GRADE 12 - Times LIVE

GRADE 12 - Times LIVE

GRADE 12 - Times LIVE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Accounting Question Paper<br />

Avusa Education<br />

Accounting Question Paper<br />

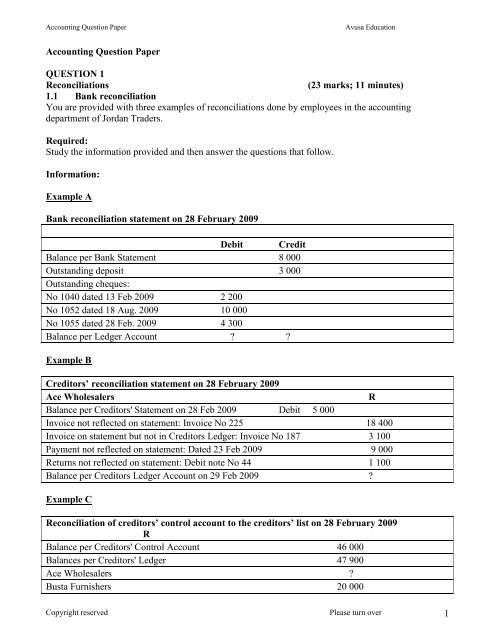

QUESTION 1<br />

Reconciliations<br />

(23 marks; 11 minutes)<br />

1.1 Bank reconciliation<br />

You are provided with three examples of reconciliations done by employees in the accounting<br />

department of Jordan Traders.<br />

Required:<br />

Study the information provided and then answer the questions that follow.<br />

Information:<br />

Example A<br />

Bank reconciliation statement on 28 February 2009<br />

Debit Credit<br />

Balance per Bank Statement 8 000<br />

Outstanding deposit 3 000<br />

Outstanding cheques:<br />

No 1040 dated 13 Feb 2009 2 200<br />

No 1052 dated 18 Aug. 2009 10 000<br />

No 1055 dated 28 Feb. 2009 4 300<br />

Balance per Ledger Account <br />

Example B<br />

Creditors’ reconciliation statement on 28 February 2009<br />

Ace Wholesalers<br />

R<br />

Balance per Creditors' Statement on 28 Feb 2009 Debit 5 000<br />

Invoice not reflected on statement: Invoice No 225 18 400<br />

Invoice on statement but not in Creditors Ledger: Invoice No 187 3 100<br />

Payment not reflected on statement: Dated 23 Feb 2009 9 000<br />

Returns not reflected on statement: Debit note No 44 1 100<br />

Balance per Creditors Ledger Account on 29 Feb 2009 <br />

Example C<br />

Reconciliation of creditors’ control account to the creditors’ list on 28 February 2009<br />

R<br />

Balance per Creditors' Control Account 46 000<br />

Balances per Creditors' Ledger 47 900<br />

Ace Wholesalers <br />

Busta Furnishers 20 000<br />

Copyright reserved Please turn over 1

Accounting Question Paper<br />

Avusa Education<br />

Camel Security Services <strong>12</strong> 000<br />

Dumbo CC <br />

Difference 1 900<br />

1.1 Briefly explain:<br />

• What you understand by the term internal control (2)<br />

• Why is it important to apply internal control in a business (2)<br />

• Why preparing reconciliations is important for internal control. (2)<br />

1.2 According to the Bank Statement, does this business have a favourable bank balance<br />

or a bank overdraft Give a reason for your choice. (2)<br />

1.3 Calculate the bank balance in the Ledger of Jordan Traders on<br />

28 February 2009. State whether this is a favourable or unfavourable balance. (3)<br />

1.4 List FOUR steps you would follow when preparing a Bank Reconciliation<br />

Statement. (4)<br />

1.5 When preparing the financial statements of Jordan Traders at the end of<br />

February 2009, what amount would you reflect under Cash and Cash<br />

Equivalents on the Balance Sheet (2)<br />

1.6 Calculate the correct amount owed to Ace Wholesalers by Jordan Traders. (4)<br />

1.7 Briefly explain what action should be taken over the difference of R1 900<br />

reflected in Example C. (2)<br />

QUESTION 2<br />

Inventory valuation and control<br />

(30 marks; 18 minutes)<br />

The following information relates to the trading activities of Micro Traders for the financial year<br />

ended 29 February 2009.<br />

The business is owned by BA Crooke. The business sells only one type of microwave oven and has<br />

decided to keep the selling price constant throughout the year.<br />

Mr Crooke is keen to secure a loan from the bank. He wants to ensure that the profit in the financial<br />

statements creates a very favourable impression with the bank.<br />

The business uses the periodic inventory system and the FIFO method of valuing stock.<br />

