Life in the Valley Economy 2010 - Working Partnerships USA

Life in the Valley Economy 2010 - Working Partnerships USA

Life in the Valley Economy 2010 - Working Partnerships USA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

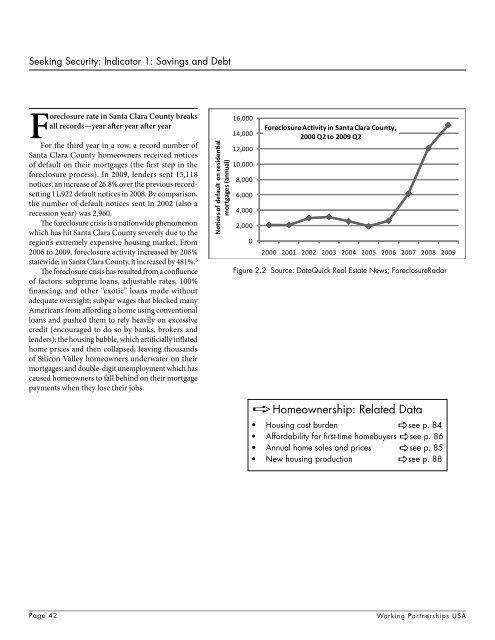

Seek<strong>in</strong>g Security: Indicator 1: Sav<strong>in</strong>gs and Debt<br />

Foreclosure rate <strong>in</strong> Santa Clara County breaks<br />

all records—year after year after year<br />

For <strong>the</strong> third year <strong>in</strong> a row, a record number of<br />

Santa Clara County homeowners received notices<br />

of default on <strong>the</strong>ir mortgages (<strong>the</strong> first step <strong>in</strong> <strong>the</strong><br />

foreclosure process). In 2009, lenders sent 15,118<br />

notices, an <strong>in</strong>crease of 26.8% over <strong>the</strong> previous recordsett<strong>in</strong>g<br />

11,922 default notices <strong>in</strong> 2008. By comparison,<br />

<strong>the</strong> number of default notices sent <strong>in</strong> 2002 (also a<br />

recession year) was 2,960.<br />

The foreclosure crisis is a nationwide phenomenon<br />

which has hit Santa Clara County severely due to <strong>the</strong><br />

region’s extremely expensive hous<strong>in</strong>g market. From<br />

2006 to 2009, foreclosure activity <strong>in</strong>creased by 208%<br />

statewide; <strong>in</strong> Santa Clara County, it <strong>in</strong>creased by 481%. 5<br />

The foreclosure crisis has resulted from a confluence<br />

of factors: subprime loans, adjustable rates, 100%<br />

f<strong>in</strong>anc<strong>in</strong>g, and o<strong>the</strong>r “exotic” loans made without<br />

adequate oversight; subpar wages that blocked many<br />

Americans from afford<strong>in</strong>g a home us<strong>in</strong>g conventional<br />

loans and pushed <strong>the</strong>m to rely heavily on excessive<br />

credit (encouraged to do so by banks, brokers and<br />

lenders); <strong>the</strong> hous<strong>in</strong>g bubble, which artificially <strong>in</strong>flated<br />

home prices and <strong>the</strong>n collapsed, leav<strong>in</strong>g thousands<br />

of Silicon <strong>Valley</strong> homeowners underwater on <strong>the</strong>ir<br />

mortgages; and double-digit unemployment which has<br />

caused homeowners to fall beh<strong>in</strong>d on <strong>the</strong>ir mortgage<br />

payments when <strong>the</strong>y lose <strong>the</strong>ir jobs.<br />

Notices of default on residential<br />

mortgages (annual)<br />

16,000<br />

14,000<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

Foreclosure Activity <strong>in</strong> Santa Clara County,<br />

2000 Q2 to 2009 Q2<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009<br />

Figure 2.2 Source: DataQuick Real Estate News; ForeclosureRadar<br />

aHomeownership: Related Data<br />

• Hous<strong>in</strong>g cost burden asee p. 84<br />

• Affordability for first-time homebuyers asee p. 86<br />

• Annual home sales and prices asee p. 85<br />

• New hous<strong>in</strong>g production asee p. 88<br />

Page 42<br />

Work<strong>in</strong>g <strong>Partnerships</strong> <strong>USA</strong>