Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

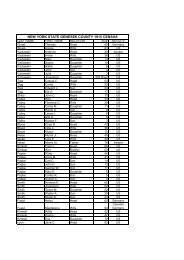

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 1<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 1.-2-99.12 *****************<br />

Clinton St. Rd 00000006300<br />

1.-2-99.12 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 2<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 6.-1-53.11 *****************<br />

8582 Sanders Rd 00000034410<br />

6.-1-53.11 210 1 Family Res VETS-CV-C 41132 21,175 0 0<br />

Acomb William H LeRoy School 183601 19,100 VETS-CV-T 41133 0 21,175 0<br />

8582 Sanders Rd ACRES 6.20 84,700 VETS-DV-C 41142 8,470 0 0<br />

<strong>Stafford</strong>, NY 14413 EAST-1278134 NRTH-1092670 VETS-DV-T 41143 0 8,470 0<br />

DEED BOOK 575 PG-258 STAR B 41854 0 0 30,000<br />

FULL MARKET VALUE 84,700 COUNTY TAXABLE VALUE 55,055<br />

TOWN TAXABLE VALUE 55,055<br />

SCHOOL TAXABLE VALUE 54,700<br />

AG001 Ag. District #1 .00 MT<br />

FD015 <strong>Stafford</strong> fire 84,700 TO<br />

******************************************************************************************************* 5.-1-8.2 *******************<br />

8802 Prole Rd 00000029500<br />

5.-1-8.2 210 1 Family Res STAR B 41854 0 0 30,000<br />

Adams Brandon Batavia City Sc 180200 5,900 COUNTY TAXABLE VALUE 94,300<br />

8802 Prole Rd ACRES 0.37 BANKFAR0100 94,300 TOWN TAXABLE VALUE 94,300<br />

Batavia, NY 14020 EAST-1274168 NRTH-1088868 SCHOOL TAXABLE VALUE 64,300<br />

DEED BOOK 869 PG-490 FD015 <strong>Stafford</strong> fire 94,300 TO<br />

FULL MARKET VALUE 94,300 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 8.-2-11.1 ******************<br />

Route 5 00000051800<br />

8.-2-11.1 341 Ind vac w/im COUNTY TAXABLE VALUE 19,900<br />

Adams Timothy M Batavia City Sc 180200 19,900 TOWN TAXABLE VALUE 19,900<br />

6596 Route 5 ACRES 8.30 19,900 SCHOOL TAXABLE VALUE 19,900<br />

<strong>Stafford</strong>, NY 14143 EAST-1277778 NRTH-1087602 FD015 <strong>Stafford</strong> fire 19,900 TO<br />

DEED BOOK 889 PG-600 WD001 <strong>Stafford</strong> Water #1 .00 UN<br />

FULL MARKET VALUE 19,900<br />

******************************************************************************************************* 10.-2-47.2 *****************<br />

6596 Route 5 00000045710<br />

10.-2-47.2 210 1 Family Res STAR B 41854 0 0 30,000<br />

Adams Timothy M LeRoy School 183601 16,100 COUNTY TAXABLE VALUE 125,000<br />

6596 Route 5 ACRES 1.10 125,000 TOWN TAXABLE VALUE 125,000<br />

<strong>Stafford</strong>, NY 14143 EAST-1291920 NRTH-1086001 SCHOOL TAXABLE VALUE 95,000<br />

DEED BOOK 870 PG-494 AG003 Ag. District #3 .00 MT<br />

FULL MARKET VALUE 125,000 FD015 <strong>Stafford</strong> fire 125,000 TO<br />

WD001 <strong>Stafford</strong> Water #1 .00 UN<br />

******************************************************************************************************* 1.-1-34 ********************<br />

8048 Byron Rd 00000004500<br />

1.-1-34 210 1 Family Res STAR B 41854 0 0 30,000<br />

Alejandro Jordan M Byron-Bergen Sc 183001 6,400 COUNTY TAXABLE VALUE 127,000<br />

8048 Byron Rd ACRES 0.40 BANKFAR0100 127,000 TOWN TAXABLE VALUE 127,000<br />

Batavia, NY 14020 EAST-1270360 NRTH-1102007 SCHOOL TAXABLE VALUE 97,000<br />

DEED BOOK 875 PG-928 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

FULL MARKET VALUE 127,000 FD015 <strong>Stafford</strong> fire 127,000 TO<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 3<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 11.-1-22.112 ***************<br />

6411 Westacott Rd 00000084150<br />

11.-1-22.112 242 Rurl res&rec STAR B 41854 0 0 30,000<br />

Allenbrandt Douglas W Pavilion School 184001 20,600 COUNTY TAXABLE VALUE 135,800<br />

6411 Westcott Rd ACRES 10.00 135,800 TOWN TAXABLE VALUE 135,800<br />

<strong>Stafford</strong>, NY 14143 EAST-1288808 NRTH-1078547 SCHOOL TAXABLE VALUE 105,800<br />

DEED BOOK 853 PG-427 FD015 <strong>Stafford</strong> fire 135,800 TO<br />

FULL MARKET VALUE 135,800<br />

******************************************************************************************************* 9.-1-47.12 *****************<br />

9190 Clipnock Rd 00000075720<br />

9.-1-47.12 242 Rurl res&rec STAR B 41854 0 0 30,000<br />

Altman Carl W Pavilion School 184001 34,200 COUNTY TAXABLE VALUE 113,400<br />

9190 Clipnock Rd ACRES 37.32 113,400 TOWN TAXABLE VALUE 113,400<br />

<strong>Stafford</strong>, NY 14143-9543 EAST-1281645 NRTH-1081588 SCHOOL TAXABLE VALUE 83,400<br />

DEED BOOK 780 PG-258 AG001 Ag. District #1 .00 MT<br />

FULL MARKET VALUE 113,400 FD015 <strong>Stafford</strong> fire 113,400 TO<br />

WD007 <strong>Stafford</strong> Water #7 1.00 UN<br />

******************************************************************************************************* 9.-1-16 ********************<br />

9220 Clipnock Rd 00000077200<br />

9.-1-16 210 1 Family Res VETS-WV-C 41122 13,515 0 0<br />

Altman Terry L Pavilion School 184001 16,000 VETS-WV-T 41123 0 13,515 0<br />

9220 Clipnock Rd ACRES 1.00 90,100 VETS-DV-C 41142 36,040 0 0<br />

PO Box 674 EAST-1282825 NRTH-1081416 VETS-DV-T 41143 0 36,040 0<br />

<strong>Stafford</strong>, NY 14143-0674 DEED BOOK 705 PG-322 STAR B 41854 0 0 30,000<br />

FULL MARKET VALUE 90,100 COUNTY TAXABLE VALUE 40,545<br />

TOWN TAXABLE VALUE 40,545<br />

SCHOOL TAXABLE VALUE 60,100<br />

FD015 <strong>Stafford</strong> fire 90,100 TO<br />

WD008 <strong>Stafford</strong> Water #8 .00 UN<br />

******************************************************************************************************* 9.-1-47.2 ******************<br />

Clipnock Rd 00000075710<br />

9.-1-47.2 310 Res Vac COUNTY TAXABLE VALUE 16,000<br />

Altman Terry L Pavilion School 184001 16,000 TOWN TAXABLE VALUE 16,000<br />

PO Box 674 FRNT 200.00 DPTH 205.25 16,000 SCHOOL TAXABLE VALUE 16,000<br />

<strong>Stafford</strong>, NY 14143 EAST-1282845 NRTH-1081170 FD015 <strong>Stafford</strong> fire 16,000 TO<br />

DEED BOOK 872 PG-197 WD008 <strong>Stafford</strong> Water #8 .00 UN<br />

FULL MARKET VALUE 16,000<br />

******************************************************************************************************* 5.-1-19 ********************<br />

8856 Fargo Rd 00000069800<br />

5.-1-19 210 1 Family Res STAR B 41854 0 0 30,000<br />

Alwardt Dixie A Batavia City Sc 180200 8,500 COUNTY TAXABLE VALUE 85,100<br />

8856 Fargo Rd ACRES 0.53 85,100 TOWN TAXABLE VALUE 85,100<br />

PO Box 754 EAST-1273869 NRTH-1087878 SCHOOL TAXABLE VALUE 55,100<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 812 PG-348 FD015 <strong>Stafford</strong> fire 85,100 TO<br />

FULL MARKET VALUE 85,100 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 4<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 3.-1-45.1 ******************<br />

8024 Mill Rd 00000021200<br />

3.-1-45.1 210 1 Family Res STAR B 41854 0 0 30,000<br />

Amend Ross G Byron-Bergen Sc 183001 16,800 COUNTY TAXABLE VALUE 185,000<br />

Amend Julie L *3.-1-45+46=45.1* 185,000 TOWN TAXABLE VALUE 185,000<br />

8024 Mill Rd ACRES 2.30 BANKBAC0100 SCHOOL TAXABLE VALUE 155,000<br />

Bergen, NY 14416 EAST-1275064 NRTH-1102571 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

