 (Print)<br />

$4,129 (Online)<br />

Volumes in print: 19<br />

* Prices correct at time of printing and subject to change.<br />

RIGHT ANSWER. RIGHT NOW.<br />

7

<strong>Australia</strong>n Income Tax Guide<br />

<strong>The</strong> <strong>Australia</strong>n Income Tax Guide provides plain English<br />

explanations of the law relating to income tax, fringe<br />

benefits tax and tax-related superannuation. <strong>The</strong> relevant<br />

tax information is covered under broad topical subject<br />

areas such as income, deductions, capital gains tax, and<br />

capital allowances.<br />

This three-volume commentary service covers the<br />

relevant cases and rulings in greater detail to that provided<br />

in <strong>CCH</strong>’s <strong>Australia</strong>n Master Tax Guide.<br />

Key features:<br />

Covers a broad range of tax topics with examples and<br />

checklists.<br />

Topic-by-topic commentary.<br />

Service is updated monthly and is accompanied by the<br />

<strong>Australia</strong>n Tax News newsletter.<br />

Also included in some Tax Solution Finders.<br />

Product Price: $1,178 (Print)<br />

$1,113 (Online)<br />

Volumes in print: 3<br />

Did you know that the <strong>Australia</strong>n Income Tax Guide was<br />

<strong>CCH</strong> <strong>Australia</strong>’s first ever commentary service (first<br />

published in April 1969) It has been going strong ever<br />

since without any similar information service available.<br />

If you are a tax practitioner who needs to keep up with the<br />

tremendous changes in tax law without the major step<br />

up to the very detailed level of the <strong>Australia</strong>n Federal Tax<br />

Reporter, then this is the service for you.<br />

Premium <strong>Australia</strong>n Master<br />

Tax Guide<br />

<strong>The</strong> <strong>Australia</strong>n Master Tax Guide is <strong>Australia</strong>’s leading tax<br />

handbook and often referred to as the tax agent’s Bible. It is<br />

also available as an electronic updating subscription service.<br />

<strong>The</strong> <strong>Australia</strong>n Master Tax Guide provides plain English<br />

explanations of the law relating to income tax, fringe<br />

benefits tax and tax-related superannuation.<br />

<strong>The</strong> <strong>Australia</strong>n Master Tax Guide is a starting point for all<br />

your tax research and makes an excellent companion to<br />

the <strong>Australia</strong>n Federal Tax Reporter and the <strong>Australia</strong>n Tax<br />

Navigator for Business Activities.<br />

Key features:<br />

Fully updated four times a year, with all changes<br />

integrated into the text.<br />

Contains hypertext links to the <strong>Australia</strong>n Federal Tax<br />

Reporter (separate subscription required) allowing for<br />

quick access to more information on the relevant topic.<br />

Allows access to archives of Master Tax Guides (back to<br />

1999).<br />

Subscription includes an annual copy of the January<br />

print edition of the book.<br />

Also included in all Tax Solution Finders.<br />

Product Price: $660 (Online)<br />

If you are a tax practitioner who just needs to get a quick<br />

plain English overview before delving into more detail,<br />

then the Premium <strong>Australia</strong>n Master Tax Guide is your ideal<br />

companion.<br />

8 <strong>CCH</strong> <strong>Australia</strong> Limited <strong>The</strong> Professional’s <strong>First</strong> <strong>Choice</strong> www.cch.com.au phone 1300 300 224

<strong>Australia</strong>n Tax Navigator for<br />

Business Activities<br />

Most transactions, or scenarios, do not fit neatly into the<br />

categories created by legislation or by traditional legal<br />

concepts. Instead, they raise a complex combination of<br />

tax issues.<br />

Tax Navigator uniquely enables you to identify the<br />

relevant tax rules in each case, shows how they fit<br />

together, and provides practical help in reaching a taxeffective<br />

result.<br />

Key features:<br />

Consists of a series of modules, each dealing with a<br />

specific business situation.<br />

Each module contains a succinct explanation of the law,<br />

supplemented by extensive checklists of key steps, tax<br />

tips, pitfalls and practical examples.<br />

Transactional approach rather than a legislative<br />

approach.<br />

Also included in some Tax Solution Finders.<br />

Product Price: Standard $636 (Online)<br />

Premium $780 (Online)<br />

Tax Navigator consists of 33 stand-alone modules, each<br />

dealing with a separate business transaction or situation.<br />

It provides coverage of the whole business life cycle – from<br />

the birth of a business to its death.<br />

<strong>Australia</strong>n Capital Gains<br />

Tax Planner<br />

This unique service is designed for practitioners who need<br />

more than a linear, section-by-section understanding<br />

of capital gains tax (CGT) provisions and adopts an<br />

integrated, transaction-based tax planning approach.<br />

It allows you to examine CGT implications before a<br />

transaction is entered into, giving you the power to plan<br />

for it and lessen the GST impact.<br />

As CGT is such a key area of the tax law, this product is<br />

an ideal addition to your tax commentary library.<br />

Key features:<br />

Key Data section upfront allows for a quick and easy<br />

view of key CGT information and includes a CGT<br />

calculator.<br />

Tax planning sections with extensive coverage for both<br />

companies and individuals.<br />

Provides practical insights into CGT planning issues and<br />

pitfalls.<br />

Also included in some Tax Solution Finders.<br />

Product Price: $708 (Print)<br />

$649 (Online)<br />

Volumes in print: 1<br />

<strong>Australia</strong>n Fringe Benefits Tax<br />

Guide for Employers<br />

This Guide provides a practical explanation of the fringe<br />

benefits tax (FBT) law and is suitable for both employers<br />

and their professional advisers.<br />

This is the only service in <strong>Australia</strong> that provides detailed<br />

topical commentary on FBT. <strong>The</strong> <strong>Australia</strong>n Federal Tax<br />

