You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1.14.5<br />

<strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong><br />

Grade Level 9-12<br />

“Take Charge <strong>of</strong> Your Finances”<br />

<strong>Time</strong> to complete: 70 minutes<br />

National Content Standards<br />

Family and Consumer Science Standards: 1.1.6, 2.1.2, 2.4.2, 2.5.1, 2.5.4, 2.6.1, 2.6.2, 3.3.2, 3.3.4<br />

National Council on Economic Education Teaching Standards: 2, 3, 12<br />

National Standards for Business Education<br />

• Career Development:<br />

• Economics: IX.1<br />

• Personal Finance: IV.1, IV.2, VIII.1<br />

Objectives<br />

Upon completion <strong>of</strong> this lesson, students will be able to:<br />

• Understand the time value <strong>of</strong> money.<br />

• Understand how interest works.<br />

• Identify the components <strong>of</strong> a present and future value problem.<br />

• Use financial calculators to solve present and future value problems.<br />

• Define and use common terminology associated with savings and investing.<br />

Introduction<br />

One <strong>of</strong> the most amazing concepts about saving and investing is the time value <strong>of</strong> money. This means money paid<br />

out or received in the future is not equivalent to money paid out or received today. Essentially, the power <strong>of</strong> time is<br />

on a person’s side. There are three factors affecting how much an investment will grow: time, money, and interest<br />

rate. Interest rate is the percentage rate paid on the money invested or saved. The more an individual invests at a<br />

higher interest rate at an earlier age, the higher the future returns will be.<br />

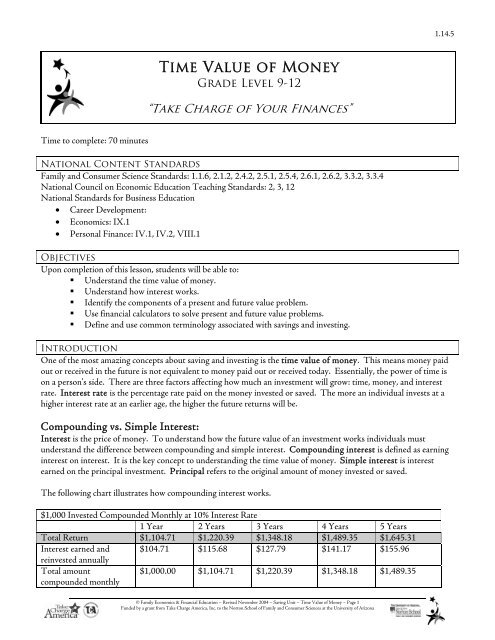

Compounding vs. Simple Interest:<br />

Interest is the price <strong>of</strong> money. To understand how the future value <strong>of</strong> an investment works individuals must<br />

understand the difference between compounding and simple interest. Compounding interest is defined as earning<br />

interest on interest. It is the key concept to understanding the time value <strong>of</strong> money. Simple interest is interest<br />

earned on the principal investment. Principal refers to the original amount <strong>of</strong> money invested or saved.<br />

The following chart illustrates how compounding interest works.<br />

$1,000 Invested Compounded Monthly at 10% Interest Rate<br />

1 Year 2 Years 3 Years 4 Years 5 Years<br />

Total Return $1,104.71 $1,220.39 $1,348.18 $1,489.35 $1,645.31<br />

Interest earned and $104.71 $115.68 $127.79 $141.17 $155.96<br />

reinvested annually<br />

Total amount<br />

compounded monthly<br />

$1,000.00 $1,104.71 $1,220.39 $1,348.18 $1,489.35<br />

© Family Economics & Financial Education – Revised November 2004 – Saving Unit – <strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong> – Page 1<br />

Funded by a grant from Take Charge America, Inc. to the Norton School <strong>of</strong> Family and Consumer Sciences at the University <strong>of</strong> Arizona

1.14.5<br />

The equation for simple interest is:<br />

Interest earned = amount invested x the annual interest rate x the number <strong>of</strong> years.<br />

Therefore, if $1,000 was earning simple interest, multiplied by 10% interest, multiplied by 5 years the total would be<br />

$500 interest earned. Compounding interest earned $1,645.31 compared to $1,500 earned by simple interest.<br />

Three Factors Affecting the <strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong>:<br />

