Learning from Repetitive Acquisitions: Evidence from the Time ...

Learning from Repetitive Acquisitions: Evidence from the Time ...

Learning from Repetitive Acquisitions: Evidence from the Time ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

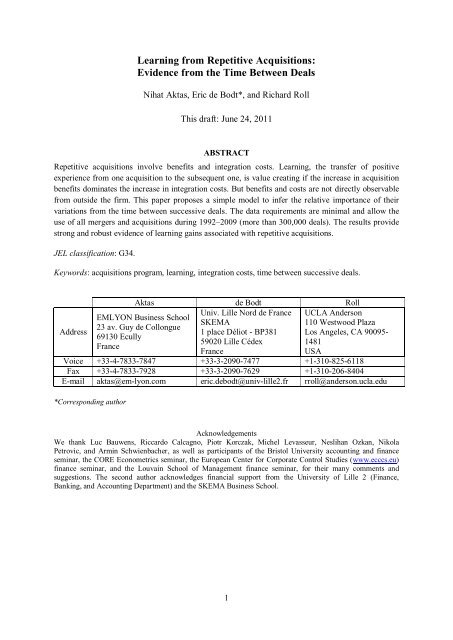

<strong>Learning</strong> <strong>from</strong> <strong>Repetitive</strong> <strong>Acquisitions</strong>:<br />

<strong>Evidence</strong> <strong>from</strong> <strong>the</strong> <strong>Time</strong> Between Deals<br />

Nihat Aktas, Eric de Bodt*, and Richard Roll<br />

This draft: June 24, 2011<br />

ABSTRACT<br />

<strong>Repetitive</strong> acquisitions involve benefits and integration costs. <strong>Learning</strong>, <strong>the</strong> transfer of positive<br />

experience <strong>from</strong> one acquisition to <strong>the</strong> subsequent one, is value creating if <strong>the</strong> increase in acquisition<br />

benefits dominates <strong>the</strong> increase in integration costs. But benefits and costs are not directly observable<br />

<strong>from</strong> outside <strong>the</strong> firm. This paper proposes a simple model to infer <strong>the</strong> relative importance of <strong>the</strong>ir<br />

variations <strong>from</strong> <strong>the</strong> time between successive deals. The data requirements are minimal and allow <strong>the</strong><br />

use of all mergers and acquisitions during 1992–2009 (more than 300,000 deals). The results provide<br />

strong and robust evidence of learning gains associated with repetitive acquisitions.<br />

JEL classification: G34.<br />

Keywords: acquisitions program, learning, integration costs, time between successive deals.<br />

Address<br />

Aktas de Bodt Roll<br />

EMLYON Business School<br />

23 av. Guy de Collongue<br />

69130 Ecully<br />

France<br />

Univ. Lille Nord de France<br />

SKEMA<br />

1 place Déliot - BP381<br />

59020 Lille Cédex<br />

France<br />

1<br />

UCLA Anderson<br />

110 Westwood Plaza<br />

Los Angeles, CA 90095-<br />

1481<br />

USA<br />

Voice +33-4-7833-7847 +33-3-2090-7477 +1-310-825-6118<br />

Fax +33-4-7833-7928 +33-3-2090-7629 +1-310-206-8404<br />

E-mail aktas@em-lyon.com eric.debodt@univ-lille2.fr rroll@anderson.ucla.edu<br />

*Corresponding author<br />

Acknowledgements<br />

We thank Luc Bauwens, Riccardo Calcagno, Piotr Korczak, Michel Levasseur, Neslihan Ozkan, Nikola<br />

Petrovic, and Armin Schwienbacher, as well as participants of <strong>the</strong> Bristol University accounting and finance<br />

seminar, <strong>the</strong> CORE Econometrics seminar, <strong>the</strong> European Center for Corporate Control Studies (www.ecccs.eu)<br />

finance seminar, and <strong>the</strong> Louvain School of Management finance seminar, for <strong>the</strong>ir many comments and<br />

suggestions. The second author acknowledges financial support <strong>from</strong> <strong>the</strong> University of Lille 2 (Finance,<br />

Banking, and Accounting Department) and <strong>the</strong> SKEMA Business School.

Athletes know that repetition is an essential ingredient of training, but too much repetition can<br />

cause damage. <strong>Repetitive</strong> acquirers face <strong>the</strong> same sort of trade-off: by repetitively undertaking<br />

acquisitions, acquirers may build experience, garnering expertise and o<strong>the</strong>r knowledge about<br />

<strong>the</strong> takeover process, which in turn increases acquisition related benefits. But successive<br />

acquisitions increase firm size and diversity as well, and thus generate additional integration<br />

costs. We define learning gains as <strong>the</strong> difference between increases in acquisition benefits and<br />

in integration costs, and investigative whe<strong>the</strong>r repetitive acquirers develop learning-by-doing.<br />

For repetition to translate into learning gains, <strong>the</strong> increase in acquisition benefits have to<br />

dominate <strong>the</strong> change in integration costs. Is it <strong>the</strong> case in practice?<br />

Potential for learning in <strong>the</strong> mergers and acquisitions (M&A) market possibly represent<br />

sizeable economic effects. The M&A market is a prime resource allocation channel; as Netter,<br />

Stegemoller, and Wintoki (forthcoming) report, <strong>the</strong> average annual aggregated deal value by<br />

U.S. acquirers during 1992–2009 was $928 billion, with a peak value in 1998 of $1,806<br />

billion, or 13% of U.S. stock market capitalization.<br />

Academics have long been aware of <strong>the</strong> presence of repetitive acquirers in <strong>the</strong> M&A<br />

market (e.g., Schipper and Thompson (1983)). Fuller, Netter, and Stegemoller (2002) provide<br />

stylized facts about <strong>the</strong> value creation effects of repetitive acquisitions using a sample of<br />

3,135 deals announced during 1990–2000: buying public firms generate significant negative<br />

returns, but buying private targets and subsidiaries generate positive ones. These latter<br />

positive returns are even stronger when <strong>the</strong> deals are financed with equity.<br />

Yet we know little about potential learning associated with repetitive acquisitions. 1<br />

Empirical evidence reported by Fuller, Netter, and Stegemoller (2002) is discouraging:<br />

acquirers that completed at least five deals during a three-year period earn 1.7% cumulative<br />

1 Management and strategy literature pertaining to learning in an M&A setting is much more developed, but <strong>the</strong><br />

empirical evidence is at best mixed (Barkema and Schijven (2008)). Moreover, most empirical evidence is<br />

limited to case study analyses or focuses on a single or small set of industries with relatively few observations.<br />

For example, Hayward (2002) uses a sample of 214 acquisitions made by 120 firms in six industries. Barkema<br />

and Scheijven (2008) provide a thorough summary of this literature.<br />

2

abnormal returns (CAR) on average, but <strong>from</strong> <strong>the</strong> fifth deal onward, <strong>the</strong>y earn only a 0.52%<br />

average CAR.<br />

The decline in average CAR during acquisitions programs may indicate growing<br />

overconfidence (or related behavioral biases). Billet and Qian (2008), for example, report a<br />

negative CAR for deals subsequent to <strong>the</strong> first among a sample of 3,537 public acquisitions<br />

during 1985–2002 and conclude that <strong>the</strong>ir results are consistent with a managerial self-<br />

attribution bias, leading to overconfidence. However, Aktas, de Bodt, and Roll (2009) argue<br />

that <strong>the</strong> declining CAR during acquisitions programs is not incompatible with learning,<br />

because learning-by-doing might lead acquirers to assess expected synergies with <strong>the</strong> next<br />

target more accurately and thus to bid more aggressively to acquire it. Such learning could<br />

increase <strong>the</strong> probability of completing transactions, though at <strong>the</strong> cost of sharing a higher<br />

fraction of <strong>the</strong> value creation with target shareholders. Consequently, an ex-post observable<br />

declining CAR trend is not a conclusive proof of growing overconfidence. In a recent study,<br />

Ahern (2010) argues also that declining acquirer CAR is consistent with acquirer value-<br />

maximization behaviors. By applying <strong>the</strong> q−<strong>the</strong>ory of investment to corporate acquisitions,<br />

<strong>the</strong> author develops a model in which firms optimally choose a target size that maximizes<br />

profits, though <strong>the</strong> ratio of profits to acquirer size is diminishing as acquirers get larger, thus<br />

percentage returns decline, but dollar returns increase.<br />

The M&A literature relies most often on relatively small samples of large M&A<br />

transactions (typically, a few thousand transactions by U.S. public acquirers). A notable<br />

exception is Netter, Stegemoller, and Wintoki (forthcoming), who assess <strong>the</strong> effect of data<br />

screens on <strong>the</strong> scope and characteristics of M&A activity. 2 These authors show in particular<br />

that some commonly known results in M&A literature (e.g., acquirers’ shareholders do not<br />

gain <strong>from</strong> acquisitions) do not generalize to larger samples. With respect to <strong>the</strong> question of<br />