Reporter includes detailed annotated (ie section-bysection)<br />

commentary on FBT.<br />

Key features:<br />

Very practical commentary allowing for easy<br />

identification of any FBT concessions available for a<br />

given situation and the practical application of FBT<br />

through work papers, examples and checklists.<br />

Includes a section on salary packaging.<br />

Includes commentary and relevant legislation and ATO<br />

rulings.<br />

Also included in some Tax Solution Finders.<br />

Product Price: $1,174 (Print)<br />

$1,082 (Online)<br />

Volumes in print: 1<br />

* Prices correct at time of printing and subject to change.<br />

RIGHT ANSWER. RIGHT NOW.<br />

9

<strong>Australia</strong>n Income<br />

Tax Legislation<br />

<strong>The</strong> <strong>Australia</strong>n Income Tax Legislation service provides an<br />

accurate and fast updating taxation legislation reference<br />

source.<br />

It includes all income tax-related legislation, fringe<br />

benefits tax legislation, and tax-related superannuation<br />

legislation. <strong>The</strong> service includes a variety of value-added<br />

features not available in other legislation services.<br />

This service is updated online continously, shortly after<br />

changes have become law. <strong>The</strong> print version is updated<br />

monthly.<br />

Key features:<br />

Links to <strong>Australia</strong>n Federal Tax Reporter commentary<br />

from individual sections and to individual sections from<br />

commentary (separate subscription required).<br />

Links to pending amendments (separate subscription to<br />

Bills service required).<br />

Second reading reference in Hansard, date of assent and<br />

date of commencement.<br />

Includes detailed indexes covering taxation legislation<br />

and superannuation legislation.<br />

Includes an Annotator that shows whether a particular<br />

provision of the key Acts or regulations has been<br />

referred to in ATO rulings, determinations, guidelines,<br />

or cases from 1992 onwards.<br />

Product Price: $899 (Print), $801 (Online)<br />

Volumes in print: 7<br />

<strong>Australia</strong>n Income Tax Rulings<br />

This service includes the full text of current ATO<br />

releases relating to income tax, fringe benefits tax and<br />

superannuation.<br />

Key features:<br />

Rulings include a concise digest to provide a useful<br />

summary and catch phrases to allow a quick scan to<br />

determine relevance to your research needs.<br />

Online service updates weekly, while the print version<br />

updates monthly.<br />

Also included in all Tax Solution Finders.<br />

Product Price: $843 (Print)<br />

$757 (Online)<br />

Volumes in print: 6<br />

<strong>Australia</strong>n Income Tax Bills<br />

<strong>The</strong> <strong>Australia</strong>n Income Tax Bills service is an easy-to-use<br />

reference service that keeps you informed of upcoming<br />

changes to the income tax laws. It is updated<br />

as required to ensure that legislative changes are<br />

incorporated into the service as soon as possible.<br />

Each amending Bill includes a <strong>CCH</strong> summary, the text<br />

of the Bill, the Explanatory Memoranda and the Second<br />

Reading Speech.<br />

Note that this service is already included in the online<br />

<strong>Australia</strong>n Federal Tax Reporter subscription.<br />

Key features:<br />

Includes progress of legislation to allow you to track<br />

the status of the changes.<br />

Includes a list of sections affected by pending<br />

amendments with hypertext links to the section<br />

affected and the pending amendment.<br />

Web version allows access to a Bills and Explanatory<br />

Memoranda archive (back to 1999).<br />

Also included in some Tax Solution Finders.<br />

Product Price: $669 (Print)<br />

$595 (Online)<br />

Volumes in print: 1<br />

10 <strong>CCH</strong> <strong>Australia</strong> Limited <strong>The</strong> Professional’s <strong>First</strong> <strong>Choice</strong> www.cch.com.au phone 1300 300 224

<strong>Australia</strong>n Tax Cases<br />

Get speedy access to the full text of the latest<br />

tax decisions handed down by the courts and the<br />

Administrative Appeals Tribunal.<br />

Updated weekly, <strong>Australia</strong>n Tax Cases provides a detailed<br />

headnote of every decision, followed by its full text –<br />

often within days of the decision being handed down.<br />

Each decision includes helpful catch phrases to allow a quick<br />

scan to determine relevance to your research needs.<br />

Key features:<br />

<strong>The</strong> online version allows access to all tax cases<br />

published by <strong>CCH</strong> since 1969.<br />

Annual bound copy for print service at no extra cost.<br />

Also included in some Tax Solution Finders.<br />

Product Price: $1,236 (Print)<br />

$1,082 (Online)<br />

Volumes in print: 2<br />

Concise well-structured headnotes set out the relevant<br />

facts, issues, arguments, outcome and reasons for the<br />

outcome.<br />

<strong>Australia</strong>n GST Guide<br />

This is your one-stop shop for GST. Get comprehensive<br />

coverage on all relevant GST material and information.<br />

<strong>The</strong> Guide covers all aspects of GST including registration,<br />

charging GST, claiming GST credits and adjustments,<br />

imports and exports, and financial supplies; as well as<br />

special topics such as real property, buying and selling a<br />

business, planning, e-commerce and GST audits.<br />

No other GST service in <strong>Australia</strong> is as comprehensive or<br />

as up-to-date.<br />

Key features:<br />

Includes commentary, legislation, Bills, rulings and case<br />

decisions, with hypertext links from commentary to<br />

source materials.<br />

Includes GST News, a monthly newsletter that contains<br />

details of the latest developments.<br />

Web version updated weekly; print version updated<br />

monthly.<br />

Also included in some Tax Solution Finders.<br />

Product Price: $1,338 (Print)<br />

$1,249 (Online)<br />

Volumes in print: 5<br />

<strong>Australia</strong>n Master GST Guide –<br />

Online<br />

<strong>The</strong> <strong>Australia</strong>n Master GST Guide is <strong>Australia</strong>’s leading<br />

GST handbook. It is available as an online updating<br />

subscription service.<br />

This practical plain English online guide provides you with<br />

the information you need to manage and comply with GST<br />

rules. It will give you many practical tips and alert you to<br />

the opportunities that GST offers, while helping you to<br />

avoid GST traps.<br />

Key features:<br />

Clearly written in easy-to-understand style.<br />

Practical with many examples and checklists.<br />

Comprehensive search tools with cross-references to<br />

the <strong>Australia</strong>n GST Guide for more detailed research.<br />

Also included in some Tax Solution Finders.<br />

Product Price: $529 (Online)<br />

If you are a GST practitioner who just wants to maintain a<br />

watching brief on the GST law or who needs to get a quick<br />

plain English overview of the GST law before delving into<br />

more detail, then the Online Master GST Guide is your<br />

ideal companion.<br />

* Prices correct at time of printing and subject to change.<br />

RIGHT ANSWER. RIGHT NOW.<br />

11

Tax Solution Finder<br />

Tax Solution Finder is your ultimate online tax research library. Use the power of <strong>CCH</strong>’s market-leading<br />

IntelliConnect platform to search through our database of information to get targeted results. Uncover the<br />

information you need – fast. Get the right answer quickly and easily.<br />

What you can expect from Tax Solution Finder:<br />

All commentary, legislation, cases, rulings and news are linked to ensure targeted and relevant search<br />

results, saving you research time and making you more productive.<br />

Frequent updates to commentary, rates and tables, including weekly releases of source materials. You<br />

can rely on <strong>CCH</strong> to keep you current.<br />

Clear, authoritative and practical explanations of income tax, superannuation and GST laws,<br />

including legislative changes and ATO rulings.<br />

Written by a <strong>CCH</strong> team of professional tax accountants, lawyers and external tax consultants.<br />