<strong>Time</strong><br />

<strong>Time</strong> has an important impact <strong>of</strong> the future value <strong>of</strong> money. <strong>Time</strong> is referred to as “N,” or “number,” and signifies<br />

the number <strong>of</strong> times something happens to your money. For example, if a three year savings bond is compounded<br />

monthly, there would be 36 compounding periods (12*3). The earlier an individual invests, the more time their<br />

investment has to compound interest and increase in value. The “A Little Goes a Long Way” poster is a visual<br />

example <strong>of</strong> this. At 10% interest rate Sally Saver started investing $3,000 per year into an Individual Retirement<br />

Account at age 22 and invested a total <strong>of</strong> $30,000.00. Ed Uninformed began investing $3,000 per year into an<br />

Individual Retirement Account earning a 10% interest rate at age 28 and invested a total <strong>of</strong> $117,000.00. At age 65,<br />

when Ed and Sally would like to retire Sally has earned $1,239,564.00 from her $30,000 investment. Ed has earned<br />

$1,102,331.00 from his $117,000.00 investment.<br />

Interest Rate<br />

The higher the interest rate, the more money an individual will earn. Investments with interest rates compounding<br />

frequently will yield higher returns. However, an individual must understand an investment with a higher interest<br />

rate generally has a greater risk. Risk is the uncertainty the yield on an investment will deviate from what is<br />

expected. Having a savings or investment plan with a fixed interest rate (the rate will not change for the lifetime <strong>of</strong><br />

the investment) guarantees a specific return but can provide a moderate risk. If the average interest rates rise, the<br />

amount a person earns from this type <strong>of</strong> investment will not increase. Another consideration with interest rates is<br />

ensuring the interest rate is higher than the rate <strong>of</strong> inflation. Inflation is the steady rise in the general level <strong>of</strong> prices<br />

<strong>of</strong> a market basket <strong>of</strong> goods. If an individual has money invested at 4%, and the inflation rate is 4%, the individual<br />

wealth will not increase. In fact, after taxes they will actually be losing money.<br />

The following is an illustration <strong>of</strong> how interest rates affect the total return on $1,000.00:<br />

$1,000 Invested Compounded Monthly<br />

Interest Rate 1 Year 5 Years 10 Years<br />

4% $1,040.74 $1,221.00 $1,490.83<br />

6% $1,061.68 $1,348.85 $1,819.40<br />

8% $1,083.00 $1,489.85 $2,219.64<br />

10% $1,104.71 $1,645.31 $2,707.04<br />

Amount Invested<br />

Even if a person can only invest $50.00 per month, it is better than not investing anything at all. Developing a “Pay<br />

Yourself First” strategy is essential to a successful investment plan. Remember the 70-20-10 rule. Seventy percent<br />

can be spent, twenty percent should be saved, and 10 percent can be invested. To have money for savings and<br />

investing, individuals should evaluate their consumption habits. A person can earn thousands <strong>of</strong> dollars by<br />

decreasing the number <strong>of</strong> unnecessary purchases and investing that extra money. The Costs Add Up overhead<br />

1.14.4.D1 is provided to illustrate this point.<br />

© Family Economics & Financial Education – Revised November 2004 – Saving Unit – <strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong> – Page 2<br />

Funded by a grant from Take Charge America, Inc. to the Norton School <strong>of</strong> Family and Consumer Sciences at the University <strong>of</strong> Arizona

1.14.5<br />

<strong>Time</strong> <strong>Value</strong> Calculations – Future and Present <strong>Value</strong>:<br />

There are two types <strong>of</strong> time value calculations. The first is future value problems which the value <strong>of</strong> an asset is<br />

projected to the end <strong>of</strong> a particular time period. The second calculation is present value which is determining the<br />

current value <strong>of</strong> an asset received in the future. These calculations can easily be completed using a financial<br />

calculator. To understand what the calculator is doing, a person must understand the algebraic equations.<br />

Future <strong>Value</strong>:<br />

Present <strong>Value</strong>:<br />

FV = (PV )(1+i) N PV = (FV)(1+i) -N<br />

FV = Future <strong>Value</strong><br />

PV = Present <strong>Value</strong><br />

I = Interest Rate<br />

N = <strong>Time</strong>, the number <strong>of</strong> compounding periods<br />

