Previous Midterm Key - Marriott School

Previous Midterm Key - Marriott School

Previous Midterm Key - Marriott School

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

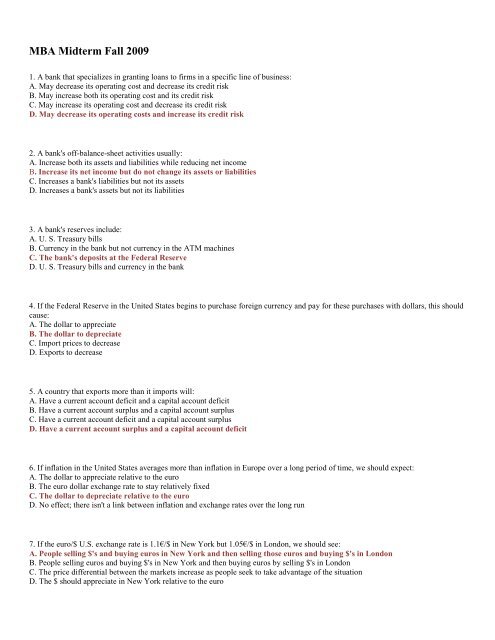

MBA <strong>Midterm</strong> Fall 2009<br />

1. A bank that specializes in granting loans to firms in a specific line of business:<br />

A. May decrease its operating cost and decrease its credit risk<br />

B. May increase both its operating cost and its credit risk<br />

C. May increase its operating cost and decrease its credit risk<br />

D. May decrease its operating costs and increase its credit risk<br />

2. A bank's off-balance-sheet activities usually:<br />

A. Increase both its assets and liabilities while reducing net income<br />

B. Increase its net income but do not change its assets or liabilities<br />

C. Increases a bank's liabilities but not its assets<br />

D. Increases a bank's assets but not its liabilities<br />

3. A bank's reserves include:<br />

A. U. S. Treasury bills<br />

B. Currency in the bank but not currency in the ATM machines<br />

C. The bank's deposits at the Federal Reserve<br />

D. U. S. Treasury bills and currency in the bank<br />

4. If the Federal Reserve in the United States begins to purchase foreign currency and pay for these purchases with dollars, this should<br />

cause:<br />

A. The dollar to appreciate<br />

B. The dollar to depreciate<br />

C. Import prices to decrease<br />

D. Exports to decrease<br />

5. A country that exports more than it imports will:<br />

A. Have a current account deficit and a capital account deficit<br />

B. Have a current account surplus and a capital account surplus<br />

C. Have a current account deficit and a capital account surplus<br />

D. Have a current account surplus and a capital account deficit<br />

6. If inflation in the United States averages more than inflation in Europe over a long period of time, we should expect:<br />

A. The dollar to appreciate relative to the euro<br />

B. The euro dollar exchange rate to stay relatively fixed<br />

C. The dollar to depreciate relative to the euro<br />

D. No effect; there isn't a link between inflation and exchange rates over the long run<br />

7. If the euro/$ U.S. exchange rate is 1.1€/$ in New York but 1.05€/$ in London, we should see:<br />

A. People selling $'s and buying euros in New York and then selling those euros and buying $'s in London<br />

B. People selling euros and buying $'s in New York and then buying euros by selling $'s in London<br />

C. The price differential between the markets increase as people seek to take advantage of the situation<br />

D. The $ should appreciate in New York relative to the euro

8. If in late 2003 one U.S. dollar exchanged for 118 euros and in mid-2004 one U.S. dollar exchanged for 127 euros, then:<br />

A. The euro appreciated relative to the dollar<br />

B. The dollar appreciated relative to the euro<br />

C. European goods became more expensive to Americans<br />

D. American goods became more expensive to Americans<br />

9. Interest-rate risk would not matter to which of the following bondholders<br />

A. A holder of a U.S. government bond<br />

B. A holder of a U.S. government bond indexed for inflation<br />

C. A holder of a U.S. government bond who plans on selling it in one year<br />

D. A holder of a U.S. government bond that plans on holding it until it matures<br />

10. Suppose that the return on assets other than bonds falls. In the bond market this will result in:<br />

A. A movement down the bond demand curve<br />

B. A shift to the left of the bond demand curve<br />

C. An increase in the price of bonds<br />

D. A shift to the left of the bond supply curve<br />

11. If interest rates are expected to fall, bond prices will:<br />

A. Fall as the demand for bonds decreases<br />

B. Remain constant until interest rates actually change<br />

C. Fall as people fear capital losses in the future<br />

D. Increase due to the demand for bonds increasing<br />

12. When expected inflation increases, for any given nominal interest rate:<br />

A. The cost of borrowing increases and the desire to borrow decreases<br />

B. The real interest rate increases<br />

C. The bond supply curve shifts to the left<br />

D. The cost of borrowing decreases and the desire to borrow increases<br />

13. The bond demand curve slopes downward because:<br />

A. At lower prices the reward for holding the bond increases<br />

B. As bond prices fall so do yields<br />

C. As bond prices fall bonds are less attractive<br />

D. As bond prices rise yields increase<br />

14. A 30-year Treasury bond as a face value of $1,000, price of $1,200 with a $50 coupon payment. Assume the price of this bond<br />

decreases to $1,100 over the next year. The one-year holding period return is equal to:<br />

A. -9.17%<br />

B. -8.33%<br />

C. -4.17%<br />

D. -3.79%

15. Which of the following statements is incorrect<br />

A. If you can buy the same goods this year as you bought last year with less money there must have been deflation<br />

B. If you can buy the same goods this year as you purchased one year ago with the same amount of money, prices are stable<br />

C. If purchasing the same goods today that were purchased one year ago requires more money, there must have been inflation<br />

D. If you can buy the same goods this year as you bought last year with the same money there must have been deflation<br />

16. Which of the following statements is most correct<br />

A. Money is wealth but not all wealth is money<br />

B. Money is a means of payment but is not part of wealth<br />

C. In order to be considered part of a person's wealth, an asset must have a positive return<br />

D. Wealth is a store of value but is not a means of payment<br />

17. For every $100 in assets, a bank has $40 in interest-rate sensitive assets, and the other $60 in non-interest-rate sensitive assets. The<br />

same bank has $50 for every $100 in liabilities in interest-rate sensitive liabilities, the other $50 are in liabilities that are not interest-rate<br />

sensitive. If the interest rate on assets increases from 5 to 6 percent, and the interest rate on liabilities increases from 3 to 4, percent the<br />

impact on the bank's profits per $100 of assets will be:<br />

A. An increase of $0.10<br />

B. A decrease of $0.10<br />

C. A reduction of $1.00<br />

D. Zero since the interest rates on assets and liabilities increased by the same amount<br />

18. The problem for a central bank setting a zero inflation policy would be:<br />

A. The risk of high employment<br />

B. It is impossible to have zero inflation<br />

C. Firms would have to cut nominal wages to reduce labor cost<br />

D. Economic growth would also have to be zero<br />

19. The consequences of an economy operating below its potential level include:<br />

A. Higher unemployment, but there is no effect on the future standard of living<br />

B. High rates of inflation<br />

C. A lower standard of living in the future, but no effect on unemployment<br />

D. Higher unemployment and a lower standard of living in the future<br />

20. For fiscal policymakers, one of the results of an independent central bank is:<br />

A. To finance government spending the Treasury has to order more currency from the central bank<br />

B. Fiscal policymakers always have to borrow to increase spending<br />

C. Fiscal policymakers cannot borrow unless the Federal Reserve prints more money<br />

D. Increased government spending has to be financed with either higher taxes or increased government borrowing