Great value – significant savings on the collective underlying RRP of the products included in each Tax<br />

Solution Finder library.<br />

Tax Solution Finder comes in four versions to suit your needs:<br />

Tax Solution Finder – Premium, Tax Solution Finder – Standard, Tax Solution Finder – Concise,<br />

Tax Solution Finder – Master Guide.<br />

Speak to a Sales Consultant to identify the information solution to fit your business requirements.<br />

Product Price: Premium: $9,776 (Online)<br />

Standard: $7,503 (Online)<br />

Concise: $4,499 (Online)<br />

Master Guide: $2,023 (Online)<br />

<strong>Australia</strong>n Federal Tax Reporter<br />

Tax Navigator for Business<br />

Tax Bills Archive<br />

Capital Gains<br />

Tax Planner<br />

GST Legislation<br />

and Rulings<br />

International Tax<br />

Agreements<br />

<strong>Australia</strong>n GST<br />

Guide<br />

Tax Solution Finder<br />

Premium<br />

Income Tax<br />

Legislation<br />

Income Tax<br />

& GST Bills<br />

Superannuation<br />

Law & Practice<br />

<strong>Australia</strong>n Tax Cases<br />

FBT Guide for Employers<br />

Income Tax Rulings<br />

Premium Master Tax Guide<br />

12 <strong>CCH</strong> <strong>Australia</strong> Limited <strong>The</strong> Professional’s <strong>First</strong> <strong>Choice</strong> www.cch.com.au phone 1300 300 224

<strong>CCH</strong><br />

International Tax<br />

How will the global<br />

financial crisis change<br />

worldwide tax laws<br />

<strong>The</strong> global financial crisis has prompted many countries to implement<br />

short-term economic stimulus packages which will result in farreaching<br />

changes to their tax systems.<br />

In <strong>Australia</strong>, the Government has already foreshadowed dramatic<br />

changes to the foreign source income attribution regimes, including<br />

the modernisation of the CFC rules and the repeal of the FIF regime.<br />

We can expect continued updating of <strong>Australia</strong>’s DTAs in 2010 and the<br />

entering into of more Tax Information Exchange Agreements.<br />

International<br />

Tax<br />

Why <strong>CCH</strong><br />

Practice with confidence, knowing that all changes to international tax<br />

rules will be covered in <strong>CCH</strong>’s international tax publications.<br />

13

International Tax Planning<br />

– Expatriates & Migrants<br />

Relocation across international boundaries affects both<br />

employees and the companies that employ them. This<br />

unique specialist online publication helps you analyse<br />

the tax consequences and opportunities of international<br />

executive transfer or migration. It enables employees<br />

to optimise their tax planning when leaving their home<br />

country and relocating to a different tax regime, or when<br />

returning home after a period abroad.<br />

If your business transfers executives, expatriates<br />

and business migrants, or you are an adviser to such<br />

businesses, this subscription service is for you.<br />

Key features:<br />

Written by Horwath International tax experts in each<br />

country.<br />

Consistent treatment of topics across countries,<br />

allowing for quick and easy comparisons.<br />

Topics covered in a structured manner, covering<br />

commencement of tax residence, tax treatment of<br />

residents and non-residents, inbound tax planning,<br />

cessation of tax residence and its consequences, and<br />

taxation treatment of residents working abroad.<br />

26 countries included for a comprehensive coverage.<br />

Product Price: $1,346 (Print)<br />

$1,271 (Online)<br />

Volumes in print: 1<br />

International Offshore<br />

Financial Centres<br />

This practical service outlines the tax-saving techniques<br />

that can be used when incorporating an offshore financial<br />

centre into international tax planning.<br />

This is an ideal companion to the Worldwide Business Tax<br />

Guide and the International Tax Planning – Expatriates &<br />

Migrants services.<br />

Key features:<br />

Written by Horwath International and other local tax<br />

experts in each country.<br />

Consistent treatment of topics across countries,<br />

allowing for quick and easy comparison.<br />

Topics covered in a structured manner, providing a<br />

general outline of each country’s tax system relevant<br />

to the use of that country as an international offshore<br />

financial centre, and an international tax planning<br />

toolkit and how it applies to each country.<br />

Comprehensive, with 30 countries covered in depth.<br />

Product Price: $1,346 (Print)<br />

$1,271 (Online)<br />

Volumes in print: 1<br />

<strong>Australia</strong>n International<br />

Tax Agreements<br />

<strong>The</strong> <strong>Australia</strong>n International Tax Agreements service<br />

provides commentary and full text on all of <strong>Australia</strong>’s<br />

current double tax treaties.<br />

It also discusses the OECD Model Tax Convention on<br />

Income and Capital, the UN Model Tax Convention and<br />

the Timor Gap Taxation Code.<br />

If you are a professional adviser in this area, you need this<br />

indispensable tool for your library of international tax<br />

resources.<br />

Key features:<br />

Detailed commentary, usually on an article by<br />

article basis, with references to relevant ATO rulings,<br />

determinations and cases.<br />

Includes commentary on <strong>Australia</strong>n taxation of<br />

international taxation with relevant cross-references<br />

to <strong>CCH</strong>’s <strong>Australia</strong>n Federal Tax Reporter for even more<br />

detail on relevant issues.<br />

A useful set of tables comparing treaties on over 20<br />

issues, eg business profits, visiting teachers.<br />

Includes a newsletter to keep up-to-date on the latest<br />

double tax treaty news and developments on other<br />

international matters.<br />

Product Price: $798 (Print), $754 (Online)<br />

Volumes in print: 1<br />

14 <strong>CCH</strong> <strong>Australia</strong> Limited <strong>The</strong> Professional’s <strong>First</strong> <strong>Choice</strong> www.cch.com.au phone 1300 300 224

Worldwide Business Tax Guide<br />

<strong>The</strong> Worldwide Business Tax Guide is your essential global cross-border tax resource. This service has been used by<br />

tax specialists around the world for over 20 years. Covering 47 countries, this comprehensive resource saves you<br />

time and money on expensive international tax advice.<br />

<strong>The</strong> Guide is written by in-country tax experts for tax professionals. It will give you in-depth tax information<br />

to support corporate investment decisions and oversee tax compliance matters of overseas subsidiaries or<br />

branches. It enables busy tax professionals to understand cross-border and business issues before engaging<br />

foreign tax advice.<br />

<strong>The</strong> International Tax Planning – Expatriates & Migrants (see page 14) service makes an ideal companion to<br />

the Guide.<br />

Key features:<br />

Written by Horwath International tax experts in each country.<br />

Contains “Snapshots” that provide essential tax facts on local tax systems, conveniently located at the<br />

beginning of each country chapter.<br />

Covers all forms of doing business for each country, eg partnerships, trusts, sole proprietorships, etc.<br />