DEED BOOK 888 PG-347 FD015 <strong>Stafford</strong> fire 185,000 TO<br />

FULL MARKET VALUE 185,000<br />

******************************************************************************************************* 4.-1-34.22 *****************<br />

8100 Route 237 00000064300<br />

4.-1-34.22 242 Rurl res&rec STAR B 41854 0 0 30,000<br />

Amico Dawn M Byron-Bergen Sc 183001 18,800 COUNTY TAXABLE VALUE 147,900<br />

8100 Route 237 ACRES 5.70 BANKFAR0100 147,900 TOWN TAXABLE VALUE 147,900<br />

LeRoy, NY 14482 EAST-1286359 NRTH-1101203 SCHOOL TAXABLE VALUE 117,900<br />

DEED BOOK 825 PG-745 FD015 <strong>Stafford</strong> fire 147,900 TO<br />

FULL MARKET VALUE 147,900 WD003 <strong>Stafford</strong> Water #3 1.00 UN<br />

******************************************************************************************************* 12.-1-31.1 *****************<br />

6612 E. Bethany-Leroy Rd 00000087900<br />

12.-1-31.1 210 1 Family Res STAR EN 41834 0 0 62,200<br />

Anchor Robert Pavilion School 184001 20,900 COUNTY TAXABLE VALUE 140,200<br />

6612 E Bethany-Leroy Rd ACRES 10.70 140,200 TOWN TAXABLE VALUE 140,200<br />

<strong>Stafford</strong>, NY 14143 EAST-1291564 NRTH-1073177 SCHOOL TAXABLE VALUE 78,000<br />

DEED BOOK 310 PG-489 FD015 <strong>Stafford</strong> fire 140,200 TO<br />

FULL MARKET VALUE 140,200 WD005 <strong>Stafford</strong> Water #5 1.00 UN<br />

******************************************************************************************************* 8.-1-40 ********************<br />

5963 Route 5 00000035600<br />

8.-1-40 210 1 Family Res STAR B 41854 0 0 30,000<br />

Anderson Michael J LeRoy School 183601 7,000 COUNTY TAXABLE VALUE 40,000<br />

5963 Route 5 ACRES 0.44 40,000 TOWN TAXABLE VALUE 40,000<br />

<strong>Stafford</strong>, NY 14143 EAST-1280883 NRTH-1087538 SCHOOL TAXABLE VALUE 10,000<br />

DEED BOOK 843 PG-301 FD015 <strong>Stafford</strong> fire 40,000 TO<br />

FULL MARKET VALUE 40,000 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 10.-2-51 *******************<br />

9009 Roanoke Rd 00000079600<br />

10.-2-51 210 1 Family Res STAR B 41854 0 0 30,000<br />

Anderson-Tooze Judith LeRoy School 183601 7,400 COUNTY TAXABLE VALUE 106,900<br />

9009 Roanoke Rd ACRES 0.46 106,900 TOWN TAXABLE VALUE 106,900<br />

<strong>Stafford</strong>, NY 14143 EAST-1290481 NRTH-1085348 SCHOOL TAXABLE VALUE 76,900<br />

DEED BOOK 864 PG-908 FD015 <strong>Stafford</strong> fire 106,900 TO<br />

FULL MARKET VALUE 106,900 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 5<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 1.-1-19 ********************<br />

7893 Fotch Rd 00000003160<br />

1.-1-19 210 1 Family Res STAR B 41854 0 0 30,000<br />

Andres Melissa M Byron-Bergen Sc 183001 7,400 COUNTY TAXABLE VALUE 83,000<br />

7893 Fotch Rd ACRES 0.46 83,000 TOWN TAXABLE VALUE 83,000<br />

Batavia, NY 14020-9714 EAST-1271283 NRTH-1104872 SCHOOL TAXABLE VALUE 53,000<br />

DEED BOOK 890 PG-266 FD015 <strong>Stafford</strong> fire 83,000 TO<br />

FULL MARKET VALUE 83,000<br />

******************************************************************************************************* 1.-1-7.12 ******************<br />

7789 Fotch Rd 00000000310<br />

1.-1-7.12 210 1 Family Res STAR EN 41834 0 0 62,200<br />

Anna John W Byron-Bergen Sc 183001 16,300 COUNTY TAXABLE VALUE 144,000<br />

Anna Margaret A ACRES 1.43 144,000 TOWN TAXABLE VALUE 144,000<br />

7789 Fotch Rd EAST-1271318 NRTH-1106722 SCHOOL TAXABLE VALUE 81,800<br />

Batavia, NY 14020 DEED BOOK 458 PG-00017 FD015 <strong>Stafford</strong> fire 144,000 TO<br />

FULL MARKET VALUE 144,000<br />

******************************************************************************************************* 1.-1-7.112 *****************<br />

Fotch Rd 00000000410<br />

1.-1-7.112 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 6<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 8.-2-3 *********************<br />

8909 Fargo Rd 00000070100<br />

8.-2-3 210 1 Family Res STAR B 41854 0 0 30,000<br />

Antoniak Cynthia A Batavia City Sc 180200 19,000 COUNTY TAXABLE VALUE 110,000<br />

Antoniak Brian ACRES 6.00 110,000 TOWN TAXABLE VALUE 110,000<br />

8909 Fargo Rd EAST-1274519 NRTH-1086905 SCHOOL TAXABLE VALUE 80,000<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 877 PG-670 FD015 <strong>Stafford</strong> fire 110,000 TO<br />

FULL MARKET VALUE 110,000 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 1.-2-14.2 ******************<br />

8219 Prole Rd Ext 00000011010<br />

1.-2-14.2 220 2 Family Res STAR B 41854 0 0 30,000<br />

Appis Jean M Byron-Bergen Sc 183001 14,400 COUNTY TAXABLE VALUE 82,000<br />

8219 Prole Road Ext ACRES 0.90 BANKWFB0100 82,000 TOWN TAXABLE VALUE 82,000<br />

Byron, NY 14422 EAST-1272755 NRTH-1098885 SCHOOL TAXABLE VALUE 52,000<br />

DEED BOOK 765 PG-28 FD015 <strong>Stafford</strong> fire 82,000 TO<br />

FULL MARKET VALUE 82,000<br />

******************************************************************************************************* 1.-2-47 ********************<br />

5539 Horseshoe Lake Rd 00000014600<br />

1.-2-47 210 1 Family Res VETS-WV-C/ 41121 15,000 17,280 0<br />

Aquino Charles J Batavia City Sc 180200 10,100 STAR EN 41834 0 0 62,200<br />

Aquino Rosemary M ACRES 0.63 115,200 COUNTY TAXABLE VALUE 100,200<br />

5539 Horseshoe Lake Rd EAST-1273364 NRTH-1096079 TOWN TAXABLE VALUE 97,920<br />

Batavia, NY 14020-9620 DEED BOOK 409 PG-59 SCHOOL TAXABLE VALUE 53,000<br />

FULL MARKET VALUE 115,200 FD015 <strong>Stafford</strong> fire 115,200 TO<br />

WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 7.-1-33.2 ******************<br />

8519 Route 237 00000058600<br />

7.-1-33.2 210 1 Family Res COUNTY TAXABLE VALUE 77,000<br />

Argenta Timothy LeRoy School 183601 11,000 TOWN TAXABLE VALUE 77,000<br />

Argenta Kimberly ACRES 0.69 77,000 SCHOOL TAXABLE VALUE 77,000<br />

6585 E Main Rd EAST-1284540 NRTH-1093884 FD015 <strong>Stafford</strong> fire 77,000 TO<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 760 PG-76 WD002 <strong>Stafford</strong> Water #2 1.00 UN<br />

FULL MARKET VALUE 77,000<br />

******************************************************************************************************* 10.-1-22 *******************<br />

6585 Route 5 00000043500<br />

10.-1-22 210 1 Family Res STAR B 41854 0 0 30,000<br />

Argenta Timothy LeRoy School 183601 14,700 COUNTY TAXABLE VALUE 96,400<br />

Argenta Kimberly ACRES 0.92 BANKFAR0100 96,400 TOWN TAXABLE VALUE 96,400<br />

6585 E Main Rd EAST-1291809 NRTH-1086349 SCHOOL TAXABLE VALUE 66,400<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 655 PG-82 FD015 <strong>Stafford</strong> fire 96,400 TO<br />

FULL MARKET VALUE 96,400 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 7<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 5.-1-46 ********************<br />

8797 <strong>Town</strong>line Rd 00000064500<br />

5.-1-46 210 1 Family Res STAR B 41854 0 0 30,000<br />

Arras Peter L Batavia City Sc 180200 15,000 COUNTY TAXABLE VALUE 134,800<br />

Arras Nancy ACRES 0.94 134,800 TOWN TAXABLE VALUE 134,800<br />

8797 Batv-Staf Twln Rd EAST-1269719 NRTH-1088936 SCHOOL TAXABLE VALUE 104,800<br />

Batavia, NY 14020 DEED BOOK 404 PG-982 FD015 <strong>Stafford</strong> fire 134,800 TO<br />

