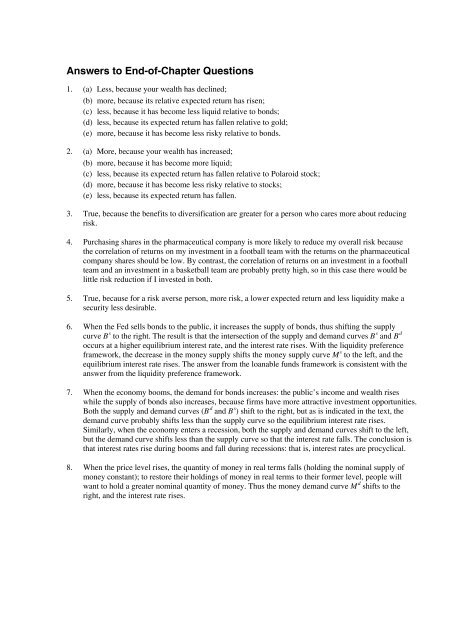

Answers to End-of-Chapter Questions

Answers to End-of-Chapter Questions

Answers to End-of-Chapter Questions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Answers</strong> <strong>to</strong> <strong>End</strong>-<strong>of</strong>-<strong>Chapter</strong> <strong>Questions</strong><br />

1. (a) Less, because your wealth has declined;<br />

(b) more, because its relative expected return has risen;<br />

(c) less, because it has become less liquid relative <strong>to</strong> bonds;<br />

(d) less, because its expected return has fallen relative <strong>to</strong> gold;<br />

(e) more, because it has become less risky relative <strong>to</strong> bonds.<br />

2. (a) More, because your wealth has increased;<br />

(b) more, because it has become more liquid;<br />

(c) less, because its expected return has fallen relative <strong>to</strong> Polaroid s<strong>to</strong>ck;<br />

(d) more, because it has become less risky relative <strong>to</strong> s<strong>to</strong>cks;<br />

(e) less, because its expected return has fallen.<br />

3. True, because the benefits <strong>to</strong> diversification are greater for a person who cares more about reducing<br />

risk.<br />

4. Purchasing shares in the pharmaceutical company is more likely <strong>to</strong> reduce my overall risk because<br />

the correlation <strong>of</strong> returns on my investment in a football team with the returns on the pharmaceutical<br />

company shares should be low. By contrast, the correlation <strong>of</strong> returns on an investment in a football<br />

team and an investment in a basketball team are probably pretty high, so in this case there would be<br />

little risk reduction if I invested in both.<br />

5. True, because for a risk averse person, more risk, a lower expected return and less liquidity make a<br />

security less desirable.<br />

6. When the Fed sells bonds <strong>to</strong> the public, it increases the supply <strong>of</strong> bonds, thus shifting the supply<br />

curve B s <strong>to</strong> the right. The result is that the intersection <strong>of</strong> the supply and demand curves B s and B d<br />

occurs at a higher equilibrium interest rate, and the interest rate rises. With the liquidity preference<br />

framework, the decrease in the money supply shifts the money supply curve M s <strong>to</strong> the left, and the<br />

equilibrium interest rate rises. The answer from the loanable funds framework is consistent with the<br />

answer from the liquidity preference framework.<br />

7. When the economy booms, the demand for bonds increases: the public’s income and wealth rises<br />

while the supply <strong>of</strong> bonds also increases, because firms have more attractive investment opportunities.<br />

Both the supply and demand curves (B d and B s ) shift <strong>to</strong> the right, but as is indicated in the text, the<br />

demand curve probably shifts less than the supply curve so the equilibrium interest rate rises.<br />

Similarly, when the economy enters a recession, both the supply and demand curves shift <strong>to</strong> the left,<br />

but the demand curve shifts less than the supply curve so that the interest rate falls. The conclusion is<br />

that interest rates rise during booms and fall during recessions: that is, interest rates are procyclical.<br />

8. When the price level rises, the quantity <strong>of</strong> money in real terms falls (holding the nominal supply <strong>of</strong><br />

money constant); <strong>to</strong> res<strong>to</strong>re their holdings <strong>of</strong> money in real terms <strong>to</strong> their former level, people will<br />

want <strong>to</strong> hold a greater nominal quantity <strong>of</strong> money. Thus the money demand curve M d shifts <strong>to</strong> the<br />

right, and the interest rate rises.