In this lesson, students learn how to “make their money work for them” by learning about the future value <strong>of</strong> money.<br />

They will begin by comparing with classmates what they would do with $100.00. Next, the class will learn the<br />

difference between simple and compounding interest. This will be followed by a discussion on the three factors<br />

affecting the time value <strong>of</strong> money: time, interest rate, and amount invested. Finally, they learn the two equations<br />

(present value and future value) used to solve for the time value <strong>of</strong> money by using financial calculators.<br />

Body<br />

1. Provide each student with $100.00 in play money.<br />

a. Ask each student what they would do with the money.<br />

i. Record their answers on the board.<br />

ii. Appling the 70-20-10 Rule students will save $20.00 and invest $10.00.<br />

iii. The 70-20-10 Rule states for every dollar earned 70% can be spent, 20% should be saved,<br />

and 10% should be invested.<br />

b. Explain to them they will be learning about the <strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong>. <strong>Money</strong> to be paid out or<br />

received in the future is not equivalent to money paid out or received today.<br />

c. The future value <strong>of</strong> money is how the adage “Make Your <strong>Money</strong> Work For You” was developed.<br />

i. This is because compounding interest causes money to make money.<br />

2. What causes the time value <strong>of</strong> money to grow is compounding interest.<br />

a. Compounding interest is earning interest on interest.<br />

b. This means if a person has $1000 earning 10% interest compounded annually he/she will earn<br />

$104.71 cents in interest. Therefore, in year two, it will be $1,104.71 earning 10% interest for a<br />

total <strong>of</strong> $1,220.39.<br />

c. Compounding interest is different than simple interest. Simple interest takes the amount invested<br />

multiplied by the annual interest rate multiplied by the number <strong>of</strong> years.<br />

3. Talk about the three factors affecting time value calculations.<br />

a. <strong>Time</strong> –<br />

i. The earlier a person can begin investing, the more return they will have in the future<br />

because the money has more time to work for them.<br />

ii. Show students the A Little Goes a Long Way poster 4.19.1 stressing how Sally only<br />

invested $30,000.00 and Ed invested $117,000.00 but Sally still earned more at retirement.<br />

iii. *Note to teacher – the interest rate is 10% because since the stock markets inception the<br />

average interest rate during any 25 year period has been 10%.<br />

b. Interest Rate<br />

i. Show The Importance <strong>of</strong> Interest Rates overhead 1.14.5.D3.<br />

ii. Stress the higher the interest rate, the greater the return on the investment.<br />

© Family Economics & Financial Education – Revised November 2004 – Saving Unit – <strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong> – Page 3<br />

Funded by a grant from Take Charge America, Inc. to the Norton School <strong>of</strong> Family and Consumer Sciences at the University <strong>of</strong> Arizona

1.14.5<br />

iii. However, higher interest rates generally mean a greater risk. Risk is the uncertainty the<br />

investment will not yield the amount expected.<br />

iv. Some investments have fixed rates (they will not change). However, this could be a risk<br />

because if average interest rates go up, the rates earned from the investment will not.<br />

v. Inflation is the steady rise in the general level <strong>of</strong> prices. If the interest rate for the savings or<br />

investment is not higher than inflation, a person will be losing money on an investment after<br />

taxes.<br />

c. Amount Invested<br />

i. The larger the amount invested the larger the return a person will earn.<br />

ii. Review the meaning <strong>of</strong> “Pay Yourself First.”<br />

1. Savings should be a fixed expense.<br />

iii. Review the 70-20-10 rule with students<br />

1. 70% can be spent, 20% saved, and 10% invested.<br />

iv. Show students the Costs Add Up overhead 1.14.5.D1. Talk to them about how they can<br />

personally decrease flexible expenses to increase the amount they are able to invest.<br />

v. Stress that every little bit helps. Even if a person can only save $1.00 per day it will add up.<br />

At 8% interest, invested at age 17, one dollar per day will become $17,865.52 by age 65.<br />

