Financial statements - International Planned Parenthood Federation

Financial statements - International Planned Parenthood Federation

Financial statements - International Planned Parenthood Federation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IPPF <strong>Financial</strong> <strong>statements</strong> 2012 57<br />

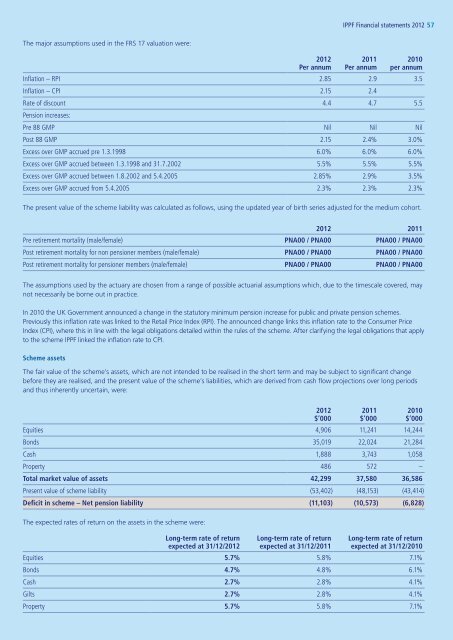

The major assumptions used in the FRS 17 valuation were:<br />

2012<br />

Per annum<br />

2011<br />

Per annum<br />

2010<br />

per annum<br />

Inflation – RPI 2.85 2.9 3.5<br />

Inflation – CPI 2.15 2.4<br />

Rate of discount 4.4 4.7 5.5<br />

Pension increases:<br />

Pre 88 GMP Nil Nil Nil<br />

Post 88 GMP 2.15 2.4% 3.0%<br />

Excess over GMP accrued pre 1.3.1998 6.0% 6.0% 6.0%<br />

Excess over GMP accrued between 1.3.1998 and 31.7.2002 5.5% 5.5% 5.5%<br />

Excess over GMP accrued between 1.8.2002 and 5.4.2005 2.85% 2.9% 3.5%<br />

Excess over GMP accrued from 5.4.2005 2.3% 2.3% 2.3%<br />

The present value of the scheme liability was calculated as follows, using the updated year of birth series adjusted for the medium cohort.<br />

2012 2011<br />

Pre retirement mortality (male/female) PNA00 / PNA00 PNA00 / PNA00<br />

Post retirement mortality for non pensioner members (male/female) PNA00 / PNA00 PNA00 / PNA00<br />

Post retirement mortality for pensioner members (male/female) PNA00 / PNA00 PNA00 / PNA00<br />

The assumptions used by the actuary are chosen from a range of possible actuarial assumptions which, due to the timescale covered, may<br />

not necessarily be borne out in practice.<br />

In 2010 the UK Government announced a change in the statutory minimum pension increase for public and private pension schemes.<br />

Previously this inflation rate was linked to the Retail Price Index (RPI). The announced change links this inflation rate to the Consumer Price<br />

Index (CPI), where this in line with the legal obligations detailed within the rules of the scheme. After clarifying the legal obligations that apply<br />

to the scheme IPPF linked the inflation rate to CPI.<br />

Scheme assets<br />

The fair value of the scheme’s assets, which are not intended to be realised in the short term and may be subject to significant change<br />

before they are realised, and the present value of the scheme’s liabilities, which are derived from cash flow projections over long periods<br />

and thus inherently uncertain, were:<br />

Equities 4,906 11,241 14,244<br />

Bonds 35,019 22,024 21,284<br />

Cash 1,888 3,743 1,058<br />

Property 486 572 –<br />

Total market value of assets 42,299 37,580 36,586<br />

Present value of scheme liability (53,402) (48,153) (43,414)<br />

Deficit in scheme – Net pension liability (11,103) (10,573) (6,828)<br />

The expected rates of return on the assets in the scheme were:<br />

Long-term rate of return<br />

expected at 31/12/2012<br />

2012<br />

$’000<br />

Long-term rate of return<br />

expected at 31/12/2011<br />

2011<br />

$’000<br />

2010<br />

$’000<br />

Long-term rate of return<br />

expected at 31/12/2010<br />

Equities 5.7% 5.8% 7.1%<br />

Bonds 4.7% 4.8% 6.1%<br />

Cash 2.7% 2.8% 4.1%<br />

Gilts 2.7% 2.8% 4.1%<br />

Property 5.7% 5.8% 7.1%