March 2011 - Crowe Horwath International

March 2011 - Crowe Horwath International

March 2011 - Crowe Horwath International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Crowe</strong> Clark Whitehill<br />

£22,480 - income tax to be<br />

saved each year through<br />

efficient use of rate bands<br />

Pensions<br />

Pension Schemes remain an important<br />

means of tax-efficient saving for<br />

retirement, but the benefits have been<br />

restricted by a number of complex<br />

changes to the higher-rate tax relief<br />

available, with further changes taking<br />

effect from 6 April <strong>2011</strong>.<br />

In brief, if you have total income in<br />

excess of £130,000 for any of the<br />

years 2007/08, 2008/09, 2009/10 or<br />

the current tax year, ‘anti-forestalling’<br />

provisions introduced on 22 April 2009<br />

will apply and tax relief may be restricted<br />

on any pension payments made by you<br />

or your employer in excess of £20,000.<br />

This limit is extended in circumstances<br />

where there was a prior history of<br />

contributions being made before<br />

22 April 2009, dependent on both the<br />

amount and the frequency of those<br />

contributions.<br />

The rules change again from<br />

6 April <strong>2011</strong>. From that date, higher-rate<br />

tax relief will be available for everyone<br />

on contributions up to £50,000 each<br />

tax year with the ability to carry forward<br />

unused allowances for up to three tax<br />

years. Importantly, this new<br />

carry-forward provision is deemed to<br />

have been in place for 2008/09, 2009/10<br />

and 2010/11. It may therefore be better<br />

to wait until after 5 April <strong>2011</strong> before<br />

making a large pension contribution.<br />

Additionally, with effect from<br />

13 October 2010, the annual allowance<br />

for pension contributions is reduced<br />

from £245,000 to £50,000. This<br />

allowance applies for Pension Input<br />

Periods rather than tax years and where<br />

these two do not coincide, there is a<br />

risk that the annual allowance can be<br />

exceeded for contributions made since<br />

13 October 2010, triggering an income<br />

tax liability.<br />

Please contact us if you require further<br />

advice on this extremely complex issue.<br />

Please note that all references<br />

to spouses also include<br />

members of Civil Partnerships<br />

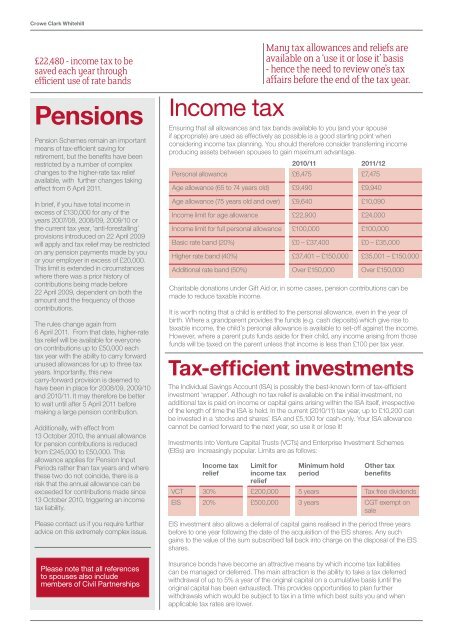

Income tax<br />

Ensuring that all allowances and tax bands available to you (and your spouse<br />

if appropriate) are used as effectively as possible is a good starting point when<br />

considering income tax planning. You should therefore consider transferring income<br />

producing assets between spouses to gain maximum advantage.<br />

2010/11 <strong>2011</strong>/12<br />

Personal allowance £6,475 £7,475<br />

Age allowance (65 to 74 years old) £9,490 £9,940<br />

Age allowance (75 years old and over) £9,640 £10,090<br />

Income limit for age allowance £22,900 £24,000<br />

Income limit for full personal allowance £100,000 £100,000<br />

Basic rate band (20%) £0 – £37,400 £0 – £35,000<br />

Higher rate band (40%) £37,401 – £150,000 £35,001 – £150,000<br />

Additional rate band (50%) Over £150,000 Over £150,000<br />

Charitable donations under Gift Aid or, in some cases, pension contributions can be<br />

made to reduce taxable income.<br />

It is worth noting that a child is entitled to the personal allowance, even in the year of<br />

birth. Where a grandparent provides the funds (e.g. cash deposits) which give rise to<br />

taxable income, the child’s personal allowance is available to set-off against the income.<br />

However, where a parent puts funds aside for their child, any income arising from those<br />

funds will be taxed on the parent unless that income is less than £100 per tax year.<br />

Tax-efficient investments<br />

The Individual Savings Account (ISA) is possibly the best-known form of tax-efficient<br />

investment ‘wrapper’. Although no tax relief is available on the initial investment, no<br />

additional tax is paid on income or capital gains arising within the ISA itself, irrespective<br />

of the length of time the ISA is held. In the current (2010/11) tax year, up to £10,200 can<br />

be invested in a ‘stocks and shares’ ISA and £5,100 for cash-only. Your ISA allowance<br />

cannot be carried forward to the next year, so use it or lose it!<br />

Investments into Venture Capital Trusts (VCTs) and Enterprise Investment Schemes<br />

(EISs) are increasingly popular. Limits are as follows:<br />

Income tax<br />

relief<br />

Many tax allowances and reliefs are<br />

available on a ‘use it or lose it’ basis<br />

- hence the need to review one’s tax<br />

affairs before the end of the tax year.<br />

Limit for<br />

income tax<br />

relief<br />

Minimum hold<br />

period<br />

Other tax<br />

benefits<br />

VCT 30% £200,000 5 years Tax free dividends<br />

EIS 20% £500,000 3 years CGT exempt on<br />

sale<br />

EIS investment also allows a deferral of capital gains realised in the period three years<br />

before to one year following the date of the acquisition of the EIS shares. Any such<br />

gains to the value of the sum subscribed fall back into charge on the disposal of the EIS<br />

shares.<br />

Insurance bonds have become an attractive means by which income tax liabilities<br />

can be managed or deferred. The main attraction is the ability to take a tax deferred<br />

withdrawal of up to 5% a year of the original capital on a cumulative basis (until the<br />

original capital has been exhausted). This provides opportunities to plan further<br />

withdrawals which would be subject to tax in a time which best suits you and when<br />

applicable tax rates are lower.