Economic and Financial Report - Grupo ACS

Economic and Financial Report - Grupo ACS

Economic and Financial Report - Grupo ACS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

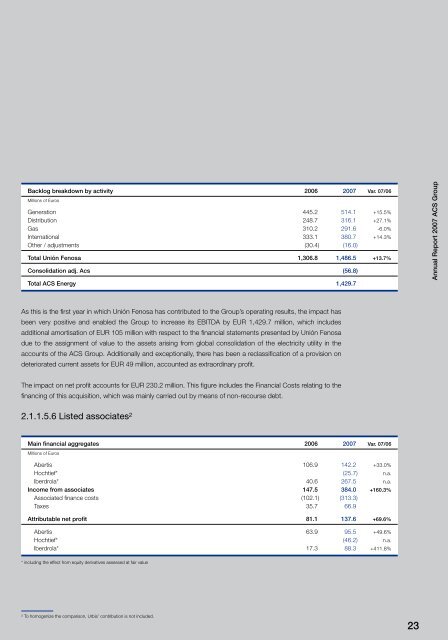

Backlog breakdown by activity 2006 2007 Var. 07/06<br />

Millions of Euros<br />

Generation 445.2 514.1 +15.5%<br />

Distribution 248.7 316.1 +27.1%<br />

Gas 310.2 291.6 -6.0%<br />

International 333.1 380.7 +14.3%<br />

Other / adjustments (30.4) (16.0)<br />

Total Unión Fenosa 1,306.8 1,486.5 +13.7%<br />

Consolidation adj. Acs (56.8)<br />

Total <strong>ACS</strong> Energy 1,429.7<br />

Annual <strong>Report</strong> 2007 <strong>ACS</strong> Group<br />

As this is the first year in which Unión Fenosa has contributed to the Group’s operating results, the impact has<br />

been very positive <strong>and</strong> enabled the Group to increase its EBITDA by EUR 1,429.7 million, which includes<br />

additional amortisation of EUR 105 million with respect to the financial statements presented by Unión Fenosa<br />

due to the assignment of value to the assets arising from global consolidation of the electricity utility in the<br />

accounts of the <strong>ACS</strong> Group. Additionally <strong>and</strong> exceptionally, there has been a reclassification of a provision on<br />

deteriorated current assets for EUR 49 million, accounted as extraordinary profit.<br />

The impact on net profit accounts for EUR 230.2 million. This figure includes the <strong>Financial</strong> Costs relating to the<br />

financing of this acquisition, which was mainly carried out by means of non-recourse debt.<br />

2.1.1.5.6 Listed associates 2<br />

Main financial aggregates 2006 2007 Var. 07/06<br />

Millions of Euros<br />

Abertis 106.9 142.2 +33.0%<br />

Hochtief* (25.7) n.a.<br />

Iberdrola* 40.6 267.5 n.a.<br />

Income from associates 147.5 384.0 +160.3%<br />

Associated finance costs (102.1) (313.3)<br />

Taxes 35.7 66.9<br />

Attributable net profit 81.1 137.6 +69.6%<br />

Abertis 63.9 95.5 +49.6%<br />

Hochtief* (46.2) n.a.<br />

Iberdrola* 17.3 88.3 +411.8%<br />

* including the effect from equity derivatives assessed at fair value<br />

2 To homogenize the comparison, Urbis’ contribution is not included.<br />

23