GUIDE TO THE TOURIST ACCOMMODATION TAX - Comune di Roma

GUIDE TO THE TOURIST ACCOMMODATION TAX - Comune di Roma

GUIDE TO THE TOURIST ACCOMMODATION TAX - Comune di Roma

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

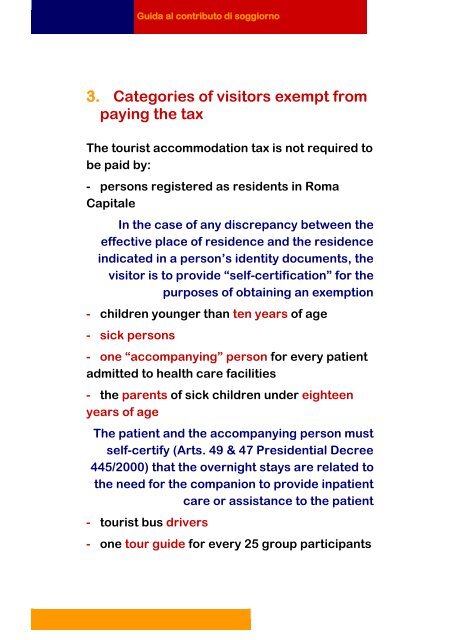

Guida al contributo <strong>di</strong> soggiorno<br />

3. Categories of visitors exempt from<br />

paying the tax<br />

The tourist accommodation tax is not required to<br />

be paid by:<br />

- persons registered as residents in <strong>Roma</strong><br />

Capitale<br />

In the case of any <strong>di</strong>screpancy between the<br />

effective place of residence and the residence<br />

in<strong>di</strong>cated in a person’s identity documents, the<br />

visitor is to provide “self-certification” for the<br />

purposes of obtaining an exemption<br />

- children younger than ten years of age<br />

- sick persons<br />

- one “accompanying” person for every patient<br />

admitted to health care facilities<br />

- the parents of sick children under eighteen<br />

years of age<br />

The patient and the accompanying person must<br />

self-certify (Arts. 49 & 47 Presidential Decree<br />

445/2000) that the overnight stays are related to<br />

the need for the companion to provide inpatient<br />

care or assistance to the patient<br />

- tourist bus drivers<br />

- one tour guide for every 25 group participants