You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

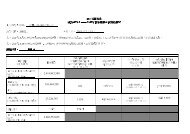

Financial Review<br />

In terms of the amounts attributable to the Group, gross rental revenue attributable to the Group during the year ended 31<br />

December 2012 amounted to HK$6,628 million (2011: HK$5,805 million), of which HK$5,466 million (2011: HK$4,889<br />

million) was generated in <strong>Hong</strong> <strong>Kong</strong> and HK$1,162 million (2011: HK$916 million) was generated in mainland China. In this<br />

regard, the Group’s share of gross rental revenue comprises contributions from (i) subsidiaries (after deducting non-controlling<br />

interests) of HK$4,482 million (2011: HK$3,907 million); (ii) associates of HK$651 million (2011: HK$562 million); and (iii)<br />

jointly controlled entities of HK$1,495 million (2011: HK$1,336 million).<br />

On the same basis, the Group’s share of pre-tax net rental income in aggregate amounted to HK$4,898 million (2011: HK$4,169<br />

million), of which HK$4,031 million (2011: HK$3,585 million) was generated in <strong>Hong</strong> <strong>Kong</strong> and HK$867 million (2011:<br />

HK$584 million) was generated in mainland China. In this regard, the Group’s share of pre-tax net rental income comprises<br />

contributions from (i) subsidiaries (after deducting non-controlling interests) of HK$3,101 million (2011: HK$2,614 million);<br />

(ii) associates of HK$563 million (2011: HK$475 million); and (iii) jointly controlled entities of HK$1,234 million (2011:<br />

HK$1,080 million).<br />

Construction<br />

Turnover for the year ended 31 December 2012 increased significantly by HK$717 million, or 1,630%, over that in the previous<br />

year which is mainly attributable to the revenue contribution during the year from the construction contracts undertaken for<br />

“Double Cove” and “The Reach” (both being the Group’s property development projects in <strong>Hong</strong> <strong>Kong</strong>) as well as a new<br />

property development project of HK Ferry in <strong>Hong</strong> <strong>Kong</strong>.<br />

The loss from operations for the year ended 31 December 2012 decreased by HK$11 million, or 18%, from that in the previous<br />

year which is mainly attributable to the increase in the operating profits generated by the abovementioned construction<br />

contracts of HK$28 million during the year, and which was partially offset by the net increase in administrative and operating<br />

expenses of HK$17 million (including the additional depreciation charge of HK$8 million relating to the construction plant and<br />

machinery acquired by the Group during the year).<br />

Infrastructure<br />

The Group’s infrastructure business represents the operation of a toll bridge in Hangzhou, mainland China, which is held by<br />

Henderson Investment Limited, a subsidiary of the Company.<br />

For the financial performance of the Group’s infrastructure business for the year ended 31 December 2012, please refer<br />

to the paragraph headed “Henderson Investment Limited (“HIL”)” under the section “Review of Operations” on page 82<br />

of the Company’s annual report for the year ended 31 December 2012 and of which this Financial Review forms a part.<br />

Notwithstanding the provisional suspension in the payment of toll fees in respect of Hangzhou Qianjiang Third Bridge to a joint<br />

venture company of HIL for the period from 20 March 2012 to 31 December 2012 for the reasons as described therein and as a<br />

result of which the Group recorded toll revenue of HK$63 million (2011: HK$299 million) representing a decrease of HK$236<br />

million or 79% from that of the previous year, the toll revenue generated by Hangzhou Qianjiang Third Bridge during the year<br />

ended 31 December 2012 amounted to HK$317 million which represents an increase of HK$18 million or 6% over that for the<br />

corresponding year ended 31 December 2011.<br />

98<br />

Henderson Land Development Company Limited<br />

Annual Report 2012