4. The two calculations used to figure the time value <strong>of</strong> money are future and present value calculations.<br />

a. They are algebraic equations students do not necessarily need to learn to solve in this class because<br />

financial calculators can calculate the answers.<br />

b. However, students do need to understand what the different components <strong>of</strong> the equations are.<br />

i. PV – Present <strong>Value</strong> (how much money does a person have today)<br />

ii. FV – Future <strong>Value</strong> (how much money does a person expect to have in the future)<br />

iii. i – Interest Rate<br />

iv. N – <strong>Time</strong> (calculated by the number <strong>of</strong> compounding periods: daily, monthly, or annually).<br />

c. *Note to teacher – to have the students practice using financial calculators using time value<br />

calculations, they may complete the Future <strong>Value</strong> Calculations lesson plan 1.6.2.<br />

5. Ask the students again what they would do with their $100.00.<br />

a. Record the answers on the board next to what was stated the first time.<br />

b. Show students the What Would You Do With $100.00 overhead 1.14.5.D2.<br />

c. Stress even a little saved early can compound into a lot by retirement.<br />

Conclusion<br />

Review with students the three factors influencing the time value <strong>of</strong> money: time, interest rate, and amount invested.<br />

Stress compounding interest is what “Makes Your <strong>Money</strong> Work for You.” It causes interest to earn additional<br />

interest rather than a person working to earn more money for investing. Finally, stress to students the value <strong>of</strong><br />

investing early.<br />

Assessment<br />

Have students complete the <strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong> Worksheet 1.14.5.A1.<br />

Materials<br />

<strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong> Worksheet – 1.14.5.A1<br />

The Costs Add Up overhead – 1.14.5.D1<br />

What Would You Do With $100.00 overhead – 1.14.5.D2<br />

The Importance <strong>of</strong> Interest Rates overhead – 1.14.5.D3<br />

A Little Goes a Long Way Poster – 4.19.1<br />

© Family Economics & Financial Education – Revised November 2004 – Saving Unit – <strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong> – Page 4<br />

Funded by a grant from Take Charge America, Inc. to the Norton School <strong>of</strong> Family and Consumer Sciences at the University <strong>of</strong> Arizona

1.14.5<br />

Resources<br />

Family Economics & Financial Education Financial Calculators lesson plan 1.6.1<br />

Future <strong>Value</strong> Calculations 1.6.2<br />

• This lesson plan guides students through a series <strong>of</strong> future value problems using a financial calculator.<br />

American Express<br />

http://finance.americanexpress.com/fsc_ss/tools/retirement/waitcost.asp<br />

• This is a calculator from American Express. It demonstrates to students the difference in money earned<br />

by retirement if they wait to begin investing. In addition, there is another calculator which demonstrates<br />

to students how much they would earn if they reduced flexible expenses and invested the money.<br />

Financial Calculator<br />

http://www.hbcollege.com/finance/students/timevalue.htm<br />

• This is a great Web site containing a financial calculator for students.<br />

© Family Economics & Financial Education – Revised November 2004 – Saving Unit – <strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong> – Page 5<br />

Funded by a grant from Take Charge America, Inc. to the Norton School <strong>of</strong> Family and Consumer Sciences at the University <strong>of</strong> Arizona

1.14.5.A1<br />

Worksheet<br />

<strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong> Worksheet<br />

Name_______________<br />

Total Points Earned<br />

16 Total Points Possible<br />

Percentage<br />

Date_______________<br />

Directions: Answer the following questions.<br />

1. What does the adage “Make Your <strong>Money</strong> Work For You” mean (1 point)<br />

2. What is the difference between compounding and simple interest (2 points)<br />

3. What are the three factors affecting time value <strong>of</strong> money calculations (3 points)<br />

4. Identify one thing people should know about when to begin investing. (1 point)<br />

5. Does a person want a higher or lower interest rate on an investment (1 point)<br />

6. What is the definition <strong>of</strong> risk (1 point)<br />

7. How do risk and interest rates relate to each other ( 1 point)<br />

8. What is the definition <strong>of</strong> inflation (1 point)<br />

9. Identify one example <strong>of</strong> how inflation affects an investment. (1 point)<br />

10. If a person only has $1.00 per day, or $30.00 per month, to invest, should he or she invest Why or<br />

why not (2 points)<br />

11. What are the two mathematical equations used for time value calculations ( 2 points)<br />

© Family Economics & Financial Education – Revised November 2004 – Saving Unit – <strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong> – Page 6<br />

Funded by a grant from Take Charge America, Inc. to the Norton School <strong>of</strong> Family and Consumer Sciences at the University <strong>of</strong> Arizona

