Taxable Municipal Guide - Piper Jaffray

Taxable Municipal Guide - Piper Jaffray

Taxable Municipal Guide - Piper Jaffray

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

September 2010<br />

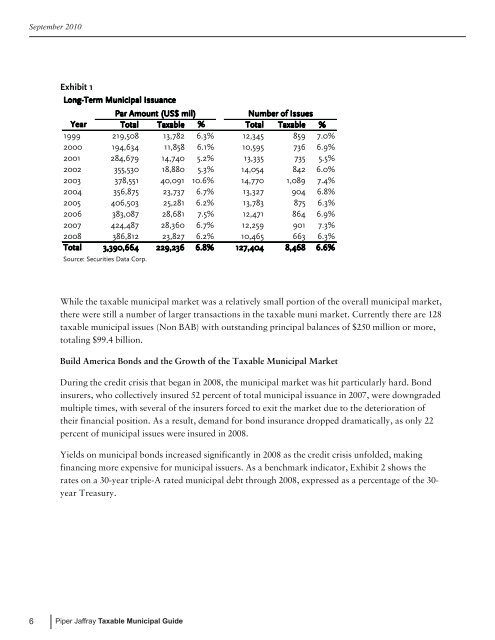

Exhibit 1<br />

Long-Term <strong>Municipal</strong> Issuance<br />

Par Amount (US$ mil)<br />

Number of Issues<br />

Year Total <strong>Taxable</strong> % Total <strong>Taxable</strong> %<br />

1999 219,508 13,782 6.3% 12,345 859 7.0%<br />

2000 194,634 11,858 6.1% 10,595 736 6.9%<br />

2001 284,679 14,740 5.2% 13,335 735 5.5%<br />

2002 355,530 18,880 5.3% 14,054 842 6.0%<br />

2003 378,551 40,091 10.6% 14,770 1,089 7.4%<br />

2004 356,875 23,737 6.7% 13,327 904 6.8%<br />

2005 406,503 25,281 6.2% 13,783 875 6.3%<br />

2006 383,087 28,681 7.5% 12,471 864 6.9%<br />

2007 424,487 28,360 6.7% 12,259 901 7.3%<br />

2008 386,812 23,827 6.2% 10,465 663 6.3%<br />

Total 3,390,664 229,236 6.8% 127,404 8,468 6.6%<br />

Source: Securities Data Corp.<br />

While the taxable municipal market was a relatively small portion of the overall municipal market,<br />

there were still a number of larger transactions in the taxable muni market. Currently there are 128<br />

taxable municipal issues (Non BAB) with outstanding principal balances of $250 million or more,<br />

totaling $99.4 billion.<br />

Build America Bonds and the Growth of the <strong>Taxable</strong> <strong>Municipal</strong> Market<br />

During the credit crisis that began in 2008, the municipal market was hit particularly hard. Bond<br />

insurers, who collectively insured 52 percent of total municipal issuance in 2007, were downgraded<br />

multiple times, with several of the insurers forced to exit the market due to the deterioration of<br />

their financial position. As a result, demand for bond insurance dropped dramatically, as only 22<br />

percent of municipal issues were insured in 2008.<br />

Yields on municipal bonds increased significantly in 2008 as the credit crisis unfolded, making<br />

financing more expensive for municipal issuers. As a benchmark indicator, Exhibit 2 shows the<br />

rates on a 30-year triple-A rated municipal debt through 2008, expressed as a percentage of the 30-<br />

year Treasury.<br />

6<br />

<strong>Piper</strong> <strong>Jaffray</strong> <strong>Taxable</strong> <strong>Municipal</strong> <strong>Guide</strong>