2 Without being exhaustive, two o<strong>the</strong>r examples of large-sample M&A research are Erel, Liao, and Weisbach<br />

(forthcoming) and Ellis et al. (2011) with 56,798 and 37,414 observations, respectively.<br />

3

potential learning associated with repetitive acquisitions, we suspect that such sample biases<br />

are relevant. For example, Hayward (2002) argues that learning depends on <strong>the</strong> time between<br />

successive transactions, such that short periods between successive acquisitions do not allow<br />

experience building processes to take place, but acquisitions that are too distant in time<br />

hamper organizational learning by creating memory losses. If one limits attention to a<br />

subsample of large transactions undertaken by serial acquirers, <strong>the</strong> time between successive<br />

transactions cannot be estimated properly, because smaller intermediate transactions are<br />

dropped <strong>from</strong> <strong>the</strong> sample. The resulting measurement error may bias inferences about learning<br />

by repetitive acquirers. Moreover, large deals are significantly more value destroying<br />

(Moeller, Schlingemann, and Stulz (2005)) and integration costs relate (at least intuitively) to<br />

deal size, so one should expect that subsamples of large transactions are not entirely<br />

representative.<br />

We <strong>the</strong>refore undertake <strong>the</strong> first, to <strong>the</strong> best of our knowledge, very large-scale study of<br />

learning in M&A markets. Our goal is to test whe<strong>the</strong>r increases in acquisition benefits<br />

dominate increases in integration costs, or vice versa. If repetition translates into learning<br />

gains for firms that implement acquisitions programs, structuring learning processes within<br />

<strong>the</strong> organization could be a key driver of value creation. On <strong>the</strong> contrary, if <strong>the</strong> increase in<br />

integration costs overcomes <strong>the</strong> change in acquisition benefits, strict governance mechanisms<br />

to control acquisitions programs are needed – especially if CEO remuneration entails M&A<br />

bonuses (see Grinstein and Hribar (2004)).<br />

But investigating learning processes is challenging because nei<strong>the</strong>r changes in acquisition<br />

benefits nor variations in integration costs are directly observable <strong>from</strong> outside <strong>the</strong> firm; <strong>the</strong>y<br />

are latent factors for <strong>the</strong> econometrician. We overcome this problem with a simple structural<br />

model that relates <strong>the</strong> behavior of <strong>the</strong> time elapsed between successive deals (TBD) through<br />

<strong>the</strong> acquisition sequence to <strong>the</strong> ratio of changes in acquisition benefits to changes in<br />

4

integrations costs. We characterize <strong>the</strong> acquisition sequence for a given acquirer with <strong>the</strong><br />

variable deal order number (DON), which is equal to one for <strong>the</strong> first deal of <strong>the</strong> firm and<br />

increases by one unit <strong>from</strong> deal to deal. In our <strong>the</strong>oretical framework, <strong>the</strong> acquirer chooses <strong>the</strong><br />

TBD (<strong>the</strong> time before undertaking a new transaction) to maximize its expected profit, which is<br />

a function of <strong>the</strong> trade-off between acquisition benefits and integration costs. Starting <strong>from</strong><br />

Hayward’s (2002) results about experience building and memory loss organizational<br />

processes, we show that (1) as long as learning gains are increasing in <strong>the</strong> TBD (experience<br />

building situation), a negative correlation between TBD and <strong>the</strong> DON suggests <strong>the</strong> existence<br />

of positive learning gains (increases in acquisition benefits dominate increases in integration<br />

costs) while (2) when learning gains are decreasing in <strong>the</strong> TBD (memory loss situation), a<br />

positive correlation between TBD and <strong>the</strong> DON indicates <strong>the</strong> existence of positive learning<br />

gains. These results are central to our method, because <strong>the</strong>y allow us to infer, <strong>from</strong> an analysis<br />

of <strong>the</strong> relation between <strong>the</strong> TBD and <strong>the</strong> DON, whe<strong>the</strong>r repetitive acquirers develop learning<br />

gains.<br />

Our main empirical evidence is drawn <strong>from</strong> a sample of 321,610 deals spanning <strong>the</strong><br />

period 1992–2009, which are extracted <strong>from</strong> <strong>the</strong> Thomson-Reuters Securities Data Company<br />

(SDC) database. This very large sample parallels <strong>the</strong> sample used by Netter, Stegemoller, and<br />

Wintoki (forthcoming) and is designed to reveal M&A market activity as a whole. Because<br />

<strong>the</strong> TBD involves minimal data (i.e., one needs to know only <strong>the</strong> acquirer’s identity and <strong>the</strong><br />

announcement date or <strong>the</strong> completion date of <strong>the</strong> deal), we impose no restrictions with respect<br />

to deal size (known or unknown), acquirer/target status (public or private), acquirer/target<br />

nationality (U.S. or non-U.S.), or deal type (merger, acquisition, partial acquisition, etc.). Our<br />

results are <strong>the</strong>refore not likely to be affected by endogenous sample selection. We<br />

complement <strong>the</strong> main analysis using a subsample of transactions with a richer set of<br />

information.<br />

5

Our main measure of <strong>the</strong> TBD is <strong>the</strong> number of days between <strong>the</strong> most recent completed<br />

deal and <strong>the</strong> announcement date of <strong>the</strong> current deal, as reported in <strong>the</strong> SDC database. We<br />

compute <strong>the</strong> DON by recomposing, for each acquirer, <strong>the</strong> history of its M&A activity. The<br />

TBD is likely affected by industry-wide factors, unrelated to <strong>the</strong> trade-off between learning<br />

and integration costs, as suggested by <strong>the</strong> well-documented existence of M&A waves (see<br />

Mitchell and Mulherin (1996); Harford, (2005)). We control for this source of interference by<br />

computing an abnormal TBD using two methods. First, we take <strong>the</strong> difference between <strong>the</strong><br />

TBD and <strong>the</strong> median TBD in <strong>the</strong> same industry/year. Second, we regress <strong>the</strong> TBD on a set of<br />

industry and market-wide potential determinants, <strong>the</strong>n use <strong>the</strong> estimated residuals of this<br />

regression as a second measure of abnormal TBD. Most of our results are based on <strong>the</strong><br />

industry median–adjusted abnormal TBD, but we obtain consistent results using <strong>the</strong><br />

regression-based approach. Finally, we study <strong>the</strong> relation between <strong>the</strong> abnormal TBD and <strong>the</strong><br />

DON using a quadratic fixed-effect panel regression model to account for <strong>the</strong> convex relation<br />

between <strong>the</strong> TBD and <strong>the</strong> DON, and to control for <strong>the</strong> correlation between successive<br />

transactions undertaken by an acquirer.<br />

Our results provide strong and robust evidence that learning gains increase through <strong>the</strong><br />

deal sequence for repetitive acquirers. First, for <strong>the</strong> main sample of 38,887 unique firms that<br />

have completed at least two deals during 1992–2009, <strong>the</strong> abnormal TBD is significantly and<br />

negatively correlated with <strong>the</strong> DON. The relation is moreover convex, as indicated by <strong>the</strong><br />

positive and significant coefficient of <strong>the</strong> squared term. This result holds whe<strong>the</strong>r we use <strong>the</strong><br />

industry median–adjusted abnormal TBD or <strong>the</strong> regression-adjusted abnormal TBD. Since our<br />

predictions depend on <strong>the</strong> sign of <strong>the</strong> learning curve slope (i.e., whe<strong>the</strong>r <strong>the</strong> experience<br />

building or <strong>the</strong> memory loss effect is at play, see Hayward (2002)), we split <strong>the</strong> main sample<br />

into a short TBD subsample (i.e., observations for which <strong>the</strong> TBD is less than <strong>the</strong> sample<br />

median TBD) and its complement, a long TBD subsample. For <strong>the</strong> short TBD subsample<br />

6

(experience building), <strong>the</strong> negative correlation between <strong>the</strong> abnormal TBD and <strong>the</strong> DON is<br />

confirmed. For <strong>the</strong> long TBD subsample (memory loss), <strong>the</strong> correlation between <strong>the</strong> abnormal<br />

