Revenue Policy 2011-12 - Wollongong City Council

Revenue Policy 2011-12 - Wollongong City Council

Revenue Policy 2011-12 - Wollongong City Council

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

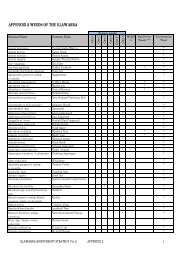

Fees quoted in the schedule of Fees and Charges are presented as the fee that will be charged,<br />

however, if there are circumstances that require fees to be reduced during the period, then such<br />

adjustment will be made. Wherever a fee is required to be adjusted upwards, a public consultation<br />

process will be carried out before a <strong>Council</strong> resolution to increase a fee.<br />

Discount or waiver of fees may be given where specifically included in the fees and charges or<br />

provided for under a <strong>Council</strong> <strong>Policy</strong>. Exemptions on discounts beyond the delegated authorities will<br />

only be approved by the General Manager.<br />

In addition to this, the following pricing categories have been used in determining the fees, which are<br />

summarised below:<br />

• Full Cost Pricing - Fees are set to enable the recovery of all direct and indirect costs involved<br />

in the provision of a service.<br />

• Subsidised Pricing - Fees and charges are set at a level that recovers less than the full cost<br />

incurred in service delivery. In effect some level of subsidisation is factored into the price.<br />

• Rate of Return Pricing - Fees and charges are set to enable the recovery of all direct and<br />

indirect costs involved in the provision of a service plus a profit margin.<br />

• Market Pricing - Fees and charges are based on current market fee structures. The market<br />

price is usually determined by examining competitors’ prices and may have little relationship<br />

to the cost of providing the service.<br />

• Statutory Pricing - Fees and charges are set to comply with statutory legislation.<br />

Goods and Services Tax (GST) has been included in the fees and charges on those items that are<br />

subject to GST after considering the items specifically exempted under Section 38 (GST Legislation)<br />

and under the provisions of the Treasurer’s Determination included as Division 81 items.<br />

In general, those fees and charges that are of a regulatory nature are exempt from GST, whereas<br />

those that constitute a fee for service or competitive supply will be subject to GST. The items have<br />

been treated under the existing legislation and may need to be reviewed if there are further changes<br />

to the GST Legislation.<br />

<strong>Council</strong> has identified its Category 1 and Category 2 Business Activities for the purpose of competitive<br />

neutrality. Category 1 businesses have a gross turnover greater than $2m and are <strong>Council</strong>’s Tourist<br />

Parks, Leisure Centres, Waste Disposal and Crematorium and Cemeteries. <strong>Council</strong> has no Category<br />

2 businesses identified that have a gross turnover of less than $2m. National Competition <strong>Policy</strong><br />

requires disclosure of the pricing methods <strong>Council</strong> used in determining the fees and charges of these<br />

declared business activities. The pricing methods that <strong>Council</strong> used in determining these fees and<br />

charges are detailed in the declared business activities section.<br />

All other fees and charges contained in <strong>Council</strong>’s Fees and Charges schedule are based on differing<br />

philosophies and pricing structures and are summarised as follows:<br />

• Dictated by strong community direction ranging from a poll of electors to sample surveys,<br />

<strong>Council</strong> has a policy of free admittance to its various swimming pools (other than Beaton<br />

Park, Corrimal and Dapto heated pools). Generally, the full cost of these swimming pools is<br />

borne from general rate revenue.<br />

• There are a group of services, mainly based on recreational activities, which <strong>Council</strong><br />

considers it unreasonable to expect members of the community to pay fees that would be<br />

based on full cost recovery. Examples of the areas affected are:<br />

- Parks and reserves (per hour fee pro rated on a soccer field as a base unit)<br />

- Aquatic centres for such uses as commercial lane hire, learn to swim programs,<br />

swimming carnivals and club point scores<br />

- Senior citizens’ activities<br />

- Youth centres<br />

- Various library services