References provided to relevant codes, laws, guidance, etc, allowing users to do more detailed research.<br />

Consistent treatment of topics across countries, allowing for quick and easy comparisons.<br />

Product Price: $2,544 (Print), $2,343 (Online)<br />

Volumes in print: 2<br />

Canada<br />

Argentina<br />

Brazil<br />

Hong Kong<br />

Austria<br />

Greece<br />

Malaysia<br />

Egypt Germany<br />

<strong>Australia</strong><br />

Korea (Republic of)<br />

Denmark Indonesia Japan Finland<br />

Belgium<br />

Taiwan Ireland Norway<br />

France<br />

Israel<br />

Sweden<br />

Worldwide Business<br />

Tax Guide<br />

New Zealand<br />

Philippines<br />

Thailand<br />

Netherlands<br />

Papua New Guinea<br />

Poland<br />

Hungary<br />

Luxembourg<br />

Mexico<br />

Turkey<br />

Switzerland<br />

India<br />

Romania<br />

China<br />

South Africa<br />

United Kingdom<br />

Czech Republic Russian Federation Venezuela<br />

Cyprus<br />

Singapore<br />

Italy<br />

Spain USA Portugal<br />

* Prices correct at time of printing and subject to change.<br />

RIGHT ANSWER. RIGHT NOW.<br />

15

Superannuation<br />

& Financial<br />

Planning<br />

Why <strong>CCH</strong><br />

<strong>CCH</strong> Superannuation<br />

& Financial Planning<br />

Are you prepared for<br />

the superannuation and<br />

financial planning changes<br />

coming in 2010<br />

Superannuation law is complex and keeps changing. Changes in 2010<br />

will result from the <strong>Australia</strong>’s Future Tax System Review Panel (the<br />

Henry Review), the Super System Review (the Cooper Review) into the<br />

governance, efficiency, structure and operation of the superannuation<br />

system, and the Ripoll parliamentary inquiry.<br />

All these reviews are viewed by the government as an opportunity for<br />

bringing greater certainty to superannuation policy. However, the only<br />

certainty seems to be that superannuation law will keep changing and<br />

remain complex.<br />

Changes to superannuation that are already in the pipeline include a<br />

proposed free superannuation clearing house for small business and<br />

amendments to the Corporations Regulations dealing with Product<br />

Disclosure Statements for superannuation products.<br />

<strong>CCH</strong> commentary and source material products will ensure that you<br />

keep up-to-date with all the changes as they happen and that the<br />

complex law is made easier to understand and apply.<br />

16

<strong>Australia</strong>n Superannuation<br />

Law & Practice<br />

This comprehensive service provides in-depth and<br />

authoritative commentary on superannuation industry<br />

supervision (SIS), the superannuation guarantee charge<br />

(SGC), superannuation complaints and taxation laws<br />

relevant to superannuation.<br />

Commentary covers all topics on superannuation<br />

regulation and relevant tax issues, including SIS, self<br />

managed superannuation funds, installation practice,<br />

disclosure, licensing requirements, trustees and<br />

trust deeds, investment performance measurement,<br />

contributions to funds, taxation of benefits, and taxation<br />

of funds.<br />

If you advise clients on superannuation, then this is an<br />

essential resource for you.<br />

Key features:<br />

<strong>The</strong> instant Reference Tab – provides quick access to<br />

all key rates, thresholds and superannuation forms,<br />

checklists, etc, as a gateway to detailed commentary.<br />

Amending Legislation Tab – tracks the progress of<br />

superannuation Bills and Legislative Instruments.<br />

<strong>The</strong> print version has commentary only; electronic<br />

versions allow you to choose either: (1) just<br />

commentary; or (2) a suite that includes the<br />

commentary plus the full text of all relevant<br />

legislation and full text of all relevant APRA, ASIC,<br />

ATO and other information releases, taken from<br />

<strong>CCH</strong>’s <strong>Australia</strong>n Superannuation Digest and <strong>Australia</strong>n<br />

Superannuation Taxation Materials. <strong>The</strong> full online<br />

<strong>Australia</strong>n Superannuation Law & Practice suite provides<br />

a significant saving.<br />

Also included in some Solution Finders.<br />

Product Price:<br />

Commentary only $1,219 (Online)<br />

Suite $1,830 (Online)<br />

Volumes in print: 2<br />

<strong>Australia</strong>n Master<br />

Superannuation Guide – Online<br />

<strong>The</strong> <strong>Australia</strong>n Master Superannuation Guide is <strong>Australia</strong>’s<br />

best selling superannuation handbook for superannuation<br />

trustees and practitioners, tax professionals, accountants,<br />

lawyers and HR managers. It provides plain English<br />

commentary on all aspects of superannuation, both<br />

regulatory and taxation.<br />

<strong>The</strong> online version provides an updating version of this<br />

book, with fully integrated updates released quarterly.<br />

<strong>The</strong> Online <strong>Australia</strong>n Master Superannuation Guide<br />

provides an excellent starting point for all your<br />

superannuation research.<br />

Key features:<br />

Covers all aspects of superannuation fund<br />

management, operations and administration.<br />

Easy to use with lots of charts, checklists and examples.<br />

Enhanced searching capability, with links to rulings,<br />

cases and legislation.<br />

Contains hypertext links to <strong>Australia</strong>n Superannuation Law<br />

& Practice (separate subscription required) allowing for<br />

quick access to more information on the relevant topic.<br />

Also included in Superannuation Solution Finder and some<br />

Tax Solution Finders.<br />

Product Price: $556 (Online)<br />

* Prices correct at time of printing and subject to change.<br />

RIGHT ANSWER. RIGHT NOW.<br />

17

<strong>Australia</strong>n Superannuation Digest<br />

Keep up-to-date with latest news and developments from<br />

the leading regulatory bodies in superannuation, APRA<br />

and ASIC. This publication provides you with the latest<br />

circulars, releases, forms and legislation. Whether you are<br />

running a super fund or providing advice, this product will<br />

help you keep in touch with the latest requirements. No<br />

superannuation professional should be without it.<br />

Note that if you subscribe to the online version of<br />

<strong>Australia</strong>n Superannuation Law & Practice, the material in<br />

<strong>Australia</strong>n Superannuation Digest is provided as part of the<br />

