Taxable Municipal Guide - Piper Jaffray

Taxable Municipal Guide - Piper Jaffray

Taxable Municipal Guide - Piper Jaffray

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

September 2010<br />

its finances. However, this is where the similarities end. It is much easier for a corporation to file<br />

for bankruptcy protection than for a municipality for several reasons.<br />

First, states cannot file Chapter 9; this provision can only be used by a municipality, defined as a<br />

“political subdivision or public agency or instrumentality of a State.”<br />

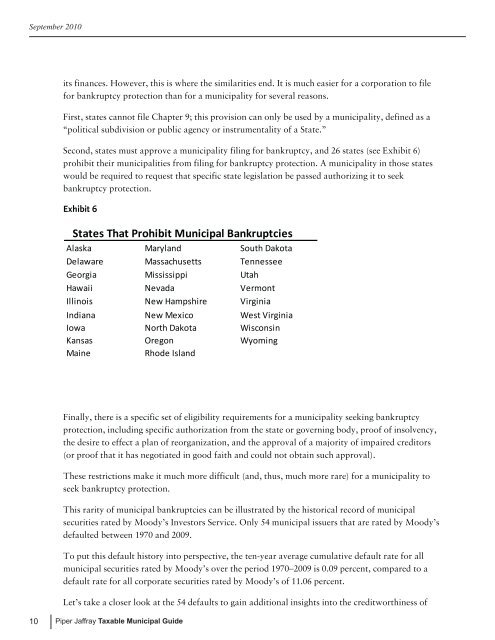

Second, states must approve a municipality filing for bankruptcy, and 26 states (see Exhibit 6)<br />

prohibit their municipalities from filing for bankruptcy protection. A municipality in those states<br />

would be required to request that specific state legislation be passed authorizing it to seek<br />

bankruptcy protection.<br />

Exhibit 6<br />

States That Prohibit <strong>Municipal</strong> Bankruptcies<br />

Alaska Maryland South Dakota<br />

Delaware Massachusetts Tennessee<br />

Georgia Mississippi Utah<br />

Hawaii Nevada Vermont<br />

Illinois New Hampshire Virginia<br />

Indiana New Mexico West Virginia<br />

Iowa North Dakota Wisconsin<br />

Kansas Oregon Wyoming<br />

Maine<br />

Rhode Island<br />

Finally, there is a specific set of eligibility requirements for a municipality seeking bankruptcy<br />

protection, including specific authorization from the state or governing body, proof of insolvency,<br />

the desire to effect a plan of reorganization, and the approval of a majority of impaired creditors<br />

(or proof that it has negotiated in good faith and could not obtain such approval).<br />

These restrictions make it much more difficult (and, thus, much more rare) for a municipality to<br />

seek bankruptcy protection.<br />

This rarity of municipal bankruptcies can be illustrated by the historical record of municipal<br />

securities rated by Moody’s Investors Service. Only 54 municipal issuers that are rated by Moody’s<br />

defaulted between 1970 and 2009.<br />

To put this default history into perspective, the ten-year average cumulative default rate for all<br />

municipal securities rated by Moody’s over the period 1970–2009 is 0.09 percent, compared to a<br />

default rate for all corporate securities rated by Moody’s of 11.06 percent.<br />

10<br />

Let’s take a closer look at the 54 defaults to gain additional insights into the creditworthiness of<br />

municipal issuers. Exhibit 7 shows the sectors of the 54 defaults by count.<br />

<strong>Piper</strong> <strong>Jaffray</strong> <strong>Taxable</strong> <strong>Municipal</strong> <strong>Guide</strong>