42 Part 2 Fundamentals <strong>of</strong> Financial Markets<br />

9. Interest rates fall. The increased volatility <strong>of</strong> gold prices makes bonds relatively less risky relative <strong>to</strong><br />

gold and causes the demand for bonds <strong>to</strong> increase. The demand curve, B d , shifts <strong>to</strong> the right and the<br />

equilibrium interest rate falls.<br />

10. Interest rates would rise. A sudden increase in people’s expectations <strong>of</strong> future real estate prices raises<br />

the expected return on real estate relative <strong>to</strong> bonds, so the demand for bonds falls. The demand curve<br />

B d shifts <strong>to</strong> the left, and the equilibrium interest rate rises.<br />

11. Interest rates might rise. The large federal deficits require the Treasury <strong>to</strong> issue more bonds; thus the<br />

supply <strong>of</strong> bonds increases. The supply curve, B s , shifts <strong>to</strong> the right and the equilibrium interest rate<br />

rises. Some economists believe that when the Treasury issues more bonds, the demand for bonds<br />

increases because the issue <strong>of</strong> bonds increases the public’s wealth. In this case, the demand curve, B d ,<br />

also shifts <strong>to</strong> the right, and it is no longer clear that the equilibrium interest rate will rise. Thus there<br />

is some ambiguity in the answer <strong>to</strong> this question.<br />

12. The increased riskines <strong>of</strong> bonds lowers the demand for bonds. The demand curve shifts <strong>to</strong> the left and<br />

the equilibrium interest rate rises.<br />

13. In the loanable funds framework, the increased riskiness <strong>of</strong> bonds lowers the demand for bonds. The<br />

demand curve B d shifts <strong>to</strong> the left, and the equilibrium interest rate rises. The same answer is found in<br />

the liquidity preference framework. The increased riskiness <strong>of</strong> bonds relative <strong>to</strong> money increases the<br />

demand for money. The money demand curve M d shifts <strong>to</strong> the right, and the equilibrium interest rate<br />

rises.<br />

14. Yes, interest rates will rise. The lower commission on s<strong>to</strong>cks makes them more liquid than bonds, and<br />

the demand for bonds will fall. The demand curve B d will therefore shift <strong>to</strong> the left, and the<br />

equilibrium interest rate will rise.<br />

15 If the public believes the president’s program will be successful, interest rates will fall. The<br />

president’s announcement will lower expected inflation so that the expected return on goods<br />

decreases relative <strong>to</strong> bonds. The demand for bonds increases and the demand curve, B d , shifts <strong>to</strong> the<br />

right. For a given nominal interest rate, the lower expected inflation means that the real interest rate<br />

has risen, raising the cost <strong>of</strong> borrowing so that the supply <strong>of</strong> bonds falls. The resulting leftward shift<br />

<strong>of</strong> the supply curve, B s , and the rightward shift <strong>of</strong> the demand curve, B d , causes the equilibrium<br />

interest rate <strong>to</strong> fall.<br />

16. The interest rate on the AT&T bonds will rise. Because people now expect interest rates <strong>to</strong> rise, the<br />

1<br />

expected return on long-term bonds such as the 8 s <strong>of</strong> 2022 will fall, and the demand for these<br />

8<br />

bonds will decline. The demand curve B d will therefore shift <strong>to</strong> the left, and the equilibrium interest<br />

rate will rise.<br />

17 Interest rates will rise. The expected increase in s<strong>to</strong>ck prices raises the expected return on s<strong>to</strong>cks<br />

relative <strong>to</strong> bonds and so the demand for bonds falls. The demand curve, B d , shift <strong>to</strong> the left and the<br />

equilibrium interest rate rises.<br />

18. Interest rates will rise. When bond prices become volatile and bonds become riskier, the demand for<br />

bonds will fall. The demand curve B d will shift <strong>to</strong> the left, and the equilibrium interest rate will rise.