1.14.5.D1<br />

Overhead<br />

The Costs Add Up<br />

The future value problems are calculated for an 18 year old person investing at 8% until age 65.<br />

Item Average Yearly Expense Future <strong>Value</strong><br />

Daily cup <strong>of</strong> c<strong>of</strong>fee at $2.50 $912.50 $38,704.46<br />

Eating lunch out 5 days per week<br />

at a cost <strong>of</strong> $5-$10 each time<br />

$1,300.00-$2,600.00 $55,140.60<br />

$110,281.21<br />

Daily can <strong>of</strong> soda or chips at $1.00<br />

each or both a can <strong>of</strong> pop and chips<br />

$365.00<br />

$730.00<br />

$15,481.78<br />

$30,963.57<br />

$2.00<br />

Daily candy bar at $1.00 $365.00 $15,481.78<br />

Daily can <strong>of</strong> chew or pack <strong>of</strong><br />

$1,383.35 $58,675.97<br />

cigarettes at $3.79<br />

Weekly attendance at a sporting<br />

$442.00 $18,747.81<br />

event at $3.50 admission and<br />

$5.00 for snacks<br />

Monthly hair cut at $25.00 per<br />

$300.00 $12,724.75<br />

month<br />

Monthly movie and popcorn for<br />

$240.00 $10,179.80<br />

two at $20.00<br />

Monthly cell phone plan at $35.00 $420.00 $17,814.66<br />

Monthly gym membership at<br />

$456.00 $19,341.63<br />

$38.00<br />

Driving a car 20 miles per day at<br />

.34 cents per mile to include gas,<br />

wear and tear, and maintenance<br />

(not including insurance or car<br />

payments)<br />

$2,482.00 $105,276.14<br />

© Family Economics & Financial Education – Revised November 2004 – Saving Unit – <strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong> – Page 7<br />

Funded by a grant from Take Charge America, Inc. to the Norton School <strong>of</strong> Family and Consumer Sciences at the University <strong>of</strong> Arizona

What Would You Do With $100.00<br />

If the students choose to invest the money into an account earning 8% interest compounded<br />

annually at age 17 and leave the money invested until age 65, they will earn $4,593.63.<br />

$100.00 Invested – 8% interest<br />

Age<br />

Amount Earned<br />

17 $100.00<br />

25 $189.25<br />

35 $420.06<br />

45 $932.38<br />

55 $2,069.54<br />

65 $4,593.63<br />

$4,593.63 Total Return From $100.00 Invested!!<br />

What if the student chooses to invest $30.00<br />

$30.00 Invested – 8% interest<br />

Age<br />

Amount Earned<br />

17 $30.00<br />

25 $56.77<br />

35 $126.02<br />

45 $279.71<br />

55 $620.86<br />

65 $1,378.09<br />

$1,378.09 Total Return from $30.00 Invested!!<br />

The <strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong><br />

1.14.5.D2<br />

Overhead<br />

© Family Economics & Financial Education – Revised November 2004 – Saving Unit – <strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong> – Page 8<br />

Funded by a grant from Take Charge America, Inc. to the Norton School <strong>of</strong> Family and Consumer Sciences at the University <strong>of</strong> Arizona

1.14.5.D3<br />

Overhead<br />

The Importance <strong>of</strong> Interest Rates<br />

$1,000 Invested Compounded Monthly<br />

Interest Rate 1 Year 5 Years 10 Years<br />

4% $1,040.74 $1,221.00 $1,490.83<br />

6% $1,061.68 $1,348.85 $1,819.40<br />

8% $1,083.00 $1,489.85 $2,219.64<br />

10% $1,104.71 $1,645.31 $2,707.04<br />

12% $1,126.83 $1,816.70 $3,300.39<br />

At 4% interest, after 10 years,<br />

$1,490.83 is earned.<br />

At 12% interest, after 10 years,<br />

$3,300.39 is earned<br />

© Family Economics & Financial Education – Revised November 2004 – Saving Unit – <strong>Time</strong> <strong>Value</strong> <strong>of</strong> <strong>Money</strong> – Page 9<br />

Funded by a grant from Take Charge America, Inc. to the Norton School <strong>of</strong> Family and Consumer Sciences at the University <strong>of</strong> Arizona