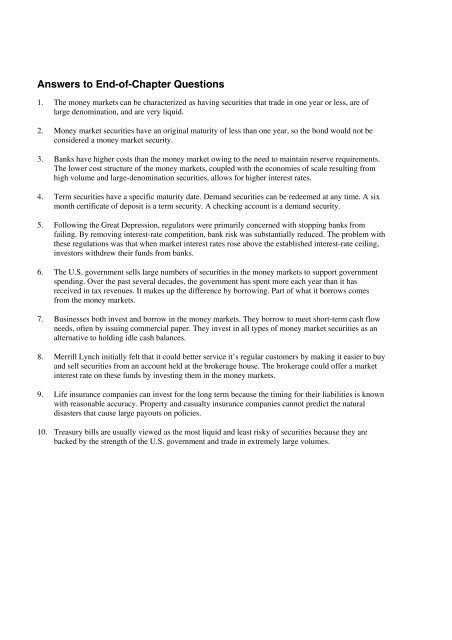

Answers to End-of-Chapter Questions

Answers to End-of-Chapter Questions

Answers to End-of-Chapter Questions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Answers</strong> <strong>to</strong> <strong>End</strong>-<strong>of</strong>-<strong>Chapter</strong> <strong>Questions</strong><br />

1. The money markets can be characterized as having securities that trade in one year or less, are <strong>of</strong><br />

large denomination, and are very liquid.<br />

2. Money market securities have an original maturity <strong>of</strong> less than one year, so the bond would not be<br />

considered a money market security.<br />

3. Banks have higher costs than the money market owing <strong>to</strong> the need <strong>to</strong> maintain reserve requirements.<br />

The lower cost structure <strong>of</strong> the money markets, coupled with the economies <strong>of</strong> scale resulting from<br />

high volume and large-denomination securities, allows for higher interest rates.<br />

4. Term securities have a specific maturity date. Demand securities can be redeemed at any time. A six<br />

month certificate <strong>of</strong> deposit is a term security. A checking account is a demand security.<br />

5. Following the Great Depression, regula<strong>to</strong>rs were primarily concerned with s<strong>to</strong>pping banks from<br />

failing. By removing interest-rate competition, bank risk was substantially reduced. The problem with<br />

these regulations was that when market interest rates rose above the established interest-rate ceiling,<br />

inves<strong>to</strong>rs withdrew their funds from banks.<br />

6. The U.S. government sells large numbers <strong>of</strong> securities in the money markets <strong>to</strong> support government<br />

spending. Over the past several decades, the government has spent more each year than it has<br />

received in tax revenues. It makes up the difference by borrowing. Part <strong>of</strong> what it borrows comes<br />

from the money markets.<br />

7. Businesses both invest and borrow in the money markets. They borrow <strong>to</strong> meet short-term cash flow<br />

needs, <strong>of</strong>ten by issuing commercial paper. They invest in all types <strong>of</strong> money market securities as an<br />

alternative <strong>to</strong> holding idle cash balances.<br />

8. Merrill Lynch initially felt that it could better service it’s regular cus<strong>to</strong>mers by making it easier <strong>to</strong> buy<br />

and sell securities from an account held at the brokerage house. The brokerage could <strong>of</strong>fer a market<br />

interest rate on these funds by investing them in the money markets.<br />

9. Life insurance companies can invest for the long term because the timing for their liabilities is known<br />

with reasonable accuracy. Property and casualty insurance companies cannot predict the natural<br />

disasters that cause large payouts on policies.<br />

10. Treasury bills are usually viewed as the most liquid and least risky <strong>of</strong> securities because they are<br />

backed by the strength <strong>of</strong> the U.S. government and trade in extremely large volumes.

11. In competitive bidding for securities, buyers submit bids. A noncompetitive bidder accepts the<br />

average <strong>of</strong> the rate paid by the competitive bidders.<br />

12. Federal funds are sold by banks <strong>to</strong> other banks. They are used <strong>to</strong> invest excess reserves and <strong>to</strong> raise<br />

reserves if a bank is short.<br />

13. The Federal Reserve cannot directly set the federal funds rate <strong>of</strong> interest. It can influence the interest<br />

rate by adding funds <strong>to</strong> or withdrawing reserves from the economy.<br />

14. Large businesses with very good credit standings sell commercial paper <strong>to</strong> raise short-term funds.<br />

The most common use <strong>of</strong> these funds it <strong>to</strong> extend short-term loans <strong>to</strong> cus<strong>to</strong>mers for the purchase <strong>of</strong><br />

the firm’s products.<br />

15. Banker’s acceptances substitute the creditworthiness <strong>of</strong> a bank for that <strong>of</strong> a business. When a<br />

company sells a product <strong>to</strong> a company it is unfamiliar with, it <strong>of</strong>ten prefers <strong>to</strong> have the promise <strong>of</strong> a<br />

bank that payment will be made.<br />

• Quantitative Problems<br />

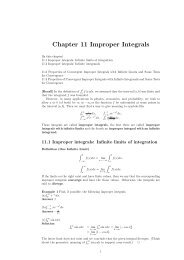

1. What would be your annualized yield on the purchase <strong>of</strong> a 182-day Treasury-Bill for $4,925 that pays<br />