<strong>Chapter</strong> 4 Why Do Interest Rates Change 43<br />

19. The slower rate <strong>of</strong> money growth will lead <strong>to</strong> a liquidity effect, which raises interest rates, while the<br />

lower price level, income, and inflation rates in the future will tend <strong>to</strong> lower interest rates. There are<br />

three possible scenarios for what will happen: (a) if the liquidity effect is larger than the other effects,<br />

then interest rates will rise; (b) if the liquidity effect is smaller than the other effects and expected<br />

inflation adjusts slowly, then interest rates will rise at first but will eventually fall below their initial<br />

level; and (c) if the liquidity effect is smaller than the expected inflation effect and there is rapid<br />

adjustment <strong>of</strong> expected inflation, then interest rates will immediately fall.<br />

• Quantitative Problems<br />

1. You own a $1,000-par zero-coupon bond that has 5 years <strong>of</strong> remaining maturity. You plan on selling<br />

the bond in one year, and believe that the required yield next year will have the following probability<br />

distribution:<br />

Probability Required Yield<br />

0.1 6.60%<br />

0.2 6.75%<br />

0.4 7.00%<br />

0.2 7.20%<br />

0.1 7.45%<br />

(a) What is your expected price when you sell the bond<br />

(b) What is the standard deviation<br />

Solution:<br />

Probability Required Yield Price Prob × Price<br />

Prob * (Price –<br />

Exp. Price) 2<br />

0.1 6.60% $774.41 $77.44 12.84776241<br />

0.2 6.75% $770.07 $154.01 9.775668131<br />

0.4 7.00% $762.90 $305.16 0.013017512<br />

0.2 7.20% $757.22 $151.44 6.862609541<br />

0.1 7.45% $750.02 $75.02 16.5903224<br />

$763.07 46.08937999<br />

The expected price is $763.07.<br />

The variance is $46.09, or a standard deviation <strong>of</strong> $6.79.

44 Part 2 Fundamentals <strong>of</strong> Financial Markets<br />

2. Consider a $1,000-par junk bond paying a 12% annual coupon. The issuing company has 20% chance<br />

<strong>of</strong> defaulting this year; in which case, the bond would not pay anything. If the company survives the<br />

first year, paying the annual coupon payment, it then has a 25% chance <strong>of</strong> defaulting the in second<br />

year. If the company defaults in the second year, neither the final coupon payment not par value <strong>of</strong><br />

the bond will be paid. What price must inves<strong>to</strong>rs pay for this bond <strong>to</strong> expect a 10% yield <strong>to</strong> maturity<br />

At that price, what is the expected holding period return Standard deviation <strong>of</strong> returns Assume that<br />

periodic cash flows are reinvested at 10%.<br />

Solution: The expected cash flow at t 1 = 0.20 (0) + 0.80 (120) = 96<br />

The expected cash flow at t 2 = 0.25 (0) + 0.75 (1,120) = 840<br />

96 840<br />

The price <strong>to</strong>day should be: P<br />

0<br />

= + = 781.49<br />

2<br />

1.10 1.10<br />

At the end <strong>of</strong> two years, the following cash flows and probabilities exist:<br />

Probability Final Cash Flow Holding Period Return Prob × HPR<br />

Prob * (HPR<br />

– Exp. HPR) 2<br />

0.2 $0.00 −100.00% −20.00% 19.80%<br />

0.2 $132.00 −83.11% −16.62% 13.65%<br />

0.6 $1,252.00 60.21% 36.12% 22.11%<br />

−0.50% 55.56%<br />

The expected holding period return is almost zero (−0.5%). The standard deviation is<br />

roughly 74.5% [the square root <strong>of</strong> 55.56%].<br />

3. Last month, corporations supplied $250 billion in bonds <strong>to</strong> inves<strong>to</strong>rs at an average market rate <strong>of</strong><br />

11.8%. This month, an additional $25 billion in bonds became available, and market rates increased<br />

<strong>to</strong> 12.2%. Assuming a Loanable Funds Framework for interest rates, and that the demand curve<br />

remained constant, derive a linear equation for the demand for bonds, using prices instead <strong>of</strong> interest<br />

rates.<br />

Solution: First, translated the interest rates in<strong>to</strong> prices.<br />

