2010 Annual Report - Grange Resources

2010 Annual Report - Grange Resources

2010 Annual Report - Grange Resources

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

36 GRANGE RESOURCES LIMITED<br />

DIRECTORS’ REPORT (cont.)<br />

There were no rights on issue during the year ended 30 June <strong>2010</strong>.<br />

As at the date of this report, the Remuneration and Nomination Committee is still reviewing variable remuneration entitlements for<br />

the six month period ended 31 December <strong>2010</strong>. Rights awarded to key management personnel for the six month period ended<br />

31 December <strong>2010</strong> will be disclosed during the period in which the Remuneration and Nomination Committee approves the<br />

variable remuneration entitlement.<br />

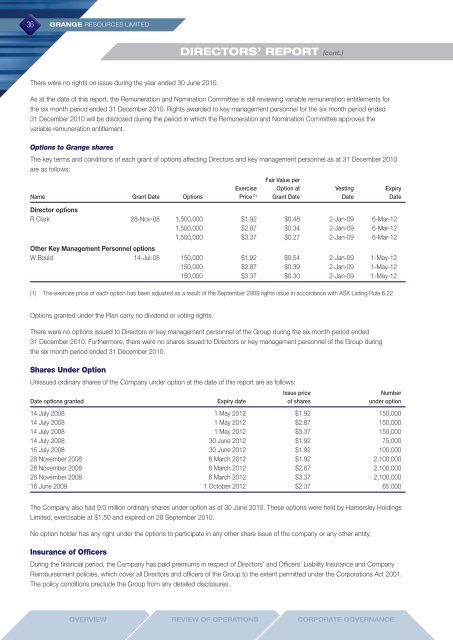

Options to <strong>Grange</strong> shares<br />

The key terms and conditions of each grant of options affecting Directors and key management personnel as at 31 December <strong>2010</strong><br />

are as follows:<br />

Fair Value per<br />

Exercise Option at Vesting Expiry<br />

Name Grant Date Options Price (1) Grant Date Date Date<br />

Director options<br />

R Clark 28-Nov-08 1,500,000 $1.92 $0.48 2-Jan-09 6-Mar-12<br />

1,500,000 $2.87 $0.34 2-Jan-09 6-Mar-12<br />

1,500,000 $3.37 $0.27 2-Jan-09 6-Mar-12<br />

Other Key Management Personnel options<br />

W Bould 14-Jul-08 150,000 $1.92 $0.54 2-Jan-09 1-May-12<br />

150,000 $2.87 $0.39 2-Jan-09 1-May-12<br />

150,000 $3.37 $0.30 2-Jan-09 1-May-12<br />

(1) The exercise price of each option has been adjusted as a result of the September 2009 rights issue in accordance with ASX Listing Rule 6.22<br />

Options granted under the Plan carry no dividend or voting rights.<br />

There were no options issued to Directors or key management personnel of the Group during the six month period ended<br />

31 December <strong>2010</strong>. Furthermore, there were no shares issued to Directors or key management personnel of the Group during<br />

the six month period ended 31 December <strong>2010</strong>.<br />

Shares Under Option<br />

Unissued ordinary shares of the Company under option at the date of this report are as follows:<br />

Issue price<br />

Number<br />

Date options granted Expiry date of shares under option<br />

14 July 2008 1 May 2012 $1.92 150,000<br />

14 July 2008 1 May 2012 $2.87 150,000<br />

14 July 2008 1 May 2012 $3.37 150,000<br />

14 July 2008 30 June 2012 $1.92 75,000<br />

15 July 2008 30 June 2012 $1.92 100,000<br />

28 November 2008 6 March 2012 $1.92 2,100,000<br />

28 November 2008 6 March 2012 $2.87 2,100,000<br />

28 November 2008 6 March 2012 $3.37 2,100,000<br />

16 June 2009 1 October 2012 $2.37 65,000<br />

The Company also had 9.0 million ordinary shares under option as at 30 June <strong>2010</strong>. These options were held by Hamersley Holdings<br />

Limited, exercisable at $1.50 and expired on 28 September <strong>2010</strong>.<br />

No option holder has any right under the options to participate in any other share issue of the company or any other entity.<br />

Insurance of Officers<br />

During the financial period, the Company has paid premiums in respect of Directors’ and Officers’ Liability Insurance and Company<br />

Reimbursement policies, which cover all Directors and officers of the Group to the extent permitted under the Corporations Act 2001.<br />

The policy conditions preclude the Group from any detailed disclosures.<br />

Overview<br />

Review Of Operations<br />

Corporate Governance