Annual Report - Glenmark

Annual Report - Glenmark

Annual Report - Glenmark

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Glenmark</strong> Pharmaceuticals Limited<br />

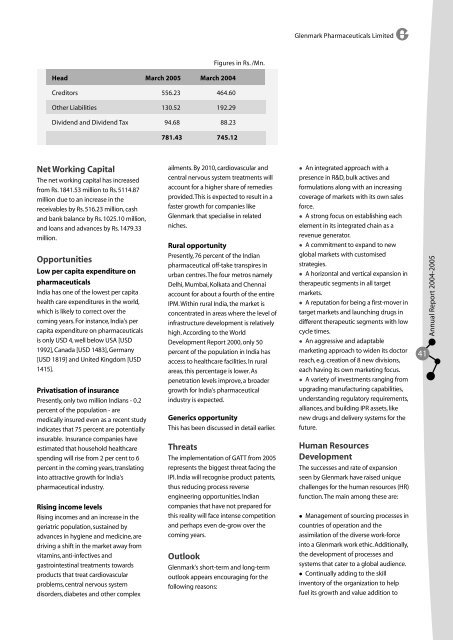

Figures in Rs. /Mn.<br />

Head March 2005 March 2004<br />

Creditors 556.23 464.60<br />

Other Liabilities 130.52 192.29<br />

Dividend and Dividend Tax 94.68 88.23<br />

781.43 745.12<br />

Net Working Capital<br />

The net working capital has increased<br />

from Rs. 1841.53 million to Rs. 5114.87<br />

million due to an increase in the<br />

receivables by Rs. 516.23 million, cash<br />

and bank balance by Rs. 1025.10 million,<br />

and loans and advances by Rs. 1479.33<br />

million.<br />

Opportunities<br />

Low per capita expenditure on<br />

pharmaceuticals<br />

India has one of the lowest per capita<br />

health care expenditures in the world,<br />

which is likely to correct over the<br />

coming years. For instance, India's per<br />

capita expenditure on pharmaceuticals<br />

is only USD 4, well below USA [USD<br />

1992], Canada [USD 1483], Germany<br />

[USD 1819] and United Kingdom [USD<br />

1415].<br />

Privatisation of insurance<br />

Presently, only two million Indians - 0.2<br />

percent of the population - are<br />

medically insured even as a recent study<br />

indicates that 75 percent are potentially<br />

insurable. Insurance companies have<br />

estimated that household healthcare<br />

spending will rise from 2 per cent to 6<br />

percent in the coming years, translating<br />

into attractive growth for India's<br />

pharmaceutical industry.<br />

Rising income levels<br />

Rising incomes and an increase in the<br />

geriatric population, sustained by<br />

advances in hygiene and medicine, are<br />

driving a shift in the market away from<br />

vitamins, anti-infectives and<br />

gastrointestinal treatments towards<br />

products that treat cardiovascular<br />

problems, central nervous system<br />

disorders, diabetes and other complex<br />

ailments. By 2010, cardiovascular and<br />

central nervous system treatments will<br />

account for a higher share of remedies<br />

provided. This is expected to result in a<br />

faster growth for companies like<br />

<strong>Glenmark</strong> that specialise in related<br />

niches.<br />

Rural opportunity<br />

Presently, 76 percent of the Indian<br />

pharmaceutical off-take transpires in<br />

urban centres. The four metros namely<br />

Delhi, Mumbai, Kolkata and Chennai<br />

account for about a fourth of the entire<br />

IPM. Within rural India, the market is<br />

concentrated in areas where the level of<br />

infrastructure development is relatively<br />

high. According to the World<br />

Development <strong>Report</strong> 2000, only 50<br />

percent of the population in India has<br />

access to healthcare facilities. In rural<br />

areas, this percentage is lower. As<br />

penetration levels improve, a broader<br />

growth for India's pharmaceutical<br />

industry is expected.<br />

Generics opportunity<br />

This has been discussed in detail earlier.<br />

Threats<br />

The implementation of GATT from 2005<br />

represents the biggest threat facing the<br />

IPI. India will recognise product patents,<br />

thus reducing process reverse<br />

engineering opportunities. Indian<br />

companies that have not prepared for<br />

this reality will face intense competition<br />

and perhaps even de-grow over the<br />

coming years.<br />

Outlook<br />

<strong>Glenmark</strong>'s short-term and long-term<br />

outlook appears encouraging for the<br />

following reasons:<br />

An integrated approach with a<br />

presence in R&D, bulk actives and<br />

formulations along with an increasing<br />

coverage of markets with its own sales<br />

force.<br />

A strong focus on establishing each<br />

element in its integrated chain as a<br />

revenue generator.<br />

A commitment to expand to new<br />

global markets with customised<br />

strategies.<br />

A horizontal and vertical expansion in<br />

therapeutic segments in all target<br />

markets.<br />

A reputation for being a first-mover in<br />

target markets and launching drugs in<br />

different therapeutic segments with low<br />

cycle times.<br />

An aggressive and adaptable<br />

marketing approach to widen its doctor<br />

reach, e.g. creation of 8 new divisions,<br />

each having its own marketing focus.<br />

A variety of investments ranging from<br />

upgrading manufacturing capabilities,<br />

understanding regulatory requirements,<br />

alliances, and building IPR assets, like<br />

new drugs and delivery systems for the<br />

future.<br />

Human Resources<br />

Development<br />

The successes and rate of expansion<br />

seen by <strong>Glenmark</strong> have raised unique<br />

challenges for the human resources (HR)<br />

function. The main among these are:<br />

Management of sourcing processes in<br />

countries of operation and the<br />

assimilation of the diverse work-force<br />

into a <strong>Glenmark</strong> work ethic. Additionally,<br />

the development of processes and<br />

systems that cater to a global audience.<br />

Continually adding to the skill<br />

inventory of the organization to help<br />

fuel its growth and value addition to<br />

41<br />

<strong>Annual</strong> <strong>Report</strong> 2004-2005

![Formulations [India] â Product List - Glenmark](https://img.yumpu.com/46601329/1/190x245/formulations-india-a-product-list-glenmark.jpg?quality=85)

![Formulation [India] â Product List - Glenmark](https://img.yumpu.com/44013338/1/190x245/formulation-india-a-product-list-glenmark.jpg?quality=85)

![Formulations [India] â Product List - Glenmark](https://img.yumpu.com/35994839/1/190x245/formulations-india-a-product-list-glenmark.jpg?quality=85)