Commodity Futures in India â A Product of ... - MCX in Marathi

Commodity Futures in India â A Product of ... - MCX in Marathi

Commodity Futures in India â A Product of ... - MCX in Marathi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Commodity</strong> <strong>Futures</strong><br />

<strong>in</strong> <strong>India</strong> – A <strong>Product</strong> <strong>of</strong><br />

Globalisation and<br />

Liberalisation<br />

By Mr. Lamon Rutten<br />

A beg<strong>in</strong>n<strong>in</strong>g has been made towards transform<strong>in</strong>g the <strong>India</strong>n commodities sector, from its<br />

current status <strong>of</strong> be<strong>in</strong>g a ‘price taker’ to a ‘price setter’, with the national onl<strong>in</strong>e commodity<br />

futures exchanges tak<strong>in</strong>g the lead. These exchanges are <strong>of</strong>fer<strong>in</strong>g the benefits <strong>of</strong><br />

liberalisation and globalisation directly to the <strong>in</strong>dustry and consumers by empower<strong>in</strong>g<br />

them to <strong>in</strong>fluence the global prices <strong>of</strong> commodities they deal <strong>in</strong>. It is time the markets were<br />

made much more vibrant and efficient by allow<strong>in</strong>g participation <strong>of</strong> a larger number <strong>of</strong> new<br />

categories <strong>of</strong> economic stakeholders and <strong>in</strong>troduction <strong>of</strong> <strong>in</strong>novative derivative<br />

<strong>in</strong>struments. This is to plug risks at the roots rather than when they f<strong>in</strong>ally sneak <strong>in</strong>to the<br />

prices <strong>of</strong> end products. And this will make the <strong>India</strong>n markets a force to reckon with on the<br />

global commodity map, turn<strong>in</strong>g them <strong>in</strong>to a ‘price setter’ <strong>in</strong>deed.<br />

Economic liberalisation took <strong>of</strong>f <strong>in</strong> the early 1990s <strong>in</strong><br />

<strong>India</strong>. Like <strong>in</strong> many countries, policymakers,<br />

practitioners and academics responded to the growth<br />

<strong>of</strong> f<strong>in</strong>ancial markets worldwide, and a new-found<br />

ebullience surround<strong>in</strong>g emerg<strong>in</strong>g markets, by<br />

advocat<strong>in</strong>g wide-rang<strong>in</strong>g reforms. International trade<br />

and <strong>in</strong>vestment were opened up, a process <strong>of</strong><br />

deregulation and privatisation <strong>in</strong>itiated, the tax regime<br />

reviewed.<br />

<strong>India</strong>'s economy greatly benefitted. In 2007, the<br />

country clocked its highest ever GDP growth rate <strong>of</strong> 9%<br />

the second-fastest <strong>in</strong> the world after Ch<strong>in</strong>a and a far cry<br />

from its annual GDP growth <strong>in</strong> the three decades post-<br />

Independence. However, the reform process is still<br />

<strong>in</strong>complete, and the f<strong>in</strong>ancial sector has been lagg<strong>in</strong>g<br />

beh<strong>in</strong>d many parts <strong>of</strong> the real economy. Stakeholders<br />

have still not reaped the fruits <strong>of</strong> greater competition <strong>in</strong><br />

f<strong>in</strong>ancial markets, unlike what has been seen <strong>in</strong> sectors<br />

such as telecom, bank<strong>in</strong>g, <strong>in</strong>surance, and aviation. But<br />

now, <strong>India</strong>n f<strong>in</strong>ancial markets are poised to scale to the<br />

next growth orbit.<br />

<strong>India</strong> <strong>in</strong>creas<strong>in</strong>gly <strong>in</strong>tegrates with markets around the<br />

world. This opens a w<strong>in</strong>dow <strong>of</strong> opportunity to <strong>India</strong>n<br />

companies but also, exposes them to a whole new<br />

world <strong>of</strong> risks. Among these risks, <strong>of</strong> key importance to<br />

many, is commodity price volatility. Companies need to<br />

be able to manage these risks if they are to be globally<br />

competitive, and this is where an efficient commodity<br />

futures market plays a primordial role not only <strong>in</strong><br />

facilitat<strong>in</strong>g price/volatility risk mitigation but also<br />

catalys<strong>in</strong>g near-perfect price discovery.<br />

After decades <strong>of</strong> decay, <strong>India</strong>'s organised futures<br />

<strong>in</strong>dustry was revived <strong>in</strong> 2003. As it matures over time, its<br />

backward and forward l<strong>in</strong>kages will strengthen,<br />

result<strong>in</strong>g <strong>in</strong> widen<strong>in</strong>g and deepen<strong>in</strong>g <strong>of</strong> the market<br />

through <strong>in</strong>creased participation by various ecosystem<br />

players. This <strong>in</strong> turn is chang<strong>in</strong>g the ways producers<br />

make their cropp<strong>in</strong>g decisions, traders trade their<br />

products, and banks lend aga<strong>in</strong>st commodities or<br />

those with exposure to commodity price risk. The<br />

ultimate results will be 'F<strong>in</strong>ancial Inclusion' and 'Market<br />

Inclusive' growth.<br />

The Enabler <strong>of</strong> Efficient Price Risk Management and<br />

Price Discovery<br />

The price discovery process should not be left to just a<br />

handful <strong>of</strong> traders <strong>in</strong> asymmetrically <strong>in</strong>formed or ill<strong>in</strong>formed,<br />

segmented markets. Rather, the best price<br />

discovery comes when a large number <strong>of</strong> various<br />

categories <strong>of</strong> market players with a wide range <strong>of</strong><br />

