Economic and Financial Report - Grupo ACS

Economic and Financial Report - Grupo ACS

Economic and Financial Report - Grupo ACS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

22.2 Consolidated <strong>Financial</strong> Statements<br />

<strong>Economic</strong> <strong>and</strong> <strong>Financial</strong> <strong>Report</strong><br />

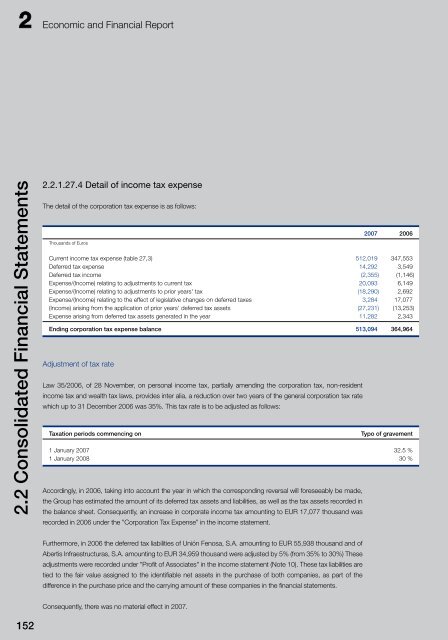

2.2.1.27.4 Detail of income tax expense<br />

The detail of the corporation tax expense is as follows:<br />

Thous<strong>and</strong>s of Euros<br />

2007 2006<br />

Current income tax expense (table 27,3) 512,019 347,553<br />

Deferred tax expense 14,292 3,549<br />

Deferred tax income (2,355) (1,146)<br />

Expense/(Income) relating to adjustments to current tax 20,093 6,149<br />

Expense/(Income) relating to adjustments to prior years' tax (18,290) 2,692<br />

Expense/(Income) relating to the effect of legislative changes on deferred taxes 3,284 17,077<br />

(Income) arising from the application of prior years' deferred tax assets (27,231) (13,253)<br />

Expense arising from deferred tax assets generated in the year 11,282 2,343<br />

Ending corporation tax expense balance 513,094 364,964<br />

Adjustment of tax rate<br />

Law 35/2006, of 28 November, on personal income tax, partially amending the corporation tax, non-resident<br />

income tax <strong>and</strong> wealth tax laws, provides inter alia, a reduction over two years of the general corporation tax rate<br />

which up to 31 December 2006 was 35%. This tax rate is to be adjusted as follows:<br />

Taxation periods commencing on<br />

Typo of gravement<br />

1 January 2007 32.5 %<br />

1 January 2008 30 %<br />

Accordingly, in 2006, taking into account the year in which the corresponding reversal will foreseeably be made,<br />

the Group has estimated the amount of its deferred tax assets <strong>and</strong> liabilities, as well as the tax assets recorded in<br />

the balance sheet. Consequently, an increase in corporate income tax amounting to EUR 17,077 thous<strong>and</strong> was<br />

recorded in 2006 under the ”Corporation Tax Expense” in the income statement.<br />

Furthermore, in 2006 the deferred tax liabilities of Unión Fenosa, S.A. amounting to EUR 55,938 thous<strong>and</strong> <strong>and</strong> of<br />

Abertis Infraestructuras, S.A. amounting to EUR 34,959 thous<strong>and</strong> were adjusted by 5% (from 35% to 30%) These<br />

adjustments were recorded under "Profit of Associates" in the income statement (Note 10). These tax liabilities are<br />

tied to the fair value assigned to the identifiable net assets in the purchase of both companies, as part of the<br />

difference in the purchase price <strong>and</strong> the carrying amount of these companies in the financial statements.<br />

Consequently, there was no material effect in 2007.<br />

152