FULL MARKET VALUE 134,800 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 2.-1-27./AA ****************<br />

7894 Godfrey's Pond Rd<br />

2.-1-27./AA 260 Seasonal res COUNTY TAXABLE VALUE 2,700<br />

Asbeck Joseph Byron-Bergen Sc 183001 0 TOWN TAXABLE VALUE 2,700<br />

123 East Ave PC-7 2,700 SCHOOL TAXABLE VALUE 2,700<br />

Akron, NY 14001 ACRES 0.01 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

DEED BOOK 266 PG-581 FD015 <strong>Stafford</strong> fire 2,700 TO<br />

FULL MARKET VALUE 2,700<br />

******************************************************************************************************* 2.-1-27./FF ****************<br />

7898 Godfrey's Pond Rd<br />

2.-1-27./FF 260 Seasonal res COUNTY TAXABLE VALUE 9,500<br />

Asbeck Joseph Byron-Bergen Sc 183001 0 TOWN TAXABLE VALUE 9,500<br />

Asbeck Heather PC-8 9,500 SCHOOL TAXABLE VALUE 9,500<br />

123 East Ave ACRES 0.01 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

Akron, NY 14001 DEED BOOK 266 PG-581 FD015 <strong>Stafford</strong> fire 9,500 TO<br />

FULL MARKET VALUE 9,500<br />

******************************************************************************************************* 5.-1-6.12 ******************<br />

Prole Rd 00000028610<br />

5.-1-6.12 105 Vac farmland COUNTY TAXABLE VALUE 9,100<br />

Atwater Ruth Prole Batavia City Sc 180200 9,100 TOWN TAXABLE VALUE 9,100<br />

195 Whitewood Ln ACRES 20.20 9,100 SCHOOL TAXABLE VALUE 9,100<br />

Rochester, NY 14618 EAST-1273034 NRTH-1091339 FD015 <strong>Stafford</strong> fire 9,100 TO<br />

DEED BOOK 461 PG-00360<br />

FULL MARKET VALUE 9,100<br />

******************************************************************************************************* 4.-1-1.116 *****************<br />

6276 Clinton St. Rd<br />

4.-1-1.116 400 Commercial BUS >1997 47615 27,413 0 27,413<br />

B.G.W. Properties, LLC Byron-Bergen Sc 183001 41,600 BUS >1997 47615 14,621 0 14,621<br />

413 Garden Dr 6276 - Wormley Constructi 168,600 BUS >1997 47615 2,632 0 2,632<br />

Batavia, NY 14020 6280 - O.A. Newton COUNTY TAXABLE VALUE 123,934<br />

ACRES 4.60 TOWN TAXABLE VALUE 168,600<br />

EAST-1286026 NRTH-1103592 SCHOOL TAXABLE VALUE 123,934<br />

DEED BOOK 863 PG-779 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

FULL MARKET VALUE 168,600 FD015 <strong>Stafford</strong> fire 168,600 TO<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 8<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 8.-2-2.111 *****************<br />

5596 Route 5 00000052300<br />

8.-2-2.111 484 1 use sm bld COUNTY TAXABLE VALUE 106,000<br />

B.G.W. Properties, LLC Batavia City Sc 180200 24,000 TOWN TAXABLE VALUE 106,000<br />

413 Garden Dr Page Auction 106,000 SCHOOL TAXABLE VALUE 106,000<br />

Batavia, NY 14020 ACRES 1.80 FD015 <strong>Stafford</strong> fire 106,000 TO<br />

EAST-1274329 NRTH-1088204 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

DEED BOOK 875 PG-107<br />

FULL MARKET VALUE 106,000<br />

******************************************************************************************************* 1.-2-1 *********************<br />

<strong>Town</strong>line Rd 00000004400<br />

1.-2-1 120 Field crops COUNTY TAXABLE VALUE 16,000<br />

Babcock Nancy Byron-Bergen Sc 183001 16,000 TOWN TAXABLE VALUE 16,000<br />

4770 Thomas Rd ACRES 14.30 16,000 SCHOOL TAXABLE VALUE 16,000<br />

Healdsburg, CA 95448 EAST-1269187 NRTH-1100947 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

DEED BOOK 816 PG-291 FD015 <strong>Stafford</strong> fire 16,000 TO<br />

FULL MARKET VALUE 16,000<br />

******************************************************************************************************* 8.-1-21.11 *****************<br />

Route 5<br />

8.-1-21.11 120 Field crops AG DIST-CO 41720 7,672 7,672 7,672<br />

Bachorski Robert R Batavia City Sc 180200 23,100 COUNTY TAXABLE VALUE 15,428<br />

Bachorski Elaine M ACRES 23.20 23,100 TOWN TAXABLE VALUE 15,428<br />

5696 Route 5 EAST-1276940 NRTH-1088852 SCHOOL TAXABLE VALUE 15,428<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 872 PG-401 AG001 Ag. District #1 .00 MT<br />

FULL MARKET VALUE 23,100 FD015 <strong>Stafford</strong> fire 23,100 TO<br />

MAY BE SUBJECT TO PAYMENT<br />

UNDER AGDIST LAW TIL 2016<br />

******************************************************************************************************* 8.-2-9.1 *******************<br />

5696 Route 5<br />

8.-2-9.1 241 Rural res&ag AG DIST-CO 41720 32,099 32,099 32,099<br />

Bachorski Robert R Batavia City Sc 180200 80,800 STAR EN 41834 0 0 62,200<br />

Bachorski Elaine M Stonehedge Produce Farm 209,400 COUNTY TAXABLE VALUE 177,301<br />

5696 Route 5 ACRES 46.10 TOWN TAXABLE VALUE 177,301<br />

<strong>Stafford</strong>, NY 14143 EAST-1276221 NRTH-1087263 SCHOOL TAXABLE VALUE 115,101<br />

DEED BOOK 872 PG-401 AG001 Ag. District #1 .00 MT<br />

MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 209,400 FD015 <strong>Stafford</strong> fire 209,400 TO<br />

UNDER AGDIST LAW TIL 2016 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 11.-1-23.2 *****************<br />

6377 Westacott Rd 00000085400<br />

11.-1-23.2 210 1 Family Res STAR B 41854 0 0 30,000<br />

Bacon Devin R Pavilion School 184001 16,100 COUNTY TAXABLE VALUE 77,000<br />

6377 Westacott Rd 11-1-23.12 77,000 TOWN TAXABLE VALUE 77,000<br />

<strong>Stafford</strong>, NY 14143 partial assm't 2012 SCHOOL TAXABLE VALUE 47,000<br />

ACRES 1.20 BANKFAR0100 FD015 <strong>Stafford</strong> fire 77,000 TO<br />

EAST-1288228 NRTH-1077888<br />

DEED BOOK 877 PG-154<br />

FULL MARKET VALUE 77,000<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 9<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 2.-2-13.2 ******************<br />

7898 Waterman Rd 00000018900<br />

2.-2-13.2 210 1 Family Res STAR B 41854 0 0 30,000<br />

Bailey Joshua G LeRoy School 183601 18,400 COUNTY TAXABLE VALUE 243,000<br />

Bailey Julie E ACRES 5.00 BANKWFB0100 243,000 TOWN TAXABLE VALUE 243,000<br />

7898 Waterman Rd EAST-1291900 NRTH-1105119 SCHOOL TAXABLE VALUE 213,000<br />

Bergen, NY 14416 DEED BOOK 865 PG-966 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

FULL MARKET VALUE 243,000 FD015 <strong>Stafford</strong> fire 243,000 TO<br />

******************************************************************************************************* 8.-1-73 ********************<br />

6085 Route 5 00000036200<br />

8.-1-73 210 1 Family Res VETS-CV-C 41132 20,650 0 0<br />

Baker Duane B LeRoy School 183601 10,700 VETS-CV-T 41133 0 20,650 0<br />

6085 Main Rd ACRES 0.67 82,600 AGED C/T/S 41800 24,780 24,780 33,040<br />

<strong>Stafford</strong>, NY 14143 EAST-1283087 NRTH-1087251 STAR EN 41834 0 0 49,560<br />

DEED BOOK 705 PG-98 COUNTY TAXABLE VALUE 37,170<br />

FULL MARKET VALUE 82,600 TOWN TAXABLE VALUE 37,170<br />

SCHOOL TAXABLE VALUE 0<br />

FD015 <strong>Stafford</strong> fire 82,600 TO<br />

WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 8.-1-3 *********************<br />

8773 Prole Rd 00000028900<br />

8.-1-3 210 1 Family Res VETS-CV-C 41132 23,825 0 0<br />

Baker Enid B Batavia City Sc 180200 13,300 VETS-CV-T 41133 0 23,825 0<br />

8773 Prole Rd ACRES 0.83 95,300 STAR EN 41834 0 0 62,200<br />

Batavia, NY 14020 EAST-1274466 NRTH-1089454 COUNTY TAXABLE VALUE 71,475<br />

DEED BOOK 413 PG-1139 TOWN TAXABLE VALUE 71,475<br />

FULL MARKET VALUE 95,300 SCHOOL TAXABLE VALUE 33,100<br />

FD015 <strong>Stafford</strong> fire 95,300 TO<br />

WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 10.-1-18.2 *****************<br />

