2008 Annual Report - S&B

2008 Annual Report - S&B

2008 Annual Report - S&B

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

focusing on our purpose ANNUAL REPORT <strong>2008</strong>

Our “Purpose”<br />

We provide innovative<br />

industrial solutions by developing<br />

and transforming natural resources<br />

into value creating products.<br />

S&B utilizes the multiple properties of industrial minerals to offer a portfolio<br />

of customized solutions across a broad range of industry applications.<br />

Our product range, our geographic dispersion in reserves and operations<br />

and our relentless efforts to understand and satisfy our customers’ needs,<br />

underpin S&B’s focus in pursuing sustainable, profitable growth.<br />

Industrial Minerals have always been at the center of our 75 year history,<br />

which has seen S&B grow into a multinational group of more than 40<br />

companies with sales in 74 countries across the globe. Our unique<br />

market-to-mine model coupled with our professional and responsible<br />

conduct towards society and the environment, provide the basis<br />

for continued sustainable development.

contents<br />

4 Financial Highlights<br />

6 Global Presence<br />

8 Management<br />

<strong>Report</strong><br />

12 Market-to-mine<br />

14 Product<br />

Divisions<br />

16 Bentonite<br />

18 Perlite<br />

20 Bauxite<br />

22 Stollberg<br />

24 Otavi<br />

26 Corporate<br />

Social<br />

Responsibility<br />

30 Corporate<br />

Governance<br />

38 Shareholders<br />

Notebook<br />

40 Glossary<br />

41 IFRS<br />

Financial<br />

Statements

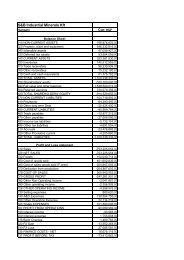

Financial Highlights<br />

Total Group<br />

In Euro ’000s except for per share data <strong>2008</strong> 2007 % change<br />

Sales 468,405 535,405 -13%<br />

EBITDA 1 65,901 74,902 -12%<br />

Operating Profit 38,307 46,723 -18%<br />

Profit before Taxes 24,711 37,451 -34%<br />

Net Profit 15,637 26,676 -41%<br />

Net Profit after Tax & Minorities 15,367 25,668 -40%<br />

Basic Earnings per Share 0.50 0.84 -40%<br />

Cash Earnings per Share 2 1.34 1.70 -21%<br />

Dividends per Share 3 0.16 0.31 -48%<br />

Continuing Operations*<br />

<strong>2008</strong> 2007 % change<br />

Sales 456,393 423,298 8%<br />

EBITDA 1 65,290 67,036 -3%<br />

Operating Profit 37,878 39,838 -5%<br />

Profit before Taxes 19,846 31,400 -37%<br />

Net Profit 14,258 22,374 -36%<br />

Net Profit after Tax & Minorities 13,988 22,505 -38%<br />

Basic Earnings per Share 0.45 0.73 -38%<br />

Cash Earnings per Share 2 1.29 1.58 -18%<br />

Dividends per Share 3 0.16 0.31 -48%<br />

Year-End No of Shares 31,010,717 30,876,660<br />

Basic Weighted Average No of Shares 30,917,917 30,705,062<br />

Notes:<br />

1: EBITDA: Profit before income tax, depreciation, financial and investment results<br />

2: Cash Earnings per Share = [Net Profit after Tax & Minorities + Depreciation&Amortisation] / Weighted Average No of Shares<br />

3: Based on Year End number of shares<br />

4<br />

S&B Industrial Minerals S.A.

* Continuing Operations include only the Industrial Mineral activities of the S&B Group<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

5

Global Presence<br />

27 mines<br />

51 plants<br />

& processing units<br />

30 distribution<br />

centers<br />

in 21 countries<br />

& 5 continents<br />

sales<br />

in 74 countries<br />

2,086 employees<br />

6<br />

S&B Industrial Minerals S.A.

Countries of operations & sales<br />

Countries of sales<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

7

Management <strong>Report</strong><br />

Continuing Operations<br />

€ 456<br />

million<br />

sales<br />

€ 14<br />

million<br />

net profit<br />

€ 65<br />

million<br />

EBITDA<br />

€ 0.45<br />

earnings<br />

per share<br />

€ 38<br />

million<br />

operating profit<br />

8<br />

S&B Industrial Minerals S.A.

a year of significant economic<br />

challenges. During the first half of the year<br />

<strong>2008</strong>represented<br />

demand remained strong leading to strong<br />

top line growth, but at the same time we observed record high oil<br />

prices, sea freight rates and materials purchase prices. Even though<br />

S&B adapted to these challenges, the costs of both our investments<br />

and our products were inevitably affected. Price adjustments were<br />

made during this volatile period, but it was not possible to offset the<br />

total cost pressures on our margins. Traditionally, in our business we<br />

conclude commercial terms with most of our clients annually, in the latter<br />

part of the previous year.<br />

During autumn, the economic environment deteriorated sharply. As the<br />

unprecedented financial crisis affected the real economy, cost pressures<br />

eased but demand in many of our end markets turned sharply downward.<br />

As a result, our sales declined rapidly during the last two months<br />

of the year. Manufacturers in our key end-use sectors of metallurgy (steel,<br />

foundry, iron ore, aluminum) and construction shifted their focus to managing<br />

excessive working capital and reducing inventories accumulated<br />

in the previous months. This led to abrupt adjustments in their production<br />

output. These stock adjustments along with depressed consumer demand<br />

have continued into the first semester of 2009.<br />

Our shareholders’ decision to concentrate on the minerals business<br />

and divest from all unrelated activities was realized during <strong>2008</strong>. We<br />

