Reserve Bank of Australia Annual Report 2011

Reserve Bank of Australia Annual Report 2011

Reserve Bank of Australia Annual Report 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A little less than half <strong>of</strong> the <strong>Bank</strong>’s financial assets are invested in highly rated domestic securities, which are<br />

held for policy-related purposes. At the end <strong>of</strong> June <strong>2011</strong>, total holdings <strong>of</strong> domestic securities were $32 billion,<br />

around $5 billion lower than a year earlier with a fall in holdings <strong>of</strong> securities held under repurchase agreements<br />

(repos) more than <strong>of</strong>fsetting an increase in securities held outright. This generated only a modest rise in interest<br />

rate risk on the domestic portfolio as outright holdings comprise a relatively small portion <strong>of</strong> total domestic<br />

assets and the purchases were concentrated in securities <strong>of</strong> very short duration. The majority <strong>of</strong> domestic<br />

securities is invested under repos with short terms to maturity. While already quite short, the average term to<br />

maturity <strong>of</strong> the <strong>Bank</strong>’s domestic repo book declined from 24 days at the end <strong>of</strong> June 2010 to around 14 days at<br />

end June <strong>2011</strong> (See chapter on ‘Operations in Financial Markets’).<br />

The <strong>Reserve</strong> <strong>Bank</strong>’s balance sheet liabilities are unique and carry little overall interest rate risk. <strong>Bank</strong>notes on<br />

issue make up around two-thirds <strong>of</strong> total liabilities and carry no price risk. The other significant obligations are<br />

deposits held by the <strong>Australia</strong>n Government and government agencies, and settlement balances held by<br />

authorised deposit-taking institutions (ADIs). These deposits have short maturities that broadly match the<br />

<strong>Bank</strong>’s domestic assets held under repo, and the interest paid reflects domestic short-term interest rates. This<br />

means the level <strong>of</strong> interest rate risk on the <strong>Bank</strong>’s liabilities is low and is mainly <strong>of</strong>fset by the exposure on its<br />

domestic assets.<br />

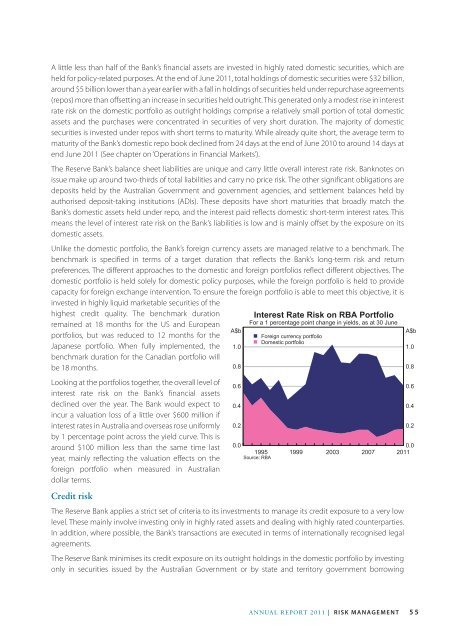

Unlike the domestic portfolio, the <strong>Bank</strong>’s foreign currency assets are managed relative to a benchmark. The<br />

benchmark is specified in terms <strong>of</strong> a target duration that reflects the <strong>Bank</strong>’s long-term risk and return<br />

preferences. The different approaches to the domestic and foreign portfolios reflect different objectives. The<br />

domestic portfolio is held solely for domestic policy purposes, while the foreign portfolio is held to provide<br />

capacity for foreign exchange intervention. To ensure the foreign portfolio is able to meet this objective, it is<br />

invested in highly liquid marketable securities <strong>of</strong> the<br />

highest credit quality. The benchmark duration<br />

remained at 18 months for the US and European<br />

portfolios, but was reduced to 12 months for the<br />

Japanese portfolio. When fully implemented, the<br />

benchmark duration for the Canadian portfolio will<br />

be 18 months.<br />

Looking at the portfolios together, the overall level <strong>of</strong><br />

interest rate risk on the <strong>Bank</strong>’s financial assets<br />

declined over the year. The <strong>Bank</strong> would expect to<br />

incur a valuation loss <strong>of</strong> a little over $600 million if<br />

interest rates in <strong>Australia</strong> and overseas rose uniformly<br />

by 1 percentage point across the yield curve. This is<br />

around $100 million less than the same time last<br />

year, mainly reflecting the valuation effects on the<br />

foreign portfolio when measured in <strong>Australia</strong>n<br />

dollar terms.<br />

Credit risk<br />

The <strong>Reserve</strong> <strong>Bank</strong> applies a strict set <strong>of</strong> criteria to its investments to manage its credit exposure to a very low<br />

level. These mainly involve investing only in highly rated assets and dealing with highly rated counterparties.<br />

In addition, where possible, the <strong>Bank</strong>’s transactions are executed in terms <strong>of</strong> internationally recognised legal<br />

agreements.<br />

The <strong>Reserve</strong> <strong>Bank</strong> minimises its credit exposure on its outright holdings in the domestic portfolio by investing<br />

only in securities issued by the <strong>Australia</strong>n Government or by state and territory government borrowing<br />

A$b<br />

1.0<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

Interest Rate Risk on RBA Portfolio<br />

For a 1 percentage point change in yields, as at 30 June<br />

• Foreign currency portfolio<br />

• Domestic portfolio<br />

0.0<br />

1995<br />

Source: RBA<br />

1999<br />

2003<br />

2007<br />

A$b<br />

1.0<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

0.0<br />

<strong>2011</strong><br />

ANNUAL REPORT <strong>2011</strong> | Risk Management<br />

55

![KNOW YOUR NEW GIBRALTAR BANKNOTES - [Home] bThe/b](https://img.yumpu.com/50890985/1/184x260/know-your-new-gibraltar-banknotes-home-bthe-b.jpg?quality=85)

![PAPUA NEW GUINEA - [Home] - Polymer Bank Notes of the World](https://img.yumpu.com/49758743/1/190x143/papua-new-guinea-home-polymer-bank-notes-of-the-world.jpg?quality=85)