Life Series Funds - First Investors

Life Series Funds - First Investors

Life Series Funds - First Investors

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Portfolio of Investments (continued)<br />

CASH MANAGEMENT FUND<br />

June 30, 2013<br />

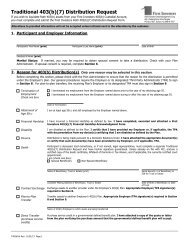

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs<br />

to establish a classification of fair value measurements for disclosure purposes. The three-tier<br />

hierarchy of inputs is summarized in the three broad Levels listed below:<br />

Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has<br />

the ability to access.<br />

Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for<br />

the asset or liability, either directly or indirectly. These inputs may include quoted prices<br />

for the identical instrument on an inactive market, prices for similar instruments, interest<br />

rates, prepayment speeds, credit risk, yield curves, default rates and similar data.<br />

Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs<br />

are not available, representing the Fund’s own assumption about the assumptions a<br />

market participant would use in valuing the asset or liability, and would be based on<br />

the best information available.<br />

The inputs methodology used for valuing securities are not necessarily an indication of the risk<br />

associated with investing in those securities. For example, amortized cost approximates the current<br />

fair value of a security, but since the value is not obtained from a quoted price in an active market,<br />

such securities are reflected as Level 2.<br />

The following is a summary, by category of Level, of inputs used to value the Fund’s investments<br />

as of June 30, 2013:<br />

Level 1 Level 2 Level 3 Total<br />

U.S. Government Agency<br />

Obligations. . . . . . . . . . . . . . . . $ — $ 3,160,534 $ — $ 3,160,534<br />

Variable and Floating Rate Notes:<br />

Municipal Bonds . . . . . . . . . . . — 900,000 — 900,000<br />

U.S. Government Agency<br />

Obligations. . . . . . . . . . . . . . — 1,320,063 — 1,320,063<br />

Corporate Notes . . . . . . . . . . . . . . — 2,099,649 — 2,099,649<br />

Short-Term U.S. Government<br />

Obligations. . . . . . . . . . . . . . . . — 2,449,894 — 2,449,894<br />

Total Investments in Securities . . . $ — $ 9,930,140 $ — $ 9,930,140<br />

There were no transfers into or from Level 1 and Level 2 by the Fund for the period ended<br />

June 30, 2013. Transfers, if any, between Levels are recognized at the end of the reporting period.<br />

8<br />

See notes to financial statements