Untitled - Fundsupermart.com

Untitled - Fundsupermart.com

Untitled - Fundsupermart.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MACQUARIE UNIT TRUST SERIES<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 2013<br />

11 Soft <strong>com</strong>mission arrangements<br />

The Manager may effect transactions, provided that any such transaction is consistent with standards of best<br />

execution, by or through the agency of another person for the account of each of the Sub-Funds with whom<br />

the Manager or any of its Connected Persons have an arrangement under which that party will from time to<br />

time provide to or procure for the Manager or any of its Connected Persons goods, services or other benefits<br />

(such as research and advisory services, <strong>com</strong>puter hardware associated with specialized software or<br />

research services and performance measures) the nature of which is such that their provision can<br />

reasonably be expected to benefit each of the Sub-Funds as a whole and may contribute to an improvement<br />

in the performance of each of the Sub-Funds. For the avoidance of doubt, such goods and services may not<br />

include travel, ac<strong>com</strong>modation, entertainment, general administrative goods or services, general office<br />

equipment or premises, membership fees, employees’ salaries or direct money payments.<br />

As at 30 June 2013 neither the Manager nor any of its Connected Persons received soft <strong>com</strong>missions from<br />

brokers or dealers in respect of transactions for the account of each of the Sub-Funds (2012: nil).<br />

12 Units<br />

Each of the Sub-Funds’ capital is represented by units. Unitholders who wish to realize their units may do so<br />

on any Dealing Day by submitting a realization request to the Service Provider to the Trustee or to an<br />

authorized distributor before the Dealing Deadline for the relevant Sub-Fund. They are entitled to payment of<br />

a proportionate share based on the respective Sub-Fund’s net asset value per unit on the redemption date.<br />

The relevant movements are shown on the statement of changes in net assets attributable to unitholders. In<br />

accordance with the objective outlined in note 1 and the risk management policies in note 4, each of the Sub-<br />

Funds endeavour to invest the subscriptions received in appropriate investments while maintaining sufficient<br />

liquidity to meet redemptions, such liquidity being augmented by short-term borrowings or disposal of<br />

investments in listed equity securities where necessary. With a view to protecting the interests of Unitholders,<br />

the Manager or the Trustee may suspend the realization of Units or delay the payment of realization<br />

proceeds during any periods if the number of Units of any Sub-Fund realized on any Dealing Day exceeds<br />

10 per cent. of the total number of Units of the relevant Sub-Fund in issue.<br />

The minimum initial investment for Units in the Sub-Funds is USD 3,000 with minimum subsequent<br />

subscriptions and redemptions of USD 1,000. The Manager or the Trustee may suspend the realisation of<br />

Units or delay the payment of realisation proceeds during any periods in which the determination of the Net<br />

Asset Value of the Sub-Fund is suspended.<br />

Meetings of Unitholders may be convened by the Manager or the Trustee, and the Unitholders of 10 per<br />

cent. or more in value of the Units in issue may require a meeting to be convened. Unitholders will be given<br />

not less than 21 days’ notice of any meeting. On a show of hands, every individual Unitholder present in<br />

period or by representative has one vote; on a poll every Unitholder present in person, by proxy or by<br />

repsentative has one vote for every Unit of which he is the holder.<br />

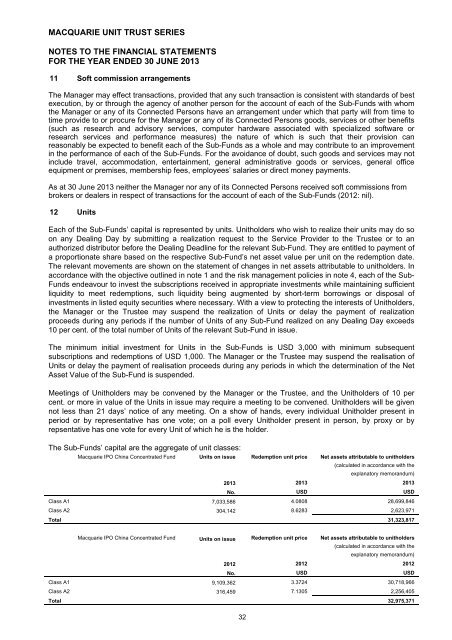

The Sub-Funds’ capital are the aggregate of unit classes:<br />

Macquarie IPO China Concentrated Fund Units on issue Redemption unit price Net assets attributable to unitholders<br />

(calculated in accordance with the<br />

explanatory memorandum)<br />

2013 2013 2013<br />

No. USD USD<br />

Class A1 7,033,586 4.0808 28,699,846<br />

Class A2 304,142 8.6283 2,623,971<br />

Total 31,323,817<br />

Macquarie IPO China Concentrated Fund Units on issue Redemption unit price Net assets attributable to unitholders<br />

(calculated in accordance with the<br />

explanatory memorandum)<br />

2012 2012 2012<br />

No. USD USD<br />

Class A1 9,109,362 3.3724 30,718,966<br />

Class A2 316,459 7.1305 2,256,405<br />

Total 32,975,371<br />

32