6737 Route 5 00000044900<br />

10.-1-18.2 210 1 Family Res STAR B 41854 0 0 30,000<br />

Balcom Charles E LeRoy School 183601 17,800 COUNTY TAXABLE VALUE 75,500<br />

Balcom Diane M 10-1-18.111 75,500 TOWN TAXABLE VALUE 75,500<br />

6737 Main Rd ACRES 4.00 SCHOOL TAXABLE VALUE 45,500<br />

<strong>Stafford</strong>, NY 14143 EAST-1294441 NRTH-1086506 AG003 Ag. District #3 .00 MT<br />

DEED BOOK 708 PG-120 AG3F2 Ag.dst. 3 form. 2 .00 MT<br />

FULL MARKET VALUE 75,500 FD015 <strong>Stafford</strong> fire 75,500 TO<br />

WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 8.-1-7 *********************<br />

8807 Prole Rd 00000029300<br />

8.-1-7 210 1 Family Res VETS-CV-C 41132 19,225 0 0<br />

Balduf Loren Batavia City Sc 180200 11,500 VETS-CV-T 41133 0 19,225 0<br />

8807 Prole Rd ACRES 0.72 76,900 STAR EN 41834 0 0 62,200<br />

Batavia, NY 14020 EAST-1274423 NRTH-1088675 COUNTY TAXABLE VALUE 57,675<br />

DEED BOOK 407 PG-1021 TOWN TAXABLE VALUE 57,675<br />

FULL MARKET VALUE 76,900 SCHOOL TAXABLE VALUE 14,700<br />

FD015 <strong>Stafford</strong> fire 76,900 TO<br />

WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 10<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 1.-1-21 ********************<br />

7879 Fotch Rd 00000000150<br />

1.-1-21 210 1 Family Res STAR B 41854 0 0 30,000<br />

Baldwin Lucinda L Byron-Bergen Sc 183001 10,600 COUNTY TAXABLE VALUE 132,500<br />

7879 Fotch Rd ACRES 0.66 132,500 TOWN TAXABLE VALUE 132,500<br />

Batavia, NY 14020 EAST-1271376 NRTH-1105093 SCHOOL TAXABLE VALUE 102,500<br />

DEED BOOK 785 PG-312 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

FULL MARKET VALUE 132,500 FD015 <strong>Stafford</strong> fire 132,500 TO<br />

******************************************************************************************************* 5.-1-3.1/J *****************<br />

5201 Seven Springs Rd<br />

5.-1-3.1/J 210 1 Family Res COUNTY TAXABLE VALUE 6,500<br />

Balling William C Batavia City Sc 180200 0 TOWN TAXABLE VALUE 6,500<br />

Balling Meghan B ACRES 0.01 6,500 SCHOOL TAXABLE VALUE 6,500<br />

5201 Seven Springs Rd Lot 10 DEED BOOK 577 PG-113 FD015 <strong>Stafford</strong> fire 6,500 TO<br />

Batavia, NY 14020 FULL MARKET VALUE 6,500<br />

******************************************************************************************************* 3.-1-24.2 ******************<br />

8030 Caswell Rd 00000022300<br />

3.-1-24.2 210 1 Family Res STAR B 41854 0 0 30,000<br />

Balonek James Byron-Bergen Sc 183001 16,100 COUNTY TAXABLE VALUE 135,000<br />

8030 Caswell Rd 3-1-24.12 135,000 TOWN TAXABLE VALUE 135,000<br />

Bergen, NY 14416 f/k/a 8730 SCHOOL TAXABLE VALUE 105,000<br />

ACRES 1.22 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

EAST-1281237 NRTH-1102347 FD015 <strong>Stafford</strong> fire 135,000 TO<br />

DEED BOOK 488 PG-148<br />

FULL MARKET VALUE 135,000<br />

******************************************************************************************************* 12.-1-4 ********************<br />

6454 Westacott Rd 00000084800<br />

12.-1-4 242 Rurl res&rec COUNTY TAXABLE VALUE 136,300<br />

Bannister John M Pavilion School 184001 30,100 TOWN TAXABLE VALUE 136,300<br />

Fedus Danielle R ACRES 32.10 BANKFAR0100 136,300 SCHOOL TAXABLE VALUE 136,300<br />

6454 Westacott Rd EAST-1289367 NRTH-1077167 FD015 <strong>Stafford</strong> fire 136,300 TO<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 884 PG-434<br />

FULL MARKET VALUE 136,300<br />

******************************************************************************************************* 10.-2-56 *******************<br />

9037 Roanoke Rd 00000080100<br />

10.-2-56 210 1 Family Res VETS-WV-C/ 41121 15,000 17,040 0<br />

Barber Barbara R LeRoy School 183601 7,400 STAR EN 41834 0 0 62,200<br />

9037 Roanoke Rd ACRES 0.46 BANKFAR0100 113,600 COUNTY TAXABLE VALUE 98,600<br />

<strong>Stafford</strong>, NY 14143 EAST-1290487 NRTH-1084849 TOWN TAXABLE VALUE 96,560<br />

DEED BOOK 873 PG-561 SCHOOL TAXABLE VALUE 51,400<br />

FULL MARKET VALUE 113,600 FD015 <strong>Stafford</strong> fire 113,600 TO<br />

WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 11<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 12.-1-23.12 ****************<br />

9711 Covell Rd 00000087400<br />

12.-1-23.12 210 1 Family Res STAR EN 41834 0 0 62,200<br />

Barber Daniel Pavilion School 184001 16,400 COUNTY TAXABLE VALUE 82,000<br />

Barber Rose ACRES 1.70 82,000 TOWN TAXABLE VALUE 82,000<br />

9711 Covell Rd EAST-1294172 NRTH-1073588 SCHOOL TAXABLE VALUE 19,800<br />

Pavilion, NY 14525 DEED BOOK 417 PG-294 AG003 Ag. District #3 .00 MT<br />

FULL MARKET VALUE 82,000 AG3F2 Ag.dst. 3 form. 2 .00 MT<br />

FD015 <strong>Stafford</strong> fire 82,000 TO<br />

******************************************************************************************************* 3.-1-21.11 *****************<br />

5976 Clinton St. Rd<br />

3.-1-21.11 210 1 Family Res STAR B 41854 0 0 30,000<br />

Barnard Dennis Byron-Bergen Sc 183001 14,700 COUNTY TAXABLE VALUE 86,400<br />

Barnard Mary ACRES 0.92 86,400 TOWN TAXABLE VALUE 86,400<br />

5976 Clinton St Rd EAST-1280991 NRTH-1101829 SCHOOL TAXABLE VALUE 56,400<br />

Bergen, NY 14416 DEED BOOK 580 PG-78 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

FULL MARKET VALUE 86,400 FD015 <strong>Stafford</strong> fire 86,400 TO<br />

******************************************************************************************************* 2.-2-7.12 ******************<br />

7739 Ivison Rd 00000018000<br />

2.-2-7.12 210 1 Family Res STAR B 41854 0 0 30,000<br />

Barnard Richard Byron-Bergen Sc 183001 8,600 COUNTY TAXABLE VALUE 109,000<br />

7739 Ivison Rd ACRES 0.54 109,000 TOWN TAXABLE VALUE 109,000<br />

Byron, NY 14422 EAST-1292278 NRTH-1107507 SCHOOL TAXABLE VALUE 79,000<br />

DEED BOOK 869 PG-283 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

FULL MARKET VALUE 109,000 FD015 <strong>Stafford</strong> fire 109,000 TO<br />

******************************************************************************************************* 10.-2-71 *******************<br />

9163 Roanoke Rd 00000080800<br />

10.-2-71 210 1 Family Res VETS-CV-C 41132 20,350 0 0<br />

Barrett John LeRoy School 183601 7,400 VETS-CV-T 41133 0 20,350 0<br />

Barrett Dorothy ACRES 0.46 81,400 STAR EN 41834 0 0 62,200<br />

9163 Roanoke Rd EAST-1290484 NRTH-1082545 COUNTY TAXABLE VALUE 61,050<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 325 PG-586 TOWN TAXABLE VALUE 61,050<br />

FULL MARKET VALUE 81,400 SCHOOL TAXABLE VALUE 19,200<br />

FD015 <strong>Stafford</strong> fire 81,400 TO<br />

WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 9.-1-36.111 ****************<br />

Fargo Rd 00000071000<br />

9.-1-36.111 314 Rural vac

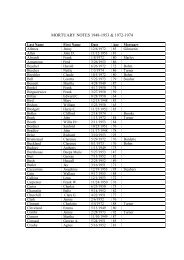

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 12<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 9.-1-36.112 ****************<br />

