ACE Investment Strategists, LLC - MoneyShow.com

ACE Investment Strategists, LLC - MoneyShow.com

ACE Investment Strategists, LLC - MoneyShow.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ACE</strong> <strong>Investment</strong> <strong>Strategists</strong>, <strong>LLC</strong><br />

April 2010 DCP Profile<br />

<strong>ACE</strong> <strong>Investment</strong> <strong>Strategists</strong>, <strong>LLC</strong> is a trading advisor that studies financial markets with the goal of<br />

developing sound and timely strategic investment approaches to add better-than-average growth<br />

to investment portfolios. Our mission is to deliver consistent investment returns, <strong>com</strong>pared with the<br />

major stock indices, by creating strategies that are uniquely designed and implemented to succeed<br />

in all market environments, whether trending or consolidating. At present, we prefer ten strategies<br />

that best meet our criteria for an effective balance of growth and risk.<br />

DIVERSIFIED COMMODITY PROGRAM (DCP)<br />

The objective of the Diversified Commodity Program (DCP) is to take a more focused advantage of trade opportunities in a broad spectrum of<br />

<strong>com</strong>modity markets. This strategy grows out of the <strong>ACE</strong> Diversified Premium Collection Strategy (DPC) which is a mix of roughly half of<br />

account assets supporting the S&P 500 Index future and half devoted to other <strong>com</strong>modities. This strategy will place higher focus on these<br />

other <strong>com</strong>modity markets. Tactically, the Advisor has the discretion to trade options-on-futures or the future itself. That will usually depend<br />

upon the specific <strong>com</strong>modity involved and the conditions in the market. The Advisor expects the greatest concentration will be on energy,<br />

precious metals, currencies, and U.S. treasury notes and bonds. Trades may also <strong>com</strong>e to the surface for other financials, agricultural<br />

<strong>com</strong>modities or other futures, including stock index futures depending upon the appraisal of the opportunity and the availability of capital<br />

in the accounts. Trading futures and options involves substantial risk of loss and is not suitable for all investors. The risk of loss in options<br />

writing programs is unlimited.<br />

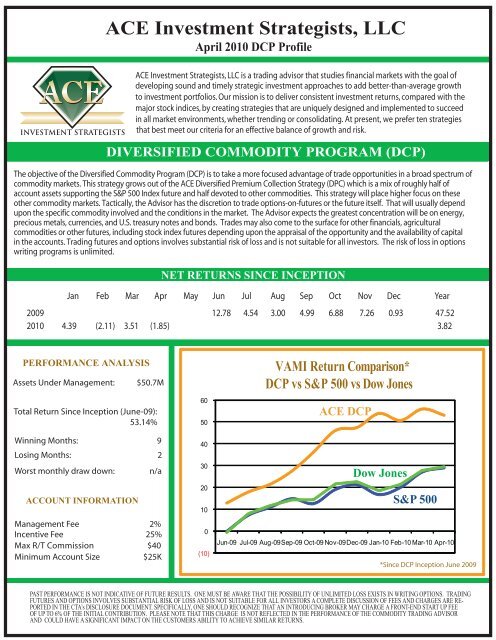

NET RETURNS SINCE INCEPTION<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year<br />

2009 12.78 4.54 3.00 4.99 6.88 7.26 0.93 47.52<br />

2010 4.39 (2.11) 3.51 (1.85) 3.82<br />

PERFORMANCE ANALYSIS<br />

Assets Under Management:<br />

$50.7M<br />

Total Return Since Inception (June-09):<br />

53.14%<br />

Winning Months: 9<br />

Losing Months: 2<br />

Worst monthly draw down:<br />

ACCOUNT INFORMATION<br />

n/a<br />

Management Fee 2%<br />

Incentive Fee 25%<br />

Max R/T Commission $40<br />

Minimum Account Size $25K<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

(10)<br />

VAMI Return Comparison*<br />

DCP vs S&P 500 vs Dow Jones<br />

<strong>ACE</strong> DCP<br />

Dow Jones<br />

S&P 500<br />

Jun-09 Jul-09 Aug-09Sep-09 Oct-09 Nov-09Dec-09 Jan-10 Feb-10 Mar-10 Apr-10<br />

*Since DCP Inception June 2009<br />

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. ONE MUST BE AWARE THAT THE POSSIBILITY OF UNLIMITED LOSS EXISTS IN WRITING OPTIONS. TRADING<br />

FUTURES AND OPTIONS INVOLVES SUBSTANTIAL RISK OF LOSS AND IS NOT SUITABLE FOR ALL INVESTORS A COMPLETE DISCUSSION OF FEES AND CHARGES ARE RE-<br />

PORTED IN THE CTA’s DISCLOSURE DOCUMENT. SPECIFICALLY, ONE SHOULD RECOGNIZE THAT AN INTRODUCING BROKER MAY CHARGE A FRONT-END START UP FEE<br />

OF UP TO 6% OF THE INITIAL CONTRIBUTION. PLEASE NOTE THAT THIS CHARGE IS NOT REFLECTED IN THE PERFORMANCE OF THE COMMODITY TRADING ADVISOR<br />

AND COULD HAVE A SIGNIFICANT IMPACT ON THE CUSTOMERS ABILITY TO ACHIEVE SIMILAR RETURNS.