finalized the carve-out of Motodynamics S.A. in mid February and<br />

completed the sale of Ergotrak S.A. in July. In doing so, we seized the<br />

opportunity to create value for our shareholders as the carve-out of<br />

Motodynamics S.A. provided a dividend in kind of 1 Motodynamics<br />

S.A. share for every 11 S&B shares owned, or € 0.46 per share, while<br />

the Ergotrak sale was completed for a consideration of € 7.5 million<br />

in cash. Hence, the total consolidated Group results as such are not<br />

comparable to the previous years. Our reporting and comparison<br />

basis henceforth will be based on Continuing Operations, comprising<br />

Industrial Minerals activities.<br />

For the full year <strong>2008</strong>, Continuing Operations reported a solid revenue<br />

increase of 8%, reaching € 456 million. This includes both the effect of<br />

acquisitions and an organic growth of 3%, reflecting a combination of<br />

volume and pricing improvements, along with an optimized product<br />

mix. Despite extreme volatility in input costs, which adversely affected<br />

our profitability margins, EBITDA –at € 65 million- and Operating profit<br />

–at € 38 million- were slightly below the previous year, by -3% and -5%,<br />

respectively. Operating profit was also inclusive of non-recurring costs<br />

related to the Group’s organizational realignment, which was rolled out<br />

and finalized in the first quarter of <strong>2008</strong>; thus net profit after taxes and<br />

minorities stood at € 14 million, 38% below 2007.<br />

Given our solid track record of continuously delivering higher shareholder<br />

value, this financial performance is not satisfactory, even though<br />

it is affected by restructuring costs and the sudden change in sales in<br />

the last quarter of <strong>2008</strong>. However, we are pleased with the speed of integration,<br />

as well as with the effectiveness of our organization in successfully<br />

adapting to change. We are well prepared to face the challenges<br />

2009 poses to our markets globally.<br />

The Bentonite Division performed well and successfully consolidated<br />

the Hill & Griffith acquisition for the full year. The total revenue growth for<br />

the Division was 20%, reaching € 207 million, while the organic growth,<br />

without the contribution of Hill & Griffith, was a solid 7%. With the contribution<br />

of our support functions, we managed to quickly integrate the<br />

newly acquired business into our Group, providing us with new blending<br />

plants in strategic geographic locations in the US and with a stepping<br />

stone into a consolidating US market. We started up a new<br />

production facility in Turkey to meet emerging local demand for foundry<br />

applications. Customer service and collaboration are always top priorities<br />

for our organization and we managed to renew long-term contracts<br />

with important key accounts, exploiting further benefits with additional<br />

and new products, such as Envibond.<br />

Our Perlite Division faced a particularly tough year ending <strong>2008</strong> with<br />

€ 74 million in sales, 2% lower than the previous year. The insulation<br />

business which depends mostly on construction activity across various<br />

geographies, regressed significantly in the U.S. and Europe in<br />

<strong>2008</strong>, thus affecting the demand for raw perlite. Additionally, high freight<br />

and energy costs eroded the profit margin and imposed a heavy burden<br />

on this Division, as logistics are a relatively big component of the product<br />

value to our customers. Expanded perlite faced significant difficulties<br />

as well, and in some markets pricing pressures started to become<br />

visible. We remain committed to our strategy for development in North<br />

America and continue to seek opportunities for enlarging our expander<br />

facilities network.<br />

In the Bauxite Division, we saw a sales revenue downturn of 4% to<br />

€ 47 million. The sharp demand slowdown for the steel and aluminum<br />

industries in the latter part of <strong>2008</strong> inevitably affected our sales. Following<br />

the 2007 decision of the Council of State to ratify the grant of<br />

environmental permits to our company for our Greek deposits, we have<br />

continued to rationalize and optimize the exploitation of our reserves, in<br />

conjunction with the long-term permits we received for our mine in Sardinia.<br />

Total bauxite reserves were significantly increased during <strong>2008</strong><br />

with moderate investments in geological exploration and drilling. Although<br />

a major part of our bauxite sales is secured through long-term<br />

contracts, we are watchful of the developments in industries such as<br />

cement and steel, which are key demand levers for our business.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

9

<strong>2008</strong>: Focusing on our Purpose<br />

• Divesting from commercial activities<br />

• Securing and rationalizing mineral reserves<br />

• Effective transition of organizational realignment<br />

• Sustaining market positions<br />

• Further integrating our CSR strategy<br />

• Adapting to the changing economic environment<br />

Compound <strong>Annual</strong> Growth Rates 2004-<strong>2008</strong><br />

Continuing Operations<br />

13%<br />

in sales<br />

8%<br />

EBITDA<br />

€ 0.16<br />

dividend<br />

per share<br />

36%<br />

payout ratio<br />

on continuing<br />

operation profits<br />

Motodynamics S.A.<br />

Carve-Out<br />

1 Motodynamics share for<br />

every 11 S&B shares owned<br />

Approximate shareholder<br />

value creation of<br />

€ 0.46<br />

per share<br />

10<br />

S&B Industrial Minerals S.A.

