Annual Report - Glenmark

Annual Report - Glenmark

Annual Report - Glenmark

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Glenmark</strong> Pharmaceuticals Limited<br />

Figures in Rs. /Mn.<br />

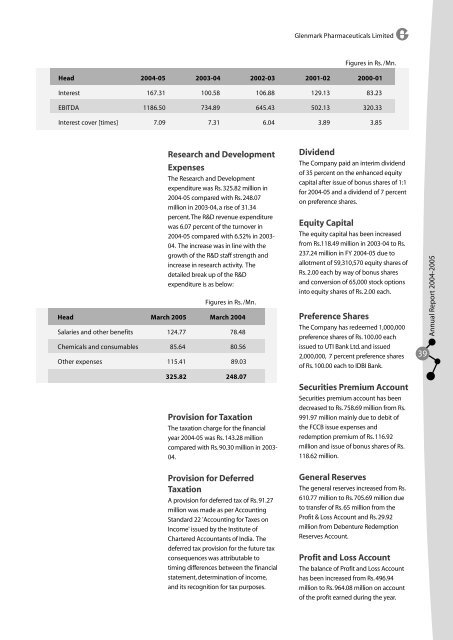

Head 2004-05 2003-04 2002-03 2001-02 2000-01<br />

Interest 167.31 100.58 106.88 129.13 83.23<br />

EBITDA 1186.50 734.89 645.43 502.13 320.33<br />

Interest cover [times] 7.09 7.31 6.04 3.89 3.85<br />

Research and Development<br />

Expenses<br />

The Research and Development<br />

expenditure was Rs. 325.82 million in<br />

2004-05 compared with Rs. 248.07<br />

million in 2003-04, a rise of 31.34<br />

percent. The R&D revenue expenditure<br />

was 6.07 percent of the turnover in<br />

2004-05 compared with 6.52% in 2003-<br />

04. The increase was in line with the<br />

growth of the R&D staff strength and<br />

increase in research activity. The<br />

detailed break up of the R&D<br />

expenditure is as below:<br />

Figures in Rs. /Mn.<br />

Head March 2005 March 2004<br />

Salaries and other benefits 124.77 78.48<br />

Chemicals and consumables 85.64 80.56<br />

Other expenses 115.41 89.03<br />

325.82 248.07<br />

Provision for Taxation<br />

The taxation charge for the financial<br />

year 2004-05 was Rs. 143.28 million<br />

compared with Rs. 90.30 million in 2003-<br />

04.<br />

Provision for Deferred<br />

Taxation<br />

A provision for deferred tax of Rs. 91.27<br />

million was made as per Accounting<br />

Standard 22 'Accounting for Taxes on<br />

Income' issued by the Institute of<br />

Chartered Accountants of India. The<br />

deferred tax provision for the future tax<br />

consequences was attributable to<br />

timing differences between the financial<br />

statement, determination of income,<br />

and its recognition for tax purposes.<br />

Dividend<br />

The Company paid an interim dividend<br />

of 35 percent on the enhanced equity<br />

capital after issue of bonus shares of 1:1<br />

for 2004-05 and a dividend of 7 percent<br />

on preference shares.<br />

Equity Capital<br />

The equity capital has been increased<br />

from Rs.118.49 million in 2003-04 to Rs.<br />

237.24 million in FY 2004-05 due to<br />

allotment of 59,310,570 equity shares of<br />

Rs. 2.00 each by way of bonus shares<br />

and conversion of 65,000 stock options<br />

into equity shares of Rs. 2.00 each.<br />

Preference Shares<br />

The Company has redeemed 1,000,000<br />

preference shares of Rs. 100.00 each<br />

issued to UTI Bank Ltd. and issued<br />

2,000,000, 7 percent preference shares<br />

of Rs. 100.00 each to IDBI Bank.<br />

Securities Premium Account<br />

Securities premium account has been<br />

decreased to Rs. 758.69 million from Rs.<br />

991.97 million mainly due to debit of<br />

the FCCB issue expenses and<br />

redemption premium of Rs. 116.92<br />

million and issue of bonus shares of Rs.<br />

118.62 million.<br />

General Reserves<br />

The general reserves increased from Rs.<br />

610.77 million to Rs. 705.69 million due<br />

to transfer of Rs. 65 million from the<br />

Profit & Loss Account and Rs. 29.92<br />

million from Debenture Redemption<br />

Reserves Account.<br />

Profit and Loss Account<br />

The balance of Profit and Loss Account<br />

has been increased from Rs. 496.94<br />

million to Rs. 964.08 million on account<br />

of the profit earned during the year.<br />

39<br />

<strong>Annual</strong> <strong>Report</strong> 2004-2005

![Formulations [India] â Product List - Glenmark](https://img.yumpu.com/46601329/1/190x245/formulations-india-a-product-list-glenmark.jpg?quality=85)

![Formulation [India] â Product List - Glenmark](https://img.yumpu.com/44013338/1/190x245/formulation-india-a-product-list-glenmark.jpg?quality=85)

![Formulations [India] â Product List - Glenmark](https://img.yumpu.com/35994839/1/190x245/formulations-india-a-product-list-glenmark.jpg?quality=85)