2008 Annual Report - Alliance Trust

2008 Annual Report - Alliance Trust

2008 Annual Report - Alliance Trust

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Alliance</strong> <strong>Trust</strong> PLC <strong>Report</strong> & Accounts | 11<br />

Brian Nicholson and Andy Killean, Asset Management.<br />

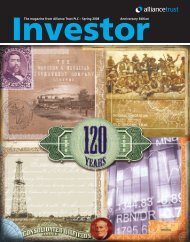

Asset Allocation<br />

Asset allocation remains heavily dominated by our exposure to<br />

quoted equities. Such a strategy has proved positive over the<br />

long-term but was more challenging in the latter part of 2007.<br />

Recognising that we need to protect the portfolio during more<br />

difficult markets, we have continued to diversify selectively into<br />

other asset classes.<br />

While we recognised early signs of problems in the credit markets,<br />

along with many others we did not foresee the full magnitude of<br />

the fall out into global financial markets and economies. We held<br />

defensive positions across regional equity portfolios, believing risk<br />

to be more fairly priced in these types of company. During last year<br />

there were a number of periods of severe equity market weakness<br />

such as in August 2007 and January <strong>2008</strong>. We took advantage of<br />

these opportunities by selective buying on weak days and<br />

borrowed to do so. As at 31 January <strong>2008</strong> our net gearing level<br />

stood at 4.8% (no gearing and cash of 7.4% at 31 January 2007).<br />

We will continuously manage the <strong>Trust</strong> to maximise returns using<br />

both asset allocation techniques as well as stock selection.<br />

In addition, we have focused our quoted equity exposure to less<br />

than 250 holdings by the end of the period. Whilst we wish to<br />

have broad company exposure in the major markets in which we<br />

Asset allocation<br />

Tim Gibbens, Investment.<br />

“We will continuously<br />

manage the <strong>Trust</strong> to maximise<br />

returns using both asset<br />

allocation techniques as well<br />

as stock selection.”<br />

Overview Business Review Governance Directors’ Remuneration Financial Statements<br />

%<br />

40<br />

Jan ‘07<br />

Jan ‘08<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

Information for<br />

Shareholders<br />

0<br />

-5<br />

UK Large<br />

UK Small<br />

Source: Internal<br />

North America<br />

Europe<br />

Japan<br />

Asia Pacific<br />

Rest of the World<br />

Subsidiaries<br />

Private Equity<br />

Property<br />

Fixed Income<br />

Cash and Other Net Assets<br />

Borrowing