service at a great saving.<br />

Key features:<br />

Endorsed by APRA, but also includes relevant material<br />

from the other regulators.<br />

Contains the major superannuation regulatory source<br />

materials in one convenient, easy-to-use service.<br />

Also included in some Solution Finders.<br />

Product Price: $430 (Print)<br />

$422 (Online)<br />

Volumes in print: 2<br />

For tax-related superannuation legislation and rulings, see<br />

the <strong>Australia</strong>n Superannuation Taxation Materials service.<br />

<strong>Australia</strong>n Superannuation<br />

Taxation Materials<br />

This service has been designed to help you keep track of<br />

all the changes in tax-related superannuation issues by<br />

bringing together source materials that focus on taxation<br />

into one convenient volume.<br />

Note that if you subscribe to the online version of<br />

<strong>Australia</strong>n Superannuation Law & Practice, the material in<br />

<strong>Australia</strong>n Superannuation: Taxation Materials is provided<br />

as part of the service at a great saving.<br />

Key features:<br />

All tax-related superannuation source materials in one<br />

convenient easy-to-use service.<br />

Contains income tax legislation (extracts relevant to<br />

superannuation) plus the full text of relevant ATO<br />

rulings and determinations.<br />

Also included in some Solution Finders.<br />

Product Price: $578 (Print)<br />

$530 (Online)<br />

Volumes in print: 1<br />

For superannuation regulatory legislation circulars,<br />

releases and forms, see the <strong>Australia</strong>n Superannuation<br />

Digest service.<br />

Practical Guide to SMSFs<br />

This is a practical online resource that takes you through all<br />

aspects of self-managed superannuation funds (SMSF)<br />

administration and operations. Taking a task-by-task, process<br />

workflow approach, this resource covers the establishment of<br />

the fund, the role of trustees, managing fund’s investments,<br />

paying benefits, audit and taxation of SMSFs.<br />

This service is available in two versions: (1) standard with<br />

just commentary; or (2) premium with commentary and<br />

legislation.<br />

Key features:<br />

Up-to-date information, checklists and approved forms.<br />

Easy-to-use format with instant references – rates &<br />

thresholds.<br />

Written by industry experts, including Louise Biti,<br />

Director, Strategy Steps and Graeme Colley, Technical<br />

Manager, SuperConcepts.<br />

Product Price<br />

Standard: $655 (Online)<br />

Premium: $874 (Online)<br />

As an SMSF administrator or adviser you can be assured<br />

this one-stop shop will have everything you need at your<br />

finger tips.<br />

18 <strong>CCH</strong> <strong>Australia</strong> Limited <strong>The</strong> Professional’s <strong>First</strong> <strong>Choice</strong> www.cch.com.au phone 1300 300 224

Financial Planning Navigator<br />

<strong>The</strong> Financial Planning Navigator is the comprehensive<br />

financial planning reference manual for all financial<br />

planning professionals and accountants.<br />

Based on material from the respected <strong>CCH</strong> Master<br />

Financial Planning Guide, it contains practical and useful<br />

material to meet your information needs.<br />

Key features:<br />

Weekly and monthly updates to keep you fully<br />

informed of all the latest industry developments.<br />

Full of strategies, checklists, case studies, examples,<br />

rates, tables and interactive calculators.<br />

Written by a range of industry experts and updated by<br />

<strong>CCH</strong> editors.<br />

Includes the bi-monthly FINGAIN newsletter produced<br />

in conjunction with Macquarie Bank.<br />

Product Price: $855 (Online)<br />

<strong>Australia</strong>n Superannuation Cases<br />

This service contains the full text of all superannuationrelated<br />

tax cases, all cases appealed from the<br />

Superannuation Complaints Tribunal, and other<br />

superannuation-related cases.<br />

Key features:<br />

All the source materials and commentary are available<br />

in one place.<br />

Full text of tax cases relevant to superannuation.<br />

Full text of other superannuation cases, dealing with<br />

regulatory issues, trust issues, resolution of complaints, etc.<br />

Full text of relevant other cases, such as family law<br />

cases dealing with superannuation.<br />

Product Price: $389 (Online)<br />

<strong>Australia</strong>n Superannuation<br />

LawLinks<br />

Super LawLinks is an easy-to-use organiser of<br />

superannuation law source material. It is located<br />

on the Electronic Superannuation Library and will<br />

enable subscribers to take full advantage of the source<br />

material. Content includes each section of the major<br />

superannuation Acts. Each entry lists the related<br />

legislation, rulings, cases, circulars, APRA, ASIC or ATO<br />

releases.<br />

Key Features:<br />

Save countless research hours.<br />

Locate the information you require quickly.<br />

Product Price: $495 (Online)<br />

* Prices correct at time of printing and subject to change.<br />

RIGHT ANSWER. RIGHT NOW.<br />

19

<strong>Australia</strong>n Accounts<br />

Preparation Manual<br />

Do you need to prepare and present financial reports for<br />

proprietors and managers to use in the management of<br />

their business <strong>The</strong> <strong>Australia</strong>n Accounts Preparation Manual<br />

provides guidelines for the optimal presentation and use<br />

of financial information for reporting entities. Written in<br />

plain English, this practical resource will help keep you<br />

abreast of all the latest changes to accounting standards<br />

and financial reporting requirements.<br />

<strong>The</strong> Manual is also designed to assist in resolving the<br />

practical problems and questions that arise from the<br />

application of various accounting standards and legislation<br />

affecting the preparation and presentation of financial<br />

statements, which makes it an essential resource<br />

throughout the year.<br />

Key features:<br />

Guidelines on preparing and presenting financial<br />

reports, according to accounting standards and the<br />

Corporations Act 2001.<br />

Follows the structure and order of financial statements,<br />

making it convenient to locate commentary on<br />

different items of a financial statement.<br />

Deals with different business entities, such as<br />

companies, trusts, superannuation plans, partnerships,<br />

associations and trade unions.<br />

Includes extracts from relevant legislation and<br />

regulations.<br />

Subscription includes Accountants Newsletter.<br />

Product Price: $1,585 (Print), $1,471 (Online)<br />

Volumes in print: 3<br />

<strong>Australia</strong>n Insolvency<br />

Management Practice<br />

<strong>Australia</strong>n Insolvency Management Practice provides<br />

legal and practical assistance in personal and corporate<br />

insolvency administrations with a comprehensive guide to<br />

day-to-day insolvency administration issues. In addition,<br />

it provides detailed legal and practical analysis of case<br />

law, legislation and the court processes. It is primarily<br />

a practice guide for anyone participating in insolvency<br />

management, whether as a “manager” or as an adviser,<br />

creditor or even debtor.<br />

Key features:<br />

Takes you step-by-step through insolvency procedures<br />

and court processes.<br />

Includes checklists, practice guides and references to<br />

the IPA Code of Professional Practice.<br />

Contains numerous cross-references throughout to<br />

other relevant parts of the Practice, and between<br />

common issues in personal and corporate insolvency.<br />

Written by Michael Murray on behalf of Ferrier Hodgson,<br />

the Practice offers a broad spectrum of personal and<br />

corporate insolvency – no other product has both.<br />

Product Price: $2,157 (Print)<br />

$2,016 (Online)<br />

Volumes in print: 2<br />

<strong>Australia</strong>n Audit Manual/Audit<br />

Workpapers Plus CD<br />

<strong>The</strong> <strong>Australia</strong>n Audit Manual is a step-by-step guide<br />