Information:<br />

Number Unit price Total<br />

of units R R<br />

Sales 1 400 252 000<br />

Stock on hand on 1 March 2008 40 units 950 38 000<br />

Purchases during the year 210 units 170 000<br />

June 2008 30 units 900 27 000<br />

October 2008 80 units 850 68 000<br />

January 2009 100 units 750 75 000<br />

Required:<br />

2.1 Explain the difference between the periodic and perpetual inventory systems.<br />

Also explain the advantage of each system. (4)<br />

2.2 Calculate the total number of microwave ovens sold during the year. (3)<br />

2.3 Calculate the total number of microwave ovens on hand at 28 February 2009. (3)<br />

The business uses the FIFO valuation method.<br />

2.4 Calculate the closing stock using the FIFO method. (3)<br />

Copyright reserved Please turn over 2

Accounting Question Paper<br />

Avusa Education<br />

2.5 Calculate the gross profit for the year ended 28 February 2009 using the FIFO stock<br />

valuation method. You may draft the Trading Account to calculate this figure. (5)<br />

In order to secure the loan the owner, BA Crooke, wants to change the stock valuation<br />

method to the weighted average method.<br />

2.6 Calculate the value of the closing stock by using the weighted average stock valuation<br />

method on 28 February 2009. (5)<br />

2.7 Calculate the gross profit for the year ended 28 February 2009 using the weighted<br />

average stock valuation method. You may draft the Trading Account to calculate this<br />

figure (3)<br />

2.8 In your opinion, will it be ethical for Mr Crooke to change the method of stock valuation<br />

Give ONE reason for your answer. (4)<br />

QUESTION 3<br />

Manufacturing<br />

(63 marks; 40 minutes)<br />

You are provided with information relating to Yum-Yum Enterprises for July 2008. The business<br />

makes tasty pellets for pets. The business is personally owned and managed by Peter Abrahams.<br />

Requited:<br />

3.1 Prepare the Production Cost Statement for July 2008. Show workings in brackets on the<br />

Production Cost Statement. (23)<br />

3.2 Prepare the Income Statement for July 2008. Show workings in brackets. (21)<br />

3.3 In order to be able to print the “Proudly South African” logo on the packaging of his product,<br />

Peter will need to purchase the card board boxes from a local supplier rather than import them<br />

from Botswana.<br />

3.3.1 Give TWO reasons why using a local supplier is likely to reduce the unit cost calculated<br />

above. (2)<br />

3.3.2 Calculate the unit cost of producing a complete box of tasty pellets in July 2008. (3)<br />

3.3.3 By doubling production to 70 000 units during August 2008 the profit will more<br />

than double. Briefly explain why. (2)<br />

3.4 In order to analyse the performance of the business, the accountant knows that it is essential to<br />

work out the break-even point of production.<br />

3.4.1 Calculate the break-even-point in units. (10)<br />

3.4.2 Should the accountant be happy with the business’ present production level Why (2)<br />

Information:<br />

1. Production and sales information of Yum-Yum Enterprises July 2008<br />

Number of finished boxes of pet pellets produced 35 000<br />

Number of units sold 30 000<br />

Mark-up cost 40%<br />

Selling price per unit <br />

2. Stock at the beginning and end of the month 1 July 2008 31 July<br />

2008<br />

Raw material stock:<br />

• Stock of ingredients to make pet pellets<br />

• Stock of card board boxes<br />

R70 000<br />

Nil<br />

R85 000<br />

R14 400<br />

Work-in-process stock R20 000 R24 000<br />

Finished goods stock R1 400 R7 000<br />

Copyright reserved Please turn over 3

Accounting Question Paper<br />

Avusa Education<br />

Indirect material stock (cleaning materials) Nil Nil<br />

Stock of packing materials for deliveries R4 200 R1 300<br />

3. Raw materials (brought from local supplier) comprise all ingredients for the production of pet<br />

pellets as well as cardboard box containers (imported from a supplier in Botswana):<br />