<strong>ACE</strong> <strong>Investment</strong> <strong>Strategists</strong><br />

APRIL 2010 DPC Profile<br />

A CE I n v estme n t S t r a t egist s , L L C is a t r ading advisor th a t studies financial ma r k ets with the goal of<br />

d e v eloping sound and timely st r a t egic i n v estme n t app r oaches t o add b et t er-than- a v e r age g r o wth<br />

t o i n v estme n t p o r t f olio s . Our mission is t o deli v er c onsis t e n t i n v estme n t r etu r n s , c ompa r ed with the<br />

major s t o ck indi c e s , b y c r e a ting st r a t egies th a t a r e uniquely designed and impleme n t ed t o succeed<br />

in all ma r k et e n vi r onme n t s , whether t r ending or c onsolid a tin g . At present, we prefer ten strategies<br />

that best meet our criteria for an effective balance of growth and risk.<br />

DIVERSIFIED PREMIUM COLLECTION (DPC)<br />

This strategy <strong>com</strong>bines the profit-generating potential of <strong>ACE</strong>’s core strategy, the Stock Index Premium Collection (SIPC)<br />

strategy, with opportunistic trading in other index, financial or <strong>com</strong>modity futures. The SIPC strategy writes call and<br />

put options on the S&P 500 index futures. The strategy balances option positions, where price changes and volatility are<br />

constantly changing, and exploits the time decay aspect of option premiums. There are twelve cycles per year, ending on<br />

options expiration each month. Profitable out<strong>com</strong>es can occur whether the S&P is up, down, or sideways as long as its<br />

price stays within a predetermined range. In the Diversified strategy, we add the use of financial and <strong>com</strong>modity futures<br />

which offers us a wider spectrum of trading opportunities. As experienced <strong>com</strong>modity traders, we know that over the<br />

course of a year individual <strong>com</strong>modities might not offer attractive investment (or trading) situations at all times. So,<br />

among the 36 <strong>com</strong>modities we currently track daily, we are always on the alert for <strong>com</strong>pelling opportunities when they<br />

do occur in one or more in the group. Please be advised that the risk of loss in option writing programs is unlimited, this<br />

investment is not suitable for all investors.<br />

NE T RETURNS SINCE IN C EPTION<br />

Jan F eb M ar A pr M a y J un J ul A ug S ep O c t N o v D ec Y ear t o D a t e<br />

2004 1.95 0.10 (1.98) 4.99 (2.32) 2.49<br />

2005 6.75 (3.70) (0.98) 0.24 3.53 0.74 0.96 (0.39) 3.78 1.30 2.61 3.22 19.17<br />

2006 (5.56) 7.24 (1.66) (8.77) (4.46) (0.21) 4.53 4.68 (1.63) 0.06 0.41 4.64 (1.97)<br />

2007 1.04 (9.09) (16.35) (1.35) 0.46 4.13 (5.69) (7.74) 7.05 (6.16) 9.07 13.90 (13.90)<br />

2008 (5.95) 2.31 4.72 9.18 7.44 7.16 3.15 6.01 (69.35) (36.71) 10.66 (2.53) (71.02)<br />

2009 8.15 12.32 (4.31) 16.36 (2.12) 12.66 5.81 4.19 7.53 9.86 8.51 0.33 111.47<br />

2010 4.38 (2.75) 3.28 (2.52) 2.20<br />

70.00<br />

60.00<br />

50.00<br />

40.00<br />

30.00<br />

20.00<br />

12 MONTH RETURN COMPARISON<br />

<strong>ACE</strong> DPC<br />

S&P 500<br />

PERFORMANCE ANA L YSIS<br />

A ssests Under M anageme n t<br />

$41.2M<br />

T otal R etu r n sin c e In c eption(Aug-04) (35.44)%<br />

Compounded Avg Annual ROR (7.33)%<br />

W inning M o n ths 44<br />

L osing M o n ths 25<br />

W orst mo n thly d r a w d o wn : 69.35%<br />

L ongest R e c o v e r y P e r i o d<br />

n/a<br />

10.00<br />

0.00<br />

(10.00)<br />

May-<br />

09<br />

Jun-09Jul-09 Aug-<br />

09<br />

Sep-<br />

09<br />

Oct-09 Nov-<br />

09<br />

Dec-<br />

09<br />

Jan-10 Feb-<br />

10<br />

Mar-<br />

10<br />

Apr-10<br />

ACCOUN T INFORM A TION<br />

M anageme n t F ee 2%<br />

In c e n ti v e F ee 25%<br />

M inimum A c c ou n t Si z e $75K<br />

P AS T PERFORMANCE IS NO T INDIC A TIVE OF FUTURE RESU L TS. ONE MUS T BE A W ARE TH A T THE POSSIBILIT Y OF UNLIMITED LOSS EXISTS IN WRITING OPTIONS. A<br />

COMPLETE DISCUSSION OF FEES AND CHARGES ARE REPO R TED IN THE C T A ’ s DISCLOSURE DOCUMEN T . SPECIFICAL L Y , ONE SHOULD RECOGNIZE TH A T AN INTRODUCING<br />

BROKER M A Y CHARGE A FRON T -END S T A R T U P FEE OF U P T O 6% OF THE INITIA L CONTRIBUTION. PLEASE NOTE TH A T THIS CHARGE IS NO T REFLECTED IN THE<br />

PERFORMANCE OF THE COMMODIT Y TRADING ADVISOR AND COULD H A VE A SIGNIFICAN T IM P AC T ON THE CUS T OMERS ABILIT Y T O ACHIEVE SIMILAR RETURNS.