In the Continuous Casting Fluxes Division, Stollberg, our record performance<br />

was abruptly disrupted by the precipitous drop in demand<br />

for steel in October <strong>2008</strong>. At the end of <strong>2008</strong>, the US steel industry was<br />

operating on as little as 50% of its installed capacity, compared with 90%<br />

one year earlier. Spillover effects are now evident all across Europe, Russia<br />

and even China. In total, the Division managed a stable revenue performance<br />

versus last year, amounting to € 87 million. We are encouraged<br />

by our strategically located production network, close to the customers<br />

we serve in different locations around the world, which enabled us to<br />

maintain our market positions and consolidate our market leadership.<br />

The added value services to our customers, in terms of expertise and innovation,<br />

continue to be key drivers of success for this Division.<br />

Our specialty minerals and trading Division, OTAVI, reported sales of<br />

€ 39 million, representing an increase of approximately 6% over 2007.<br />

The focus was on increasing our effectiveness and on a faster development<br />

of our customer base. Toward this end, the Division was internally<br />

reorganized into two Business Units: Glass & Ceramics and<br />

Refractory. Our strategy of entering into more profitable uses, such as<br />

crystal glass and polymers, is helping to position us as one of the<br />

largest suppliers of specialty minerals in Europe. Moreover, our ability<br />

to provide our customers with tailored solutions and high-quality products,<br />

combined with our penetration into niche segments, impacted<br />

positively on our profitability.<br />

During <strong>2008</strong>, we continued to make progress on our sustainability initiatives<br />

and on our Corporate Social Responsibility practices. We report<br />

on our social and environmental performance by adhering to the<br />

strict standards of the Global <strong>Report</strong>ing Initiative’s (GRI) Sustainability<br />

<strong>Report</strong>ing Guidelines. During the year, we joined the United Nations<br />

Global Compact initiative, committing to its ten principles. We operate<br />

by established policies concerning the environment, health and safety<br />

both of our employees and of the communities with which we coexist.<br />

Through a pioneer partnership with the local municipality of Milos, we<br />

contributed to the installation and operation of the first biological<br />

household waste water treatment facility on the island. Evidence of<br />

our efforts to elevate awareness on the importance of minerals in our<br />

everyday life is the promotion of a special communication campaign<br />

and of a micro site on our website (available currently in Greek), both<br />

being the result of a joint cooperation with the Greek Mining Enterprises<br />

Association. Our conduct reflects our firm belief that commitment<br />

to the principles of Sustainable Development and Corporate<br />

Social Responsibility is an integral part of our business.<br />

In our last year’s <strong>Annual</strong> <strong>Report</strong>, we announced our joint cooperation<br />

framework with Public Power Corporation (PPC) Renewables S.A.<br />

regarding the exploitation and potential utilization of the geothermal<br />

field of Milos. During <strong>2008</strong> we expanded and deepened our knowledge<br />

on geothermal energy, but we also realized that community dialogue<br />

and acceptance, needs to mature further before the opportunities<br />

can be realized. We remain committed to this dialogue and we expect<br />

steady progress.<br />

As we continue to deal with the global economic crisis, we realize that<br />

further adversities may arise, making it difficult to predict the length and<br />

depth of the downturn. Our market-to-mine business model remains<br />

intact, providing a strong competitive advantage, but we are not isolated<br />

from the current market challenges. We continue to manage our<br />

business for the long term, but we have undertaken short-term initiatives<br />

to adapt to the current conditions. Our emphasis continues to be<br />

on maintaining strong customer relationships. We are focusing on managing<br />

our balance sheet and on adjusting our production to lower demand<br />

levels. We are aiming to improve free cash flow generation,<br />

through a prudent capital investment approach and diligent working<br />

capital management. We have already embarked on cost saving initiatives<br />

that aim to carry us through the turmoil and lower our cost base.<br />

We have frozen basic salaries and reduced total remuneration for senior<br />

managers. We are reducing administrative expenses through overtime<br />

elimination, and have implemented a hiring freeze and a general<br />

re-examination of our processes.<br />

Our Board of Directors recognizes the continuing uncertainties and dangers<br />

of the current environment and endorses management’s actions to<br />

de-leverage our balance sheet. However, recognizing our uninterrupted<br />

dividend payment record over the last 13 years, we are proposing a<br />

modest dividend of € 0.16 for <strong>2008</strong>, compared to € 0.31 paid for the<br />

previous year.<br />

In the near term, our focus will remain on cash generation and cost reduction<br />

through productivity improvements and streamlined capital expenditure<br />

levels. However, we will consider any opportunities that have<br />

immediate strategic fit to our existing business, are attractive in value<br />

and may quickly generate earnings and cash.<br />

As we look to the short-term challenges we draw confidence from the<br />

knowledge that we have the right people in place across all levels of our<br />

organization. Our teams are motivated and experienced in our business<br />

and will take advantage of our product market strengths, to position<br />

S&B for further development upon the first signs of economic recovery.<br />

The current economic and capital market developments will delay the<br />

accomplishment of our long-term vision and plans for continuous<br />

growth, but we remain committed to our goal of becoming one of the<br />

leading industrial minerals companies in the world and will continue to<br />

offer long-term and valuable industrial solutions to benefit our customers<br />

and to reward our shareholders for their support.<br />

Ulysses P. Kyriacopoulos<br />

Chairman of the Board<br />

Efthimios O. Vidalis<br />

Chief Executive Officer<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

11

Market-to-mine<br />

Market-to-mine is S&B’s approach<br />

to bringing its “Purpose” to life.<br />

The deep understanding of how our products<br />

can be applied in various industrial processes<br />

and add value according to customers’ needs<br />

(the “market”), is the key, in developing<br />

and transforming natural resources (the “mine”),<br />

into value creating industrial solutions.<br />

Our commercial teams continuously<br />

build knowledge on the various processes<br />

in the production of a multitude of end products.<br />

They possess the skills needed, to identify<br />

problems, design and propose solutions through<br />

our product offering, that add new value<br />

to an existing product and/or manufacturing<br />

customer process.<br />

12<br />

S&B Industrial Minerals S.A.

