full story - Caribbean Cement Company Limited

full story - Caribbean Cement Company Limited

full story - Caribbean Cement Company Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

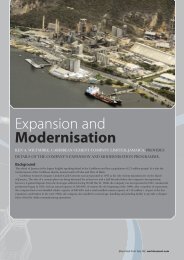

IFC Supports Expansion and Modernization of <strong>Cement</strong> Group in the <strong>Caribbean</strong><br />

Kingston, Jamaica, July 22, 2005.- The International Finance Corporation, the private<br />

sector arm of the World Bank Group, facilitated Trinidad <strong>Cement</strong> <strong>Limited</strong> (TCL) in<br />

structuring and arranging a US$105 million equivalent financing package that will help<br />

TCL expand and modernize its Jamaican subsidiary, Carib <strong>Cement</strong>, while reducing<br />

carbon emissions and improving environmental standards. The TCL Group is the<br />

dominant supplier and only integrated cement producer in the English-speaking<br />

<strong>Caribbean</strong>.<br />

Today IFC signed an agreement with TCL to<br />

provide US$35 million in senior and<br />

subordinated loans. In addition, IFC helped<br />

TCL raise financing totaling US$70 million<br />

equivalent from regional banks, which<br />

includes a US$20 million loan and a US$50<br />

million equivalent bond issue in Trinidad and<br />

Tobago dollars. Republic Finance and<br />

Merchant Bank Ltd in Trinidad are<br />

undertaking both the local loan and the bond<br />

issue.<br />

Brian Young, Chairman of Carib <strong>Cement</strong>, said, “Using its considerable global<br />

experience, knowledge of the cement industry, and expertise in sustainability, IFC is<br />

supporting Carib <strong>Cement</strong>’s long-term plans and investment program, which will<br />

significantly improve efficiency and lower costs.” He added, “We value IFC’s<br />

commitment as a long-term partner and are pleased that it responded to our tight schedule<br />

for funding in a very prompt and efficient manner.”<br />

The TCL Group is currently strengthening the cement sector of its business by expanding<br />

capacity and optimizing its plants. The company is establishing cement terminals<br />

regionally, thus geographically diversifying its concrete operations. It is also introducing<br />

new products, such as Carib <strong>Cement</strong> Plus in Jamaica<br />

Kirk Ifill, IFC’s <strong>Caribbean</strong> Regional<br />

Manager based in Trinidad and Tobago,<br />

noted, “This is an excellent example of how<br />

IFC provides value added services to<br />

companies, in addition to capital. It is a<br />

landmark investment for Jamaica, as IFC is<br />

leveraging TCL’s regional presence to help<br />

Carib <strong>Cement</strong> access financing in Trinidad<br />

and Tobago at longer tenures and better<br />

terms. The company would otherwise be

constrained by Jamaica’s sovereign ceiling for long-term debt.” He added, “The<br />

investment launches an important partnership with the TCL Group in a high-impact<br />

segment of the Jamaican economy.”<br />

IFC’s investment will help improve the local availability of cement and will promote<br />

investment in infrastructure, industry, and the housing sector. Carib <strong>Cement</strong>’s<br />

modernization of the plant will improve its environmental performance, including<br />

significant reducing its emissions of carbon dioxide, a greenhouse gas that contributes to<br />

global warming and climate change. This reduction should make the operation eligible<br />

for carbon credits under the IFC-Netherlands Carbon Facility – a first for Carib <strong>Cement</strong><br />

and for IFC in the <strong>Caribbean</strong>.<br />

In the <strong>Caribbean</strong>, IFC is the leader in providing long-term financial instruments and<br />

sustainability products to help companies grow and compete in the global economy. In<br />

the last five years, IFC's <strong>Caribbean</strong> portfolio has tripled from $173 million in FY01 to<br />

$541 million today. The major sectors of IFC's portfolio in the <strong>Caribbean</strong> are finance and<br />

insurance ($130 million), utilities ($112 million), transportation ($95 million),<br />

manufacturing ($63 million), tourism ($46 million), and telecommunications ($45<br />

million).<br />

The mission of IFC (www.ifc.org) is to promote sustainable private sector investment in<br />

developing countries, helping to reduce poverty and improve people’s lives. IFC finances<br />

private sector investments in the developing world, mobilizes capital in the international<br />

financial markets, helps clients improve social and environmental sustainability, and<br />

provides technical assistance and advice to governments and businesses. From its<br />

founding in 1956 through FY04, IFC has committed more than $44 billion of its own<br />

funds and arranged $23 billion in syndications for 3,143 companies in 140 developing<br />

countries. IFC’s worldwide committed portfolio as of FY04 was $17.9 billion for its own<br />

account and $5.5 billion held for participants in loan syndications.<br />

A major objective of the TCL Group’s expansion plan is to satisfy a regional market that<br />

continues to be very buoyant, as construction activity remains very strong. The Group is<br />

positioning itself to satisfy its markets and to take advantage of opportunities for<br />

additional exports. The outcome of the capacity expansion will be a lower cost of<br />

production per ton of cement, which will increase the company’s competitiveness.