TBD and <strong>the</strong> DON is positive, indicating that acquisition benefits also dominate integration<br />

costs on average for this subsample. An increasing TBD <strong>from</strong> deal to deal for <strong>the</strong> long TBD<br />

subsample is moreover not consistent with an overconfidence- or hubris-based explanation in<br />

deal making, since overconfident or hubris-infected CEOs are known to be more acquisitive<br />

and aggressive during <strong>the</strong> bidding process (Roll (1986); Malmendier and Tate (2008); Aktas,<br />

de Bodt, and Roll (2009)). Our results <strong>the</strong>refore bring a strong support to <strong>the</strong> learning<br />

hypo<strong>the</strong>sis.<br />

Second, <strong>the</strong> presence of several acquisitions by a firm over a period as long as 1992–2009<br />

does not necessarily mean that <strong>the</strong> firm implemented an acquisitions program, defined as a<br />

succession of related acquisitions (Schipper and Thompson (1983)). Therefore, we create<br />

ano<strong>the</strong>r subsample that includes only firms that did not announce any acquisitions during a<br />

period of at least 24 months, <strong>the</strong>n engaged in successive acquisitions separated by at most 6<br />

months (a short TBD). We identify 1,816 such nearby sequences (13,010 observations) that<br />

we define as acquisitions programs. Results obtained for this subsample of acquisitions<br />

programs are even more supportive of <strong>the</strong> learning hypo<strong>the</strong>sis. The decrease in <strong>the</strong> TBD <strong>from</strong><br />

deal to deal is economically significant, with an average reduction of more than 60 days <strong>from</strong><br />

<strong>the</strong> second deal to <strong>the</strong> third deal within <strong>the</strong> program. This corresponds to a 20% reduction<br />

with respect to <strong>the</strong> sample average abnormal TBD. Perhaps acquirers starting an acquisitions<br />

program focus more on putting learning processes into place throughout <strong>the</strong>ir organization as<br />

emphasized by consulting firms and <strong>the</strong> business press (see, e.g., Ashkenas, DeMonaco, and<br />

Francis (1998); Harding and Rovit (2004)). For example, General Electric, a well-known<br />

repetitive acquirer, has managed to specialize its acquisition process in order to effectively<br />

integrate most of its acquisitions within 100 days (Ashkenas, DeMonaco, and Francis (1998)).<br />

7

Third, we investigate whe<strong>the</strong>r our results are due to <strong>the</strong> presence of many small<br />

transactions in <strong>the</strong> selected sample of M&A transactions. On a sample of 22,648 observations<br />

limited to M&A transactions with deal size above $50 million, we get comparable results<br />

(only <strong>the</strong> results for <strong>the</strong> long TBD cases appear somehow to be weaker).<br />

We provide many robustness checks. Among o<strong>the</strong>rs, we investigate <strong>the</strong> role of financial<br />

resources committed into <strong>the</strong> acquisition process. By design, we do not take into account <strong>the</strong><br />

amounts invested into acquisitions, because our goal is to study <strong>the</strong> whole M&A market and<br />

impose minimal data requirements. Yet we expect that deal size may relate to acquisition<br />

benefits (i.e., acquirers may learn by undertaking small deals; Harding and Rovit (2004)) and<br />

integration costs (i.e., large acquisitions require more resources to merge with existing<br />

activities), so its omission <strong>from</strong> our analyses may raise an issue of a correlated missing factor.<br />

To investigate this issue, we replicate our analyses using <strong>the</strong> cumulative deal size of previous<br />

transactions, in place of <strong>the</strong> DON variable, which captures both <strong>the</strong> number of deals already<br />

undertaken (similar to <strong>the</strong> DON) and <strong>the</strong> size of <strong>the</strong>se previous transactions. We obtain<br />

consistent results using this new specification. Our results are <strong>the</strong>refore robust to <strong>the</strong> inclusion<br />

of <strong>the</strong> importance of financial resources invested in an M&A. O<strong>the</strong>r robustness checks bears<br />

on <strong>the</strong> classification of M&A transactions, <strong>the</strong> choice of <strong>the</strong> econometric estimators, and <strong>the</strong><br />

choice of <strong>the</strong> threshold to identify short and long TBD transactions.<br />

Our results not only generalize limited existing empirical evidence about learning but<br />

also focus on <strong>the</strong> TBD, an attribute of acquisition sequences that previously has gone<br />

unexplored in finance literature.<br />

The paper is organized as follows. Section I introduces a simple <strong>the</strong>oretical framework to<br />

infer learning <strong>from</strong> <strong>the</strong> time between successive deals. Section II is devoted to <strong>the</strong> empirical<br />

analysis. Section III provides additional results and robustness checks. Section IV concludes.<br />

8

I. A Simple Framework to Infer <strong>Learning</strong> <strong>from</strong> <strong>the</strong> TBD<br />

A. The Setup<br />

Our goal is to study learning by a firm undertaking acquisitions. Following Barkema and<br />

Schijven (2008), learning corresponds to <strong>the</strong> transfer of an organization’s experience <strong>from</strong> one<br />

deal to a subsequent deal, and it is expected to affect positively acquisition profit (i.e., positive<br />

experience transfer). 3 We define <strong>the</strong> acquisition profit by invested dollars as <strong>the</strong> difference<br />

between acquisition benefits and integration costs, scaled by <strong>the</strong> invested amount (<strong>the</strong> deal<br />

size): 4<br />

9<br />

, (1)<br />

where is <strong>the</strong> deal subscript, B denotes acquisition benefits, C corresponds to integration<br />

costs, and I is <strong>the</strong> invested amount. For <strong>the</strong> ease of exposition, we fix <strong>the</strong> invested amount to<br />

one. Acquisition benefits correspond to synergy realization and any acquisition-induced<br />

scale/scope economies, while integration costs are costs incurred by <strong>the</strong> acquirer to reconcile<br />

various business activities; to melt administrative, accounting, controlling, and information<br />

systems; and to manage corporate culture differences.<br />

<strong>Learning</strong> affects potentially both acquisition benefits and integration costs. In fact,<br />

learning might bear on multiple dimensions of <strong>the</strong> takeover process (Hitt, Harrison, and<br />

Ireland (2001)), including <strong>the</strong> selection and valuation of targets, due diligence, negotiation,<br />

offer specification (e.g., premium, mode of payment), and management of regulatory issues<br />

(e.g., intervention of <strong>the</strong> Federal Trade Commission and/or Department of Justice). <strong>Learning</strong><br />

3 Arrow (1962) is one of <strong>the</strong> first author to analyze <strong>the</strong>oretically <strong>the</strong> economic implications of learning-bv-doing<br />

and to acknowledge that experience effects are positive, such that growing stock experience improves inputoutput<br />

ratios of a given operational task.<br />

4 Kaplan, Mitchell, and Wruck (2000) argue that acquisition profit does not only depend on initial due diligence<br />

and information ga<strong>the</strong>ring but also on postmerger incentives and organizational design. M&A scholars in<br />

management document also that <strong>the</strong> realization of expected synergies and acquisition profit depends on effective<br />

post-acquisition integration (see, e.g., Datta (1991); Chatterjee et al. (1992); Larsson and Finkelstein (1999);<br />

Weber and Camerer (2003)).

also bears on <strong>the</strong> post-acquisition phase and, at that stage, captures efficiency of integration<br />

processes.<br />

The measure of learning gains (L) at deal d (<strong>the</strong> focal deal) is <strong>the</strong> change in acquisition<br />

profit by invested dollars <strong>from</strong> deal d – 1 to deal d :<br />

10<br />

, (2)<br />

where is <strong>the</strong> deal subscript and denotes acquisition profit by invested dollars. <strong>Learning</strong> is<br />

<strong>the</strong>refore evaluated as <strong>the</strong> net change in value by invested dollars induced by <strong>the</strong> positive<br />

transfer of experience <strong>from</strong> one deal to <strong>the</strong> subsequent one.<br />

The CEO decision variable is <strong>the</strong> time <strong>the</strong> firm waits before making a new acquisition<br />

attempt (TBD). We use <strong>the</strong> deal order number (DON) to proxy for <strong>the</strong> history of transactions<br />

already completed by <strong>the</strong> firm. The DON in itself is not a decision variable; ra<strong>the</strong>r, it<br />

encapsulates past decisions. To keep <strong>the</strong> model as simple as possible, we abstract <strong>from</strong><br />

information asymmetry issues and agency conflicts (e.g., among <strong>the</strong> CEO, shareholders,<br />

and/or creditors). We assume that firm decisions are made by <strong>the</strong> CEO, in <strong>the</strong> best interest of<br />

shareholders and with no budget constraints. The firm shareholders are risk neutral, so <strong>the</strong><br />

CEO maximizes <strong>the</strong> firm’s expected profit, and <strong>the</strong> timing decision (TBD) affects acquisition<br />

profit only through <strong>the</strong> influence on acquisition benefits and integration costs.<br />

Following Hayward (2002), learning for a given deal attempt d is a concave function of<br />

