2010 Annual Report - Grange Resources

2010 Annual Report - Grange Resources

2010 Annual Report - Grange Resources

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

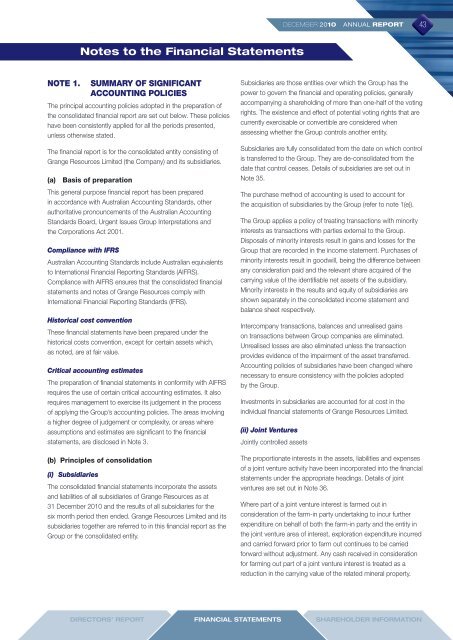

DECEMBER <strong>2010</strong> ANNUAL REPORT 43<br />

Notes to the Financial Statements<br />

NOTE 1.<br />

SUMMARY OF SIGNIFICANT<br />

aCCOUNTING POLICIES<br />

The principal accounting policies adopted in the preparation of<br />

the consolidated financial report are set out below. These policies<br />

have been consistently applied for all the periods presented,<br />

unless otherwise stated.<br />

The financial report is for the consolidated entity consisting of<br />

<strong>Grange</strong> <strong>Resources</strong> Limited (the Company) and its subsidiaries.<br />

(a) Basis of preparation<br />

This general purpose financial report has been prepared<br />

in accordance with Australian Accounting Standards, other<br />

authoritative pronouncements of the Australian Accounting<br />

Standards Board, Urgent Issues Group Interpretations and<br />

the Corporations Act 2001.<br />

Compliance with IFRS<br />

Australian Accounting Standards include Australian equivalents<br />

to International Financial <strong>Report</strong>ing Standards (AIFRS).<br />

Compliance with AIFRS ensures that the consolidated financial<br />

statements and notes of <strong>Grange</strong> <strong>Resources</strong> comply with<br />

International Financial <strong>Report</strong>ing Standards (IFRS).<br />

Historical cost convention<br />

These financial statements have been prepared under the<br />

historical costs convention, except for certain assets which,<br />

as noted, are at fair value.<br />

Critical accounting estimates<br />

The preparation of financial statements in conformity with AIFRS<br />

requires the use of certain critical accounting estimates. It also<br />

requires management to exercise its judgement in the process<br />

of applying the Group’s accounting policies. The areas involving<br />

a higher degree of judgement or complexity, or areas where<br />

assumptions and estimates are significant to the financial<br />

statements, are disclosed in Note 3.<br />

(b) Principles of consolidation<br />

(i) Subsidiaries<br />

The consolidated financial statements incorporate the assets<br />

and liabilities of all subsidiaries of <strong>Grange</strong> <strong>Resources</strong> as at<br />

31 December <strong>2010</strong> and the results of all subsidiaries for the<br />

six month period then ended. <strong>Grange</strong> <strong>Resources</strong> Limited and its<br />

subsidiaries together are referred to in this financial report as the<br />

Group or the consolidated entity.<br />

Subsidiaries are those entities over which the Group has the<br />

power to govern the financial and operating policies, generally<br />

accompanying a shareholding of more than one-half of the voting<br />

rights. The existence and effect of potential voting rights that are<br />

currently exercisable or convertible are considered when<br />

assessing whether the Group controls another entity.<br />

Subsidiaries are fully consolidated from the date on which control<br />

is transferred to the Group. They are de-consolidated from the<br />

date that control ceases. Details of subsidiaries are set out in<br />

Note 35.<br />

The purchase method of accounting is used to account for<br />

the acquisition of subsidiaries by the Group (refer to note 1(e)).<br />

The Group applies a policy of treating transactions with minority<br />

interests as transactions with parties external to the Group.<br />

Disposals of minority interests result in gains and losses for the<br />

Group that are recorded in the income statement. Purchases of<br />

minority interests result in goodwill, being the difference between<br />

any consideration paid and the relevant share acquired of the<br />

carrying value of the identifiable net assets of the subsidiary.<br />

Minority interests in the results and equity of subsidiaries are<br />

shown separately in the consolidated income statement and<br />

balance sheet respectively.<br />

Intercompany transactions, balances and unrealised gains<br />

on transactions between Group companies are eliminated.<br />

Unrealised losses are also eliminated unless the transaction<br />

provides evidence of the impairment of the asset transferred.<br />

Accounting policies of subsidiaries have been changed where<br />

necessary to ensure consistency with the policies adopted<br />

by the Group.<br />

Investments in subsidiaries are accounted for at cost in the<br />

individual financial statements of <strong>Grange</strong> <strong>Resources</strong> Limited.<br />

(ii) Joint Ventures<br />

Jointly controlled assets<br />

The proportionate interests in the assets, liabilities and expenses<br />

of a joint venture activity have been incorporated into the financial<br />

statements under the appropriate headings. Details of joint<br />

ventures are set out in Note 36.<br />

Where part of a joint venture interest is farmed out in<br />

consideration of the farm-in party undertaking to incur further<br />

expenditure on behalf of both the farm-in party and the entity in<br />

the joint venture area of interest, exploration expenditure incurred<br />

and carried forward prior to farm out continues to be carried<br />

forward without adjustment. Any cash received in consideration<br />

for farming out part of a joint venture interest is treated as a<br />

reduction in the carrying value of the related mineral property.<br />

DirectorS’ <strong>Report</strong><br />

Financial Statements<br />

Shareholder information