We aim to be the preferred supplier to over 1,500<br />

customers by offering customized solutions<br />

to various industrial applications.<br />

Market<br />

Being close to our customers allows us to understand in detail, what<br />

they produce and how. Ideas of how our products can improve the<br />

performance of a customer’s production process are drawn up by<br />

our commercial teams or requested by our customers themselves.<br />

Concurrently, our “out of the box” thinking brings to our R&D teams,<br />

conceptions of what we wish to propose to our customers for bringing<br />

additional value and efficiency to their process. The feasibility<br />

and validity of these conceptions are put to the test. Depending on<br />

the outcome of this evaluation and also on whether or not our current<br />

product portfolio can provide the solution, the necessary actions<br />

are considered all the way from process redesign to new<br />

reserve identification.<br />

Mine<br />

All the current and potential market needs are accumulated and translated<br />

into reserve requirements. Our mining and processing experts<br />

will validate that the quality of the product can be available consistently<br />

in depth of time. The forecasted quantities will be incorporated in our<br />

medium and long term plans. With the assistance of our engineers and<br />

our R&D department, the necessary processing will be designed in order<br />

to tailor the product to the desired specifications for the customer’s use.<br />

Potential capital investments will be investigated and evaluated if necessary.<br />

The new value adding customized solution will find its way back to<br />

the market.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

13

Product Divisions<br />

Bentonite<br />

leading innovations<br />

Foundry, Pelletizing, Civil engineering, Oil Drilling, Pet litter, Specialties<br />

Perlite<br />

expanding markets<br />

Building Materials, Construction, Horticulture, Cryogenics, Filter Aids,<br />

Industrial Applications<br />

Bauxite<br />

specialty class<br />

Alumina, Iron / Steel Making, Aluminous Cements, Portland Cements,<br />

Abrasives, Mineral Fibers<br />

Stollberg<br />

engineered solutions<br />

Continuous Casting Fluxes, Covering Compounds, Metallurgical Active Slags<br />

Otavi<br />

building new chains<br />

Glass, Ceramics, Refractory, Metallurgy<br />

14<br />

S&B Industrial Minerals S.A.

Bentonite is a plastic clay generated from the in situ alteration of volcanic<br />

ash, consisting predominantly of montmorillonite. It acquired its<br />

name from Fort Benton of the State of Montana in the U.S.A. where it<br />

was first discovered and extracted. Bentonite presents strong colloidal<br />

properties and increases its volume several times when coming into<br />

contact with water, creating a gelatinous and viscous substance. The<br />

special properties of bentonite (swelling, water absorption, viscosity,<br />

thixotropy) make it a very valuable clay for a wide range of uses and<br />

applications.<br />

Perlite is a natural volcanic glassy material, formed by rapidly cooled<br />

lava trapping water within its mass. This phenomenon gives perlite its<br />

most important physical property, the ability to expand at temperatures<br />

of 800-950°C. White mass of tiny, glass-sealed bubbles is formed<br />

when sudden controlled heating causes perlite to expand as a result<br />

of the trapped water being evaporated. Its volume increases 10 to 20<br />

times and its bulk density decreases accordingly, giving perlite excellent<br />

thermal and acoustic insulation properties, particularly in lightweight<br />

aggregates.<br />

Bauxite is the primary raw material for the production of aluminium,<br />

while it also has several other specialty applications. S&B leases and<br />

owns bauxite mines in the Parnassos and Giona mountain regions in<br />

central Greece. Its bauxite reserves are of diasporic and boehmitic<br />

nature.<br />

From the standpoint of chemical composition, bauxite contains mainly<br />

alumina (more than 55%). It also contains other oxides such as those<br />

of silicon, iron, titanium and calcium. S&B also controls the bauxite<br />

reserves of Sardinia, which are of boehmitic type and represent a complementary<br />

product to Greek bauxite.<br />

The casting fluxes of the Stollberg Division are a range of specialized<br />

and high value adding products utilized for the facilitation of the continuous<br />

casting process in steel casting. They are available as granules<br />

or as powders.<br />

They are applied to the mould during the continuous casting process<br />

of steel making. This method of pouring steel into a near to net-shape<br />

like slabs, blooms and billets represents the most efficient way to produce<br />

innovative and high-grade steel products.<br />

The Otavi Division is processing and marketing a variety of specialty<br />

minerals –such as wollastonite– under the “OTAVI” brand, from its own<br />

sources or from its partners worldwide, serving the glass, ceramics,<br />

refractory and metallurgy markets. Otavi is also acting as a “window<br />

of opportunity” for S&B by developing new businesses on a Marketto-Mine<br />

basis. Otavi strives to be a reliable provider of solutions to its<br />

customers by developing profitable and sustainable supply chains in<br />

specialty industrial minerals and new geographical areas.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

15

Bentonite<br />

Countries of operations & sales<br />

Countries of sales<br />

No 1<br />

bentonite<br />

producer<br />

in the EU<br />

No 2<br />

bentonite<br />

producer<br />

in the world<br />

44<br />

mines<br />

and plants<br />

in 14<br />

countries<br />

€ 207<br />

million<br />

in sales<br />

with more<br />

than 1,000<br />

product<br />

formulations<br />

to 57<br />

countries<br />

16 S&B Industrial Minerals S.A.

Bentonite is the product of 1,000 uses with<br />

applications ranging from foundry and oil drilling<br />

to pet litter and cosmetics. It helps to seal<br />

waste landfills, purify wastewater and remove<br />

impurities from edible oils.<br />

During <strong>2008</strong> the main strategic focus of the Bentonite Division<br />

was placed on exploiting the synergies derived from last year’s<br />

global expansion of our mineral reserves and processing network,<br />

in order to realize efficiency gains and further expand sales in new<br />

markets and end uses. The operational focus was on managing a very<br />

volatile market, which started the year with the challenges of a supply<br />

chain operating at full capacity and ended with the collapse of demand<br />

and destocking across the whole chain. For the full year, sales revenues<br />

increased by 20%, reaching a new record of € 207 million.<br />

In the foundry market, we maintained our leading position and increased<br />

sales revenues by 13%. The foundry market, closely linked to<br />

the automotive sector, was heavily exposed to the volatility of <strong>2008</strong>.<br />