22 | A PUBLICATION BY <strong>MCX</strong> AND PRICEWATERHOUSECOOPERS

objectives and <strong>in</strong>terests converge on an organized<br />

futures platform. Such a platform and the Multi<br />

<strong>Commodity</strong> Exchange <strong>of</strong> <strong>India</strong> Ltd. (<strong>MCX</strong>) is one<br />

ensures that all relevant <strong>in</strong>formation is absorbed <strong>in</strong> the<br />

price formation process, and the “right price” is<br />

discovered. The more efficient the discovered prices on<br />

a futures platform is, the more effective are the<br />

bus<strong>in</strong>ess and policy decisions that are taken based on<br />

these prices.<br />

The efficiency and transparency <strong>of</strong> price discovery<br />

depends on the robustness <strong>of</strong> the trad<strong>in</strong>g platform; its<br />

regulations; the right mix <strong>of</strong> its participants with<br />

relevant price <strong>in</strong>formation; mak<strong>in</strong>g participation costeffective<br />

vis-à-vis alternatives available for risk<br />

management and/or <strong>in</strong>vestment; effec tive<br />

management <strong>of</strong> the participants' varied risks and, last<br />

but not the least, a robust and transparent clear<strong>in</strong>g<br />

policy.<br />

In just about six years, the national commodity futures<br />

exchanges <strong>in</strong> <strong>India</strong> performed better than the<br />

policymakers expected <strong>in</strong> terms <strong>of</strong> catch<strong>in</strong>g up with<br />

their age-old global counterparts on most <strong>of</strong> the<br />

aforesaid parameters. A lot <strong>of</strong> efforts delivered from a<br />

base <strong>of</strong> strong doma<strong>in</strong> knowledge and technical skills<br />

went beh<strong>in</strong>d this spectacular growth. Selection <strong>of</strong><br />

commodities relevant to the stakeholders; right<br />

contract design; keep<strong>in</strong>g ears and eyes to market<br />

needs; tak<strong>in</strong>g them to appropriate participants;<br />

creat<strong>in</strong>g awareness; expand<strong>in</strong>g <strong>in</strong>frastructure; and<br />

br<strong>in</strong>g<strong>in</strong>g <strong>in</strong> world-class technology and global best<br />

practices are some worth mention<strong>in</strong>g.<br />

To make these markets more relevant and useful to<br />

different categories <strong>of</strong> stakeholders and thus their<br />

participation more effective, it is necessary that various<br />

risks to the participants be effectively managed. Risk<br />

management tools on a futures platform <strong>in</strong>clude<br />

marg<strong>in</strong><strong>in</strong>g, limits on open positions, and effective<br />

surveillance (see table 1). Price volatility <strong>of</strong><br />

commodities traded on an exchange is an <strong>in</strong>dicator <strong>of</strong><br />

how effectively these tools are used by the exchange<br />

managers to improve the efficiency <strong>of</strong> price discovery.<br />

That is to gauge the capability <strong>of</strong> its futures contracts to<br />

predict its maturity prices more accurately (<strong>in</strong>dicated<br />

by the percentage deviation between the first traded<br />

price and the last traded price <strong>of</strong> a given contract). The<br />

efficiency <strong>of</strong> price discovery is also <strong>in</strong>dicated by the<br />

nearness <strong>of</strong> the spot and futures price movements. In<br />

the case <strong>of</strong> <strong>MCX</strong>, the correlation between its gold<br />

futures contract and gold spot prices is around 99.8%<br />

(from January 2007 to August 2009), which <strong>in</strong>dicates a<br />

strong <strong>in</strong>ter-l<strong>in</strong>kage between domestic spot and<br />

futures markets. For the same period, <strong>MCX</strong> gold<br />

contract's correlation with the global benchmark,<br />

COMEX gold futures contract, is around 99.9% (the<br />

rupee adjusted). This reflects how efficient the <strong>India</strong>n<br />

futures market is <strong>in</strong> captur<strong>in</strong>g global cues.<br />

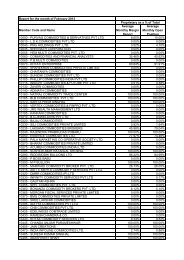

Table 1: <strong>MCX</strong> vis-à-vis global parameters<br />

Particulars<br />

Domestic Exchanges<br />

<strong>Commodity</strong><br />

exchange (<strong>MCX</strong>)<br />

Stock<br />

exchange (NSE)<br />

Global Exchanges<br />

COMEX<br />

and CBOT<br />

Remarks<br />

Position limit to<br />

physical market<br />

size (%)<br />

Gold - 0.9%<br />

-<br />

COMEX Gold - 18.7%<br />

Position limit is significantly lower than that<br />

<strong>of</strong> global benchmark exchanges <strong>in</strong>dicat<strong>in</strong>g<br />

that the domestic futures market cannot be<br />

distorted by s<strong>in</strong>gle/a few players.<br />

Avg. daily volatility<br />

<strong>in</strong> January 2007<br />

to August 2009<br />

Gold - 1.3%,<br />

Ref. Soy Oil - 1.2%<br />

<strong>MCX</strong> Comdex<br />

- 1.4%.<br />

NIFTY - 1.60%<br />

COMEX Gold - 1.5%<br />

CBOT Soybean Oil<br />

- 2.1%<br />

The lower price volatility on <strong>MCX</strong> compared<br />

with global exchanges reflects that price<br />

discovery on the domestic platform is<br />

happen<strong>in</strong>g with more price stability.<br />

Impact cost<br />

Gold - 0.027%<br />

NIFTY - 0.16%<br />

COMEX Gold - 0.019%<br />

The lower impact cost on <strong>MCX</strong> at par with<br />

global exchanges reflects better liquidity <strong>in</strong><br />

terms <strong>of</strong> market depth and width.<br />

Note: In the case <strong>of</strong> price discovery, we considered August 2009 contracts – <strong>MCX</strong> Gold contract, COMEX Gold and Nifty <strong>Futures</strong>.<br />