9395 Fargo Rd 00000071000<br />

9.-1-36.112 241 Rural res&ag STAR B 41854 0 0 30,000<br />

Barton Paul R Pavilion School 184001 33,900 COUNTY TAXABLE VALUE 163,000<br />

9395 Fargo Rd ACRES 19.80 163,000 TOWN TAXABLE VALUE 163,000<br />

East Bethany, NY 14054 EAST-1275162 NRTH-1078476 SCHOOL TAXABLE VALUE 133,000<br />

DEED BOOK 890 PG-835 FD015 <strong>Stafford</strong> fire 163,000 TO<br />

FULL MARKET VALUE 163,000<br />

******************************************************************************************************* 1.-2-20 ********************<br />

8210 Prole Rd Ext 00000009900<br />

1.-2-20 210 1 Family Res STAR B 41854 0 0 30,000<br />

Bartz Steven E Byron-Bergen Sc 183001 13,100 COUNTY TAXABLE VALUE 121,200<br />

Bartz Della L ACRES 0.82 BANKFAR0100 121,200 TOWN TAXABLE VALUE 121,200<br />

8210 Prole Rd Ext EAST-1272319 NRTH-1098848 SCHOOL TAXABLE VALUE 91,200<br />

Byron, NY 14422 DEED BOOK 469 PG-00182 FD015 <strong>Stafford</strong> fire 121,200 TO<br />

FULL MARKET VALUE 121,200<br />

******************************************************************************************************* 6.-1-53.2 ******************<br />

8584 Sanders Rd 00000034700<br />

6.-1-53.2 210 1 Family Res STAR B 41854 0 0 30,000<br />

Bartz Steven M LeRoy School 183601 16,800 COUNTY TAXABLE VALUE 90,900<br />

Bartz Penny L ACRES 2.30 90,900 TOWN TAXABLE VALUE 90,900<br />

8584 Sanders Rd EAST-1277508 NRTH-1092673 SCHOOL TAXABLE VALUE 60,900<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 872 PG-237 FD015 <strong>Stafford</strong> fire 90,900 TO<br />

FULL MARKET VALUE 90,900<br />

******************************************************************************************************* 6.-1-54.12 *****************<br />

Sanders Rd 00000034810<br />

6.-1-54.12 120 Field crops COUNTY TAXABLE VALUE 5,300<br />

Bartz Steven M LeRoy School 183601 5,300 TOWN TAXABLE VALUE 5,300<br />

Bartz Penny L ACRES 6.88 5,300 SCHOOL TAXABLE VALUE 5,300<br />

8584 Sanders Rd EAST-1277899 NRTH-1092164 AG001 Ag. District #1 .00 MT<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 651 PG-310 FD015 <strong>Stafford</strong> fire 5,300 TO<br />

FULL MARKET VALUE 5,300<br />

******************************************************************************************************* 6.-1-65 ********************<br />

5848 Horseshoe Lake Rd 00000027700<br />

6.-1-65 210 1 Family Res VETS-CV-C 41132 24,250 0 0<br />

Batchellor Helen B LeRoy School 183601 16,000 VETS-CV-T 41133 0 24,250 0<br />

Batchellor Gary F ACRES 1.00 97,000 STAR EN 41834 0 0 62,200<br />

5848 Horseshoe Lake Rd EAST-1278773 NRTH-1095747 COUNTY TAXABLE VALUE 72,750<br />

<strong>Stafford</strong>, NY 14143-9515 DEED BOOK 816 PG-224 TOWN TAXABLE VALUE 72,750<br />

FULL MARKET VALUE 97,000 SCHOOL TAXABLE VALUE 34,800<br />

FD015 <strong>Stafford</strong> fire 97,000 TO<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 13<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 10.-2-13 *******************<br />

6276 Route 5 00000048600<br />

10.-2-13 210 1 Family Res STAR EN 41834 0 0 55,000<br />

Batchelor John H Sr LeRoy School 183601 7,800 COUNTY TAXABLE VALUE 55,000<br />

6276 Route 5 ACRES 0.49 BANKFAR0100 55,000 TOWN TAXABLE VALUE 55,000<br />

<strong>Stafford</strong>, NY 14143 EAST-1286329 NRTH-1086276 SCHOOL TAXABLE VALUE 0<br />

DEED BOOK 882 PG-651 FD015 <strong>Stafford</strong> fire 55,000 TO<br />

FULL MARKET VALUE 55,000 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 2.-1-4.2 *******************<br />

7791 Byron Rd 00000002210<br />

2.-1-4.2 210 1 Family Res STAR B 41854 0 0 30,000<br />

Bausch Donald Byron-Bergen Sc 183001 17,700 COUNTY TAXABLE VALUE 190,000<br />

Bausch Joan 2-1-32 190,000 TOWN TAXABLE VALUE 190,000<br />

7791 Byron Rd ACRES 3.90 SCHOOL TAXABLE VALUE 160,000<br />

Byron, NY 14422 EAST-1274058 NRTH-1107023 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

DEED BOOK 759 PG-216 FD015 <strong>Stafford</strong> fire 190,000 TO<br />

FULL MARKET VALUE 190,000<br />

******************************************************************************************************* 9.-1-39 ********************<br />

5730 Sweetland Rd 00000075300<br />

9.-1-39 210 1 Family Res STAR B 41854 0 0 30,000<br />

Beaver Jeffrey S Batavia City Sc 180200 11,500 COUNTY TAXABLE VALUE 89,900<br />

Beaver Susan C ACRES 0.72 89,900 TOWN TAXABLE VALUE 89,900<br />

5730 Sweetland Rd EAST-1276664 NRTH-1080961 SCHOOL TAXABLE VALUE 59,900<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 597 PG-76 FD015 <strong>Stafford</strong> fire 89,900 TO<br />

FULL MARKET VALUE 89,900<br />

******************************************************************************************************* 10.-2-73 *******************<br />

9160 Roanoke Rd 00000084400<br />

10.-2-73 210 1 Family Res STAR B 41854 0 0 30,000<br />

Beck Anne L LeRoy School 183601 10,400 COUNTY TAXABLE VALUE 98,000<br />

9160 Roanoke Rd ACRES 0.72 BANKFAR0100 98,000 TOWN TAXABLE VALUE 98,000<br />

<strong>Stafford</strong>, NY 14143 EAST-1290201 NRTH-1082691 SCHOOL TAXABLE VALUE 68,000<br />

DEED BOOK 782 PG-48 FD015 <strong>Stafford</strong> fire 98,000 TO<br />

FULL MARKET VALUE 98,000 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 8.-1-5 *********************<br />

8783 Prole Rd 00000029100<br />

8.-1-5 210 1 Family Res COUNTY TAXABLE VALUE 60,000<br />

Bednarek Kevin J Jr Batavia City Sc 180200 8,800 TOWN TAXABLE VALUE 60,000<br />

Howe Brooke F ACRES 0.55 60,000 SCHOOL TAXABLE VALUE 60,000<br />

8783 Prole Rd EAST-1274447 NRTH-1089232 FD015 <strong>Stafford</strong> fire 60,000 TO<br />

Batavia, NY 14020 DEED BOOK 854 PG-726 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

FULL MARKET VALUE 60,000<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 14<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 7.-1-17.2 ******************<br />

6692 Randall Rd 00000057800<br />

7.-1-17.2 210 1 Family Res STAR B 41854 0 0 30,000<br />

Beedham David R LeRoy School 183601 16,000 COUNTY TAXABLE VALUE 110,000<br />

Murray-Beedham Terri ACRES 1.00 110,000 TOWN TAXABLE VALUE 110,000<br />

6692 Randall Rd EAST-1293945 NRTH-1096018 SCHOOL TAXABLE VALUE 80,000<br />

Leroy, NY 14482 DEED BOOK 481 PG-00229 AG003 Ag. District #3 .00 MT<br />

FULL MARKET VALUE 110,000 AG3F2 Ag.dst. 3 form. 2 .00 MT<br />

FD015 <strong>Stafford</strong> fire 110,000 TO<br />

******************************************************************************************************* 12.-1-48.1 *****************<br />

E. Bethany-Leroy Rd 00000088550<br />

12.-1-48.1 320 Rural vacant AG DIST-CO 41720 22,275 22,275 22,275<br />

Berkemeier Jeremy Pavilion School 184001 31,500 COUNTY TAXABLE VALUE 9,225<br />

10749 East Rd ACRES 24.80 31,500 TOWN TAXABLE VALUE 9,225<br />

Pavilion, NY 14525 EAST-1285803 NRTH-1072685 SCHOOL TAXABLE VALUE 9,225<br />

DEED BOOK 707 PG-349 AG003 Ag. District #3 .00 MT<br />

MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 31,500 AG3F2 Ag.dst. 3 form. 2 .00 MT<br />

UNDER AGDIST LAW TIL 2016 FD015 <strong>Stafford</strong> fire 31,500 TO<br />

******************************************************************************************************* 8.-2-30 ********************<br />