• Ingredients were bought during the month on credit for R330 000 (these were delivered free<br />

of charge).<br />

• Bought 60 000 cardboard boxes from Botswana for a total cost of 24 000 Botswana pula.<br />

One Botswana pula is equivalent to R1.30.<br />

• Import duty is 10%.<br />

• Transport cost paid on these boxes, R8 100.<br />

4. Remuneration is as follows:<br />

• The <strong>12</strong> direct workers are each required to work 180 hours per month, in other words, 20<br />

days at 9 hours per day. Their normal rate of pay is R30 per hour. However, during July 60<br />

hours were lost as a result of Eskom power cuts. The workers were required to work 60<br />

hours overtime weekends but only 10 workers were available for this. The overtime rate is<br />

double the normal rate.<br />

• The factory foreman is paid a fixed salary of R<strong>12</strong> 000 per month irrespective of overtime.<br />

He had to be paid a bonus of R8 000 for working over the weekends.<br />

• The bookkeeper is paid a monthly salary of R5 600.<br />

• The cleaner is paid a fixed salary of R4 000 per month. This is split between the factory,<br />

the office and the sales department in the ratio 5:2:3.<br />

• The sales people were paid commission of R42 380 in total.<br />

5. Electricity and water paid during the month was R27 800. This has been allocated as follows:<br />

• Office: R450<br />

• Sales department: R1 200<br />

• The factory plant and machinery accounts for the rest.<br />

6. Cleaning materials bought for cash, R14 200. Transport costs on these were paid out of the<br />

petty cash, R800. All these materials were used. The factory uses 80% of these indirect<br />

materials, while the rest is used equally by the administration, selling and distribution<br />

departments.<br />

7. Rent paid was R16 000. This is to split according to floor area:<br />

• Factory 400 square metres<br />

• Office 30 square metres<br />

• Sales department 70 square metres<br />

8. Depreciation for the month:<br />

• Depreciation on delivery vehicle, R5 800.<br />

• Depreciation on factory plant, R45 000.<br />

• Depreciation on office equipment, R800.<br />

9. Other transactions for July:<br />

• Packing materials (for deliveries to customers) bought, R7 200 (R1 300 of this was unused).<br />

• Petrol bought for the delivery vehicle and salesmen’s sales vehicles, R16 500.<br />

• Repairs to factory machines, R58 400.<br />

QUESTION 4<br />

Financial statements and audit<br />

(107 marks; 65 minutes)<br />

There are three parts to this question. Each part must be seen independent from the other.<br />

Part A<br />

4.1 The following information was extracted from the accounting records of Spencer Company Ltd.<br />

Copyright reserved Please turn over 4

Accounting Question Paper<br />

Avusa Education<br />

Required<br />

4.1.1 Complete the Income statement for the year ended 30 June 2009.<br />

Note: Certain information has already been filled in for you. (22)<br />

4.1.2 Prepare the following notes to the financial statements for the year ended<br />

30 June 2009:<br />

Accumulated profit (7)<br />

Trade and other payables (<strong>12</strong>)<br />

4.1.3 Prepare the Equity and liabilities section of the Balance sheet on 30 June 2009. (<strong>12</strong>)<br />

Information to prepare the Income statement<br />

1. Spencer Company Ltd operates on a profit mark-up of 80% on cost price.<br />

2. Gross profit achieved on 30 June amounted to R320 000.<br />

3. Rent income amounted to R3 500 per month from 1 July 2008. The rental agreement<br />

stipulated an increase of 10% as from 1 April 2009. The amount for rent income appeared<br />

as R50 500 in the Pre-adjustment trial balance on 30 June 2009.<br />

4. Insurance for the year amounted to R21 750. Included in this amount is an amount of<br />

R3 750 paid on an annual insurance contract on 1 March 2009.<br />

5. On 1 July 2008, the loan from Absa Bank had a balance of R450 000. In terms of the loan<br />

agreement interest is calculated at 18% per annum and is paid half-yearly. The capital sum of<br />

