Budget Document - City of Urbandale

Budget Document - City of Urbandale

Budget Document - City of Urbandale

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

anticipates an addition to the general fund balance <strong>of</strong> $317,966, again due to $475,800 in<br />

SAFER grant funds to be received. At the end <strong>of</strong> FY2011-12, it is estimated that the General<br />

Fund balance will represent 41.4% <strong>of</strong> annual operating expenses.<br />

In order to fund the expenditures contained in the recommended FY2011-12 budget, the<br />

general property tax levy rate will remain at $7.17/$1,000 <strong>of</strong> valuation. The debt service tax<br />

levy rate will be increased to $2.15/$1,000 <strong>of</strong> valuation, as programmed in the Capital<br />

Improvements Program. The Police and Fire Retirement tax levy rate will be increased to<br />

$0.20/$1,000 <strong>of</strong> valuation. Due to increases in valuation and above noted rate increases, the<br />

proposed cumulative tax levy rate <strong>of</strong> $9.52 will generate an additional $912,674 (4.3%) in<br />

property tax revenues when compared to FY2010-11.<br />

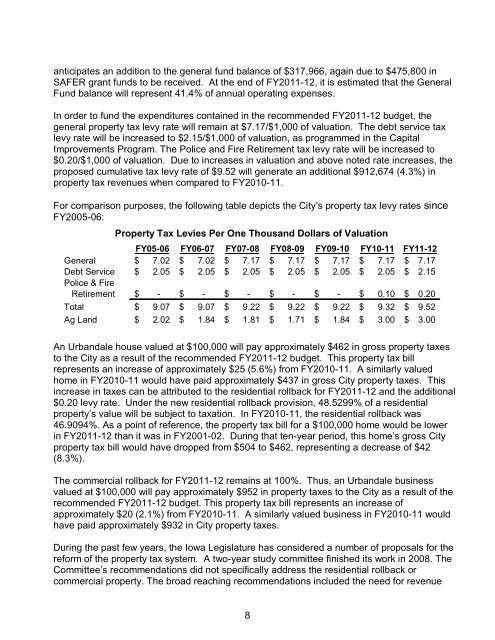

For comparison purposes, the following table depicts the <strong>City</strong>’s property tax levy rates since<br />

FY2005-06:<br />

Property Tax Levies Per One Thousand Dollars <strong>of</strong> Valuation<br />

FY05-06 FY06-07 FY07-08 FY08-09 FY09-10 FY10-11 FY11-12<br />

General $ 7.02 $ 7.02 $ 7.17 $ 7.17 $ 7.17 $ 7.17 $ 7.17<br />

Debt Service $ 2.05 $ 2.05 $ 2.05 $ 2.05 $ 2.05 $ 2.05 $ 2.15<br />

Police & Fire<br />

Retirement $ - $ - $ - $ - $ - $ 0.10 $ 0.20<br />

Total $ 9.07 $ 9.07 $ 9.22 $ 9.22 $ 9.22 $ 9.32 $ 9.52<br />

Ag Land $ 2.02 $ 1.84 $ 1.81 $ 1.71 $ 1.84 $ 3.00 $ 3.00<br />

An <strong>Urbandale</strong> house valued at $100,000 will pay approximately $462 in gross property taxes<br />

to the <strong>City</strong> as a result <strong>of</strong> the recommended FY2011-12 budget. This property tax bill<br />

represents an increase <strong>of</strong> approximately $25 (5.6%) from FY2010-11. A similarly valued<br />

home in FY2010-11 would have paid approximately $437 in gross <strong>City</strong> property taxes. This<br />

increase in taxes can be attributed to the residential rollback for FY2011-12 and the additional<br />

$0.20 levy rate. Under the new residential rollback provision, 48.5299% <strong>of</strong> a residential<br />

property’s value will be subject to taxation. In FY2010-11, the residential rollback was<br />

46.9094%. As a point <strong>of</strong> reference, the property tax bill for a $100,000 home would be lower<br />

in FY2011-12 than it was in FY2001-02. During that ten-year period, this home’s gross <strong>City</strong><br />

property tax bill would have dropped from $504 to $462, representing a decrease <strong>of</strong> $42<br />

(8.3%).<br />

The commercial rollback for FY2011-12 remains at 100%. Thus, an <strong>Urbandale</strong> business<br />

valued at $100,000 will pay approximately $952 in property taxes to the <strong>City</strong> as a result <strong>of</strong> the<br />

recommended FY2011-12 budget. This property tax bill represents an increase <strong>of</strong><br />

approximately $20 (2.1%) from FY2010-11. A similarly valued business in FY2010-11 would<br />

have paid approximately $932 in <strong>City</strong> property taxes.<br />

During the past few years, the Iowa Legislature has considered a number <strong>of</strong> proposals for the<br />

reform <strong>of</strong> the property tax system. A two-year study committee finished its work in 2008. The<br />

Committee’s recommendations did not specifically address the residential rollback or<br />

commercial property. The broad reaching recommendations included the need for revenue<br />

8