to key audit procedures for a variety of reporting and<br />

non-reporting entitles, written by Sothertons Chartered<br />

Accountants. It provides you with all the information you<br />

require to conduct audits for all types of entities.<br />

<strong>The</strong> Audit Workpapers Plus CD is an integrated suite<br />

of Microsoft Excel worksheets that output audit<br />

workpapers to be used in statutory audits for businesses,<br />

superannuation funds (including self managed) and trust<br />

accounts. Requires Excel version 2003.<br />

Key features:<br />

Contains checklists and special features that save you<br />

time and help ensure nothing is omitted.<br />

Sample audit reports and opinions, with sample letters<br />

to manage your engagement and collect audit evidence.<br />

Allows you to reproduce audit programs, checklists and<br />

working papers as desired, for internal use.<br />

Includes Accountants Newsletter.<br />

Product Price:<br />

<strong>Australia</strong>n Audit Manual $596 (Print)<br />

<strong>Australia</strong>n Audit Manual $575 (Online)<br />

Audit Workpapers Plus CD Package $853 (Print)<br />

Volumes in print: 1<br />

20 <strong>CCH</strong> <strong>Australia</strong> Limited <strong>The</strong> Professional’s <strong>First</strong> <strong>Choice</strong> www.cch.com.au phone 1300 300 224

Superannuation Solution Finder<br />

Superannuation Solution Finder is your ultimate online research tool. Search through <strong>CCH</strong>’s database of<br />

superannuation-related information sources to get targeted results, cross-referenced to commentary.<br />

Uncover the information you need – fast. Save yourself the hassle of many hours sifting through large<br />

numbers of online results from other information sources that may not be relevant to your search criteria.<br />

What you get with Superannuation Solution Finder:<br />

<strong>Australia</strong>n Superannuation Law & Practice<br />

<strong>Australia</strong>n Master Superannuation Guide<br />

Premium Master Tax Guide<br />

<strong>CCH</strong> <strong>Australia</strong>n Super News<br />

<strong>CCH</strong> Tax Week<br />

<strong>Australia</strong>n Superannuation Digest<br />

<strong>Australia</strong>n Superannuation Taxation Materials<br />

<strong>Australia</strong>n Superannuation Law Bills<br />

<strong>Australia</strong>n Superannuation Cases<br />

<strong>Australia</strong>n Superannuation Complaints Tribunal<br />

<strong>Australia</strong>n Superannuation Lawlinks<br />

What you can expect with Superannuation Solution Finder:<br />

Use the power of IntelliConnect to search across a <strong>CCH</strong> library of relevant products by topic or<br />

content type. All commentary, legislation, rulings, circulars, cases and news are linked to relevant topic<br />

areas that ensure targeted relevant search results, saving you research time.<br />

Regular updates to commentary, rates and tables. You can rely on <strong>CCH</strong> to keep you current.<br />

Great value – significant savings on the collective underlying RRP of the products that make up the<br />

Superannuation Solution Finder library<br />

Product Price: $4,836 (Online)<br />

<strong>Australia</strong>n<br />

Superannuation Lawlinks<br />

<strong>Australia</strong>n Superannuation<br />

Law & Practice<br />

<strong>Australia</strong>n Master<br />

Superannuation Guide<br />

<strong>Australia</strong>n<br />

Superannuation<br />

Complaints Tribunal<br />

<strong>Australia</strong>n<br />

Superannuation Cases<br />

Superannuation<br />

Solution Finder<br />

Premium Master<br />

Tax Guide<br />

<strong>CCH</strong> <strong>Australia</strong>n<br />

Super News<br />

<strong>CCH</strong> Tax Week<br />

<strong>Australia</strong>n Superannuation<br />

<strong>Australia</strong>n<br />

Law Bills<br />

Superannuation Digest<br />

<strong>Australia</strong>n Superannuation<br />

Taxation Materials<br />

* Prices correct at time of printing and subject to change.<br />

RIGHT ANSWER. RIGHT NOW.<br />

21

Corporations<br />

Law<br />

Why <strong>CCH</strong><br />

<strong>CCH</strong> Corporations<br />

Law Library<br />

Are you up-to-date<br />

<strong>The</strong> regulation of corporations under the Corporations Act and other<br />

related legislation continued to grow very significantly during 2009,<br />

and 2010 promises to provide further legislative and other changes.<br />

Apart from the proposal to make ASIC the main regulator in relation<br />

to securities markets (removing this role from ASX), the legislative<br />

amendments for 2010 will introduce further important changes<br />

as a result of the report of the Corporations & Markets Advisory<br />

Committee on market integrity. <strong>The</strong>se will be in addition to recent<br />

changes that introduced reporting and other requirements relating to<br />

short sales and margin lending.<br />

When implemented, the proposals in the recent Productivity<br />

Commission Report into Executive Remuneration will add to the<br />

regulation of directors’ remuneration. Recent legislation dealing with<br />

termination benefits has impacted this area significantly. In addition to<br />

these changes, there have been important amendments dealing with<br />

the operations of trustee companies.<br />

Further legislative changes will reverse the effect of the decision in<br />

Sons of Gwalia v Margaretic, which decided that certain claims by<br />

shareholders were not subordinated below the claims of other creditors<br />

in a winding up.<br />

A package of reforms to insolvency laws has been announced, including<br />

the long awaited and controversial proposal to adopt a modified<br />

statutory business judgment rule in respect of the director’s duty to<br />

avoid insolvent trading.<br />

<strong>The</strong>re have also been some very significant court decisions dealing with<br />

directors’ duties and related matters (including ASIC v Macdonald and<br />

ASIC v Rich). <strong>The</strong> significant decision on continuous disclosure in ASIC v<br />