It was hit by large increases in the prices of coal and other lustrous<br />

carbon formers, which could only partly be passed on to customers.<br />

A new processing plant in Karabiga, Turkey, started operations in late<br />

<strong>2008</strong> and is already serving several major foundries with just-in-time<br />

deliveries. In North America, operational and mineral reserve optimization<br />

guarantees the successful integration of the five processing<br />

plants and one mine acquired in 2007. To maintain a strong market<br />

position and ensure future growth, S&B will continue to develop innovative<br />

products with an emphasis on environmentally friendly solutions.<br />

Towards this end, the second generation of Envibond enjoys<br />

continuously increasing market acceptance by helping foundries to<br />

reduce harmful emissions, while the development of a new inorganic<br />

Antrapex version is expected to lead the growth in products for<br />

foundry core shops.<br />

In the iron-ore pelletizing market, sales in <strong>2008</strong> exceeded any historical<br />

level. Revenues increased by 20%, driven by the high demand<br />

for steel products. The unfavorable foreign exchange rates and the extremely<br />

high ocean freight tariffs had a negative impact on margins, as<br />

many customers in this segment are supplied under multi-year contracts<br />

with significant fixed-price components. S&B maintained its leadership<br />

position in this growing market and increased its market share by<br />

adding significant sales volume in Eastern Europe. The main contributors<br />

to this success are our excellent technical support, our consistent<br />

product quality and our track record as a sustainable and strategic<br />

supplier to the leading iron-ore pelletizing plants.<br />

In <strong>2008</strong>, S&B strengthened its presence in the oil and gas drilling market<br />

by capitalizing on last year’s acquisition of a 50% stake in Cebo International<br />

B.V., which accounted for 14% of total Bentonite Division’s sales.<br />

Sales in the civil engineering market in <strong>2008</strong> reached record levels.<br />

Having enlarged and optimized its supply chain, S&B was able to<br />

serve an extended project pipeline across Europe by providing superior<br />

logistics, product customization and on-site technical service.<br />

In addition, <strong>2008</strong> was an exceptionally strong year for tunnelling in<br />

Western Europe, while ground engineering and drilling works continued<br />

to grow in Eastern Europe and Russia.<br />

In the pet litter market, we managed to stimulate larger purchase<br />

quantities of granular bentonite products by our key accounts. This<br />

achievement was based on our diverse and high-quality product<br />

palette combined with our customers’ successful marketing campaigns<br />

and distribution network across Europe.<br />

The paper industry has been experiencing significant turmoil, as<br />

major papermakers are closing plants and chemical suppliers are consolidating.<br />

Amidst fierce competition, S&B acquired new accounts in<br />

<strong>2008</strong> by promoting higher-value white micronized bentonite products<br />

from its recently acquired plant in Neuss, Germany. Through various industrial<br />

trials at paper mills, performance improvements have been<br />

achieved by customized bentonite-polymer solutions.<br />

In the specialty applications market, utilization of bentonite as a<br />

functional filler in animal feed increased considerably to replace cereals<br />

at peak prices. S&B’s sales in niche chemical applications also grew<br />

in <strong>2008</strong>, especially in catalysts and rheology modifiers.<br />

Our challenge for 2009 is to adjust quickly from the time of overcapacity<br />

to an anticipated protracted period of low sales worldwide. Our focus<br />

will be on cash generation and in particular on reducing inventories.<br />

We will also seek to reduce our costs, by adjusting our plant capacities to<br />

the new demand levels and optimising raw material handling. Ultimately,<br />

we will try to strengthen our market position, by intensifying our customer<br />

relations, working together to face this downturn and preparing for the<br />

demand recovery.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

17

Perlite<br />

Countries of operations & sales<br />

Countries of sales<br />

No 1<br />

supplier of<br />

graded perlite<br />

worldwide<br />

€ 74<br />

million<br />

sales<br />

109<br />

perlite-based<br />

products<br />

provided<br />

to 35<br />

countries<br />

37<br />

mines, plants<br />

& distribution<br />

centers<br />

in 11<br />

countries<br />

18<br />

S&B Industrial Minerals S.A.

Perlite’s insulating properties help to save energy<br />

in buildings, public works and industrial sites.<br />

Perlite also acts as a significant soil improver<br />

helping the agricultural industry for better yields.<br />

<strong>2008</strong>has been a challenging year for the Perlite<br />

Division. The current global economic crisis,<br />

which in the case of the U.S. hit the construction<br />

sector at the end of 2007, rapidly spread over to Europe and<br />

negatively impacted on our sales. Raw perlite volumes declined by<br />

10% while total sales revenue stood at € 74 million, 2% lower than<br />

2007. Input costs for energy and ocean freights peaked during the first<br />

half of the year. Due to the fact that logistics form a significant part of<br />

our delivered value to our customers, the unprecedented increases in<br />

ocean freights during the year placed additional pressures on our cost<br />

structure and profitability margins. Our pricing initiatives managed to<br />

partly offset these adverse effects.<br />

The construction business declined significantly in key countries like<br />

the U.S., Spain, Greece and the UK, impacting strongly on raw and<br />

mainly expanded perlite sales. Demand in central Europe remained stable<br />

during the first half of the year and we defended our market positions<br />

by capitalizing on our ability for just in time deliveries through our<br />

strategic warehousing network. By contrast, for the first half of the year<br />

demand was strong in Eastern Europe, stimulated mainly by the construction<br />

sector in Russia, leading to solid growth for our division in this<br />

geography.<br />

Our agriculture business remained strong in markets like Spain,<br />

Holland and Bulgaria, and even in North America our operations in<br />

this category were not seriously affected by the economic crisis.<br />

On the contrary, the acquisition of Airlite -a significant expander in<br />

the south eastern United States- helped us to enhance our position<br />

in the raw perlite market and brought us closer to key markets,<br />

such as retail gardening shops and soil mixers. Simultaneously, we<br />

initiated joint projects with some of our key customers for the development<br />