the loan is to be repaid in installments of R50 000 on 31 October of each year. The repayment<br />

to Absa Bank was made on 30 October 2008. The interest on loan account had a debit balance<br />

of R68 000.<br />

6. The bookkeeper has already calculated depreciation on assets as R32 000. It has now<br />

been discovered that this has been overstated by R3 000.<br />

7. Operating expenses as a percentage on sales for the year ended 30 June 2009, 20%.<br />

8. Income tax for the year ended 30 June 2009 amounted to R45 080. Income tax is<br />

calculated at 28%.<br />

9. Provisional income tax paid to SARS for the financial year ended amounted to R39 080.<br />

10. Total dividends declared and paid during the financial year amounted to R29 500. Of this<br />

R18 000 is still owed to shareholders for their final dividends declared but not yet paid on<br />

30 June 2009.<br />

11. The accumulated profit account had a balance of R72 000 on 1 July 2008.<br />

Information to prepare the Equity and Liabilities section of the Balance sheet and notes to the<br />

Balance sheet<br />

<strong>12</strong>. Trade and other receivables amounted to R322 000 on 30 June 2009 and the current ratio on<br />

this date was 2.3:1.<br />

13. Ordinary shareholders equity amounted to R1 200 000 on 30 June 2009.<br />

14. Spencer Company Ltd has 36 000 shares in issue with a par value of R25 each.<br />

Part B<br />

4.2 The following information was extracted from the accounting records of Labels Are Me Ltd.<br />

Required:<br />

4.2.1 Prepare the note to the Cash flow statement for the year ended 30 June 2009:<br />

Reconciliation of profit before tax and cash generated from operations (21)<br />

Fixed assets purchased (6)<br />

4.2.2 Prepare the cash flow from operations section of the Cash flow statement for the year<br />

ended 30 June 2009. Show calculation in brackets to earn part marks. (14)<br />

Copyright reserved Please turn over 5

Accounting Question Paper<br />

Avusa Education<br />

Information:<br />

1. The following information was extracted from the accounting records of Labels Are Me Ltd for<br />

the year ended 30 June 2009 with comparative figures for 2008.<br />

30 June 2009 30 June 2008<br />

Mortgage bond 750 000 900 000<br />

Loan from Absa 250 000 250 000<br />

Land and buildings 2 400 000 1 700 000<br />

Vehicles 480 000 380 000<br />

Equipment 310 000 275 000<br />

Accumulated depreciation on vehicles 240 000 140 000<br />

Accumulated depreciation on equipment 110 000 88 000<br />

Trading stock 572 000 610 000<br />

Trade debtors 325 000 280 000<br />

Accrued income 8 000 5 000<br />

SARS (Income tax) 22 200(DR) 15 800(CR)<br />

Bank 79 300 16 000(CR)<br />

Trade creditors 477 300 430 000<br />

Accrued expense (Interest on Loan) 3 500 5 200<br />

Income received in advance 7 700 10 000<br />

Shareholders for dividends 140 000 <strong>12</strong>5 000<br />

2. Additional information<br />

2.1 The net profit before tax amounted to R1 280 000 and income tax is calculated at 30% of<br />

pre-tax profits.<br />

2.2 A vehicle costing R80 000 was sold at carrying value, R35 000. No equipment was sold<br />

during the financial year.<br />

2.3 The following interest was incurred during the financial year:<br />

• Interest on mortgage bond, R98 250<br />

• Interest on loan, R26 750<br />

• Interest on overdraft, R2 000<br />

2.4 An interim dividend of R286 000 was declared and paid on 1 December 2008.<br />

Part C<br />

4.3 Read the following carefully then answer the questions below.<br />

Sven Johannson is an investor in Labels Are Me Ltd. He owns 21 000 shares in the business.<br />

14 500 were purchased on 1 July 2007 for R5.50 each and the remainder were purchased on<br />