Impact cost <strong>of</strong> the S&P CNX Nifty for a portfolio size <strong>of</strong> Rs.2 crore sourced from NSE website on September 9, 2009.<br />

Impact cost for Nifty was calculated based on trad<strong>in</strong>g happened on a regular trad<strong>in</strong>g day. Impact cost <strong>of</strong> <strong>MCX</strong> gold calculated for a portfolio size <strong>of</strong> Rs.2 crore.<br />

Impact cost <strong>of</strong> COMEX Gold calculated for a portfolio <strong>of</strong> USD4 lakh (app. Rs.2 crore).<br />

EXPERTS’ VIEWS | 23

Aga<strong>in</strong>, as the same table shows, <strong>MCX</strong> gold contract is<br />

more efficient than COMEX gold contract <strong>in</strong> terms <strong>of</strong><br />

price discovery. The lower volatility on the <strong>India</strong>n<br />

commodity exchanges is due to the close monitor<strong>in</strong>g<br />

and the robust marg<strong>in</strong><strong>in</strong>g system adopted by them.<br />

<strong>MCX</strong> follows strict vigilance with an automated system<br />

<strong>in</strong> place. The system, for example, provides automated<br />

alerts when a member’s marg<strong>in</strong> utilization crosses<br />

various levels. If the marg<strong>in</strong> utilization crosses 100%,<br />

the member <strong>in</strong> question is put automatically on a<br />

“square <strong>of</strong>f” mode. This <strong>in</strong>novative risk management<br />

system has been adopted to prevent any spread <strong>of</strong><br />

f<strong>in</strong>ancial contagion. Besides the functional efficiency <strong>of</strong><br />

trad<strong>in</strong>g, the technological robustness (both hardware<br />

and s<strong>of</strong>tware) also adds value to the <strong>MCX</strong> participants<br />

by enabl<strong>in</strong>g cost reduction. It has a constant<br />

collaboration with FTIL, the parent company, aimed at<br />

improv<strong>in</strong>g the s<strong>of</strong>tware through telecom technology,<br />

and this works towards cost-effectively connect<strong>in</strong>g the<br />

stakeholders to the market.<br />

<strong>Commodity</strong> Derivatives - the Road So Far<br />

The <strong>in</strong>troduction <strong>of</strong> commodity derivatives has<br />

rema<strong>in</strong>ed one <strong>of</strong> the most significant developments <strong>in</strong><br />

the <strong>India</strong>n commodity market sector. The three<br />

national onl<strong>in</strong>e exchanges brought <strong>in</strong> revolutionary<br />

changes <strong>in</strong> this sector by br<strong>in</strong>g<strong>in</strong>g <strong>in</strong> spatial <strong>in</strong>tegration<br />

and temporal price discovery <strong>of</strong> commodities at the<br />

national level. In the span <strong>of</strong> just six years, they have<br />

performed well, be<strong>in</strong>g successful <strong>in</strong> br<strong>in</strong>g<strong>in</strong>g various<br />

ecosystem participants such as producers, hedgers,<br />

arbitragers, and speculators on to a s<strong>in</strong>gle platform. The<br />

annual turnover <strong>of</strong> domestic commodity exchanges<br />

<strong>in</strong>creased from Rs.5.7 lakh crore ($127.6 billion) dur<strong>in</strong>g<br />

2004-05 to about Rs.52.48 lakh crore ($1,143.1 billion)<br />

<strong>in</strong> 2008-09 at 74.10% CAGR.<br />

The exchanges clocked this robust growth despite<br />

cont<strong>in</strong>uance <strong>of</strong> various restrictions. For example, on<br />

<strong>in</strong>struments such as options and <strong>in</strong>dices; participation<br />

<strong>of</strong> commercial banks, mutual funds and FIIs; and so on.<br />

What helped these exchanges to leap forward and<br />

atta<strong>in</strong> higher levels <strong>of</strong> efficiency and trade volumes are<br />

their <strong>in</strong>novative products, functional transparency<br />

based on sound regulation, <strong>in</strong>novative applications <strong>of</strong><br />

technology, effective adoption <strong>of</strong> global best practices,<br />

etc. These exchanges’ efforts and performance helped<br />

make <strong>India</strong>n companies and economy globally<br />

competitive. The robust growth numbers reflect the<br />

stakeholders’ strong faith <strong>in</strong> these exchanges’<br />

functional efficiency and transparency, as well as<br />

<strong>in</strong>dicate the commodity markets’ grow<strong>in</strong>g <strong>in</strong>fluence<br />

over the <strong>India</strong>n economy. The prices efficiently and<br />

transparently discovered on these exchanges are<br />

gradually be<strong>in</strong>g transmitted to the physical markets,<br />

and this will lead to <strong>in</strong>creased competitiveness both <strong>in</strong><br />

the manufactur<strong>in</strong>g and services sectors.<br />

Global commodities traded on these <strong>India</strong>n exchanges,<br />

such as bullion, ferrous and non-ferrous metals<br />

(copper, alum<strong>in</strong>ium, steel, etc) and energy (crude oil<br />

and natural gas), account for more than 80% <strong>of</strong> their<br />

average daily turnover. These commodities are largely<br />

l<strong>in</strong>ked to the global markets as their imports and<br />

exports are allowed subject to a marg<strong>in</strong>al tariff<br />

<strong>in</strong>cidence. Obviously, most <strong>of</strong> these commodities are<br />