of new generation products.<br />

Cryogenics continued the strong trend we had seen in 2007, contributing<br />

positively in both volume and margin. However we expect a<br />

sharp decline in the year ahead, given that cryogenics have a narrow<br />

scope of application and are very dependent on demand economics.<br />

The adverse economic circumstances we navigated through were identified<br />

as the right time and opportunity to further strengthen our relationships<br />

with our customers and share in their challenges. The scope<br />

of our customer collaboration and the capabilities of our commercial<br />

team allowed us to pass energy surcharges through, while at the same<br />

time sustaining our customer base.<br />

In 2009 so far, we have observed prolonged and deteriorating conditions<br />

in construction activity across our markets. New construction<br />

and remodelling have basically halted in both the US and Europe. Even<br />

China has started to show signs of slowdown in their demand growth<br />

rates. Inevitably, our priority is to give more weight on securing our<br />

cash flows, mainly through solid management of our working capital.<br />

Furthermore, we will be focused on lowering our costs by adjusting<br />

our production to the current conditions, and we anticipate some benefits<br />

to our profit margins from lower ocean freights, should demand<br />

strengthen. Last but not least, we aim to safeguard our leadership positions<br />

and to that end we will continue collaborating closely with our<br />

customers and providing them with secure supplies in their new plants<br />

globally. Our high quality reserves are of importance to our customers,<br />

as they seek added value from consistency in the product formulations<br />

we provide.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

19

Bauxite<br />

Countries of operations & sales<br />

Countries of sales<br />

No 1<br />

bauxite<br />

producer<br />

in the E.U.<br />

€ 47<br />

million<br />

in sales<br />

14<br />

bauxite-based<br />

products<br />

7<br />

bauxite<br />

applications<br />

in 21<br />

countries<br />

20<br />

S&B Industrial Minerals S.A.

In the iron and steel making processes Bauxite<br />

is used to convert the accrued and usually disposed<br />

of slag, into a valorized and recyclable product.<br />

The Bauxite Division generated sales of € 47 million in <strong>2008</strong>, showing<br />

a downturn of 4% versus 2007, mainly due to the changed<br />

balance of sales basis (FOB from CFR previously) and product<br />

mix, aiming at improving operational results. Our North American<br />

revenue was affected by the economic crisis that commenced in the<br />

United States in the middle of <strong>2008</strong>. Conversely in Europe revenues<br />

achieved were slightly higher than last year. This is mainly attributed to<br />

increased bauxite supplies to the construction sector where cement<br />

applications absorbed the highest percentage and boasted revenue<br />

growth of 15%, as well as to alumina and rockwool production where<br />

revenue increased by 6% and 7% respectively.<br />

Geological exploration and mine development were of major importance<br />

during <strong>2008</strong>, as we were able to continue exploitation of deposits<br />

in Greece, following the Council of State’s decision in 2007. In this context,<br />

new findings and relevant studies brought about a considerable increase<br />

to our reserves potential. Furthermore, we were awarded with<br />

the long-term mining rights of the Sardinian bauxite operations, in<br />

Olmedo, Italy.<br />

Another significant development in <strong>2008</strong> was the decision to internally<br />

merge the Bauxite and Otavi Divisions. The strategy underlying this decision<br />

aims at exploiting growth opportunities by broadening the segments<br />

currently served and extending our customer portfolio. Given<br />

that both divisions have complementary products for a number of final<br />

applications, synergies are expected to arise through the pooling of<br />

commercial, market and technical expertise in the two divisions.<br />

However, we expect our overall performance in 2009 to be affected by<br />

the persisting financial and economic crisis. The metallurgical and construction<br />

industries have been facing very weak demand thus far in the<br />

current year. The Bauxite Division serves key segments within these industries,<br />

and as long as the adverse developments continue, we expect<br />

a downturn in our volumes and revenues. Our efforts will be<br />

focused on minimizing the effect of these implications, by balancing<br />

market needs with appropriate production adjustments as may be required.<br />

Our priorities are aligned with the Group and we will contribute<br />

to cash generation through tight control on our working capital and optimization<br />

of our investments. In parallel, we aim to be prepared to take<br />

advantage of any potential industrial upswings and positive developments<br />

of some segments in specific geographical areas. Additionally,<br />

we will pursue and develop sales of bauxite-based products to highvalue,<br />

niche sectors and place emphasis on product development for<br />

selected and sophisticated high-end applications.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

21

Stollberg<br />

Countries of operations & sales<br />

Countries of sales<br />

No 1<br />

producer of<br />

casting fluxes<br />

worldwide<br />

€ 87<br />

million<br />

in sales<br />

1,000<br />

customized<br />

solutions<br />

to<br />

50<br />

countries<br />

plants<br />

in 7<br />

countries<br />

22 S&B Industrial Minerals S.A.

Stollberg carries sophisticated products which enable<br />

the steel making process to emit reduced dust<br />

quantities during manufacturing.<br />

During <strong>2008</strong>, the Stollberg Division navigated through volatile<br />

and unfavourable steel industry conditions for the first nine<br />

months, with an abrupt and harsh downturn in the last quarter<br />

of the year. Record world steel production highs in the month of May<br />

were followed by a plummeting performance after the month of July,<br />

with decreases of 30% to 60% varying across different geographies.<br />

We expect the downtrend to continue well into the current year, with<br />

adverse effects on our revenues and profitability.<br />

Nevertheless, the strategy of our division to operate close to its customers<br />

via a global production network enabled us to outperform the global<br />

steel production developments and increase our market shares in all<br />

major steel producing areas of the world. Despite a very challenging<br />

last quarter in <strong>2008</strong>, we were able to maintain stable sales revenues of<br />