Fortescue Metals, together with the continued use of the infringement<br />

notice regime by ASIC, has increased the spotlight on this area of<br />

corporate law.<br />

<strong>The</strong> <strong>CCH</strong> Corporations Law Library covers the major legislative, judicial<br />

and other developments in detail, keeping you up-to-date.<br />

22

<strong>Australia</strong>n Corporations &<br />

Securities Law Reporter<br />

<strong>The</strong> <strong>Australia</strong>n Corporations & Securities Law Reporter<br />

is a definitive guide to the length and breadth of the<br />

Corporations Act 2001 and related legislation. With an<br />

emphasis on practical and speedily updated commentary,<br />

this service gives legal and accounting practitioners and<br />

corporate advisers the information they need when<br />

dealing with the Corporations Act.<br />

<strong>The</strong> online version of this reporter also includes access to<br />

<strong>Australia</strong>n Corporations & Securities Legislation as well as<br />

over 200 forms in <strong>CCH</strong>’s Corporations Act Forms.<br />

Key features:<br />

Provides detailed analysis of the Corporations Act 2001<br />

and regulations, ASIC Act 2001, company law cases<br />

and ASIC releases that affect all aspects of <strong>Australia</strong>n<br />

company law.<br />

Contributions from expert consulting editors including<br />

Professor Bob Baxt, Pamela Hanrahan and firms Blake<br />

Dawson Waldron, Clayton Utz and Corrs Chambers<br />

Westgarth.<br />

Online: $2,418<br />

Print: $1,738<br />

Volumes in print: 4<br />

<strong>Australia</strong>n Corporate<br />

Practice Manual<br />

This service is designed for active use by company<br />

secretaries and practitioners. It will save you hours of<br />

time by making available essential checklists, examples,<br />

flowcharts and <strong>Australia</strong>n Securities & Investments<br />

Commission (ASIC) forms. <strong>The</strong> service also contains the<br />

ASX Listing Rules.<br />

Key features:<br />

Provides an essential library of forms catering for all<br />

administration requirements of Corporations Law which<br />

you can copy and paste for immediate completion and<br />

lodgment with ASIC.<br />

Includes pro forma financial statements.<br />

<strong>The</strong> online version has hypertext links which enable you<br />

to cross-reference to specific sections of legislation or<br />

ASIC releases.<br />

Online: $867<br />

Print: $917<br />

Volumes in print: 1<br />

<strong>Australia</strong>n Corporations Act<br />

Partner Online<br />

This is a unique electronic research tool that shows<br />

at a glance the regulations, case law, ASIC policy and<br />

forms relevant to each section of the Corporations Act.<br />

<strong>The</strong> Partner can be linked to other products in the <strong>CCH</strong><br />

Corporations Law library allowing quick access to the<br />

relevant source material and commentary.<br />

Partner:<br />

Partner PLUS Full Suite:<br />

Partner PLUS Commentary:<br />

Partner PLUS Source Materials:<br />

$822 (online)<br />

$4,445 (online)<br />

$2,924 (online)<br />

$2,700 (online)<br />

Package options:<br />

Partner PLUS Full Suite: includes the Partner, plus:<br />

<strong>Australia</strong>n Corporations & Securities Law Reporter,<br />

<strong>Australia</strong>n Corporations & Securities Legislation, ASIC<br />

Releases, <strong>Australia</strong>n Company Law Cases, Forms and<br />

<strong>Australia</strong>n Corporate News.<br />

Partner PLUS Commentary: includes the Partner, plus:<br />

<strong>Australia</strong>n Corporations & Securities Law Reporter,<br />

<strong>Australia</strong>n Corporations & Securities Legislation, Forms<br />

and <strong>Australia</strong>n Corporate News.<br />

Partner PLUS Source Materials: includes the Partner,<br />

plus: <strong>Australia</strong>n Corporations & Securities Legislation,<br />

ASIC Releases, <strong>Australia</strong>n Company Law Cases, Forms<br />

and <strong>Australia</strong>n Corporate News.<br />

* Prices correct at time of printing and subject to change.<br />

RIGHT ANSWER. RIGHT NOW.<br />

23

Corporations & Securities Solution Finder<br />

<strong>CCH</strong>’s Corporations & Securities Solution Finder is your ultimate research tool for <strong>CCH</strong>’s database<br />

of corporations law-related information sources. You will get fast and accurate results to all your<br />

corporations law questions.<br />

<strong>CCH</strong>’s Corporations & Securities Solution Finder comes in two versions – a premium version which is the<br />

ultimate corporations law research tool, and a standard version which still offers a comprehensive service<br />

but at a lower price. Both are great value for money.<br />

What you get with Corporations & Securities Solution Finder:<br />

<strong>Australia</strong>n Corporations & Securities Law Reporter (includes forms) (premium version only)<br />

<strong>Australia</strong>n Corporations Court Rules (premium version only)<br />

<strong>Australia</strong>n Corporate Practice Manual<br />

<strong>Australia</strong>n Corporations & Securities Legislation<br />

<strong>Australia</strong>n Company Law Cases<br />

Annotated Listing Rules<br />

<strong>Australia</strong>n Corporate Business Law Report<br />

<strong>Australia</strong>n Corporate News<br />

What you can expect with Corporations & Securities Solution Finder:<br />

Use the power of IntelliConnect, <strong>CCH</strong>’s market-leading research platform, and get the right answers<br />

quickly and easily.<br />

Frequent updates to content — you can rely on <strong>CCH</strong> to keep you current.<br />

Great value – significant savings on the collective underlying RRP of the products that make up the<br />

Solution Finder library.<br />

Product Price:<br />

Premium $5,589 (Online)<br />

Standard $3,415 (Online)<br />

<strong>Australia</strong>n Corporate<br />

Business Law Report<br />

<strong>Australia</strong>n<br />

Corporate News<br />

<strong>Australia</strong>n Corporations<br />

& Securities Law Reporter<br />

(includes forms)<br />

Corporations<br />

& Securities<br />

Solution Finder<br />

<strong>Australia</strong>n Corporations<br />

Court Rules<br />

Annotated<br />

Listing Rules<br />

<strong>Australia</strong>n Company<br />

Law Cases<br />

<strong>Australia</strong>n Corporations &<br />

Securities Legislation<br />

<strong>Australia</strong>n Corporate<br />

Practice Manual<br />

24 <strong>CCH</strong> <strong>Australia</strong> Limited <strong>The</strong> Professional’s <strong>First</strong> <strong>Choice</strong> www.cch.com.au phone 1300 300 224