6084 Route 5 00000051200<br />

8.-2-30 210 1 Family Res STAR B 41854 0 0 30,000<br />

Bernard Nina K LeRoy School 183601 5,400 COUNTY TAXABLE VALUE 70,000<br />

Bernard Gary F ACRES 0.34 BANKFSB0100 70,000 TOWN TAXABLE VALUE 70,000<br />

6084 Main Rd EAST-1283036 NRTH-1086915 SCHOOL TAXABLE VALUE 40,000<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 530 PG-00346 FD015 <strong>Stafford</strong> fire 70,000 TO<br />

FULL MARKET VALUE 70,000 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 1.-2-82 ********************<br />

5358 Horseshoe Lake Rd 00000016200<br />

1.-2-82 270 Mfg housing STAR B 41854 0 0 30,000<br />

Best Michael T Byron-Bergen Sc 183001 11,800 COUNTY TAXABLE VALUE 30,000<br />

Best Deborah R ACRES 0.74 30,000 TOWN TAXABLE VALUE 30,000<br />

5358 Horseshoe Lake Rd EAST-1270806 NRTH-1097082 SCHOOL TAXABLE VALUE 0<br />

Batavia, NY 14020 DEED BOOK 460 PG-00105 FD015 <strong>Stafford</strong> fire 30,000 TO<br />

FULL MARKET VALUE 30,000 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 11.-1-7.12 *****************<br />

6627 Sweetland Rd 00000072800<br />

11.-1-7.12 210 1 Family Res STAR B 41854 0 0 30,000<br />

Bestor Gary D LeRoy School 183601 8,600 COUNTY TAXABLE VALUE 113,300<br />

Bestor Anne Marie ACRES 0.54 113,300 TOWN TAXABLE VALUE 113,300<br />

6627 Sweetland Rd EAST-1292652 NRTH-1081107 SCHOOL TAXABLE VALUE 83,300<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 525 PG-00137 FD015 <strong>Stafford</strong> fire 113,300 TO<br />

FULL MARKET VALUE 113,300 WD004 <strong>Stafford</strong> Water #4 1.00 UN<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 15<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 7.-1-64 ********************<br />

8551 Woodland Dr 00000059480<br />

7.-1-64 210 1 Family Res STAR B 41854 0 0 30,000<br />

Betters James R LeRoy School 183601 16,000 COUNTY TAXABLE VALUE 210,000<br />

8551 Woodland Dr ACRES 1.03 210,000 TOWN TAXABLE VALUE 210,000<br />

Leroy, NY 14482 EAST-1291794 NRTH-1093321 SCHOOL TAXABLE VALUE 180,000<br />

DEED BOOK 818 PG-227 FD015 <strong>Stafford</strong> fire 210,000 TO<br />

FULL MARKET VALUE 210,000<br />

******************************************************************************************************* 9.-1-32.111 ****************<br />

9336 Clipnock Rd 00000077100<br />

9.-1-32.111 210 1 Family Res VETS-WV-C 41122 15,000 0 0<br />

Bianchi Amelia B Pavilion School 184001 20,200 VETS-WV-T 41123 0 18,000 0<br />

9336 Clipnock Rd ACRES 9.00 124,100 STAR EN 41834 0 0 62,200<br />

<strong>Stafford</strong>, NY 14143 EAST-1282539 NRTH-1079274 COUNTY TAXABLE VALUE 109,100<br />

DEED BOOK 432 PG-642 TOWN TAXABLE VALUE 106,100<br />

FULL MARKET VALUE 124,100 SCHOOL TAXABLE VALUE 61,900<br />

FD015 <strong>Stafford</strong> fire 124,100 TO<br />

WD008 <strong>Stafford</strong> Water #8 .00 UN<br />

******************************************************************************************************* 9.-1-24.22 *****************<br />

Clipnock Rd 0000076020<br />

9.-1-24.22 310 Res Vac COUNTY TAXABLE VALUE 16,800<br />

Bianchi Vincent D LeRoy School 183601 16,800 TOWN TAXABLE VALUE 16,800<br />

Bianchi Amelia B ACRES 2.30 16,800 SCHOOL TAXABLE VALUE 16,800<br />

9336 Clipnock Rd EAST-1283262 NRTH-1079492 FD015 <strong>Stafford</strong> fire 16,800 TO<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 698 PG-241 WD008 <strong>Stafford</strong> Water #8 .00 UN<br />

FULL MARKET VALUE 16,800<br />

******************************************************************************************************* 9.-1-23 ********************<br />

9311 Clipnock Rd 00000075900<br />

9.-1-23 210 1 Family Res STAR B 41854 0 0 30,000<br />

Bianchi Vincent D Jr Pavilion School 184001 16,700 COUNTY TAXABLE VALUE 117,200<br />

9311 Clipnock Rd ACRES 2.20 BANKFAR0100 117,200 TOWN TAXABLE VALUE 117,200<br />

<strong>Stafford</strong>, NY 14143 EAST-1283200 NRTH-1079773 SCHOOL TAXABLE VALUE 87,200<br />

DEED BOOK 854 PG-767 FD015 <strong>Stafford</strong> fire 117,200 TO<br />

FULL MARKET VALUE 117,200 WD008 <strong>Stafford</strong> Water #8 .00 UN<br />

******************************************************************************************************* 2.-2-15.2 ******************<br />

6496 Clinton St. Rd 00000017750<br />

2.-2-15.2 210 1 Family Res VETS-WV-C 41122 15,000 0 0<br />

Biegas John D Byron-Bergen Sc 183001 16,300 VETS-WV-T 41123 0 17,220 0<br />

6496 Clinton St Rd ACRES 1.50 BANKFSB0100 114,800 VETS-DV-C 41142 5,740 0 0<br />

Bergen, NY 14416-9760 EAST-1290334 NRTH-1105599 VETS-DV-T 41143 0 5,740 0<br />

DEED BOOK 525 PG-00095 STAR B 41854 0 0 30,000<br />

FULL MARKET VALUE 114,800 COUNTY TAXABLE VALUE 94,060<br />

TOWN TAXABLE VALUE 91,840<br />

SCHOOL TAXABLE VALUE 84,800<br />

AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

FD015 <strong>Stafford</strong> fire 114,800 TO<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 16<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 9.-1-15.2 ******************<br />

9196 Transit Rd 00000079000<br />

9.-1-15.2 210 1 Family Res STAR B 41854 0 0 30,000<br />

Bigsby - McQuillen Sheila Pavilion School 184001 16,500 COUNTY TAXABLE VALUE 127,600<br />

9196 Transit Rd ACRES 1.80 127,600 TOWN TAXABLE VALUE 127,600<br />

<strong>Stafford</strong>, NY 14143 EAST-1284385 NRTH-1081947 SCHOOL TAXABLE VALUE 97,600<br />

DEED BOOK 684 PG-160 FD015 <strong>Stafford</strong> fire 127,600 TO<br />

FULL MARKET VALUE 127,600 WD008 <strong>Stafford</strong> Water #8 .00 UN<br />

******************************************************************************************************* 1.-2-95 ********************<br />

8399 Seven Springs Rd 00000006700<br />

1.-2-95 210 1 Family Res STAR B 41854 0 0 30,000<br />

Bisch<strong>of</strong>f Adam R Batavia City Sc 180200 7,500 COUNTY TAXABLE VALUE 103,800<br />

8399 Seven Springs Rd ACRES 0.47 BANKFAR0100 103,800 TOWN TAXABLE VALUE 103,800<br />

Batavia, NY 14020 EAST-1268757 NRTH-1095820 SCHOOL TAXABLE VALUE 73,800<br />

DEED BOOK 888 PG-404 FD015 <strong>Stafford</strong> fire 103,800 TO<br />

FULL MARKET VALUE 103,800 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

******************************************************************************************************* 6.-1-7.12 ******************<br />

5591 Horseshoe Lake Rd 00000026200<br />

6.-1-7.12 210 1 Family Res STAR B 41854 0 0 30,000<br />

Blake David G Byron-Bergen Sc 183001 16,400 COUNTY TAXABLE VALUE 138,700<br />

Blake Donna J ACRES 1.59 138,700 TOWN TAXABLE VALUE 138,700<br />

5591 Horseshoe Lake Rd EAST-1274366 NRTH-1096041 SCHOOL TAXABLE VALUE 108,700<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 442 PG-00148 FD015 <strong>Stafford</strong> fire 138,700 TO<br />

FULL MARKET VALUE 138,700<br />

******************************************************************************************************* 3.-1-29 ********************<br />

8143 Mill Rd 00000021900<br />

3.-1-29 210 1 Family Res STAR B 41854 0 0 30,000<br />

Bobo Rodney B Byron-Bergen Sc 183001 7,400 COUNTY TAXABLE VALUE 137,800<br />

Bobo Susan E ACRES 0.46 137,800 TOWN TAXABLE VALUE 137,800<br />

8143 Mill Rd EAST-1275275 NRTH-1100348 SCHOOL TAXABLE VALUE 107,800<br />

Bergen, NY 14416 DEED BOOK 837 PG-103 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

