2010 Annual Report - Grange Resources

2010 Annual Report - Grange Resources

2010 Annual Report - Grange Resources

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

56 GRANGE RESOURCES LIMITED<br />

Notes to the Financial Statements (cont.)<br />

NOTE 2.<br />

FINANCIAL RISK<br />

MANAGEMENT (cont.)<br />

Going forward, the Group may consider using financial<br />

instruments to manage commodity price risk given exposures to<br />

market prices arising from recent changes to pricing<br />

mechanisms.<br />

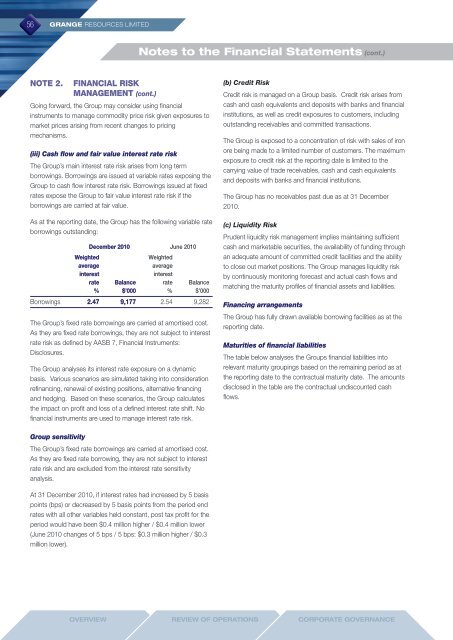

(iii) Cash flow and fair value interest rate risk<br />

The Group’s main interest rate risk arises from long term<br />

borrowings. Borrowings are issued at variable rates exposing the<br />

Group to cash flow interest rate risk. Borrowings issued at fixed<br />

rates expose the Group to fair value interest rate risk if the<br />

borrowings are carried at fair value.<br />

As at the reporting date, the Group has the following variable rate<br />

borrowings outstanding:<br />

December <strong>2010</strong> June <strong>2010</strong><br />

Weighted<br />

Weighted<br />

average<br />

average<br />

interest<br />

interest<br />

rate Balance rate Balance<br />

% $’000 % $’000<br />

Borrowings 2.47 9,177 2.54 9,282<br />

The Group’s fixed rate borrowings are carried at amortised cost.<br />

As they are fixed rate borrowings, they are not subject to interest<br />

rate risk as defined by AASB 7, Financial Instruments:<br />

Disclosures.<br />

The Group analyses its interest rate exposure on a dynamic<br />

basis. Various scenarios are simulated taking into consideration<br />

refinancing, renewal of existing positions, alternative financing<br />

and hedging. Based on these scenarios, the Group calculates<br />

the impact on profit and loss of a defined interest rate shift. No<br />

financial instruments are used to manage interest rate risk.<br />

(b) Credit Risk<br />

Credit risk is managed on a Group basis. Credit risk arises from<br />

cash and cash equivalents and deposits with banks and financial<br />

institutions, as well as credit exposures to customers, including<br />

outstanding receivables and committed transactions.<br />

The Group is exposed to a concentration of risk with sales of iron<br />

ore being made to a limited number of customers. The maximum<br />

exposure to credit risk at the reporting date is limited to the<br />

carrying value of trade receivables, cash and cash equivalents<br />

and deposits with banks and financial institutions.<br />

The Group has no receivables past due as at 31 December<br />

<strong>2010</strong>.<br />

(c) Liquidity Risk<br />

Prudent liquidity risk management implies maintaining sufficient<br />

cash and marketable securities, the availability of funding through<br />

an adequate amount of committed credit facilities and the ability<br />

to close out market positions. The Group manages liquidity risk<br />

by continuously monitoring forecast and actual cash flows and<br />

matching the maturity profiles of financial assets and liabilities.<br />

Financing arrangements<br />

The Group has fully drawn available borrowing facilities as at the<br />

reporting date.<br />

Maturities of financial liabilities<br />

The table below analyses the Groups financial liabilities into<br />

relevant maturity groupings based on the remaining period as at<br />

the reporting date to the contractual maturity date. The amounts<br />

disclosed in the table are the contractual undiscounted cash<br />

flows.<br />

Group sensitivity<br />

The Group’s fixed rate borrowings are carried at amortised cost.<br />

As they are fixed rate borrowing, they are not subject to interest<br />

rate risk and are excluded from the interest rate sensitivity<br />

analysis.<br />

At 31 December <strong>2010</strong>, if interest rates had increased by 5 basis<br />

points (bps) or decreased by 5 basis points from the period end<br />

rates with all other variables held constant, post tax profit for the<br />

period would have been $0.4 million higher / $0.4 million lower<br />

(June <strong>2010</strong> changes of 5 bps / 5 bps: $0.3 million higher / $0.3<br />

million lower).<br />

Overview<br />

Review Of Operations<br />

Corporate Governance