$5,000 at maturity?<br />

Solution:<br />

$5,000 − $4,925 365<br />

i = × = 3.05%<br />

$4,925 182<br />

2. What is the annualized yield on a Treasury bill that you purchase for $9,940 and will mature in<br />

91 days for $10,000?<br />

Solution: 2.42%<br />

3. If you want <strong>to</strong> earn an annualized yield <strong>of</strong> 3.5%, what is the most you can pay for a 91-day Treasury-<br />

Bill $5,000 at maturity?<br />

Solution:<br />

$5,000 − P 365<br />

× = 3.50%<br />

P 91<br />

P = $4,956.74<br />

4. What is the annualized yield on a Treasury bill that you purchase for $9,900 that will mature in 91<br />

days for $10,000?<br />

Solution: 4.05%<br />

5. The price <strong>of</strong> 182-day commercial paper is $7,840. If the annualized yield is 4.04%, what will the<br />

paper pay at maturity?<br />

Solution:<br />

$F − $7,840 365<br />

× = 4.04%<br />

$7,840 182<br />

P = $7997.93

6. How much would you pay for a Treasury bill that matures in one year and pays $10,000 if you<br />

require a 1.8% return?<br />

Solution: $9,823.18<br />

7. The price <strong>of</strong> $8,000 face value commercial paper is $7,930. if the annualized yield is 4%, when will<br />

the paper mature?<br />

Solution:<br />

$8,000 − $7,930 365<br />

× = 4.00%<br />

$7,930 X<br />

X = 80 days<br />

8. How much would you pay for a Treasury bill that matures in one year and pays $10,000 if you<br />

require a 3% return?<br />

Solution: $9,708.74<br />

9. The annualized yield on a particular money market instrument is 3.75%. The face value is $200,000<br />

and it matures in 51 days. What is it’s price? What would be the price if it had 71 days <strong>to</strong> maturity?<br />

Solution:<br />

$200,000 − P 365<br />

× = 3.75%<br />

P 51<br />

P = $198,958<br />

$200,000 − P 365<br />

× = 3.75%<br />

P 71<br />

P = $198,552<br />

10. The annualized yield is 3% for 91-day commercial paper and 3.5% for 182-days commercial paper.<br />

What is the expected 91-day commercial paper rate 91 days from now?<br />

Assuming the difference is just due <strong>to</strong> higher future interest rates, an inves<strong>to</strong>r should be able <strong>to</strong> earn<br />

the same return over 182 days using either 182-day paper or a 91-day paper rollover strategy.<br />

Assume that the 182-day paper has a $100,000 face value. The current price is:<br />

$100,000 − P 365<br />

× = 3.5%<br />

P 182<br />

P = $98,284.73<br />

Now, invest the same amount in 91-day paper.<br />

F − 98,284.73 365<br />

× = 3.0%<br />

98,284.73 91<br />

F = $99,019.87. That is, such an investment should pay<strong>of</strong>f $99,019.87 after 91 days.<br />

Now, invest $99,019.87 in 91-day paper again. It is expected <strong>to</strong> give a final value <strong>of</strong> $100,000 (just<br />

like the 182-day paper).<br />

100,000 − 99,019.87 365<br />

× = 3.97%. The 91-day rate in 91-days is expected <strong>to</strong> be 3.97%.<br />

99,019.87 91

11. Assume that 45% <strong>of</strong> a Treasury Bill auction was sold for $998 per $1,000 per value, 35% was sold<br />

for $997, and the last 20% was sold for $996. What would be the weighted average price paid by a<br />

noncompetitive bid?<br />

Solution: $998 × 0.45 + $997 × 0.35 + $996 × 0.20 = $997.25<br />

Noncompetitive bidders pay $997.25 per $1,000 <strong>of</strong> Treasury Bills purchased.<br />

12. In a Treasury auction <strong>of</strong> $2.5 billion par value 91-day T-bills, the following bids were submitted:<br />

Bidder Bid Amount Price<br />

1 $500 million $0.9940<br />

2 $750 million $0.9901<br />

3 $1.5 billion $0.9925<br />

4 $1 billion $0.9936<br />

5 $600 million $0.9939<br />

(a) If only these competitive bids are received, who will receive T-bills, what quantity, and at what<br />

price?<br />

(b) If the Treasury also received $750 million in noncompetitive bids, who will receive T-bills, what<br />

quantity, and at what price?<br />

Solution: (a) If only the competitive bids are received, the following bids, quantities, and prices<br />

will be awarded:<br />

Bidder Bid Amount Price Amount Paid<br />

1 $500 million $0.9940 $497.00 million<br />

5 $600 million $0.9939 $596.34 million<br />

4 $1 billion $0.9936 $993.60 million<br />

3 $400 million $0.9925 $397.00 million<br />

(b) If $750 million in noncompetitive bids are also received, the following bids, quantities,<br />

and prices will be awarded:<br />

Competitive Bids<br />

Bidder Bid Amount Price Amount Paid<br />

1 $500 million $0.9940 $497.00 million<br />

5 $600 million $0.9939 $596.34 million<br />

4 $650 million $0.9936 $645.84 million<br />

Noncompetitive Bids<br />

$750 million $0.9938 * $745.35 million<br />

* $0.9938 = (500 × 0.9940 + 600 × 0.9939 +<br />

650 × 0.9936)/1,750