1 July 2008 when the company made a further allocation of shares at R6.15 each.<br />

30 June 2009 30 June 2008<br />

Earnings per share (EPS) 134 cents <strong>12</strong>0 cents<br />

Dividends per share (DPS) 115 cents 95 cents<br />

Return on shareholders equity 22.07% 20.2%<br />

Net assets value per share (NAV) R6.29 R6.25<br />

Average trading price on the JSE for the year ending R7.00 R7.11<br />

Interest on Fixed Deposit 6.5% 6%<br />

Questions:<br />

Sven bought the share in Labels Are Me Ltd because a friend told him that this was a good investment.<br />

Copyright reserved Please turn over 6

Accounting Question Paper<br />

Avusa Education<br />

Sven has asked for your help with the following:<br />

4.3.1 Calculate how much Sven received in dividends from Labels For Me Ltd for the year<br />

ending 30 June 2009. (3)<br />

4.3.2 As a shareholder in Labels For Me Ltd should he be happy with the dividends declared and paid<br />

by the company for the year ended 30 June 2009 Quote the relevant figures from the above table<br />

to substantiate your answer. (5)<br />

4.3.3 Sven is not quite sure if he should keep his investment in Labels For Me Ltd or sell his<br />

shares on the JSE. Advise Sven on what he should do by quoting figures from the above<br />

table to help him make an informed decision on keeping or selling the shares. (5)<br />

QUESTION 5<br />

Interpretation of financial information<br />

(40marks; 24 minutes)<br />

Use the detachable Data Sheet (appendix A; page) as well as the information below to answer the<br />

questions that follow.<br />

Information:<br />

John Smith, a food and beverage manager at Hilton Hotel, has inherited R1 000 000. He wishes to<br />

invest the money to gain maximum capital growth for a medium-term investment.<br />

Two options are available to Mr Smith — he can either buy shares in CAWOOD Ltd or he can buy<br />

into an existing close corporation trading as SINGH CC.<br />

CAWOOD Ltd is a construction company. The directors are investigating a possible BEE deal.<br />

This deal will ensure additional share capital as well as being able to position themselves favourably<br />

for government contracts in the future.<br />

SINGH CC is an upmarket delicatessen that specialises in the selling of elite imported food items as<br />

well as a selection of expensive luxury “proudly South African” products. SINGH CC is a secondgeneration<br />

organisation located in La Lucia Mall. The owners pride themselves on the personal<br />

services they offer to their regular elite customers.<br />

Questions:<br />

5.1 Name two parties who would be interested in the audited financial statements of CAWOOD<br />

Ltd. (2)<br />

5.2 What is the difference between Authorised and Issued Share Capital<br />

Why is it necessary for both these figures to be reflected in the published financial<br />

statements (3)<br />

5.3 It is possible that for SINGH CC to make its business look attractive to potential investors they<br />

may have overstated (inflated) their turnover figure.<br />

How is this problem prevented in CAWOOD Ltd (2)<br />

5.4 Identify three ratios that Mr Smith should utilise in analysing the audited financial<br />

statements of CAWOOD Ltd before deciding whether he should invest in the<br />

company or not. (3)<br />

5.5 To secure the possible BEE deal, CAWOOD Ltd needs to raise a further R5 000 000.<br />

How could the company raise the necessary finance Discuss the positive effects that the<br />

securing of the BEE deal will have on the overall performance of the company. (8)<br />

5.6 Due to the continued unexpected slump in the South African economy,<br />

SINGH CC is currently experiencing liquidity problems. A possible solution would be<br />

to attract an additional member to the CC. Identify two advantages, relevant to SINGH CC,<br />

of signing on an additional member. (2)<br />

5.7.1 Mr Smith has done extensive research into SINGH CC and has raised a few concerns,<br />

one of which is the liquidity problem that the CC is currently experiencing.<br />

Write a paragraph, on behalf of SINGH CC, to Mr Smith that highlights the positive<br />

Copyright reserved Please turn over 7

Accounting Question Paper<br />

Avusa Education<br />

financial aspects of the business. Ensure you cover the following aspects in<br />

your motivation: goodwill; profitability; and return on investment. (9)<br />

5.8 The “buy in” price for SINGH CC is R700 000 and it is projected that a loan<br />

of R300 000 will be needed in the second half of the financial year. Discuss<br />

