Vol 10, No 4 - Financial Planning Association of Malaysia

Vol 10, No 4 - Financial Planning Association of Malaysia

Vol 10, No 4 - Financial Planning Association of Malaysia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INDUSTRY<br />

October - December 20<strong>10</strong><br />

A Behavioural View <strong>of</strong> How People Make<br />

<strong>Financial</strong> Decisions<br />

By Keith Redhead<br />

Executive Summary<br />

The paper provides a guide to<br />

the implications <strong>of</strong> behavioural<br />

finance for financial advisers.<br />

The focus is on the process<br />

<strong>of</strong> financial decision-making.<br />

<strong>Financial</strong> decision-making is<br />

seen to be subject to behavioural<br />

biases at three stages:<br />

1. The perception <strong>of</strong><br />

information<br />

There is a difference between<br />

objective information and<br />

perceived information.<br />

Decisions are based on<br />

perceived information.<br />

Selectivity, interpretation<br />

and closure affect<br />

perceptions. These<br />

processes are affected by<br />

behavioural biases, such<br />

as narrow framing and the<br />

availability bias along with a<br />

wide range <strong>of</strong> motivational,<br />

attitudinal, social, and<br />

emotional factors.<br />

2. Cognition<br />

Thought is not entirely rational and<br />

is influenced by bounded rationality,<br />

the extent <strong>of</strong> cognitive reflection,<br />

mental accounting, illusions and selfdeception<br />

along with other cognitive,<br />

emotional and social factors.<br />

3. Motivation<br />

Decisions may be made but not<br />

implemented. Procrastination and<br />

mistrust can inhibit the activation <strong>of</strong><br />

decisions.<br />

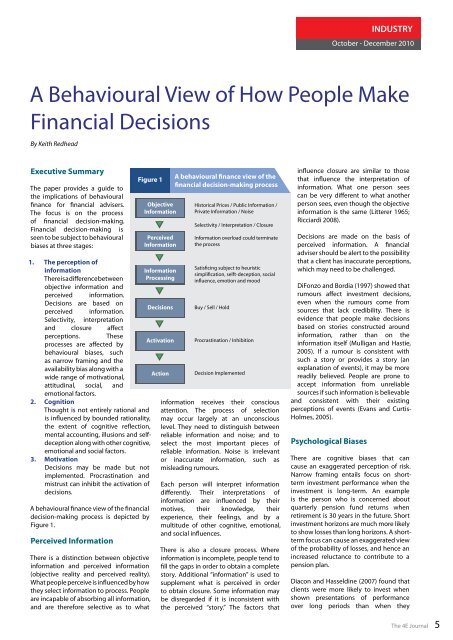

A behavioural finance view <strong>of</strong> the financial<br />

decision-making process is depicted by<br />

Figure 1.<br />

Perceived Information<br />

Figure 1<br />

There is a distinction between objective<br />

information and perceived information<br />

(objective reality and perceived reality).<br />

What people perceive is influenced by how<br />

they select information to process. People<br />

are incapable <strong>of</strong> absorbing all information,<br />

and are therefore selective as to what<br />

Objective<br />

Information<br />

Perceived<br />

Information<br />

Information<br />

Processing<br />

Decisions<br />

Activation<br />

Action<br />

A behavioural finance view <strong>of</strong> the<br />

financial decision-making process<br />

Historical Prices / Public Information /<br />

Private Information / <strong>No</strong>ise<br />

Selectivity / Interpretation / Closure<br />

Information overload could terminate<br />

the process<br />

Satisficing subject to heuristic<br />

simplification, selft-deception, social<br />

influence, emotion and mood<br />

Buy / Sell / Hold<br />

Procrastination / Inhibition<br />

Decision Implemented<br />

information receives their conscious<br />

attention. The process <strong>of</strong> selection<br />

may occur largely at an unconscious<br />

level. They need to distinguish between<br />

reliable information and noise; and to<br />

select the most important pieces <strong>of</strong><br />

reliable information. <strong>No</strong>ise is irrelevant<br />

or inaccurate information, such as<br />

misleading rumours.<br />

Each person will interpret information<br />

differently. Their interpretations <strong>of</strong><br />

information are influenced by their<br />

motives, their knowledge, their<br />

experience, their feelings, and by a<br />

multitude <strong>of</strong> other cognitive, emotional,<br />

and social influences.<br />

There is also a closure process. Where<br />

information is incomplete, people tend to<br />

fill the gaps in order to obtain a complete<br />

story. Additional “information” is used to<br />

supplement what is perceived in order<br />

to obtain closure. Some information may<br />

be disregarded if it is inconsistent with<br />

the perceived “story.” The factors that<br />

influence closure are similar to those<br />

that influence the interpretation <strong>of</strong><br />

information. What one person sees<br />

can be very different to what another<br />

person sees, even though the objective<br />

information is the same (Litterer 1965;<br />

Ricciardi 2008).<br />

Decisions are made on the basis <strong>of</strong><br />

perceived information. A financial<br />

adviser should be alert to the possibility<br />

that a client has inaccurate perceptions,<br />

which may need to be challenged.<br />

DiFonzo and Bordia (1997) showed that<br />

rumours affect investment decisions,<br />

even when the rumours come from<br />

sources that lack credibility. There is<br />

evidence that people make decisions<br />

based on stories constructed around<br />

information, rather than on the<br />

information itself (Mulligan and Hastie,<br />

2005). If a rumour is consistent with<br />

such a story or provides a story (an<br />

explanation <strong>of</strong> events), it may be more<br />

readily believed. People are prone to<br />

accept information from unreliable<br />

sources if such information is believable<br />

and consistent with their existing<br />

perceptions <strong>of</strong> events (Evans and Curtis-<br />

Holmes, 2005).<br />

Psychological Biases<br />

There are cognitive biases that can<br />

cause an exaggerated perception <strong>of</strong> risk.<br />

Narrow framing entails focus on shortterm<br />

investment performance when the<br />

investment is long-term. An example<br />

is the person who is concerned about<br />

quarterly pension fund returns when<br />

retirement is 30 years in the future. Short<br />

investment horizons are much more likely<br />

to show losses than long horizons. A shortterm<br />

focus can cause an exaggerated view<br />

<strong>of</strong> the probability <strong>of</strong> losses, and hence an<br />

increased reluctance to contribute to a<br />

pension plan.<br />

Diacon and Hasseldine (2007) found that<br />

clients were more likely to invest when<br />

shown presentations <strong>of</strong> performance<br />

over long periods than when they<br />

The 4E Journal 5