largely governed by their fundamentals (the supply<br />

and demand conditions) at the global level and partly<br />

by developments on the domestic front. Therefore, it is<br />

necessary for the users <strong>of</strong> these commodities to take<br />

positions on a futures platform with global l<strong>in</strong>kages <strong>in</strong><br />

order to hedge their risk. Such users may participate <strong>in</strong><br />

exchange-traded contracts with their underly<strong>in</strong>g<br />

physicals be<strong>in</strong>g the same as their raw materials and<br />

whose prices are l<strong>in</strong>ked to the prices discovered on the<br />

<strong>in</strong>ternational benchmark exchanges. But <strong>in</strong> the<br />

absence <strong>of</strong> such an arrangement, trad<strong>in</strong>g on<br />

exchanges hav<strong>in</strong>g the right mix <strong>of</strong> arbitragers between<br />

the domestic and global benchmark exchanges will<br />

also serve the hedg<strong>in</strong>g purpose. However, the second<br />

option may not be workable due to lack <strong>of</strong> clear<br />

participation norms for <strong>in</strong>ternational exchanges, while<br />

the option <strong>of</strong> <strong>in</strong>direct participation will be costly for<br />

most <strong>of</strong> today’s corporate hedgers.<br />

For globally traded commodities, particularly metals<br />

and crude oil, the prices discovered on <strong>MCX</strong> have very<br />

high correlation (96%, on an average) with the<br />

<strong>in</strong>ternational benchmarks (see table 2) despite the high<br />

volatility <strong>in</strong> USDINR <strong>in</strong> the recent past. This also shows<br />

that the prices <strong>of</strong> <strong>MCX</strong>’s futures on globally traded<br />

commodity follow efficiently — and <strong>in</strong> tandem — the<br />

comb<strong>in</strong>ed forces <strong>of</strong> domestic and <strong>in</strong>ternational<br />

fundamentals. And this makes the domestic onl<strong>in</strong>e<br />

exchanges a cost-effective and superior alternative to<br />

their <strong>in</strong>ternational counterparts.<br />

Table 2: Price correlation – <strong>MCX</strong> vs. global benchmark<br />

exchanges <strong>in</strong> globally-l<strong>in</strong>ked commodities from<br />

Apr ‘05-Mar ’09 (<strong>in</strong> %)<br />

Gold 94.3<br />

Silver 94.8<br />

Copper 94.4<br />

Crude oil 97.6<br />

Average 96.0<br />

Data Source: Exchanges' websites<br />

24 | A PUBLICATION BY <strong>MCX</strong> AND PRICEWATERHOUSECOOPERS

The Way Forward<br />

At this juncture when the <strong>India</strong>n markets are on their<br />

way to the heights achieved by the global benchmark<br />

markets, it is essential that they are allowed to have the<br />

right mix <strong>of</strong> participants —and products — to have the<br />

necessary liquidity depth and width. Corporates and<br />

physical market players <strong>in</strong> <strong>India</strong> are gradually realis<strong>in</strong>g<br />

the importance and need to participate on commodity<br />

exchanges. An <strong>in</strong>creased participation <strong>of</strong> such players<br />

will go a long way <strong>in</strong> streaml<strong>in</strong><strong>in</strong>g commodity trad<strong>in</strong>g<br />

<strong>in</strong> <strong>India</strong> by br<strong>in</strong>g<strong>in</strong>g <strong>in</strong> relevant <strong>in</strong>formation about the<br />

fundamentals <strong>in</strong>to the markets and, thus, mak<strong>in</strong>g the<br />

price discovery process more efficient. Besides, this will<br />

also help corporate best practices percolate <strong>in</strong>to the<br />

markets to f<strong>in</strong>e-tune their function<strong>in</strong>g and efficiency.<br />

Given the current trend <strong>of</strong> globalisation <strong>of</strong> economies,<br />

competitiveness rema<strong>in</strong>s one <strong>of</strong> the most def<strong>in</strong><strong>in</strong>g<br />

factors for develop<strong>in</strong>g economies. And this not only<br />

means hav<strong>in</strong>g competitive manufactur<strong>in</strong>g and services<br />

sectors but also necessitates promotion <strong>of</strong> markets to<br />

make them globally-competitive.<br />

To cite an example, <strong>in</strong> I ndia, neither the<br />

automobile/ancillary <strong>in</strong>dustries manage their <strong>in</strong>put<br />

costs effectively nor do the suppliers <strong>of</strong> their raw<br />

materials. This is partly due to lack <strong>of</strong> policy guidel<strong>in</strong>es<br />

allow<strong>in</strong>g and promot<strong>in</strong>g them to effectively participate<br />

<strong>in</strong> the market and partly because <strong>of</strong> lack <strong>of</strong> awareness<br />

on their part. However, <strong>of</strong> late, the com<strong>in</strong>g up <strong>of</strong> the<br />

national commodity exchanges, armed with their<br />

global alliances, has provided <strong>in</strong>dustrial users <strong>of</strong><br />

primary commodities with easy access to an alternative<br />

platform to trade on. The domestic exchanges <strong>of</strong>fer<strong>in</strong>g<br />

such an opportunity to the <strong>in</strong>dustry ought to be<br />

effectively harnessed to efficiently manage their pr<strong>of</strong>it<br />

marg<strong>in</strong>s and safeguard their <strong>in</strong>vestor and consumer<br />

