You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

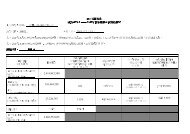

Highlights of 2012 Final Results<br />

Note<br />

For the year ended 31 December<br />

2012<br />

2011<br />

HK$ million HK$ million<br />

Change<br />

Property sales<br />

– Revenue 1 8,942 9,479 -6%<br />

– Profit contribution 1 2,291 2,079 +10%<br />

Property leasing<br />

– Gross rental income 2 6,628 5,805 +14%<br />

– Net rental income 2 4,898 4,169 +17%<br />

Profit attributable to shareholders<br />

– Underlying profit 3 7,098 5,560 +28%<br />

– Reported profit 20,208 17,184 +18%<br />

Earnings per share<br />

– Based on underlying profit 3 2.97 2.41 +23%<br />

– Based on reported profit 8.47 7.44 +14%<br />

Dividends per share 1.06 1.00 +6%<br />

Allotment of bonus shares<br />

HK$<br />

HK$<br />

1 share for every<br />

Nil<br />

10 shares held<br />

At 31 December 2012 At 31 December 2011<br />

HK$<br />

HK$<br />

Not<br />

applicable<br />

Change<br />

Net asset value per share 84.97 78.23 +9%<br />

Net debt to shareholders’ equity 17.2% 19.9% -2.7 percentage<br />

points<br />

At 31 December 2012 At 31 December 2011<br />

Million square feet Million square feet<br />

<strong>Hong</strong> <strong>Kong</strong><br />

Land bank (attributable floor area)<br />

– Properties held for/under development 10.4 10.2<br />

– Stock of unsold properties 0.4 0.7<br />

– Completed investment properties (including<br />

hotel properties) 4 10.1 10.2<br />

20.9 21.1<br />

New Territories land (total land area) 42.8 41.9<br />

Mainland China<br />

Land bank (attributable floor area)<br />

– Properties held for/under development 140.3 151.2<br />

– Stock of unsold properties 1.2 1.0<br />

– Completed investment properties 4 6.4 5.9<br />

147.9 158.1<br />

Note 1: Representing the Group’s attributable share of property sales revenue and their profit contribution (before taxation) in <strong>Hong</strong> <strong>Kong</strong> and mainland China by<br />

subsidiaries, associates and jointly controlled entities (“JCEs”).<br />

Note 2: Representing the Group’s attributable share of gross rental income and net rental income (before taxation) from investment properties in <strong>Hong</strong> <strong>Kong</strong> and mainland<br />

China held by subsidiaries, associates and JCEs.<br />

Note 3: Excluding the fair value change (net of deferred tax) of the investment properties held by subsidiaries, associates and JCEs.<br />

Note 4: The Group held additional rentable car parking spaces with a total area of approximately 2.7 million square feet (2011: approximately 2.8 million square feet) in<br />

<strong>Hong</strong> <strong>Kong</strong>, and approximately 0.7 million square feet (2011: approximately 0.6 million square feet) in mainland China.<br />

Henderson Land Development Company Limited<br />

Annual Report 2012 7