KPMG PPT - Tax Executives Institute, Inc.

KPMG PPT - Tax Executives Institute, Inc.

KPMG PPT - Tax Executives Institute, Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

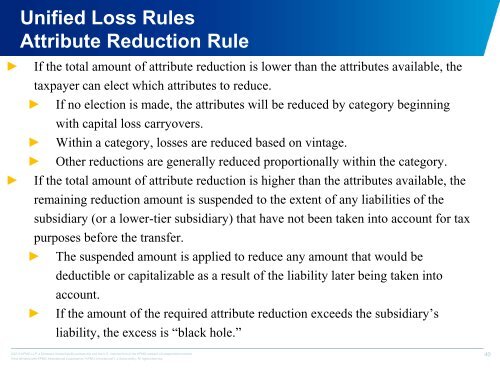

Unified Loss Rules<br />

Attribute Reduction Rule<br />

►<br />

►<br />

If the total amount of attribute reduction is lower than the attributes available, the<br />

taxpayer can elect which attributes to reduce.<br />

► If no election is made, the attributes will be reduced by category beginning<br />

with capital loss carryovers.<br />

► Within a category, losses are reduced based on vintage.<br />

► Other reductions are generally reduced proportionally within the category.<br />

If the total amount of attribute reduction is higher than the attributes available, the<br />

remaining reduction amount is suspended to the extent of any liabilities of the<br />

subsidiary (or a lower-tier subsidiary) that have not been taken into account for tax<br />

purposes before the transfer.<br />

► The suspended amount is applied to reduce any amount that would be<br />

deductible or capitalizable as a result of the liability later being taken into<br />

account.<br />

► If the amount of the required attribute reduction exceeds the subsidiary’s<br />

liability, the excess is “black hole.”<br />

©2012 <strong>KPMG</strong> LLP, a Delaware limited liability partnership and the U.S. member firm of the <strong>KPMG</strong> network of independent member<br />

firms affiliated with <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. All rights reserved.<br />

40