<strong>in</strong>terests by <strong>in</strong>fus<strong>in</strong>g efficiency and economy <strong>in</strong>to their<br />

procurement operations. Effectiveness <strong>of</strong> participation<br />

<strong>in</strong> global exchanges can only be replicated if the<br />

domestic exchanges meet the efficiency <strong>of</strong> trad<strong>in</strong>g <strong>in</strong><br />

the global benchmark exchanges, especially <strong>in</strong> the<br />

globally traded commodities (with least trade<br />

distortions).<br />

Although <strong>India</strong> has a long way to cover <strong>in</strong> harness<strong>in</strong>g<br />

the potential <strong>in</strong> the major commodities, the story <strong>of</strong> its<br />

bullion market is bright. The <strong>India</strong>n bullion market has<br />

demonstrated its resilience to rema<strong>in</strong> the “price setter”<br />

for gold and silver <strong>in</strong> the Euro-Asian time zone. <strong>India</strong>n<br />

(<strong>MCX</strong>) bullion prices have strong correlation with those<br />

<strong>of</strong> the <strong>in</strong>ternational benchmark markets.<br />

Gone are those days when policymakers successfully<br />

used MSP as an <strong>in</strong>strument to <strong>in</strong>fluence the cropp<strong>in</strong>g<br />

pattern and production <strong>of</strong> farmers. It is the function<strong>in</strong>g<br />

<strong>of</strong> the domestic commodity exchanges which will<br />

strengthen the market-based trad<strong>in</strong>g system <strong>in</strong> <strong>India</strong><br />

mak<strong>in</strong>g it useful for Government procurement. The<br />

exchanges will create an environment where farmers<br />

have multiple sell<strong>in</strong>g options (for their produce) such<br />

as the spot market, the futures market, and the futures<br />

market-referred over-the-counter forward market. The<br />

futures market <strong>in</strong> electronic format be<strong>in</strong>g executable at<br />

the national level, <strong>in</strong>tegration <strong>of</strong> banks and<br />

<strong>in</strong>stitutional traders <strong>in</strong>to the market will create several<br />

<strong>in</strong>stitutional options for farmers. Further, once allowed<br />

options will help farmers lock <strong>in</strong> their prices on the<br />

commodity exchanges <strong>in</strong> a more efficient way than<br />

they can currently do with the exist<strong>in</strong>g <strong>in</strong>struments.<br />

Besides the price risk, which can be mitigated by<br />

trad<strong>in</strong>g <strong>in</strong> relevant commodity derivatives, the weather<br />

risk has a pr<strong>of</strong>ound impact on a farmer’s <strong>in</strong>come under<br />

the predom<strong>in</strong>antly ra<strong>in</strong>fed farm<strong>in</strong>g (about 70% <strong>of</strong> net<br />

cultivated area) conditions prevalent <strong>in</strong> <strong>India</strong>. And if<br />

there could be a s<strong>in</strong>gle most positive and def<strong>in</strong><strong>in</strong>g step<br />

that can be taken towards solutions to such problems<br />

as mentioned above it shall be the passage <strong>of</strong> the longpend<strong>in</strong>g<br />

amendment to For ward Contracts<br />

(Regulation) Act. The Act, once effective, will work<br />

towards an efficient and vibrant commodity market <strong>in</strong><br />

<strong>India</strong> (both on the physical and futures fronts) and<br />

br<strong>in</strong>g a world <strong>of</strong> good to the entire commodity market<br />

ecosystem. The multi-faceted benefits will <strong>in</strong>clude<br />

<strong>in</strong>troduction <strong>of</strong> a number <strong>of</strong> <strong>in</strong>novative <strong>in</strong>struments,<br />

such as farmer-friendly weather derivatives.<br />

<strong>India</strong> is a land <strong>of</strong> billions that<br />

consume a large portion <strong>of</strong> most<br />

primary commodities produced <strong>in</strong><br />

the country. For the domestic<br />

exchanges to rise to the challenge<br />

<strong>of</strong> turn<strong>in</strong>g the country <strong>in</strong>to a ‘price<br />

setter’ it is necessary that <strong>India</strong> has<br />

strong and transparent markets<br />

with robust <strong>in</strong>frastructure for<br />

efficient transactions.<br />

EXPERTS’ VIEWS | 25

<strong>India</strong> is a land <strong>of</strong> billions that consume a large portion <strong>of</strong><br />

most primary commodities produced <strong>in</strong> the country.<br />

For the domestic exchanges to rise to the challenge <strong>of</strong><br />

turn<strong>in</strong>g the country <strong>in</strong>to a ‘price setter’ it is necessary<br />

that <strong>India</strong> has strong and transparent markets with<br />

robust <strong>in</strong>frastructure for efficient transactions. This <strong>in</strong><br />

turn necessitates that <strong>India</strong>n commodity exchanges<br />

have an upright regulatory framework under a robust<br />

regulator. Therefore, strengthen<strong>in</strong>g FMC through the<br />

FCRA will be a momentous step towards strengthen<strong>in</strong>g<br />

the commodity futures market as a whole.<br />

First, once amended, the FCRA will clear the deck for<br />

<strong>in</strong>troduction <strong>of</strong> long-awaited <strong>in</strong>struments such as<br />

options, <strong>in</strong>tangibles like weather derivatives,<br />

commodity <strong>in</strong>dices and freight <strong>in</strong>dices, which through<br />

value additions will attract risk-averse participants.<br />

And the deepen<strong>in</strong>g <strong>of</strong> the commodity market, thus<br />

achieved, will enhance the market’s efficiency <strong>of</strong> price<br />

discovery and efficacy <strong>of</strong> risk management. And this<br />

will eventually result <strong>in</strong> fairer returns to farmers.<br />

Second, the amended FCRA will pave the way for<br />

participation <strong>of</strong> banks, MFs and FIIs <strong>in</strong> the commodities<br />

market. This will not only democratise the price<br />

discovery process on the exchange platform but will<br />

also stabilise the market forces and, thus, the overall<br />

economy. Participation <strong>of</strong> f<strong>in</strong>ancial <strong>in</strong>stitutions on<br />

exchanges will also enable lend<strong>in</strong>g at market-l<strong>in</strong>ked<br />

prices, which <strong>in</strong> turn will lead to the benefits <strong>of</strong> price<br />

discovery flow<strong>in</strong>g down even to small farmers, as their<br />

hold<strong>in</strong>g power will be enhanced.<br />

Warehouses and the related <strong>in</strong>stitutions (quality test<strong>in</strong>g,<br />

standardization, and market<strong>in</strong>g yards) form a vital cluster<br />

