Taxable Municipal Guide - Piper Jaffray

Taxable Municipal Guide - Piper Jaffray

Taxable Municipal Guide - Piper Jaffray

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

September 2010<br />

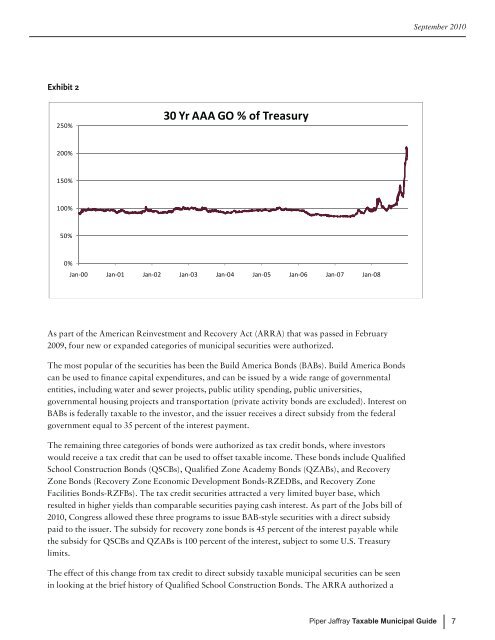

Exhibit 2<br />

250%<br />

30 Yr AAA GO % of Treasury<br />

200%<br />

150%<br />

100%<br />

50%<br />

0%<br />

Jan‐00 Jan‐01 Jan‐02 Jan‐03 Jan‐04 Jan‐05 Jan‐06 Jan‐07 Jan‐08<br />

As part of the American Reinvestment and Recovery Act (ARRA) that was passed in February<br />

2009, four new or expanded categories of municipal securities were authorized.<br />

The most popular of the securities has been the Build America Bonds (BABs). Build America Bonds<br />

can be used to finance capital expenditures, and can be issued by a wide range of governmental<br />

entities, including water and sewer projects, public utility spending, public universities,<br />

governmental housing projects and transportation (private activity bonds are excluded). Interest on<br />

BABs is federally taxable to the investor, and the issuer receives a direct subsidy from the federal<br />

government equal to 35 percent of the interest payment.<br />

The remaining three categories of bonds were authorized as tax credit bonds, where investors<br />

would receive a tax credit that can be used to offset taxable income. These bonds include Qualified<br />

School Construction Bonds (QSCBs), Qualified Zone Academy Bonds (QZABs), and Recovery<br />

Zone Bonds (Recovery Zone Economic Development Bonds-RZEDBs, and Recovery Zone<br />

Facilities Bonds-RZFBs). The tax credit securities attracted a very limited buyer base, which<br />

resulted in higher yields than comparable securities paying cash interest. As part of the Jobs bill of<br />

2010, Congress allowed these three programs to issue BAB-style securities with a direct subsidy<br />

paid to the issuer. The subsidy for recovery zone bonds is 45 percent of the interest payable while<br />

the subsidy for QSCBs and QZABs is 100 percent of the interest, subject to some U.S. Treasury<br />

limits.<br />

The effect of this change from tax credit to direct subsidy taxable municipal securities can be seen<br />

in looking at the brief history of Qualified School Construction Bonds. The ARRA authorized a<br />

<strong>Piper</strong> <strong>Jaffray</strong> <strong>Taxable</strong> <strong>Municipal</strong> <strong>Guide</strong><br />

7