<strong>the</strong> TBD (see Figure 1): learning is increasing in <strong>the</strong> TBD up to a threshold value, because<br />

acquisitions made too quickly in succession do not provide enough time to build experience<br />

(experience building effect), <strong>the</strong>n, starting <strong>from</strong> <strong>the</strong> threshold value, learning is decreasing in<br />

<strong>the</strong> TBD, because acquisition expertise decays if successive takeovers are too far apart <strong>from</strong><br />

each o<strong>the</strong>r (memory loss effect). Therefore, <strong>the</strong>re is a TBD threshold value denoted<br />

such that signs of <strong>the</strong> first and second derivatives of Ld with respect to <strong>the</strong> TBD are:<br />

̅̅̅̅̅̅<br />

̅̅̅̅̅̅,<br />

̅̅̅̅̅̅, (3)

B. The Acquirer’s Decision Problem<br />

[Figure 1 About Here]<br />

11<br />

. (4)<br />

The firm’s decision problem is to choose when to undertake <strong>the</strong> next acquisition, that is,<br />

<strong>the</strong> time between <strong>the</strong> previous deal and <strong>the</strong> next deal attempt (TBD). 5 Given <strong>the</strong> characteristics<br />

of <strong>the</strong> selected target, <strong>the</strong> firm’s expected rate of return <strong>from</strong> <strong>the</strong> acquisition is:<br />

( ) ( ( ) ). (5)<br />

In equilibrium, <strong>the</strong> firm achieves its required rate of return such that ( ) , where is<br />

<strong>the</strong> cost of capital.<br />

In <strong>the</strong> absence of (invertible) functional specifications of acquisition profit, no closed<br />

form expression of <strong>the</strong> optimal TBD can be derived. Our strategy is <strong>the</strong>refore to develop<br />

predictions about <strong>the</strong> relation between <strong>the</strong> TBD and <strong>the</strong> DON (two variables that are<br />

observable and <strong>the</strong>ir relation characterizes <strong>the</strong> dynamic of <strong>the</strong> TBD in a sequence of<br />

acquisitions) using <strong>the</strong> implicit function <strong>the</strong>orem. The derivative of <strong>the</strong> TBD with respect to<br />

<strong>the</strong> DON can be expressed as follows: 6<br />

( )<br />

( )<br />

. (6)<br />

Equation (6) allows us to derive empirical testable predictions, because TBD and DON are<br />

observable.<br />

C. Empirical Predictions<br />

5<br />

Recall that <strong>the</strong> DON is not a decision variable but summarizes <strong>the</strong> history of acquisitions completed by <strong>the</strong><br />

firm.<br />

6<br />

Since <strong>the</strong> acquisition profit of <strong>the</strong> previous deal, is constant with respect to <strong>the</strong> TBD (DON) of <strong>the</strong> focal<br />

deal, <strong>the</strong> derivate of with respect to <strong>the</strong> TBD (DON) is equal to <strong>the</strong> derivative of with respect to <strong>the</strong> TBD<br />

(DON).

<strong>Learning</strong> gains are increasing for TBD below ̅̅̅̅̅̅ (experience building effect) and<br />

decreasing for TBD above<br />

<strong>the</strong>refore on <strong>the</strong> sign of<br />

When<br />

.<br />

̅̅̅̅̅̅ (memory loss effect). Our empirical predictions depend<br />

is strictly positive (experience building effect), <strong>the</strong> denominator of Equation<br />

(6) is strictly positive. Therefore, <strong>the</strong> sign of<br />

-<br />

-<br />

12<br />

depends on <strong>the</strong> sign of<br />

: if learning gains increase through <strong>the</strong> deal sequence, <strong>the</strong>n,<br />

:<br />

should be<br />

negative (i.e., <strong>the</strong> time that elapses between successive deals should decrease during <strong>the</strong><br />

acquisition sequence).<br />

: if learning gains decrease through <strong>the</strong> deal sequence, <strong>the</strong>n<br />

should be<br />

positive ((i.e., <strong>the</strong> time that elapses between successive deals should increase during <strong>the</strong><br />

acquisition sequence).<br />

These empirical predictions reverse when<br />

thus summarize our empirical predictions in Proposition 1.<br />

Proposition 1. <strong>Learning</strong> gains inferred <strong>from</strong> <strong>the</strong> sign of<br />

is strictly negative (memory loss effect). We<br />

(a) Under <strong>the</strong> experience building effect: if acquirers develop learning gains through<br />

<strong>the</strong> deal sequence (<br />

), <strong>the</strong>n<br />

should be negative (and vice versa).<br />

(b) Under <strong>the</strong> memory loss effect: if acquirers develop learning gains through <strong>the</strong> deal<br />

sequence (<br />

), <strong>the</strong>n<br />

should be positive (and vice versa).<br />

Proposition 1 allows us to infer <strong>from</strong> <strong>the</strong> sign of <strong>the</strong> relation between <strong>the</strong> TBD and <strong>the</strong><br />

DON <strong>the</strong> existence of learning gains for repetitive acquirers, conditional on whe<strong>the</strong>r <strong>the</strong><br />

experience building or <strong>the</strong> memory loss effect is at play. Experience building manifests itself<br />

for TBD below ̅̅̅̅̅̅ and memory loss appears for TBD above ̅̅̅̅̅̅.

II. Empirical <strong>Evidence</strong><br />

A. Sample<br />

The Securities Data Company (SDC) provides <strong>the</strong> sample of takeovers. To examine all<br />

completed transactions, we adopt <strong>the</strong> selection criteria used by Netter, Stegemoller, and<br />

Wintoki (forthcoming). We first select all completed takeovers available <strong>from</strong> January 1,<br />

1992, to December 31, 2009, including transactions classified by SDC as mergers,<br />

acquisitions, acquisitions of majority interest, acquisitions of assets, acquisitions of certain<br />

assets, acquisitions of remaining interest, and exchange offers. All <strong>the</strong>se diverse transactions<br />

are retained in <strong>the</strong> sample because our focus is on <strong>the</strong> acquirer and because SDC’s transaction<br />

definitions are often vague. For example, almost half <strong>the</strong> transactions reported by Microsoft as<br />

mergers and acquisitions are classified by SDC as acquisitions of assets. 7 We have no reason<br />

to overlook such transactions. However, to limit <strong>the</strong> analysis to acquisitions with an explicit<br />

change of control, we retain <strong>the</strong>m only when <strong>the</strong> acquirer purchases 50% or more of <strong>the</strong><br />

target’s shares and owns less than 50% of <strong>the</strong> target six months prior to <strong>the</strong> deal<br />

announcement.<br />

No restrictions are imposed with respect to deal size (whe<strong>the</strong>r or not SDC reports <strong>the</strong> deal<br />

value), to <strong>the</strong> status of acquirers and targets (public or private), or to <strong>the</strong> nationality of<br />

acquirers and targets (U.S. or non-U.S.). The earliest sample year is 1992 when SDC begin<br />

covering deals of any value, even those with unknown deal size. This is particularly relevant<br />

for our goal of building a complete acquisition history of every firm and minimizing <strong>the</strong> risk<br />

of missing a transaction.<br />

After removing 1,394 duplicate observations, identified by <strong>the</strong>ir announcement date,<br />

acquirer, and target CUSIP, we retain 321,610 transactions (<strong>the</strong> main sample). Table I<br />

contains summary statistics of <strong>the</strong> annual acquisition activity by all acquirers and by U.S.<br />

7 See http://www.microsoft.com/investor/Stock/AcquisitonHistory/All/default.aspx.<br />

13

acquirers. For both groups of acquirers, <strong>the</strong> sample exhibits a first peak in <strong>the</strong> number of<br />

transactions between 1997 and 2000, consistent with <strong>the</strong> well-documented “friendly” M&A<br />

wave of <strong>the</strong> end of <strong>the</strong> 1990s (Betton, Eckbo, and Thorburn (2008)), and a second peak<br />

between 2005 and 2007. The differences between <strong>the</strong> yearly average and median deal size<br />

highlight <strong>the</strong> impact of large transactions on reported aggregate deal sizes. Forty percent of<br />

<strong>the</strong>se 321,610 transactions were undertaken by U.S. acquirers. We report <strong>the</strong> aggregate deal<br />

size for U.S. acquirers in 2008 constant dollars, to provide a direct comparison with Netter,<br />

Stegemoller, and Wintoki (forthcoming). 8 These authors report on 128,900 transactions for<br />

<strong>the</strong> period 1992–2009, with an aggregate deal value of $16,702 billion (in 2008 constant<br />

dollars). We replicate <strong>the</strong>ir sample with 126,878 transactions and an aggregate deal value of<br />