TWO reasons why it would be beneficial for Mr Smith to offer a loan to the<br />

CC rather than to have the CC borrow the funds from a commercial bank. (4)<br />

5.9 Based on the information that has been provided, you are required to advise<br />

Mr Smith as to which investment would fulfil his investment criteria. Quote<br />

figures, where necessary, to substantiate your answer. (7)<br />

Appendix A<br />

DATA SHEET<br />

BEE: Black Economic Empowerment<br />

The development and economic empowerment of historically<br />

disadvantaged people, including all non-white people, for example,<br />

Africans, Indians, coloureds and Chinese.<br />

CAWOOD Ltd<br />

SINGH CC<br />

2008 2007 2008 2007<br />

Authorised Share Capital (R2.00) 10 000 000 10 000 000<br />

Issued Share Capital (R2.00) 4 500 000 3 500 000<br />

Capital Employed 1 200 000 1 000 000<br />

Return on Shareholders Equity 34% 43%<br />

Dividends per Share 56 c 40 c<br />

Earnings per share 90 c <strong>12</strong>0 c<br />

Return on Capital Employed 38% 40 %<br />

Long term loans (16%) 3 000 000 2 000 000 50 000 10 000<br />

Debt:Equity ratio 0.46 : 1 0.35:1 0.04:1 0.01:1<br />

Acid test ratio 1.75 :1 1.9 :1 0.3 : 1 0.8 :1<br />

Current Ratio 2.1:1 1.9 : 1 0.9 : 1 1.1 : 1<br />

Net profit/Turnover 45 % 56 % 32 % 41 %<br />

Operating Expenses on Turnover 51 % 31 % 43 % 39 %<br />

Achieved mark up % 1<strong>12</strong> % <strong>12</strong>0% 90 % 100%<br />

Actual Mark up % <strong>12</strong>5% <strong>12</strong>5 % 100% 100%<br />

Goodwill – the name of the game! - Clifton <strong>Times</strong> 21 August 2008<br />

Peter Mallet, owner of Peter Pans, a catering company situated in Durban North<br />

showed us once again what it means to care for your customers. Mr Mallet has<br />

secured an elite niche market amongst the who’s who of Durban North. He caters for<br />

private cocktail functions at residential homes.<br />

On 9 August he came to the rescue of Mrs Robinson. Mrs Robinson had invited 20<br />

distinguished guests to a cocktail party at her residence. Much to her dismay, at<br />

17h00, 2 hours before the guests were due to arrive, her long-time domestic worker<br />

and assistant walked out of the house stating that because it was Women’s Day they<br />

deserved the night off.<br />

Mrs Robinson was horrified. She immediately phoned Mr Mallet for his assistance.<br />

Copyright reserved Please turn over 8

Accounting Question Paper<br />

Avusa Education<br />

Mr Mallet agreed to leave his son’s school function to come and assist her in her<br />

plight. The evening was a huge success.<br />

Needless to say, the guests left with Mr Mallet’s business card carefully tucked into<br />

their top pockets!<br />

This poses the question: Does the business make the business or is it the man who<br />

makes the business<br />

QUESTION 6<br />

Debtors’ collection and cash budget<br />

(37 marks; 22 minutes)<br />

You have recently been appointed bookkeeper of Mutzim Dealers (Pty) Ltd. This business sells<br />

household electrical appliances, from kettles to washing machines. You are required to use the<br />