<strong>in</strong> the logistics sector l<strong>in</strong>k<strong>in</strong>g the producers <strong>of</strong> agricultural<br />

commodities with their end-users ensur<strong>in</strong>g effective<br />

carryover <strong>of</strong> the commodity from the farm gate to the<br />

consumers’ table. Efficient warehous<strong>in</strong>g creates efficient<br />

l<strong>in</strong>kages among the participants <strong>in</strong> a value cha<strong>in</strong> result<strong>in</strong>g<br />

<strong>in</strong> improved efficiency with which the produce is be<strong>in</strong>g<br />

marketed, enhanced <strong>in</strong>come <strong>of</strong> the farmer, availability <strong>of</strong><br />

credit through warehouse receipts (WR) etc. Besides the<br />

revenue earned from scientific stock management, the<br />

com<strong>in</strong>g <strong>in</strong>to force <strong>of</strong> the Warehous<strong>in</strong>g (Development and<br />

Regulation) Act, 2007 (WDRA) and sett<strong>in</strong>g up <strong>of</strong> the<br />

authority will create an efficient warehous<strong>in</strong>g ecosystem<br />

that will <strong>in</strong>clude quality test<strong>in</strong>g and certification,<br />

standardization, and market<strong>in</strong>g. Follow<strong>in</strong>g this, issuance<br />

<strong>of</strong> WRs and collateral management services will enable<br />

earn<strong>in</strong>g <strong>of</strong> higher revenues than the pla<strong>in</strong>-vanilla storage<br />

charges levied on their clients.<br />

As the WR draws its power under the act, the value to it is<br />

added by the l<strong>in</strong>kages that the warehous<strong>in</strong>g <strong>in</strong>stitution<br />

creates with the fund<strong>in</strong>g <strong>in</strong>stitutions and the strength <strong>of</strong><br />

the collateral management services for the fund<strong>in</strong>g<br />

agencies and their clients at a cost which would keep<br />

both the f<strong>in</strong>ancial <strong>in</strong>stitutions and clients happy.<br />

The WDRA will also create efficient l<strong>in</strong>kages between<br />

producers and markets. Application <strong>of</strong> <strong>in</strong>formation,<br />

communication and technology (ICT); <strong>in</strong>novative<br />

solutions to practical constra<strong>in</strong>ts; and effective<br />

nurtur<strong>in</strong>g <strong>of</strong> the l<strong>in</strong>kages will go a long way <strong>in</strong> creat<strong>in</strong>g<br />

a healthy warehous<strong>in</strong>g system <strong>in</strong> the country.<br />

Development <strong>of</strong> the warehous<strong>in</strong>g sector — through<br />

the l<strong>in</strong>kages to be created between the players and the<br />

<strong>in</strong>stitutions <strong>in</strong> the agricultural supply cha<strong>in</strong> ecosystem<br />

— will help achieve the ultimate objective <strong>of</strong> creat<strong>in</strong>g<br />

w<strong>in</strong>-w<strong>in</strong> supply cha<strong>in</strong>s for producers, <strong>in</strong>termediaries,<br />

and consumers.<br />

<strong>MCX</strong> – Unrelent<strong>in</strong>g <strong>in</strong> Its Endeavour<br />

S<strong>in</strong>ce its <strong>in</strong>ception <strong>in</strong> 2003 <strong>MCX</strong> has taken a number <strong>of</strong><br />

<strong>in</strong>itiatives to help the farm<strong>in</strong>g community to realize a<br />

better value for their produce. It launched two major<br />

<strong>in</strong>frastructure projects - National Spot Exchange Ltd<br />

(NSEL) and National Bulk Handl<strong>in</strong>g Corporation Ltd.<br />

(NBHC). The comb<strong>in</strong>ed strengths <strong>of</strong> <strong>MCX</strong>, NSEL and NBHC,<br />

along with its strategic partners, is committed to<br />

transform<strong>in</strong>g the <strong>India</strong>n rural economy to <strong>in</strong>ternational<br />

standards by provid<strong>in</strong>g the last mile connectivity to rural<br />

areas and develop<strong>in</strong>g the required <strong>in</strong>frastructure.<br />

Availability <strong>of</strong> liquid futures contracts on various key<br />

commodities on the <strong>MCX</strong> platform has dramatically<br />

changed the spot market scenario. The fact that these<br />

prices are arrived through collective participation <strong>of</strong> the<br />

stakeholders from various parts <strong>of</strong> the ecosystem and the<br />

country makes it suitable to be benchmarked for the<br />

commodities underly<strong>in</strong>g the futures contracts for the spot<br />

markets. This is despite the standardised nature <strong>of</strong><br />

contracts and terms and conditions <strong>of</strong> futures trad<strong>in</strong>g. This<br />

has ensured emergence <strong>of</strong> benchmark prices <strong>of</strong> various<br />

commodities represent<strong>in</strong>g the most prevalent varieties <strong>in</strong><br />

the most active physical markets <strong>in</strong> <strong>India</strong>. Thus, these<br />

benchmark prices, discovered on the <strong>MCX</strong> platform,<br />

reflect the sentiments <strong>of</strong> the entire produc<strong>in</strong>g, trad<strong>in</strong>g and<br />

consum<strong>in</strong>g community represent<strong>in</strong>g a one-<strong>India</strong> market.<br />