$16,032 billion. Our main sample also matches <strong>the</strong>ir universe with respect to <strong>the</strong> form of <strong>the</strong><br />

deal, according to SDC’s classification (unreported results). Most transactions are classified<br />

as acquisitions of assets (64.67% for all acquirers; 73.49% for U.S. acquirers). Mergers are<br />

<strong>the</strong> second most common deal form, with more than 20% of transactions classified as such,<br />

regardless of <strong>the</strong> nationality of <strong>the</strong> acquirer.<br />

B. Variables and Methods<br />

B.1. Deal Order Number (DON)<br />

[Table I About Here]<br />

To infer <strong>the</strong> existence of learning gains, Proposition 1 predicts relations between <strong>the</strong> deal<br />

order number (DON) and <strong>the</strong> time between successive deals (TBD). We <strong>the</strong>refore start by<br />

tracing acquisitions sequences by acquirer to compute <strong>the</strong> DON variable. Specifically, we<br />

identify first each acquirer using its historical CUSIP code, extracted <strong>from</strong> <strong>the</strong> main sample all<br />

of its acquisitions, and sort <strong>the</strong> acquisition list by announcement date. Then, acquirer by<br />

8 Transactions with missing deal value in SDC are not taken into account to obtain aggregate, average and<br />

median deal size by year. This creates a downward bias in <strong>the</strong> reported statistics. But deal values are most often<br />

missing for small transactions in SDC.<br />

14

acquirer, a DON is assigned to each transaction by increasing announcement date, <strong>from</strong> 1 for<br />

<strong>the</strong> first acquisition of <strong>the</strong> acquirer to N for its last acquisition.<br />

Table II reports <strong>the</strong> distribution of deal order numbers. More than 55% of all deals are a<br />

first deal for a particular acquirer, though multiple acquisitions are still quite common: 67,387<br />

transactions are associated with a DON of at least 5, 36,835 transactions indicate a number of<br />

at least 10, and 19,341 transactions have a DON of at least 21. Schipper and Thompson (1983)<br />

and Fuller, Netter, and Stegemoller (2002) similarly have highlighted <strong>the</strong> presence of serial<br />

acquirers. The average deal size by DON in Table II is clearly increasing through <strong>the</strong><br />

acquisition sequence. For example, <strong>the</strong> fifth deal in a sequence has an average (median) deal<br />

size three (two) times higher than <strong>the</strong> first deal, and <strong>the</strong> tenth deal has an average (median)<br />

deal size approximately four (three) times higher than <strong>the</strong> first deal. After <strong>the</strong> fifteenth deal,<br />

<strong>the</strong> average deal size seems not to increase much more, with an average deal size five times<br />

higher than <strong>the</strong> first. This substantial increase of <strong>the</strong> deal size throughout <strong>the</strong> acquisition<br />

sequence appears consistent with learning. That is, firms would begin with smaller deals to<br />

learn <strong>the</strong> basics, <strong>the</strong>n as <strong>the</strong>y gain more knowledge, <strong>the</strong>y would risk bigger acquisitions (as<br />

indicated in <strong>the</strong> business press; Harding and Rovit (2004)). But ano<strong>the</strong>r interpretation is that<br />

deal size is correlated with acquirer size and that larger acquirers do more deals. The apparent<br />

positive correlation between DON and <strong>the</strong> deal size would <strong>the</strong>n be driven by <strong>the</strong> acquirer size<br />

(a latent factor here). The last two columns of Table II (average and median acquirer market<br />

value in millions of dollars) are consistent with this second interpretation.<br />

B.2. <strong>Time</strong> Between Deals (TBD)<br />

[Table II About Here]<br />

Potentially, increase in acquisition benefits starts as soon as an acquisition is attempted,<br />

whe<strong>the</strong>r or not it is completed, because target identification, <strong>the</strong> choice of buying procedure,<br />

<strong>the</strong> offer specification, etc., can be as much source of learning as <strong>the</strong> post-acquisition<br />

15

activities. But changes in integration costs arise only after <strong>the</strong> acquisition is completed. Thus,<br />

<strong>the</strong> choice of whe<strong>the</strong>r to compute <strong>the</strong> TBD as <strong>the</strong> difference between <strong>the</strong> announcement date<br />

of <strong>the</strong> current transaction and <strong>the</strong> completion date of <strong>the</strong> most recently completed transaction<br />

or as <strong>the</strong> difference between announcement dates of successive transactions is an important<br />

issue (see Figure 2). We use mostly <strong>the</strong> TBD defined as <strong>the</strong> days between <strong>the</strong> announcement<br />

date of <strong>the</strong> current transaction and <strong>the</strong> completion date of <strong>the</strong> preceding transaction, which we<br />

denote TBDC. The TBDC spans a conservative interval of learning, because it does not<br />

include <strong>the</strong> earliest part of <strong>the</strong> potential learning period (<strong>the</strong> pre-acquisition phase of <strong>the</strong><br />

preceding transaction). We provide also results using <strong>the</strong> days between <strong>the</strong> announcement<br />

dates of <strong>the</strong> current deal and <strong>the</strong> previous deal (denoted TBDA) as a robustness check.<br />

[Figure 2 About Here]<br />

M&As exhibit waves at <strong>the</strong> aggregate and industry levels (Mitchell and Mulherin (1996);<br />

Harford (2005)), which should materially influence <strong>the</strong> TBD. However, our model postulates<br />

a trade-off between changes in acquisition benefits and in integration costs at <strong>the</strong> firm level.<br />

It is firm specific, so we must control for industry and aggregate influences on <strong>the</strong> TBD in<br />

empirical tests. Accordingly, we compute <strong>the</strong> abnormal TBD as <strong>the</strong> difference between <strong>the</strong><br />

TBD and median TBD of deals in <strong>the</strong> same industry/year as <strong>the</strong> deal under consideration,<br />

16<br />

( ), (7)<br />

where d is <strong>the</strong> current deal, and Median is <strong>the</strong> median TBD of <strong>the</strong> set of deals in <strong>the</strong> same<br />

industry/year. We use <strong>the</strong> three-digit SIC code to define <strong>the</strong> industry. (In our robustness<br />

checks, we assess <strong>the</strong> stability of <strong>the</strong> results using <strong>the</strong> two-digit SIC code, and we complement<br />

this median-adjusted abnormal TBD approach with a regression-based approach.)<br />

Table III lists <strong>the</strong> summary statistics for <strong>the</strong> TBD variables for <strong>the</strong> entire sample. We also<br />

report statistics for transactions with a TBD below <strong>the</strong> sample median (short TBD) and above<br />

<strong>the</strong> sample median (long TBD). Empirical predictions of Proposition 1 depend indeed on

whe<strong>the</strong>r <strong>the</strong> experience building part of <strong>the</strong> learning curve or <strong>the</strong> memory loss part is at play.<br />

Hayward (2002) argues that experience building manifests itself when transactions are not too<br />

close to each o<strong>the</strong>r while memory loss appears when <strong>the</strong>y are too distant in time. The author<br />

uncovers a convex relation between acquirer CAR and <strong>the</strong> TBD, and reports, on a sample of<br />

192 acquisitions by 100 large U.S. acquirers during <strong>the</strong> period 1985–1995, an optimal TBD of<br />

220 days. We choose to split our sample between short and long TBD subsamples using <strong>the</strong><br />

median TBD (174 days). This threshold is not too far away <strong>from</strong> <strong>the</strong> estimate reported by<br />

Hayward (2002). 9,10<br />

[Table III About Here]<br />

Panel A of Table III reports on TBDC, <strong>the</strong> number of days between <strong>the</strong> announcement<br />

date of <strong>the</strong> current deal and <strong>the</strong> completion date of <strong>the</strong> previous deal (TBDC). In total <strong>the</strong>re<br />

are 129,400 TBDCs, because <strong>the</strong>re must be at least two deals for any given firm. The average<br />

TBDC is 420 days (about 14 months), and <strong>the</strong> corresponding median is 174 days (almost 6<br />

months). The TBDC is clearly decreasing throughout <strong>the</strong> deal sequence: <strong>from</strong> 577 days (19<br />

months) on average during <strong>the</strong> first five transactions to 61 days (2 months) for deal order<br />

numbers greater than 20. The same decreasing pattern emerges for both <strong>the</strong> short and long<br />

TBD subsamples.<br />

Panel B of Table III reports on TBDA, <strong>the</strong> number of days between <strong>the</strong> announcement<br />

dates of <strong>the</strong> current and previous deals. The patterns of TBDA and TBDC are similar, which<br />

suggests that <strong>the</strong> analyses might not be seriously affected by <strong>the</strong> particular way TBD is<br />

computed.<br />

Panel C of Table III focuses on <strong>the</strong> abnormal TBDC. Removing <strong>the</strong> industry median<br />