1000 − P<br />

i= 11.8% = , or P=<br />

894.454<br />

P<br />

1000 − P<br />

i= 12.2% = , or P=<br />

891.266<br />

P<br />

We know two points on the demand curve:<br />

P = 891.266, Q = 275<br />

P = 894.454, Q = 250<br />

ΔP<br />

891.266 −894.454<br />

So, the slope = = = 0.12755<br />

ΔQ<br />

275 −250<br />

Using the point-slope form <strong>of</strong> the line, Price = 0.12755 × Quantity + Constant. We can<br />

substitute in either point <strong>to</strong> determine the constant. Let’s use the first point:<br />

891.266 = 0.12755 × 275 + constant, or constant = 856.189<br />

Finally, we have:<br />

B d : Price = 0.12755 × Quantity + 856.189

<strong>Chapter</strong> 4 Why Do Interest Rates Change 45<br />

4. An economist has estimated that, near the point <strong>of</strong> equilibrium, the demand curve and supply curve<br />

for bonds can be estimated using the following equations:<br />

B d −2<br />

: Price =<br />

940<br />

5 Quantity +<br />

B s : Price = Quantity + 500<br />

(a) What is the expected equilibrium price and quantity <strong>of</strong> bonds in this market<br />

(b) Given your answer <strong>to</strong> part a., which is the expected interest rate in this market<br />

Solution:<br />

(a) Solve the equations simultaneously:<br />

−2<br />

P= Q+<br />

940<br />

5<br />

− [P = Q + 500]<br />

−7<br />

0 = Q+ 440, or Q=<br />

314.2857<br />

5<br />

This implies that P = 814.2857.<br />

1000 − 814.2857<br />

(b) i = = 22.8%<br />

814.2857<br />

5. As in question 6, the demand curve and supply curve for bonds are estimated using the following<br />

equations:<br />

B d −2<br />

: Price =<br />

940<br />

5 Quantity +<br />

B s : Price = Quantity + 500<br />

Following a dramatic increase in the value <strong>of</strong> the s<strong>to</strong>ck market, many retirees started moving money<br />

out <strong>of</strong> the s<strong>to</strong>ck market and in<strong>to</strong> bonds. This resulted in a parallel shift in the demand for bonds, such<br />

that the price <strong>of</strong> bonds at all quantities increased $50. Assuming no change in the supply equation for<br />

bonds, what is the new equilibrium price and quantity What is the new market interest rate<br />

Solution:<br />

The new demand equation is as follows:<br />

B d −2<br />

: Price =<br />

990<br />

5 Quantity +<br />

Now, solve the equations simultaneously:<br />

−2<br />

P= Q+<br />

990<br />

5<br />

− [P = Q + 500]<br />

−7<br />

0 = Q+ 490, or Q=<br />

350.00<br />

5<br />

This implies that P = 850.00<br />

1000 − 850.00<br />

i = = 17.65%<br />

850.00

46 Part 2 Fundamentals <strong>of</strong> Financial Markets<br />

6. Following question 5, the demand curve and supply curve for bonds are estimated using the following<br />

equations:<br />

B d −2<br />

: Price =<br />

990<br />

5 Quantity +<br />

B s : Price = Quantity + 500<br />

As the s<strong>to</strong>ck market continued <strong>to</strong> rise, the Federal Reserve felt the need <strong>to</strong> increase the interest rates.<br />

As a result, the new market interest rate increased <strong>to</strong> 19.65%, but the equilibrium quantity remained<br />

unchanged. What are the new demand and supply equations Assume parallel shifts in the equations.<br />

Solution: Prior <strong>to</strong> the change in inflation, the equilibrium was Q = 350.00 and P = 850.00 The new<br />

equilibrium price can be found as follows:<br />

1000 − P<br />

i= 19.65% = , or P=<br />

835.771<br />

P<br />

This point (350, 835.771) will be common <strong>to</strong> both equations. Further since the shift was a<br />

parallel shift, the slope <strong>of</strong> the equations remains unchanged. So, we use the equilibrium<br />

point and the slope <strong>to</strong> solve for the constant in each equation:<br />

B d −2 : 835.771 = 350 + constant , or constant = 975.771<br />

5<br />

B d −2<br />

: Price =<br />

975.771<br />

5 Quantity +<br />

and<br />

B s : 835.771 = 350 + constant, or constant = 485.771<br />

B s : Price = Quantity + 485.771