The futures market is also <strong>in</strong>creas<strong>in</strong>gly act<strong>in</strong>g as a guid<strong>in</strong>g<br />

light for the physical markets to assess the upcom<strong>in</strong>g<br />

underly<strong>in</strong>g fundamentals and sentiments, and provide<br />

price signals to the physical markets.<br />

26 | A PUBLICATION BY <strong>MCX</strong> AND PRICEWATERHOUSECOOPERS

Creat<strong>in</strong>g a silent revolution…<br />

Why Can <strong>India</strong> Not Be a ‘Price Setter’<br />

A pre-WDRA entity, NBHC, which was floated by <strong>MCX</strong><br />

with the felt need for deliver<strong>in</strong>g the underly<strong>in</strong>g at the<br />

maturity <strong>of</strong> contracts, is an end-to-end solutions<br />

provider <strong>in</strong> the entire gamut <strong>of</strong> collateral management;<br />

procurement; warehous<strong>in</strong>g; bulk handl<strong>in</strong>g, grad<strong>in</strong>g and<br />

quality certification; commodity care and pest<br />

management; audit; accreditation and commodity<br />

valuation; trade consultancy and disposal <strong>of</strong><br />

commodities. In just a few years, NBHC, with its robust<br />

standardisation and quality-test<strong>in</strong>g facilities, developed<br />

its own susta<strong>in</strong>able bus<strong>in</strong>ess model and came out <strong>of</strong><br />

<strong>MCX</strong>’s shadow. One such bus<strong>in</strong>ess opportunity that<br />

evolved was collateral management undertaken to<br />

facilitate trad<strong>in</strong>g aga<strong>in</strong>st collaterals (warehouse<br />

receipts). NBHC, with about 437 warehouses spread over<br />

18 states with a total capacity <strong>of</strong> 16.5 lakh million tonnes<br />

by the end <strong>of</strong> 2008-09, facilitated <strong>in</strong> its first year <strong>of</strong><br />

operation (2006-07) collateral fund<strong>in</strong>g <strong>of</strong> Rs.1,500 crore,<br />

which rose to a cumulative<br />

figure <strong>of</strong> over Rs.8,800<br />

crore <strong>in</strong> the current fiscal.<br />

NBHC also facilitates<br />

government procurement<br />

(cumulative <strong>of</strong> 5,34,007<br />

tonnes <strong>of</strong> rice and wheat by<br />

2008-09).<br />

Tak<strong>in</strong>g the market to the<br />

masses…<br />

M C X h a s a c h i e v e d<br />

remarkable success <strong>in</strong><br />

reach<strong>in</strong>g out to a large<br />

n u m b e r o f a g r i -<br />

c o m m o d i t y<br />

producers/farmers hitherto unreached through its<br />

unique Gram<strong>in</strong> Suvidha Kendra (GSK) model. The<br />

<strong>in</strong>novative outreach network <strong>in</strong> tie-up with <strong>India</strong> Post<br />

to leverage the latter’s vast rural <strong>in</strong>frastructure <strong>in</strong> costeffective,<br />

traditional modes <strong>of</strong> communications for<br />

price dissem<strong>in</strong>ation and provid<strong>in</strong>g other services like<br />

redressal <strong>of</strong> technical queries and supplies <strong>of</strong> farm<br />

<strong>in</strong>puts such as seeds, pesticides/fungicides/weedicides<br />

and fertilizers, has now spread over 768 villages served<br />

by about 160 branch post <strong>of</strong>fices, across five states,<br />

benefit<strong>in</strong>g over 3,800 registered farmers more directly.<br />

Farmer registration with GSK shot up by 34% to 3,897 as<br />

on March 31, 2009 vis-à-vis 2,869 <strong>in</strong> 2007-08 —<br />

testify<strong>in</strong>g the grow<strong>in</strong>g popularity <strong>of</strong> the model.<br />

Despite the fact that it is fast develop<strong>in</strong>g <strong>in</strong>to a major<br />

‘economic powerhouse’ <strong>in</strong> the global arena <strong>India</strong><br />

cont<strong>in</strong>ues to look up at other markets to decide the<br />

local prices <strong>of</strong> commodities. With the country be<strong>in</strong>g the<br />

largest producer and consumer <strong>of</strong> a large number <strong>of</strong><br />

commodities, is it not just logical that the <strong>India</strong>n<br />

markets upgrade to the level <strong>of</strong> ‘price setter’ from their<br />

current tag <strong>of</strong> a ‘price taker’ And this assumes more<br />

relevance and priority with the <strong>India</strong>n markets<br />

<strong>in</strong>creas<strong>in</strong>gly open<strong>in</strong>g up and <strong>in</strong>tegrat<strong>in</strong>g with markets<br />

around the world. As for commodity markets, <strong>in</strong> which<br />

it is either one <strong>of</strong> the largest producers or consumers or<br />

both, <strong>India</strong> has immense potential to have a domestic<br />

market that is strong enough to set global market<br />

prices. In fact, given its share <strong>in</strong> global supply and<br />

demand as a dom<strong>in</strong>ant player <strong>in</strong> the world market (see<br />

table 3), the country has the potential to become the<br />

price setter <strong>in</strong> 17-odd commodities.<br />

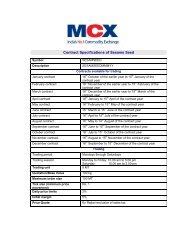

Table 3: <strong>India</strong>'s share <strong>in</strong> global production and consumption<br />