TBDC significantly affects our results in one key respect: for <strong>the</strong> short TBD subsample, <strong>the</strong><br />

9<br />

We also check <strong>the</strong> robustness of our results in Section III by reporting results based on <strong>the</strong> first quartile for<br />

short TBD and <strong>the</strong> third quartile for long TBD.<br />

10<br />

We note also that our sample includes many small transactions, absent <strong>from</strong> <strong>the</strong> Hayward (2002) sample.<br />

Increases in integrations costs are expected to be less important for smaller transactions and <strong>the</strong>refore, <strong>the</strong><br />

optimal TBD should be lower in our sample than in <strong>the</strong> Hayward (2002) sample.<br />

17

abnormal TBDC is almost constant <strong>from</strong> DON = 1 to DON = 20, <strong>the</strong>n drops substantially for<br />

DON greater than 20. This indicates that industry determinants play a role in <strong>the</strong> decreasing<br />

trend shown by TBD in Panels A and B.<br />

It is tempting to interpret <strong>the</strong> trends in <strong>the</strong> TBDC, TBDA, and abnormal TBDC in light of<br />

Proposition 1, but successive transactions by a given acquirer are not independent<br />

observations. Statistical inference <strong>the</strong>refore could be distorted, a concern we address in<br />

Section II.C.<br />

B.3. Control Variables<br />

Some of our analyses require <strong>the</strong> use of additional control variables. We collect several<br />

transaction-level control variables: a dummy variable identifying horizontal deals (at <strong>the</strong> four-<br />

digit SIC industry level), a dummy variable identifying private targets, a dummy variable<br />

identifying U.S. targets, and deal size in millions of dollars. Panel A of Table IV provides <strong>the</strong><br />

number of observations in our main sample for which <strong>the</strong>se variables are available, <strong>the</strong><br />

fraction of horizontal transactions, <strong>the</strong> fractions of private targets and domestic targets, and<br />

<strong>the</strong> average and median deal sizes. Panels B and C contain <strong>the</strong> corresponding figures for <strong>the</strong><br />

short and long TBD subsamples, respectively. Although <strong>the</strong> three dummy variables are<br />

available for all transactions, <strong>the</strong> SDC reports deal size for less than half of <strong>the</strong>m (see also<br />

Netter, Stegemoller, and Wintoki (forthcoming)). The percentage of horizontal transactions<br />

appears slightly higher for <strong>the</strong> long TBD subsample, whereas domestic targets seem slightly<br />

more present in <strong>the</strong> short TBD subsample. The percentage of private targets is stable between<br />

<strong>the</strong> two subsamples. The average deal size is substantially higher for short TBD transactions<br />

(a difference of almost $40 million), but this difference likely driven by a few large<br />

transactions, because <strong>the</strong> median deal sizes are comparable.<br />

[Table IV About Here]<br />

18

B.4. Econometric Specifications<br />

Proposition 1 establishes testable empirical predictions about <strong>the</strong> sign of <strong>the</strong> relation<br />

between <strong>the</strong> TBD and <strong>the</strong> DON depending on whe<strong>the</strong>r <strong>the</strong> experience building or memory loss<br />

part of <strong>the</strong> learning curve is at play. But Proposition 1 is silent about <strong>the</strong> shape of <strong>the</strong> relation<br />

between <strong>the</strong> TBD and <strong>the</strong> DON. We investigate this issue in Figure 3 for <strong>the</strong> All Transactions<br />

Sample (129,400 deals, see Table III, Panel C) and <strong>the</strong> sub-sample of Large Transactions<br />

(22,453 transactions with deal size above $50 million). Panel A presents a scatter plot<br />

between <strong>the</strong> abnormal TBDC and <strong>the</strong> DON. Panel B reports <strong>the</strong> corresponding fitted values<br />

<strong>from</strong> a Gaussian kernel regression (using 255 kernels for <strong>the</strong> All Transactions Sample and 157<br />

kernels for <strong>the</strong> Large Transactions Sample). Panel C displays <strong>the</strong> fitted values <strong>from</strong> a linear<br />

and a quadratic model.<br />

Panels A (<strong>the</strong> data cloud) and B (<strong>the</strong> non-parametric regression fitted values) clearly<br />

highlights <strong>the</strong> non-linear relation between <strong>the</strong> abnormal TBD and <strong>the</strong> DON. The convex shape<br />

is captured by <strong>the</strong> quadratic model (Panel C). We adopt <strong>the</strong>refore <strong>the</strong> following specification:<br />

19<br />

, (8)<br />

where i is <strong>the</strong> acquisition index, j is <strong>the</strong> firm index, and is <strong>the</strong> firm-fixed effect that captures<br />

unobservable factors constant through time. Successive transactions by a given acquirer are<br />

indeed not independent observations. We control for this potential source of correlation<br />

among observations by using a fixed-effect panel data specification. The section on<br />

robustness checks reports additional results using a pooled estimator and clustered standard<br />

errors (Petersen (2009); Thompson (2011)).<br />

C. Results<br />

[Figure 3 About Here]<br />

Our main results, <strong>the</strong> estimation of Equation (8), are reported in Table V. The dependent<br />

variable is <strong>the</strong> industry-adjusted abnormal TBDC. The first column in Panel A of Table V

summarizes <strong>the</strong> main sample results for 129,400 observations. 11 These observations involve<br />

38,887 unique acquirers, for an average of 3.3 observations per acquirer. Fixed-effect<br />

coefficients are <strong>the</strong>refore not included in Table V (<strong>the</strong>re are 38,887). The Fisher statistic is<br />

highly significant, with a value of 82.54 (despite <strong>the</strong> large number of estimated coefficients).<br />

The DON variable is negatively related to <strong>the</strong> abnormal TBDC, with a statistically significant<br />

coefficient estimate of –3.831. The estimated coefficient of <strong>the</strong> squared term (DON²) is<br />

positive with a value of 0.015 and statistically significant. These coefficient estimates confirm<br />

<strong>the</strong> convex relation between <strong>the</strong> abnormal TBDC and <strong>the</strong> DON, even after controlling for<br />

acquirer fixed effects. The behavior of <strong>the</strong> abnormal TBDC starts by a decreasing phase. From<br />

<strong>the</strong> second deal to <strong>the</strong> fifth deal (80% of <strong>the</strong> sample, see Table II), <strong>the</strong> decrease in TBDC is on<br />

average 15 days. The average abnormal TBDC <strong>from</strong> deal number 2 to deal number 5 is 330<br />

days (see Table III, Panel C). The abnormal TBDC decreases <strong>the</strong>refore by 4.5% on average<br />

during this phase.<br />

[Table V About Here]<br />

Proposition 1 allows us to infer <strong>the</strong> existence of learning gains <strong>from</strong> <strong>the</strong> relation between<br />

<strong>the</strong> TBD and <strong>the</strong> DON. Proposition 1 predictions are however conditional on <strong>the</strong> sign of <strong>the</strong><br />

learning curve slope. To empirically identify experience building situations (i.e., learning is<br />

increasing in <strong>the</strong> TBD, see Figure 1) and memory loss situations (i.e., learning is decreasing in<br />

<strong>the</strong> TBD, see Figure 1), we use <strong>the</strong> short TBD (in column 2 of Table V) and long TBD<br />

subsamples (in column 3 of Table V), respectively. For <strong>the</strong> short TBD subsample in column 2,<br />

<strong>the</strong> DON coefficient is negative and statistically significant with a value of –2.374, while <strong>the</strong><br />

coefficient of <strong>the</strong> squared term is positive and statistically significant with a value of 0.009.<br />

This result indicates that learning gains increases <strong>from</strong> deal to deal in experience building<br />

situations. For <strong>the</strong> long TBD subsample in column 3, <strong>the</strong> DON variable has a highly<br />

11 This number of observations may appear as a significant reduction in sample size relative to <strong>the</strong> 321,610<br />

transactions identified in Table I. But we need at least two transactions to compute <strong>the</strong> TBD, and 179,057<br />

transactions are for <strong>the</strong> first deal (see Table II).<br />

20

significant positive coefficient of 2.423 and <strong>the</strong> squared term has a highly significant negative<br />

coefficient of –0.010. This inversion in <strong>the</strong> sign of <strong>the</strong> relation between <strong>the</strong> abnormal TBDC<br />

and <strong>the</strong> DON <strong>from</strong> experience building to memory loss confirms that learning gains are<br />

increasing through <strong>the</strong> deal sequence in both situations.<br />

An increasing TBD <strong>from</strong> deal to deal for <strong>the</strong> long TBD subsample is moreover not<br />

consistent with an overconfidence- or hubris-based explanation in deal making, since<br />

overconfident or hubris-infected CEOs are known to be more acquisitive and aggressive<br />

during <strong>the</strong> bidding process (Roll (1986); Malmendier and Tate (2008); Aktas, de Bodt, and<br />

