KPMG PPT - Tax Executives Institute, Inc.

KPMG PPT - Tax Executives Institute, Inc.

KPMG PPT - Tax Executives Institute, Inc.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

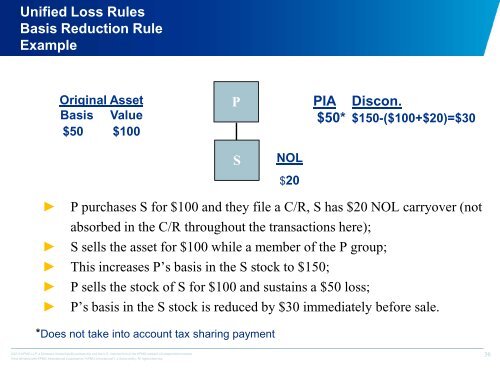

Unified Loss Rules<br />

Basis Reduction Rule<br />

Example<br />

Original Asset<br />

Basis Value<br />

$50 $100<br />

P<br />

PIA<br />

$50*<br />

Discon.<br />

$150-($100+$20)=$30<br />

S<br />

NOL<br />

$20<br />

► P purchases S for $100 and they file a C/R, S has $20 NOL carryover (not<br />

absorbed in the C/R throughout the transactions here);<br />

► S sells the asset for $100 while a member of the P group;<br />

► This increases P’s basis in the S stock to $150;<br />

► P sells the stock of S for $100 and sustains a $50 loss;<br />

► P’s basis in the S stock is reduced by $30 immediately before sale.<br />

*Does not take into account tax sharing payment<br />

©2012 <strong>KPMG</strong> LLP, a Delaware limited liability partnership and the U.S. member firm of the <strong>KPMG</strong> network of independent member<br />

firms affiliated with <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. All rights reserved.<br />

36