08-09 - Jindal Group of Companies

08-09 - Jindal Group of Companies

08-09 - Jindal Group of Companies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

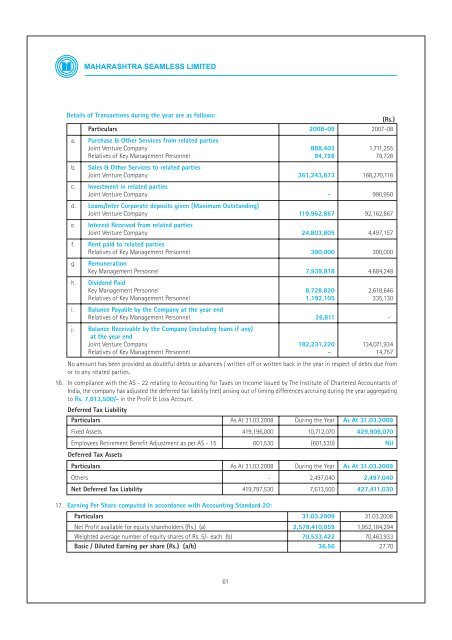

Details <strong>of</strong> Transactions during the year are as follows:<br />

(Rs.)<br />

Particulars 20<strong>08</strong>-<strong>09</strong> 2007-<strong>08</strong><br />

a. Purchase & Other Services from related parties<br />

Joint Venture Company 888,403 1,711,255<br />

Relatives <strong>of</strong> Key Management Personnel 94,728 78,726<br />

b. Sales & Other Services to related parties<br />

Joint Venture Company 361,243,673 166,270,116<br />

c. Investment in related parties<br />

Joint Venture Company - 990,950<br />

d. Loans/Inter Corporate deposits given (Maximum Outstanding)<br />

Joint Venture Company 119,962,867 92,162,867<br />

e. Interest Received from related parties<br />

Joint Venture Company 24,803,805 4,497,157<br />

f. Rent paid to related parties<br />

Relatives <strong>of</strong> Key Management Personnel 300,000 300,000<br />

g. Remuneration<br />

Key Management Personnel 7,939,818 4,684,248<br />

h. Dividend Paid<br />

Key Management Personnel 8,728,820 2,618,646<br />

Relatives <strong>of</strong> Key Management Personnel 1,192,105 335,130<br />

i. Balance Payable by the Company at the year end<br />

Relatives <strong>of</strong> Key Management Personnel 26,811 -<br />

j. Balance Receivable by the Company (including loans if any)<br />

at the year end<br />

Joint Venture Company 182,231,220 134,071,934<br />

Relatives <strong>of</strong> Key Management Personnel - 14,757<br />

No amount has been provided as doubtful debts or advances / written <strong>of</strong>f or written back in the year in respect <strong>of</strong> debts due from<br />

or to any related parties.<br />

16. In compliance with the AS - 22 relating to Accounting for Taxes on Income issued by The Institute <strong>of</strong> Chartered Accountants <strong>of</strong><br />

India, the company has adjusted the deferred tax liability (net) arising out <strong>of</strong> timing differences accruing during the year aggregating<br />

to Rs. 7,613,500/- in the Pr<strong>of</strong>it & Loss Account.<br />

Deferred Tax Liability<br />

Particulars As At 31.03.20<strong>08</strong> During the Year As At 31.03.20<strong>09</strong><br />

Fixed Assets 419,196,000 10,712,070 429,9<strong>08</strong>,070<br />

Employees Retirement Benefit Adjustment as per AS - 15 601,530 (601,530) Nil<br />

Deferred Tax Assets<br />

Particulars As At 31.03.20<strong>08</strong> During the Year As At 31.03.20<strong>09</strong><br />

Others - 2,497,040 2,497,040<br />

Net Deferred Tax Liability 419,797,530 7,613,500 427,411,030<br />

17. Earning Per Share computed in accordance with Accounting Standard 20:<br />

Particulars 31.03.20<strong>09</strong> 31.03.20<strong>08</strong><br />

Net Pr<strong>of</strong>it available for equity shareholders (Rs.) (a) 2,578,410,059 1,952,184,294<br />

Weighted average number <strong>of</strong> equity shares <strong>of</strong> Rs. 5/- each (b) 70,533,422 70,463,933<br />

Basic / Diluted Earning per share (Rs.) (a/b) 36.56 27.70<br />

61