Roll (2009)). There are no clear reasons why <strong>the</strong> effect of overconfidence would revert<br />

between short and long TBD subsamples. Our results <strong>the</strong>refore bring a strong support to <strong>the</strong><br />

learning hypo<strong>the</strong>sis.<br />

The results in columns 2 and 3 refer to subsamples formed by selecting observations on<br />

<strong>the</strong> dependent variable (TBDC). This procedure might raise concerns about endogenous<br />

subsampling, but our aim is not to generalize <strong>the</strong>se results to <strong>the</strong> whole population of<br />

transactions (which are in column 1). Ra<strong>the</strong>r, columns 2 and 3 offer direct tests of Proposition<br />

1. We note finally that <strong>the</strong> results for <strong>the</strong> full sample seem driven mainly by <strong>the</strong> short TBDC<br />

subsample: in both cases, <strong>the</strong> relation between <strong>the</strong> abnormal TBDC and <strong>the</strong> DON is decreasing<br />

and convex.<br />

These results pertain to a long period of time (1992 to 2009), and it is possible that<br />

acquirers undertaking a few transactions (e.g., 2 or 3) over a 18-year period are not really<br />

implementing acquisitions programs (Schipper and Thompson (1983)). Therefore, to refine<br />

our analysis, Panel B of Table V reports results for a subsample of acquisitions sequences that<br />

clearly reflect acquisitions programs, according to two criteria. First, <strong>the</strong> acquirer must remain<br />

quiet for 24 months (no acquisition attempts in our main sample), similar to Song and<br />

Walkling’s (forthcoming) dormant period (though <strong>the</strong>y use a period of 12 months). This<br />

21

makes it likely that we capture <strong>the</strong> starts of new acquisitions programs. Second, <strong>the</strong> maximum<br />

time elapsed between two successive transactions is 6 months and thus includes only<br />

sequences of related (or at least close to each o<strong>the</strong>r) transactions. With respect to our main<br />

sample, in which <strong>the</strong> median TBD is 174 days (see Panel A, Table III), we select only<br />

sequences of short TBD transactions. In comparison, Fuller, Netter, and Stegemoller (2002)<br />

demand that “<strong>the</strong> acquirer completes bids for five or more targets in any three-year window<br />

during <strong>the</strong> sample period” (p. 1771), which implies a six-month maximum average time<br />

between transactions for <strong>the</strong> window of three years. Their criterion is thus somewhat less<br />

strict than ours, because we apply <strong>the</strong> six-month threshold on a transaction-by-transaction<br />

basis.<br />

The results in Panel B of Table V confirm our initial evidence: <strong>the</strong> DON coefficient is<br />

negative and statistically significant with a value of –71.311, while <strong>the</strong> coefficient of <strong>the</strong><br />

squared term is positive and statistically significant with a value of 1.211. The value of <strong>the</strong><br />

DON coefficient (in absolute terms) is almost 20 times higher than <strong>the</strong> coefficients reported in<br />

Panel A of Table V for <strong>the</strong> total sample (column 1). This result indicates that <strong>the</strong> decrease in<br />

<strong>the</strong> TBDC through <strong>the</strong> deal sequence for <strong>the</strong> acquisitions programs subsample is even more<br />

supportive of <strong>the</strong> learning hypo<strong>the</strong>sis. Perhaps acquirers starting an acquisitions program<br />

focus more on putting learning processes into place throughout <strong>the</strong>ir organization as<br />

emphasized by consulting firms and <strong>the</strong> business press (see, e.g., Ashkenas, DeMonace, and<br />

Francis (1998); Harding and Rovit (2004)). The impact of learning on <strong>the</strong> abnormal TBDC for<br />

acquisition programs is remarkable: <strong>from</strong> deal number 2 to deal number 3, <strong>the</strong> average<br />

abnormal TBDC shrinks by 65 days. This corresponds to a 20% reduction with respect to <strong>the</strong><br />

sample average abnormal TBDC of 330 days (see Panel C of Table III).<br />

Are our results driven essentially by small transactions? One might in particular argue<br />

that acquisition benefits captured in small deals do not transpose to large and complex<br />

22

transactions, even if <strong>the</strong> business press argues that doing small acquisitions is a route to<br />

organizational learning (Harding and Rovit (2004)). Panel C of Table V focuses on large<br />

transactions with deal size above $50 million. Estimated coefficients for <strong>the</strong> all sample<br />

(22,648 observations, column 1) and <strong>the</strong> short TBD subsample (10,231 observations, column<br />

2) are close to estimations obtained for <strong>the</strong> main sample (Table V, Panel A). For <strong>the</strong> long TBD<br />

subsample, <strong>the</strong> coefficient estimates of <strong>the</strong> linear and squared term keep <strong>the</strong> same signs as for<br />

<strong>the</strong> main sample (Table V, Panel A, column 3) but lose <strong>the</strong>ir statistical significance. For large<br />

transactions <strong>the</strong>refore, <strong>the</strong> increase in learning through <strong>the</strong> deal sequence is confirmed for<br />

experience building situations but not for memory loss ones. The costs associated with<br />

memory loss are probably higher for such large deals, lowering incentives to delay <strong>the</strong><br />

subsequent acquisitions.<br />

III. Robustness Checks<br />

This section checks <strong>the</strong> robustness of our results with respect to various potential issues,<br />

including <strong>the</strong> computation of <strong>the</strong> TBD, <strong>the</strong> sample composition, <strong>the</strong> financial resources<br />

committed to acquisitions, <strong>the</strong> correlation between successive observations for a given<br />

acquirer, and <strong>the</strong> threshold chosen to indentify short and long TBD deals. For brevity, results<br />

are given only for <strong>the</strong> main sample (i.e., <strong>the</strong> sample discussed in column 1, Panel A, Table<br />

V). 12<br />

A. TBD Computation<br />

The results in Table V are based on <strong>the</strong> TBDC, <strong>the</strong> number of days between <strong>the</strong> current<br />

transaction announcement date and <strong>the</strong> completion date of <strong>the</strong> most recent transaction (see<br />

Figure 2). An alternative computation would use <strong>the</strong> number of days between successive<br />

announcement dates (TBDA). The first column of Table VI provides <strong>the</strong> results when TBDA is<br />

12 The full set of results are available on request.<br />

23

<strong>the</strong> dependent variable. The coefficients of <strong>the</strong> DON variable and its squared term are highly<br />

significant and very close to <strong>the</strong> values reported in Panel A of Table V (column 1). Hence,<br />

defining <strong>the</strong> time elapsed between two successive deals, commencing with <strong>the</strong> announcement<br />

date or <strong>the</strong> completion date of <strong>the</strong> previous deal, does not affect <strong>the</strong> results.<br />

[Table VI About Here]<br />

The range of <strong>the</strong> TBDC is large (<strong>from</strong> 1 to 6,430 days in <strong>the</strong> main sample). We check<br />

whe<strong>the</strong>r <strong>the</strong> results are affected by using <strong>the</strong> natural logarithm of <strong>the</strong> TBDC before computing<br />

<strong>the</strong> abnormal TBDC. The second column of Table VI displays <strong>the</strong> results. The coefficients of<br />

<strong>the</strong> DON variable and its squared term are again respectively negative (–0.027) and positive<br />

(0.001), both coefficients are highly significant.<br />

We also compute <strong>the</strong> industry median–adjusted TBDC using <strong>the</strong> two-digit ra<strong>the</strong>r than <strong>the</strong><br />

three-digit SIC code. The results are in column 3 of Table VI. Our results are almost<br />

unaffected by this change.<br />

In column 4 of Table VI, we finally assess <strong>the</strong> robustness of <strong>the</strong> results by computing <strong>the</strong><br />

abnormal TBD using a regression-based approach. We start by regressing <strong>the</strong> TBDC on a set<br />

of industry- and market-wide determinants: HHI, industry concentration (i.e., <strong>the</strong> Herfindahl-<br />

Hirschman index for firms with a given three-digit SIC code, computed using firm total assets<br />

reported in <strong>the</strong> Compustat database); Median Firm Size, (estimated using firm market value<br />

<strong>from</strong> <strong>the</strong> CRSP database); Median ROA, <strong>the</strong> industry median return on assets; Median Growth<br />

Rate, <strong>the</strong> industry median sales-based growth rate; Liquidity, <strong>the</strong> liquidity index introduced by<br />

Schlingemann, Stulz, and Walkling (2002) to capture <strong>the</strong> intensity of corporate asset<br />

transactions within an industry; Aggregate Market-to-Book, <strong>the</strong> aggregate market-to-book<br />

ratio; and C&I spread, <strong>the</strong> commercial and industrial loan rate spreads used by Harford<br />