If it’s in the news,<br />

it’s too late!<br />

Don’t wait for political and regulatory<br />

information that impacts your organisation<br />

to appear in the news.<br />

<strong>CCH</strong> Political Alert is the most immediate<br />

source of political, government and legislative<br />

information available. Alerts are delivered via<br />

email as developments occur, according to your<br />

interest areas.<br />

You receive:<br />

Media releases<br />

Interview transcripts and speeches<br />

Legislation and regulations<br />

Reports and publications<br />

Transcripts of parliamentary and committee<br />

proceedings<br />

Policy announcements from major election<br />

campaigns.<br />

<strong>CCH</strong> Political Alert offers comprehensive<br />

coverage of government – federal, state and<br />

territory – and industry developments. With<br />

<strong>CCH</strong> Political Alert your business will be better<br />

informed and better protected against political<br />

and government change.<br />

Benefits include:<br />

Fast access – often delivered within minutes<br />

of the release of the information<br />

Customised alert profile drawn from more<br />

than 350 specialist topics<br />

Multiple user options, which you can change<br />

at any time<br />

Dedicated online library with search facility<br />

to assist with information management.<br />

Speak to a <strong>CCH</strong> Parliament Specialist today for a tailored<br />

solution to meet your organisations needs.<br />

Call 02 9857 1682 or 1300 300 224.<br />

<strong>CCH</strong> Political Alert<br />

Your Partner<br />

in Parliament<br />

25

<strong>CCH</strong><br />

ProSystem<br />

Software<br />

Why <strong>CCH</strong><br />

<strong>CCH</strong> ProSystem Software<br />

<strong>The</strong> <strong>CCH</strong> ProSystem applications are an industry-leading suite of<br />

product software that gives accountants exceptional control of all<br />

their information – from billing to legislation, accounting standards to<br />

staffing. It helps accountants dramatically improve productivity and<br />

move towards the long-awaited paperless office. By doing so it also<br />

improves the services offered to end customers.<br />

<strong>CCH</strong> ProSystem and its award-winning technology have been providing<br />

solutions for more than two decades. Over 30,000 customers<br />

throughout North America, United Kingdom and Asia Pacific, including<br />

90 of the top 100 US Tax and Accounting firms, use and trust the <strong>CCH</strong><br />

ProSystem suite.<br />

<strong>The</strong> core <strong>CCH</strong> ProSystem suite has been localised to meet the<br />

<strong>Australia</strong>n compliance obligations and the needs of <strong>Australia</strong>n<br />

accountants. By localising a world-class application supported by<br />

a team of over 1,000 developers and support staff, we are able to<br />

leverage global scale to deliver cost effective, “best in class” solutions.<br />

Launched in <strong>Australia</strong> in 2007, <strong>CCH</strong> ProSystem customers include 10 of<br />

the top 100 <strong>Australia</strong>n firms.<br />

<strong>CCH</strong> ProSystem helps our customers make the most of their time, so<br />

they can focus on their customers.<br />

“We’ve drastically cut down the time we used to spend<br />

doing these processes, and we’re spending less time<br />

on jobs because we’re cutting down so much of the<br />

processing time involved. We can get away from spending<br />

all our time doing compliance work, and start to work on<br />

adding value for our clients instead.”<br />

Nick Ciccocioppo, Hattam McCarthy Reeves<br />

In 2010 <strong>CCH</strong>, one of <strong>Australia</strong>’s most trusted tax information brands,<br />

together with one of the world’s leading tax software brands<br />

<strong>CCH</strong> ProSystem, combine to deliver a new alternative in <strong>Australia</strong>n<br />

tax and accounting software.<br />

26

<strong>CCH</strong> ProSystem Document<br />

Once your client source documents are electronic,<br />

they can be stored using <strong>CCH</strong> ProSystem Document,<br />

the complete electronic storage solution designed<br />

for accountants. <strong>CCH</strong> ProSystem Document securely<br />

maintains your firm’s client source documents, financial<br />

documents, emails and more.<br />

Storing and retrieving documents are just a few clicks<br />

of a mouse with <strong>CCH</strong> ProSystem Document. From tax<br />

returns to client/authority correspondence, to employee<br />

records and emails - <strong>CCH</strong> ProSystem Document is the<br />

virtual central depository storage solution for all your<br />

paper documents for many years. It saves you space to<br />

store physical file, saves you time to search for it and is<br />

accessible anytime and anywhere remotely.<br />

Key features:<br />

Document Manager – Allows you to index, store,<br />

track, search, and retrieve all electronic files in your<br />

organisation.<br />

Records Management – Includes the ability to retain<br />

unalterable record copies and easy retrieval during the<br />

retention period, plus easy destruction of records at the<br />

end of the retention period.<br />

Client Portal – Collaborate with your clients/mobile<br />

staff remotely via the secured client portal, providing<br />

the ability to make any size document available<br />

instantly.<br />

Streamlined Document Process – Wizards enable<br />

automatic document indexing and publishing directly<br />

from in-house applications to the document manager.<br />

Document Retention – A one-time setup of retention<br />

periods sets the expiration dates for any type of<br />

document to ensure it purged from the system at the<br />

appropriate time.<br />

Audit Trails – Track the history of documents so you can<br />

know who has viewed, edited and checked documents<br />

in and out, along with customisable version controls.<br />

Highly integrated with other <strong>CCH</strong> ProSystem Office<br />

Suite applications.<br />

<strong>CCH</strong> ProSystem Engagement<br />

Standardise your firm’s compliance and audit processes and<br />

workpapers with electronic binders that mimic your physical<br />

files and increase efficiency and productivity. Allow your<br />

staff to access workpapers anywhere they have networked or<br />

internet access.<br />

Discover the solution that is saving firms up to 40% on each<br />

of their engagements after the first year of implementation.<br />

<strong>CCH</strong> ProSystem Engagement allows your firm to maximise<br />

efficiency by moving toward a true paperless office.<br />

Start your journey to move towards true paperless<br />

engagements now!<br />

Key features:<br />

Automate first-year engagements with customised<br />

binder templates, eliminating the hassles associated<br />

with paper binders.<br />

Efficiently review your workpapers side-by-side using<br />

dual monitors.<br />

User friendly interface that is similar to Windows®<br />

Explorer-style and integrate with Microsoft® Office<br />

applications and conversion into PDF files.<br />

Scan related documents directly to the binder, archive<br />

and store binder electronically for as long as you want<br />

without worrying about them being misplaced and save<br />

physical storage place.<br />

Allow multiple staff members to work on an<br />

engagement simultaneously and synchronise files with<br />

various permission levels to maintain high data security<br />

and integrity during all stages.<br />

Highly integrated with other <strong>CCH</strong> ProSystem Office<br />

Suite applications.<br />

* Prices correct at time of printing and subject to change.<br />

RIGHT ANSWER. RIGHT NOW.<br />

27

<strong>CCH</strong> ProSystem Audit<br />

<strong>CCH</strong> ProSystem Audit comprises a complete set of audit<br />

titles, everything your firm will need to undertake any audit<br />

assignments including customisable audit plans and checklists,<br />

sign off capability and links to supporting workpapers, audit<br />

template library, external sources and more.<br />