Financial statements - International Planned Parenthood Federation

Financial statements - International Planned Parenthood Federation

Financial statements - International Planned Parenthood Federation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

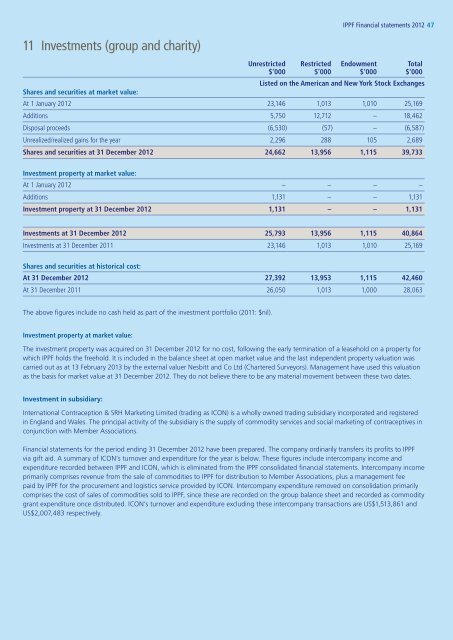

IPPF <strong>Financial</strong> <strong>statements</strong> 2012 47<br />

11 Investments (group and charity)<br />

Unrestricted<br />

$’000<br />

Restricted<br />

$’000<br />

Endowment<br />

$’000<br />

Listed on the American and New York Stock Exchanges<br />

Shares and securities at market value:<br />

At 1 January 2012 23,146 1,013 1,010 25,169<br />

Additions 5,750 12,712 – 18,462<br />

Disposal proceeds (6,530) (57) – (6,587)<br />

Unrealized/realized gains for the year 2,296 288 105 2,689<br />

Shares and securities at 31 December 2012 24,662 13,956 1,115 39,733<br />

Total<br />

$’000<br />

Investment property at market value:<br />

At 1 January 2012 – – – –<br />

Additions 1,131 – – 1,131<br />

Investment property at 31 December 2012 1,131 – – 1,131<br />

Investments at 31 December 2012 25,793 13,956 1,115 40,864<br />

Investments at 31 December 2011 23,146 1,013 1,010 25,169<br />

Shares and securities at historical cost:<br />

At 31 December 2012 27,392 13,953 1,115 42,460<br />

At 31 December 2011 26,050 1,013 1,000 28,063<br />

The above figures include no cash held as part of the investment portfolio (2011: $nil).<br />

Investment property at market value:<br />

The investment property was acquired on 31 December 2012 for no cost, following the early termination of a leasehold on a property for<br />

which IPPF holds the freehold. It is included in the balance sheet at open market value and the last independent property valuation was<br />

carried out as at 13 February 2013 by the external valuer Nesbitt and Co Ltd (Chartered Surveyors). Management have used this valuation<br />

as the basis for market value at 31 December 2012. They do not believe there to be any material movement between these two dates.<br />

Investment in subsidiary:<br />

<strong>International</strong> Contraception & SRH Marketing Limited (trading as ICON) is a wholly owned trading subsidiary incorporated and registered<br />

in England and Wales. The principal activity of the subsidiary is the supply of commodity services and social marketing of contraceptives in<br />

conjunction with Member Associations.<br />

<strong>Financial</strong> <strong>statements</strong> for the period ending 31 December 2012 have been prepared. The company ordinarily transfers its profits to IPPF<br />

via gift aid. A summary of ICON’s turnover and expenditure for the year is below. These figures include intercompany income and<br />

expenditure recorded between IPPF and ICON, which is eliminated from the IPPF consolidated financial <strong>statements</strong>. Intercompany income<br />

primarily comprises revenue from the sale of commodities to IPPF for distribution to Member Associations, plus a management fee<br />

paid by IPPF for the procurement and logistics service provided by ICON. Intercompany expenditure removed on consolidation primarily<br />

comprises the cost of sales of commodities sold to IPPF, since these are recorded on the group balance sheet and recorded as commodity<br />

grant expenditure once distributed. ICON’s turnover and expenditure excluding these intercompany transactions are US$1,513,861 and<br />

US$2,007,483 respectively.