Untitled - Fundsupermart.com

Untitled - Fundsupermart.com

Untitled - Fundsupermart.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MACQUARIE UNIT TRUST SERIES<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2013<br />

9 Related party transactions/transactions with the Trustee, the Manager and their connected<br />

persons (continued)<br />

j) Bank borrowing (continued)<br />

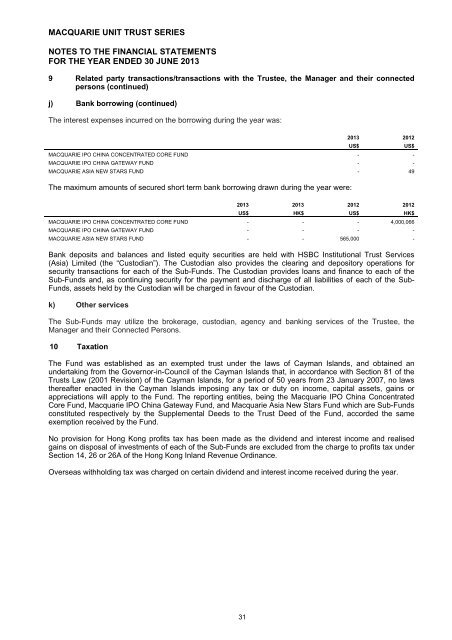

The interest expenses incurred on the borrowing during the year was:<br />

2013 2012<br />

US$<br />

US$<br />

MACQUARIE IPO CHINA CONCENTRATED CORE FUND - -<br />

MACQUARIE IPO CHINA GATEWAY FUND - -<br />

MACQUARIE ASIA NEW STARS FUND - 49<br />

The maximum amounts of secured short term bank borrowing drawn during the year were:<br />

2013 2013 2012 2012<br />

US$ HK$ US$ HK$<br />

MACQUARIE IPO CHINA CONCENTRATED CORE FUND - - - 4,000,066<br />

MACQUARIE IPO CHINA GATEWAY FUND - - - -<br />

MACQUARIE ASIA NEW STARS FUND - - 565,000 -<br />

Bank deposits and balances and listed equity securities are held with HSBC Institutional Trust Services<br />

(Asia) Limited (the “Custodian”). The Custodian also provides the clearing and depository operations for<br />

security transactions for each of the Sub-Funds. The Custodian provides loans and finance to each of the<br />

Sub-Funds and, as continuing security for the payment and discharge of all liabilities of each of the Sub-<br />

Funds, assets held by the Custodian will be charged in favour of the Custodian.<br />

k) Other services<br />

The Sub-Funds may utilize the brokerage, custodian, agency and banking services of the Trustee, the<br />

Manager and their Connected Persons.<br />

10 Taxation<br />

The Fund was established as an exempted trust under the laws of Cayman Islands, and obtained an<br />

undertaking from the Governor-in-Council of the Cayman Islands that, in accordance with Section 81 of the<br />

Trusts Law (2001 Revision) of the Cayman Islands, for a period of 50 years from 23 January 2007, no laws<br />

thereafter enacted in the Cayman Islands imposing any tax or duty on in<strong>com</strong>e, capital assets, gains or<br />

appreciations will apply to the Fund. The reporting entities, being the Macquarie IPO China Concentrated<br />

Core Fund, Macquarie IPO China Gateway Fund, and Macquarie Asia New Stars Fund which are Sub-Funds<br />

constituted respectively by the Supplemental Deeds to the Trust Deed of the Fund, accorded the same<br />

exemption received by the Fund.<br />

No provision for Hong Kong profits tax has been made as the dividend and interest in<strong>com</strong>e and realised<br />

gains on disposal of investments of each of the Sub-Funds are excluded from the charge to profits tax under<br />

Section 14, 26 or 26A of the Hong Kong Inland Revenue Ordinance.<br />

Overseas withholding tax was charged on certain dividend and interest in<strong>com</strong>e received during the year.<br />

31