information given to complete the questions that follow.<br />

Information:<br />

Mutzim Dealers (Pty) Ltd<br />

Cash budget for the period 1 October — 31 December 2008<br />

Cash receipts October November December<br />

Cash sales 45 000 66 000 *<br />

Cash Received from debtors 27 000 * *<br />

Sale of old computers - 6 000 -<br />

Rent income 4 000 2 000 2 000<br />

Total receipts 76 900 * *<br />

Cash payments<br />

Payments to creditors 32 000 30 000 *<br />

Salaries 15 000 15 000 15 000<br />

Advertising 1 050 1 250 1 300<br />

Interest on loan 1 500 1 500 1 050<br />

Other operating expenses 15 000 15 500 16 010<br />

New computers bought - - 24 000<br />

Loan repayment - - 30 000<br />

Total payments 64 550 63 250 *<br />

Cash surplus/shortfall <strong>12</strong> 350 * *<br />

Bank – opening balance 8 000 20 350 *<br />

Bank – closing balance 20 350 * *<br />

Additional information:<br />

1. Sales figures.<br />

Actual (40% on credit)<br />

Budgeted (projected)<br />

August 2008 September October 2008 November 2007 December 2008<br />

2008<br />

R90 000 R80 000 R75 000 R110 000 R150 000<br />

2. During October and November of the budget period 40% of sales are expected to be on credit<br />

and the rest will be for cash. From 1 December 2008, credit sales are expected to increase by<br />

15%.<br />

3. Debtors are allowed 60 days credit and the amounts owing by debtors are expected to be<br />

collected as follows:<br />

Copyright reserved Please turn over 9

Accounting Question Paper<br />

Avusa Education<br />

• 50% in the month of sale, to take advantage of the 10% settlement discount allowed for<br />

prompt settlement.<br />

• 45% in the month following the sale.<br />

• The rest is written off as irrecoverable after three months.<br />

4. Trading stock on hand is maintained through monthly purchases.<br />

5. Cost of sales is equivalent to 40% of turnover.<br />

6. All stock purchases are on credit. Creditors are paid in the month following the purchases (after<br />

30 days).<br />

Required:<br />

6.1 Is the drawing up of a cash budget an aspect of Financial Accounting or<br />

Management Accounting (1)<br />

6.2 Why is a Debtors Collection Schedule drawn up when preparing a cash budget (1)<br />

6.3 Complete the cash budget by filling in the amounts marked with an asterisk (*). (19)<br />

6.4 The rental income is fixed at R2 000. Explain why the amount of R4 000 is<br />

reflected in October. Supply one possible reason. (1)<br />

6.5 Explain, quoting figures and/or policies, whether you think that they are<br />

effectively managing their working capital. (2)<br />

6.6 Mutzim Dealers (Pty) Ltd like other retailers in South Africa today are facing many<br />

challenges which are impacting on their future profits and cash flows. The<br />

following are some of these challenges. Read through them and comment on<br />

what effect you think each of them could have on the cash flow of Mutzim Dealers<br />

(Pty) Ltd.<br />

6.6.1 In June 2007 the South African government introduced the National Credit Act.<br />

According to this act, retailers are not allowed to give their customers credit<br />

facilities unless they have first checked on their income to ensure that they can<br />

afford to buy on credit, and if they can, how much credit they should be allowed. (2)<br />

6.6.2 South Africa cannot supply enough power to cope with demand and electricity<br />

tariffs are expected to increase by at least 30% and the worldwide shortage<br />

of fuel is pushing up the fuel price at an alarming rate. (2)<br />

6.6.3 The inflation rate is in double figures and, because of this increase in the cost<br />

of living, employees are demanding at least a <strong>12</strong>% increase in salaries. (2)<br />

6.7 As a result of the challenges mentioned in 2.6 above, the directors of<br />

Mutzim Dealers (Pty) Ltd are concerned about its future prospects and are<br />

wondering if they should close down the business. Advise them as to what you<br />

think they should do, giving reasons for your suggestions. (2)<br />

6.8 An employee of the company has informed the directors that some staff in the<br />

“goods returned department” are stealing faulty electrical products that have<br />

been returned by customers instead of returning these products to the suppliers<br />

in order for Mutzim Dealers (Pty) Ltd to get a credit on their account.<br />

The directors cannot understand how this can happen as they employ an internal<br />

auditor who should have detected this in his audit.<br />

6.8.1 What are your views on “whistle-blowing” (reporting on irregular or unethical<br />

actions by other members of staff) Your answer must include both the positive<br />

and negative aspects of “whistle-blowers” and should “whistle-blowers” be rewarded<br />

in some way by the company. (3)<br />

6.8.2 What two internal control measures can be put in place to prevent staff from<br />

taking faulty products returned by customers (2)<br />

Total: 300<br />

Copyright reserved Please turn over 10