Commodities<br />

Share (%) <strong>in</strong><br />

total global<br />

output<br />

Share (%) <strong>in</strong> total<br />

global consumption<br />

Global rank <strong>in</strong><br />

production/consumption<br />

Rice milled 19.4 20.5 2nd largest producer beh<strong>in</strong>d Ch<strong>in</strong>a<br />

Wheat 12.1 12.0<br />

Soybean Oil 3.8 6.1<br />

3rd largest producer beh<strong>in</strong>d EU-27<br />

and Ch<strong>in</strong>a<br />

6th largest producer and 5th largest<br />

consumer<br />

Gold - 22.7 Largest consumer<br />

Coal 7.6 7<br />

Alum<strong>in</strong>ium 3.1 3.2 6th largest producer<br />

Source: USDA, GFMS, BP Statistical review<br />

To transform the country <strong>in</strong>to a 'price setter' the first<br />

logical step would be to democratize its markets to<br />

enable an efficient flow <strong>of</strong> <strong>in</strong>formation for effective<br />

determ<strong>in</strong>ation <strong>of</strong> commodity prices. And this has partly<br />

been taken care <strong>of</strong> by the modern national-level<br />

commodity exchanges, thanks to policy liberalization<br />

<strong>of</strong> 2002-03. The rapid ICT developments helped<br />

penetration <strong>of</strong> the onl<strong>in</strong>e electronic exchanges<br />

through reduced participation costs and <strong>in</strong>creas<strong>in</strong>g<br />

awareness. With the development <strong>of</strong> liquid futures<br />

contracts <strong>in</strong> many <strong>of</strong> the aforesaid commodities, <strong>India</strong><br />

has started emitt<strong>in</strong>g price signals to the l<strong>in</strong>ked global<br />

markets <strong>of</strong> those commodities. To a large extent, such<br />

benchmark futures prices <strong>of</strong> the standardised<br />

contracts, as discovered on the <strong>MCX</strong> platform, have<br />

started <strong>in</strong>fluenc<strong>in</strong>g the global counterparts. They have<br />

EXPERTS’ VIEWS | 27

started discount<strong>in</strong>g the <strong>India</strong>n fundamentals and<br />

sentiments <strong>in</strong> <strong>India</strong>n time zone. For example, <strong>in</strong><br />

commodities such as gold, <strong>of</strong> which it is the world's<br />

largest importer and consumer, and chana, <strong>of</strong> which it<br />

is the largest producer and consumer, <strong>India</strong>, on the<br />

strength <strong>of</strong> its futures market, is slowly ga<strong>in</strong><strong>in</strong>g the<br />

rightful place among the world markets, <strong>in</strong> terms <strong>of</strong><br />

<strong>in</strong>fluenc<strong>in</strong>g or sett<strong>in</strong>g the prices.<br />

Although it is still a long way to go, a beg<strong>in</strong>n<strong>in</strong>g has<br />

been made towards transform<strong>in</strong>g the country's<br />

commodities sector from be<strong>in</strong>g a price taker to a price<br />

setter, with the national commodity futures exchanges<br />

tak<strong>in</strong>g a lead. They are <strong>of</strong>fer<strong>in</strong>g the benefits <strong>of</strong><br />

liberalisation and globalisation directly to the <strong>India</strong>n<br />

<strong>in</strong>dustry and consumers by empower<strong>in</strong>g them to<br />

<strong>in</strong>fluence the global prices <strong>of</strong> the commodities they<br />

deal <strong>in</strong>. With <strong>in</strong>creased accuracy <strong>of</strong> the prices<br />

discovered and more effective price risk management,<br />

the efficiency <strong>of</strong> the <strong>India</strong>n <strong>in</strong>dustries and commodity<br />

markets will <strong>in</strong>crease significantly. And this will result <strong>in</strong><br />

a “multiplier effect” on the national economy.<br />

the participants tended to discount the global pricemov<strong>in</strong>g<br />

factors rather than domestic <strong>in</strong>formation.<br />

<strong>India</strong>n markets have to enable cost-effective<br />

participation <strong>of</strong> all those with <strong>in</strong>formation to effectively<br />

discover prices, and the national onl<strong>in</strong>e commodity<br />

exchanges are already help<strong>in</strong>g various categories <strong>of</strong><br />

participants get all such available <strong>in</strong>formation to<br />

converge.<br />

It is time these markets were made much more vibrant<br />

and efficient by allow<strong>in</strong>g participation <strong>of</strong> a larger<br />

number <strong>of</strong> new categories <strong>of</strong> economic stakeholders<br />

and <strong>in</strong>troduction <strong>of</strong> more <strong>in</strong>novative derivative<br />

<strong>in</strong>struments, besides carry<strong>in</strong>g out other next-level<br />

reforms. This is to plug risks at the roots rather than<br />

when they f<strong>in</strong>ally sneak <strong>in</strong>to the prices <strong>of</strong> end products.<br />

And this will make the <strong>India</strong>n markets a force to reckon<br />

with on the global commodity map, turn<strong>in</strong>g them <strong>in</strong>to<br />

a 'price setter' <strong>in</strong>deed.<br />

While proliferation <strong>of</strong> products and participants is<br />

evident from the phenomenal 110% annual<br />

compounded growth rate at which the trade on the<br />

domestic commodity futures exchanges grew<br />

between 2003-04 and 2008-09 (source: FMC and<br />

Economic Survey data), <strong>in</strong> many global commodities<br />

Mr. Laman Rutten is MD & CEO <strong>of</strong> Multi <strong>Commodity</strong> Exchange <strong>of</strong> <strong>India</strong> Ltd. Views expressed <strong>in</strong> this article are personal.<br />

28 | A PUBLICATION BY <strong>MCX</strong> AND PRICEWATERHOUSECOOPERS