€ 87 million, supported by the newly implemented merchandise products<br />

which showed an increase of more than 20% versus last year and the<br />

rising demand of eco-friendly granule products.<br />

Following through on the capacity-driven infrastructure investments of<br />

2007, we focused our resources during <strong>2008</strong> on the development and<br />

installation of global standards for our production process, product<br />

quality and added value services, to better support our global acting<br />

customers. We optimized our operating facilities by improving the production<br />

process across all our business units to reduce costs and<br />

increase hourly production capacity. In line with our Group’s sustainability<br />

goals, we invested in the development of environmentally friendly<br />

solutions and also reviewed our processes and our logistic chain in<br />

relation to their environmental footprint. Our emphasis on the aforementioned<br />

initiatives and the structure of our operations allowed us to<br />

precisely and punctually meet the demand in the local markets we<br />

serve. The proximity of our sites to the local markets and our flexible<br />

production ability enabled us to offer quicker response times to our<br />

customers and to support them in optimizing their inventory and working<br />

capital levels. This tied in perfectly with our own efforts to control working<br />

capital and preserve cash flows towards the second half of the year.<br />

As the leader in the continuous casting industry, the Stollberg Division<br />

focuses on further diversification of its portfolio, by applying its<br />

technological expertise of the continuous casting process to other<br />

commercial activities within the steel industry. We have already embarked<br />

on innovation initiatives with external partners, we are consolidating<br />

innovation know-how within our division and we are<br />

implementing structures for detecting and adhering to the latest customer<br />

developments.<br />

Although we continued to observe depressed demand for steel well<br />

into the current year, Stollberg will continue to work as close as possible<br />

with its customers to develop customized solutions. Under the current<br />

operating conditions, we anticipate lower production levels and<br />

we have redirected our efforts towards cost-reducing initiatives. In addition,<br />

we are aligned with the Group’s current priorities for generating<br />

cash flows and continue to maintain a tight control on working capital.<br />

Especially in the time of a downturn, Stollberg will continue to look for<br />

the opportunities that will solidify its competitive advantage in meeting<br />

global customer demand for technological expertise, quality and ontime<br />

delivery of premium product solutions.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

23

Otavi<br />

Countries of operations & sales<br />

Countries of sales<br />

No 1<br />

supplier of<br />

wollastonite<br />

in the E.U.<br />

€ 39<br />

million<br />

in sales<br />

9<br />

production<br />

lines<br />

in Germany<br />

5 distribution<br />

centers<br />

in 4 countries<br />

30<br />

mineral-based<br />

products<br />

selling to<br />

27 countries<br />

2 wollastonite<br />

mines & plants<br />

in China<br />

24 S&B Industrial Minerals S.A.

With over 100 years of experience in supplying<br />

specialty minerals to the Glass, Ceramics,<br />

Refractory and Metallurgy industries,<br />

Otavi is our “window to new opportunities”.<br />

The Otavi Division continued to focus on developing its business<br />

in existing and new markets and segments during <strong>2008</strong>. The<br />

overall performance of the division stood at € 39 million, improved<br />

by 6% in terms of sales turnover versus the previous year, with<br />

both the European and Chinese operations contributing effectively to<br />

this performance.<br />

As part of S&B’s organizational restructuring initiatives for <strong>2008</strong>, Otavi<br />

was internally restructured into business units, allowing it to primarily<br />

focus on higher effectiveness and faster customer development, while<br />

optimally allocating its resources behind its activities.<br />

The Glass & Ceramics Business Unit oversees our operations in<br />

the segments of glass, ceramics and metallurgy, which are supplied by<br />

key minerals such as spodumene and wollastonite. Spodumene is a<br />

key material for all the three segments within the newly formed business<br />

unit. We capitalize on our extensive and specialist experience in<br />

this fluxing agent, to offer a superior service to our current customer<br />

base and to generate new fields of application, such as crystal glass<br />

and foundry coremaking, which are profitable niche segments that positively<br />

affect our product mix.<br />

Our strategy to enter into more profitable uses is bringing positive results<br />

and helping to position Otavi as the largest supplier of specialty<br />

minerals in Europe. Although <strong>2008</strong> overall proved to be a tough year,<br />

demand for steel and construction was solid in the first half and we took<br />

advantage of this to increase sales of wollastonite for the metallurgy<br />

and ceramics segments. Moreover, by leveraging our team’s knowledge<br />

and capabilities we managed to stimulate sales in segments such<br />

as construction and polymers, again niche but profitable segments.<br />

The Refractory Business Unit is responsible for the development of<br />

the refractory segment. Despite the scarce supply of calcined bauxites<br />

during the year -mainly from China where internal consumption remained<br />

strong- Otavi reliably served key European customers who are<br />

amongst the major producers for this industry. Although cost pressures<br />

persisted, our team managed to continue supplying calcined bauxites,<br />

high quality chamottes and BFA to our customers, owing to our ability to<br />

provide tailor-made solutions for high-quality products according to individual<br />

specifications. It is anticipated that the formation of the Refractory<br />

Business Unit will enable S&B as a Group to investigate new<br />

business opportunities based on synergies with the Bauxite Division.<br />

Challenges lie ahead, especially given the current economic turbulence<br />

and financial uncertainty. We are committed to safeguarding our existing<br />

strong positions in the aforementioned segments. The Otavi Division<br />

continues to be S&B’s platform for opening “new windows of opportunity”<br />

on a market-to-mine basis. However, as the economic and operational<br />

challenges that were observed in the beginning of 2009 still<br />

persist, we inevitably expect a reduction in revenues and profits resulting<br />

from lower volumes. Slow demand in key segments, such as refractories,<br />

continues. Other, heretofore more resilient segments, -such as ceramics-<br />

are now showing signs of slowdown across more geographies.<br />

Our priority focus has shifted towards managing our high-value inventory<br />

levels and enhancing our cash generating ability, contributing positively to<br />

the overall priorities of the Group.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