FULL MARKET VALUE 137,800 FD015 <strong>Stafford</strong> fire 137,800 TO<br />

******************************************************************************************************* 1.-2-30 ********************<br />

5449 Clinton St. Rd 00000009300<br />

1.-2-30 210 1 Family Res STAR B 41854 0 0 30,000<br />

Bohn Michael J Jr Byron-Bergen Sc 183001 16,100 COUNTY TAXABLE VALUE 98,600<br />

5449 Clinton St Rd ACRES 1.10 98,600 TOWN TAXABLE VALUE 98,600<br />

Batavia, NY 14020 EAST-1271976 NRTH-1098131 SCHOOL TAXABLE VALUE 68,600<br />

DEED BOOK 756 PG-212 FD015 <strong>Stafford</strong> fire 98,600 TO<br />

FULL MARKET VALUE 98,600 WD001 <strong>Stafford</strong> Water #1 1.00 UN<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 17<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 2.-2-18.12 *****************<br />

6310 Griswold Rd 00000023110<br />

2.-2-18.12 210 1 Family Res AGED C/T/S 41800 18,930 18,930 18,930<br />

Boldt Arlene Byron-Bergen Sc 183001 16,300 STAR EN 41834 0 0 62,200<br />

Boldt Steven B 2-2-18.112 126,200 COUNTY TAXABLE VALUE 107,270<br />

6310 Griswold Rd ACRES 1.50 TOWN TAXABLE VALUE 107,270<br />

South Byron, NY 14557 EAST-1286774 NRTH-1105829 SCHOOL TAXABLE VALUE 45,070<br />

DEED BOOK 570 PG-265 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

FULL MARKET VALUE 126,200 FD015 <strong>Stafford</strong> fire 126,200 TO<br />

WD003 <strong>Stafford</strong> Water #3 1.00 UN<br />

******************************************************************************************************* 2.-1-8.1 *******************<br />

Griswold Rd 00000016700<br />

2.-1-8.1 120 Field crops AG DIST-CO 41720 24,260 24,260 24,260<br />

Boldt Gene L Byron-Bergen Sc 183001 51,200 COUNTY TAXABLE VALUE 26,940<br />

Boldt Farms D/B/A ACRES 61.60 51,200 TOWN TAXABLE VALUE 26,940<br />

7865 Byron-Holley Rd EAST-1277205 NRTH-1107246 SCHOOL TAXABLE VALUE 26,940<br />

PO Box 10 DEED BOOK 767 PG-85 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

South Byron, NY 14557 FULL MARKET VALUE 51,200 FD015 <strong>Stafford</strong> fire 51,200 TO<br />

MAY BE SUBJECT TO PAYMENT<br />

UNDER AGDIST LAW TIL 2016<br />

******************************************************************************************************* 2.-1-9 *********************<br />

Griswold Rd 00000016700<br />

2.-1-9 120 Field crops AG DIST-CO 41720 39,294 39,294 39,294<br />

Boldt Gene L Byron-Bergen Sc 183001 79,700 COUNTY TAXABLE VALUE 40,406<br />

Boldt Farms D/B/A ACRES 68.10 79,700 TOWN TAXABLE VALUE 40,406<br />

7865 Byron-Holley Rd EAST-1279128 NRTH-1106918 SCHOOL TAXABLE VALUE 40,406<br />

PO Box 10 DEED BOOK 767 PG-85 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

South Byron, NY 14557 FULL MARKET VALUE 79,700 FD015 <strong>Stafford</strong> fire 79,700 TO<br />

MAY BE SUBJECT TO PAYMENT<br />

UNDER AGDIST LAW TIL 2016<br />

******************************************************************************************************* 2.-1-24.1 ******************<br />

Griswold Rd 00000020000<br />

2.-1-24.1 120 Field crops AG DIST-CO 41720 43,888 43,888 43,888<br />

Boldt Gene L Byron-Bergen Sc 183001 89,900 COUNTY TAXABLE VALUE 46,012<br />

Boldt Farms D/B/A ACRES 72.50 89,900 TOWN TAXABLE VALUE 46,012<br />

7865 Byron-Holley Rd EAST-1277846 NRTH-1105160 SCHOOL TAXABLE VALUE 46,012<br />

PO Box 10 DEED BOOK 767 PG-89 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

South Byron, NY 14557 FULL MARKET VALUE 89,900 FD015 <strong>Stafford</strong> fire 89,900 TO<br />

MAY BE SUBJECT TO PAYMENT<br />

UNDER AGDIST LAW TIL 2016<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 18<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 2.-2-17.2 ******************<br />

6402 Griswold Rd<br />

2.-2-17.2 210 1 Family Res STAR B 41854 0 0 30,000<br />

Boldt Gene L Byron-Bergen Sc 183001 16,400 COUNTY TAXABLE VALUE 115,100<br />

6402 Griswold Rd ACRES 1.70 115,100 TOWN TAXABLE VALUE 115,100<br />

PO Box 10 EAST-1288424 NRTH-1105777 SCHOOL TAXABLE VALUE 85,100<br />

South Byron, NY 14557 DEED BOOK 800 PG-220 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

FULL MARKET VALUE 115,100 FD015 <strong>Stafford</strong> fire 115,100 TO<br />

******************************************************************************************************* 3.-1-5 *********************<br />

Griswold Rd 00000021600<br />

3.-1-5 105 Vac farmland AG DIST-CO 41720 34,848 34,848 34,848<br />

Boldt Gene L Byron-Bergen Sc 183001 73,500 COUNTY TAXABLE VALUE 38,652<br />

Boldt Farms D/B/A ACRES 65.60 73,500 TOWN TAXABLE VALUE 38,652<br />

7865 Byron-Holley Rd EAST-1277613 NRTH-1103863 SCHOOL TAXABLE VALUE 38,652<br />

PO Box 10 DEED BOOK 767 PG-89 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

South Byron, NY 14557 FULL MARKET VALUE 73,500 FD015 <strong>Stafford</strong> fire 73,500 TO<br />

MAY BE SUBJECT TO PAYMENT<br />

UNDER AGDIST LAW TIL 2016<br />

******************************************************************************************************* 2.-2-18.2 ******************<br />

7865 Route 237 00000023100<br />

2.-2-18.2 210 1 Family Res STAR B 41854 0 0 30,000<br />

Boldt James F Byron-Bergen Sc 183001 16,200 COUNTY TAXABLE VALUE 116,100<br />

7865 Rt 237 ACRES 1.35 116,100 TOWN TAXABLE VALUE 116,100<br />

So Byron, NY 14557 EAST-1286835 NRTH-1105334 SCHOOL TAXABLE VALUE 86,100<br />

DEED BOOK 426 PG-644 FD015 <strong>Stafford</strong> fire 116,100 TO<br />

FULL MARKET VALUE 116,100 WD003 <strong>Stafford</strong> Water #3 1.00 UN<br />

******************************************************************************************************* 2.-2-2 *********************<br />

6403 Griswold Rd<br />

2.-2-2 120 Field crops AG BLDG 41700 80,000 80,000 80,000<br />

Boldt Steven B Byron-Bergen Sc 183001 167,100 AG DIST-CO 41720 89,909 89,909 89,909<br />

Boldt Gene L ACRES 105.90 410,000 COUNTY TAXABLE VALUE 240,091<br />

6402 Griswold Rd EAST-1288083 NRTH-1106847 TOWN TAXABLE VALUE 240,091<br />

PO Box 10 DEED BOOK 800 PG-223 SCHOOL TAXABLE VALUE 240,091<br />

South Byron, NY 14557 FULL MARKET VALUE 410,000 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

FD015 <strong>Stafford</strong> fire 410,000 TO<br />

MAY BE SUBJECT TO PAYMENT WD003 <strong>Stafford</strong> Water #3 .00 UN<br />

UNDER AGDIST LAW TIL 2016<br />

******************************************************************************************************* 2.-2-17.11 *****************<br />

Griswold Rd<br />

2.-2-17.11 120 Field crops AG DIST-CO 41720 43,918 43,918 43,918<br />

Boldt Steven B Byron-Bergen Sc 183001 83,600 COUNTY TAXABLE VALUE 39,682<br />

Boldt Gene L *2.-2-17.1+18.111=17.11* 83,600 TOWN TAXABLE VALUE 39,682<br />

6402 Griswold Rd ACRES 59.10 SCHOOL TAXABLE VALUE 39,682<br />

PO Box 10 EAST-1287711 NRTH-1105220 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

So Byron, NY 14557 DEED BOOK 800 PG-223 FD015 <strong>Stafford</strong> fire 83,600 TO<br />

FULL MARKET VALUE 83,600 WD003 <strong>Stafford</strong> Water #3 .00 UN<br />

MAY BE SUBJECT TO PAYMENT<br />

UNDER AGDIST LAW TIL 2016<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 19<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 4.-1-4.2 *******************<br />