24

(2005). 13 All <strong>the</strong>se variables are measured as of year-end when <strong>the</strong> transaction was<br />

announced. The first-step regression is <strong>the</strong>refore:<br />

25<br />

, (9)<br />

where i is <strong>the</strong> acquisition index, j is <strong>the</strong> firm index, and Ind and Year are <strong>the</strong> corresponding<br />

industry and year indices, respectively.<br />

TBDC:<br />

where<br />

The residuals of this first-step regression become our new measure of <strong>the</strong> abnormal<br />

̂ is <strong>the</strong> fitted value <strong>from</strong> Equation (9).<br />

̂ , (10)<br />

The estimation results for Equation (9), in Panel A of Table VII, refer to a sample of<br />

136,910 observations. All coefficients are highly significant except <strong>the</strong> M&A market liquidity<br />

index. The TBDC is increasing with industry concentration, industry median firm size, and<br />

industry median ROA. These three variables seem to characterize industries with fewer<br />

transaction opportunities. The median industry growth variable instead reveals a negative<br />

coefficient: growing industries offer more opportunities for acquirers. The C&I Spread has a<br />

positive and statistically significant coefficient, which indicates that, consistent with Harford<br />

(2005), tighter financing conditions slow down M&A market activity. Surprisingly, <strong>the</strong><br />

aggregate market-to-book ratio has also a positive and significant coefficient. Periods of high<br />

valuations may delay acquisition activity if targets are more expensive or if <strong>the</strong>re is more<br />

potential competition in <strong>the</strong> M&A market (see Aktas, de Bodt, and Roll (2010)).<br />

Column 4 of Table VI, provides <strong>the</strong> results obtained with <strong>the</strong> regression-adjusted<br />

abnormal TBDC. The coefficients of <strong>the</strong> DON variable and its squared term are respectively<br />

13 http://www.federalreserve.gov/releases/e2/e2chart.htm.

negative (–7.17) and positive (0.022), both highly statistically significant. The coefficient of<br />

<strong>the</strong> linear term is moreover almost two times larger (in absolute value) than <strong>the</strong> coefficient<br />

estimated with <strong>the</strong> industry median–adjusted TBDC (column 1, Panel A, Table V). We<br />

<strong>the</strong>refore consider <strong>the</strong> results in Table V cautious estimates with respect to <strong>the</strong> procedure<br />

chosen to adjust <strong>the</strong> TBDC to industry- and market-wide determinants.<br />

Ano<strong>the</strong>r concern that might be raised about <strong>the</strong> computation of <strong>the</strong> TBDC is <strong>the</strong> presence<br />

of a private part in <strong>the</strong> M&A process, as recently emphasized by Boone and Mulherin (2007).<br />

The issue is potentially serious, because private negotiations between parties make <strong>the</strong><br />

announcement date an imperfect measure of <strong>the</strong> transaction starting point. If this measurement<br />

error is correlated with our independent variable, we face an endogenous errors-in-variables<br />

problem. We check it using a sample of 1,573 transactions for which we collected <strong>the</strong> length<br />

of <strong>the</strong> private process by hand, using <strong>the</strong> SEC filings S4 and 14D for mergers and 14A for<br />

tender offers (see also Aktas, de Bodt, and Roll (2010)). This sample of M&A transactions<br />

spanned 1994–2007 among U.S. listed firms, featured a minimum deal size of $100 million,<br />

and required that <strong>the</strong> percentage held by <strong>the</strong> acquirer was less than 50% before <strong>the</strong> deal<br />

announcement and more than 50% after its completion. The private process length is <strong>the</strong> time<br />

elapsed, in days, between <strong>the</strong> initiation of <strong>the</strong> takeover process and <strong>the</strong> announcement date of<br />

<strong>the</strong> takeover agreement. For <strong>the</strong>se 1,573 transactions, we regress <strong>the</strong> private process length on<br />

<strong>the</strong> DON variable (computed using our main sample):<br />

where i is <strong>the</strong> acquisition index, and j is <strong>the</strong> firm index.<br />

26<br />

, (11)<br />

Panel B of Table VII features <strong>the</strong> estimation results for Equation (11). The DON<br />

coefficient is negative (–0.15) but not statistically significant (t-stat = –0.43). We thus

conclude that private process-generated errors in <strong>the</strong> TBD variable are mainly innocuous noise<br />

that might affect test power but do not influence our inferences. 14<br />

B. Sample Composition<br />

[Table VII About Here]<br />

The main sample includes transactions classified by SDC as acquisitions of assets,<br />

majority of interest, certain assets, remaining interests, and exchange offers, as well as those<br />

strictly classified as mergers or acquisitions. This choice is motivated by <strong>the</strong> goal of<br />

computing <strong>the</strong> DON variable as precisely as possible and to study <strong>the</strong> M&A market as a<br />

whole. However, including transactions not clearly identified as mergers or acquisitions may<br />

raise questions about <strong>the</strong> real nature of <strong>the</strong> observed phenomena. It also limits <strong>the</strong> possibility<br />

of including control variables in multivariate analyses (though <strong>the</strong> fixed-effect panel estimator<br />

controls for acquirer characteristics that are stable through time). None<strong>the</strong>less, <strong>the</strong> robustness<br />

of <strong>the</strong> results presented thus far can be checked against sampling choices by studying three<br />

subsamples: (1) transactions classified as mergers or acquisitions in <strong>the</strong> SDC database (M&A<br />

subsample); (2) transactions classified as mergers or acquisitions in <strong>the</strong> SDC database and for<br />

which <strong>the</strong> following control variables are available: horizontal transaction (acquirer and target<br />

in <strong>the</strong> same four-digit SIC code industry), private target, deal size, and U.S. target (M&A<br />

subsample with controls); and (3) acquirers that completed at least five transactions during<br />

1992–2009 (repetitive acquirers subsample).<br />

Panel A of Table VIII reports on <strong>the</strong> M&A subsample (column 1). The subsample<br />

includes 17,655 transactions and produces a negative (–14.68) and positive (0.13) coefficient<br />

estimates for <strong>the</strong> linear and <strong>the</strong> squared term, respectively. Both coefficients are statistically<br />

14 It could be argued that <strong>the</strong> private part in <strong>the</strong> M&A process generates signed errors in <strong>the</strong> TBDC computation,<br />

because <strong>the</strong> announcement date by definition is <strong>the</strong> last day of <strong>the</strong> private period. Signed errors of measurement<br />

might also be a source of an estimation bias, but this concern only holds for <strong>the</strong> TBDC variable. For <strong>the</strong> TBDA<br />

variable, <strong>the</strong> errors of measurement may be positive or negative. Column 1 of Table VI shows that <strong>the</strong> TBDC and<br />

<strong>the</strong> TBDA give similar results.<br />

27

significant. The DON coefficient is moreover four times higher (in absolute value) than <strong>the</strong><br />

estimate obtained with <strong>the</strong> main sample (–3.831, see column 1, Panel A, Table V). Adding <strong>the</strong><br />

control variables in column 2 reduces <strong>the</strong> sample to 12,769 observations (column 2) but leads<br />

to <strong>the</strong> same conclusions. For <strong>the</strong> sake of brevity, <strong>the</strong> coefficients of <strong>the</strong> control variables are<br />

not reported, because none of <strong>the</strong>m is significant. Focusing on repetitive acquirers in column<br />

3 generates a sample of 84,637 observations. Almost <strong>the</strong> same coefficient estimates are<br />

obtained for <strong>the</strong> linear and squared term as in <strong>the</strong> main sample. These results toge<strong>the</strong>r confirm<br />

that <strong>the</strong> results presented thus far do not depend on sampling choices.<br />

C. Financial Resources Committed to <strong>Acquisitions</strong><br />

A potential shortcoming of <strong>the</strong> model in Section I relates to financial resources<br />

committed to acquisitions. A key characteristic of M&A transactions is <strong>the</strong> deal size (Fuller,<br />

Netter, and Stegemoller (2002)), which <strong>the</strong> <strong>the</strong>oretical analysis presented in Section I ignores.<br />

Yet one may suspect relations among deal size, acquisition benefits, and integration costs. In<br />

particular, integration costs should increase with deal size, and undertaking small acquisitions<br />

may be a good path to mastering <strong>the</strong> acquisition process (Harding and Rovit (2004)). To<br />

check whe<strong>the</strong>r omitting <strong>the</strong> financial resources committed to acquisitions affects our results,<br />

we replace <strong>the</strong> DON variable by <strong>the</strong> cumulative deal size through <strong>the</strong> acquisition sequence:<br />

28<br />

, (12)<br />