Clinton St. Rd 00000023350<br />

4.-1-4.2 120 Field crops AG DIST-CO 41720 21,148 21,148 21,148<br />

Boldt Steven B Byron-Bergen Sc 183001 43,800 COUNTY TAXABLE VALUE 22,652<br />

Boldt Gene L ACRES 38.80 43,800 TOWN TAXABLE VALUE 22,652<br />

6310 Giswold Rd EAST-1288820 NRTH-1103836 SCHOOL TAXABLE VALUE 22,652<br />

PO Box 10 DEED BOOK 800 PG-223 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

South Byron, NY 14557 FULL MARKET VALUE 43,800 FD015 <strong>Stafford</strong> fire 43,800 TO<br />

MAY BE SUBJECT TO PAYMENT<br />

UNDER AGDIST LAW TIL 2016<br />

******************************************************************************************************* 9.-1-58 ********************<br />

9168 Clipnock Rd<br />

9.-1-58 210 1 Family Res STAR B 41854 0 0 30,000<br />

Boldt Steven B Pavilion School 184001 19,300 COUNTY TAXABLE VALUE 192,600<br />

Boldt Crista J ACRES 6.70 192,600 TOWN TAXABLE VALUE 192,600<br />

9168 Clipnock Rd EAST-1282328 NRTH-1082311 SCHOOL TAXABLE VALUE 162,600<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 848 PG-754 AG001 Ag. District #1 .00 MT<br />

FULL MARKET VALUE 192,600 FD015 <strong>Stafford</strong> fire 192,600 TO<br />

WD007 <strong>Stafford</strong> Water #7 1.00 UN<br />

******************************************************************************************************* 2.-1-13 ********************<br />

7824 Caswell Rd 00000017100<br />

2.-1-13 220 2 Family Res STAR B 41854 0 0 30,000<br />

Borden Karen Byron-Bergen Sc 183001 16,200 COUNTY TAXABLE VALUE 152,000<br />

7824 Caswell Rd ACRES 1.30 BANKFAR0100 152,000 TOWN TAXABLE VALUE 152,000<br />

Byron, NY 14422 EAST-1282643 NRTH-1106150 SCHOOL TAXABLE VALUE 122,000<br />

DEED BOOK 761 PG-28 FD015 <strong>Stafford</strong> fire 152,000 TO<br />

FULL MARKET VALUE 152,000<br />

******************************************************************************************************* 2.-2-23.11 *****************<br />

6181 Clinton St. Rd 00000023052<br />

2.-2-23.11 210 1 Family Res AGED C/T/S 41800 51,500 51,500 51,500<br />

Bow Irene M Byron-Bergen Sc 183001 16,200 STAR EN 41834 0 0 51,500<br />

6181 Clinton St. Rd ACRES 1.40 103,000 COUNTY TAXABLE VALUE 51,500<br />

Bergen, NY 14416 EAST-1284599 NRTH-1103538 TOWN TAXABLE VALUE 51,500<br />

DEED BOOK 881 PG-67 SCHOOL TAXABLE VALUE 0<br />

FULL MARKET VALUE 103,000 AG5F4 Ag.dst. 5 form. 4 .00 MT<br />

FD015 <strong>Stafford</strong> fire 103,000 TO<br />

******************************************************************************************************* 3.-1-16.2 ******************<br />

6065 Mullen Rd 00000024900<br />

3.-1-16.2 210 1 Family Res VETS-CV-C 41132 21,750 0 0<br />

Boyce Martin I LeRoy School 183601 16,100 VETS-CV-T 41133 0 21,750 0<br />

Boyce Bonita L ACRES 1.10 BANKESL0100 87,000 VETS-DV-C 41142 4,350 0 0<br />

6065 Mullen Rd EAST-1282473 NRTH-1097713 VETS-DV-T 41143 0 4,350 0<br />

<strong>Stafford</strong>, NY 14143 DEED BOOK 433 PG-00790 STAR B 41854 0 0 30,000<br />

FULL MARKET VALUE 87,000 COUNTY TAXABLE VALUE 60,900<br />

TOWN TAXABLE VALUE 60,900<br />

SCHOOL TAXABLE VALUE 57,000<br />

FD015 <strong>Stafford</strong> fire 87,000 TO<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 20<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 9.-1-4 *********************<br />

9029 Fargo Rd 00000070700<br />

9.-1-4 210 1 Family Res STAR B 41854 0 0 30,000<br />

Boyce Scott Batavia City Sc 180200 5,800 COUNTY TAXABLE VALUE 87,000<br />

9029 Fargo Rd ACRES 0.36 BANKFAR0100 87,000 TOWN TAXABLE VALUE 87,000<br />

<strong>Stafford</strong>, NY 14143 EAST-1274049 NRTH-1084773 SCHOOL TAXABLE VALUE 57,000<br />

DEED BOOK 633 PG-149 FD015 <strong>Stafford</strong> fire 87,000 TO<br />

FULL MARKET VALUE 87,000 WD007 <strong>Stafford</strong> Water #7 1.00 UN<br />

******************************************************************************************************* 6.-1-32 ********************<br />

8465 Morganville Rd 00000061700<br />

6.-1-32 210 1 Family Res STAR EN 41834 0 0 62,200<br />

Boyle Judith A LeRoy School 183601 9,000 COUNTY TAXABLE VALUE 84,200<br />

8465 Morganville Rd ACRES 0.56 84,200 TOWN TAXABLE VALUE 84,200<br />

<strong>Stafford</strong>, NY 14143 EAST-1284109 NRTH-1094979 SCHOOL TAXABLE VALUE 22,000<br />

DEED BOOK 461 PG-00966 FD015 <strong>Stafford</strong> fire 84,200 TO<br />

FULL MARKET VALUE 84,200 WD002 <strong>Stafford</strong> Water #2 1.00 UN<br />

******************************************************************************************************* 9.-1-55.11 *****************<br />

5750 Sweetland Rd<br />

9.-1-55.11 210 1 Family Res STAR B 41854 0 0 30,000<br />

Boyle Keith E Batavia City Sc 180200 18,300 COUNTY TAXABLE VALUE 245,000<br />

Boyle Susan A Liber 237-18 245,000 TOWN TAXABLE VALUE 245,000<br />

5750 Sweetland Rd *9.-1-54+55+56=55.1* SCHOOL TAXABLE VALUE 215,000<br />

<strong>Stafford</strong>, NY 14143 ACRES 4.80 BANKFAR0100 AG001 Ag. District #1 .00 MT<br />

EAST-1277041 NRTH-1080862 FD015 <strong>Stafford</strong> fire 245,000 TO<br />

DEED BOOK 870 PG-986<br />

FULL MARKET VALUE 245,000<br />

******************************************************************************************************* 12.-1-63 *******************<br />

Roanoke Rd 00000082900<br />

12.-1-63 105 Vac farmland COUNTY TAXABLE VALUE 6,500<br />

Bradley Dorothy Pavilion School 184001 6,500 TOWN TAXABLE VALUE 6,500<br />

Bradley Robert L ACRES 16.20 6,500 SCHOOL TAXABLE VALUE 6,500<br />

6731 Junction Rd EAST-1291427 NRTH-1071475 AG003 Ag. District #3 .00 MT<br />

Pavilion, NY 14525 DEED BOOK 862 PG-857 FD015 <strong>Stafford</strong> fire 6,500 TO<br />

FULL MARKET VALUE 6,500<br />

******************************************************************************************************* 12.-1-37.113 ***************<br />

Roanoke Rd 00000082900<br />

12.-1-37.113 120 Field crops AG DIST-CO 41720 34,667 34,667 34,667<br />

Bradley Robert L Pavilion School 184001 64,600 COUNTY TAXABLE VALUE 29,933<br />

6731 Junction Rd ACRES 64.40 64,600 TOWN TAXABLE VALUE 29,933<br />

Pavilion, NY 14525 EAST-1289881 NRTH-1071603 SCHOOL TAXABLE VALUE 29,933<br />

DEED BOOK 862 PG-857 AG003 Ag. District #3 .00 MT<br />

MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 64,600 FD015 <strong>Stafford</strong> fire 64,600 TO<br />

UNDER AGDIST LAW TIL 2016 WD005 <strong>Stafford</strong> Water #5 .00 UN<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 21<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Stafford</strong> OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 184400 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 7.-1-61 ********************<br />

8536 Woodland Dr 00000059400<br />

7.-1-61 210 1 Family Res COUNTY TAXABLE VALUE 202,000<br />

Brady Brenda L LeRoy School 183601 16,300 TOWN TAXABLE VALUE 202,000<br />

8536 Woodland Dr ACRES 1.50 202,000 SCHOOL TAXABLE VALUE 202,000<br />

Leroy, NY 14482 EAST-1291415 NRTH-1093663 FD015 <strong>Stafford</strong> fire 202,000 TO<br />

DEED BOOK 878 PG-148<br />

FULL MARKET VALUE 202,000<br />