25

Corporate Social Responsibility<br />

Our commitment to the principles of Sustainable<br />

Development is an integral part of our business<br />

approach.<br />

S&B’s strategic approach to Corporate Social<br />

Responsibility reflects its voluntary contribution<br />

to Sustainable Development.<br />

Our access to the earth’s scarce natural resources in depth of time is<br />

inextricably linked with the “social license” to operate. Therefore, our<br />

commitment to business development and growth in a long-term perspective<br />

is coupled with our practices for Sustainable Development,<br />

with accountability and transparency.<br />

The continuous journey of responsible entrepreneurship, that has been<br />

part of S&B’s value system all along, has evolved today to a systematic<br />

and strategic pursuit of all three pillars of Sustainable Development,<br />

towards the maximization of long-term value to shareholders.<br />

Our Values<br />

Integrity<br />

We keep our promise.<br />

Customer Intimacy<br />

We strive to understand and satisfy our customers’<br />

needs and to share their aspirations for the future.<br />

Respect for People<br />

We value our people and we foster their development<br />

within a safe working environment of mutual trust<br />

and respect.<br />

Social Responsibility<br />

We gain the respect of our stakeholders<br />

with our professional and responsible conduct.<br />

26<br />

S&B Industrial Minerals S.A.

We are committed to continue with consistency<br />

our efforts for responsible contribution<br />

to Sustainable Development.<br />

Fulfilling our Purpose and Vision demands that we successfully address<br />

both our business objectives and our sustainable development challenges<br />

for:<br />

• Securing access to and responsible management of natural resources<br />

• Safeguarding occupational Health & Safety<br />

• Valuing our people and fostering their development<br />

• Mitigating the environmental footprint of the Company’s activities<br />

• Caring for local communities and society at large<br />

Always mindful of the sustainability of our Group, in dealing with the above<br />

challenges, we are committed to invest in our people’s development and<br />

safety at work, to effectively improve efficiency in the use of resources, to<br />

minimize the environmental impact of our operations, to effectively restore<br />

areas affected by mining operations and to gain the respect of the<br />

local communities where we operate through continuous dialogue and<br />

specific investments in community development and welfare.<br />

With appropriate policies and practices and stakeholder engagement,<br />

we consistently and systematically strive for the continuous improvement<br />

of our performance both in Greece, where our environmental and<br />

social work is deep rooted and has a long historical tradition and continuity,<br />

as well as in our worldwide operations, which continue to be added<br />

to our Group mostly through acquisitions.<br />

As our international presence evolves and we integrate our new colleagues,<br />

we expand the systematic recording and monitoring of the<br />

performance of all Group operations in the areas of corporate social responsibility,<br />

and we are challenged to diffuse relevant corporate policies<br />

and practices throughout our subsidiaries worldwide, adjusted to<br />

local needs and differing cultures. These cover our corporate human<br />

resource management systems and procedures, our comprehensive<br />

Corporate Policy on Quality, Environment and Health &Safety, already<br />

published in all the 11 languages spoken in our countries of activity,<br />

and the expansion of our social policy throughout the Group. Group integration<br />

follows a gradual and systematic approach on the basis of<br />

carefully selected criteria.<br />

Our Social <strong>Report</strong>, which is published every year separately from the <strong>Annual</strong><br />

<strong>Report</strong>, is a tool of accountability for the ways we address and manage<br />

our sustainable development challenges and the commitments we<br />

have made, documenting and communicating our practices and our<br />

performance in all areas of concern: Human Resources, Health & Safety,<br />

Environment, Social Contribution. Our Social <strong>Report</strong> is compiled according<br />

to the GRI Sustainability Guidelines.<br />

€ 4.9<br />

million to<br />

shareholders<br />

€ 72.1<br />

million<br />

to employees<br />

in compensation<br />

and benefits<br />

€ 320.4<br />

million<br />

to suppliers<br />

of all kinds<br />

€ 45<br />

million for taxes,<br />

duties, and social<br />

contributions<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

27

Human Resources<br />

The continuous training and professional development of the company’s<br />

human resources, the fair recognition and reward of their efforts,<br />

the safe working conditions and a working environment of<br />

mutual trust and respect that inspires creativity and innovation are objectives<br />

of the utmost importance for S&B, both for its own sustainability<br />

and progress in depth of time, as well as for the personal<br />

satisfaction of its employees.<br />

In <strong>2008</strong>, the corporate restructuring was effectively completed, providing<br />

company executives with new opportunities for professional evolution. Incorporation<br />

of the newly acquired companies and further integration of<br />

the Group’s subsidiaries to the corporate Human Resources systems<br />

continued at unabated pace. Finally, emphasis was given to the support<br />

and empowerment of executive personnel for developing their leadership,<br />

teamwork and change management capabilities.<br />

Personnel headcount in <strong>2008</strong> amounted to 2,086 persons<br />

Employee turnover rate remained relatively low at 3.2%<br />

Health & Safety<br />

Safeguarding Health & Safety at work is one of the major challenges<br />

the S&B Group is facing in all its activities, from minerals’ extraction<br />

to processing and transportation. Thus, eliminating or minimizing<br />

the various hazards in the workplace is of primary importance for<br />

S&B people and is reflected in the corporate target for “zero accidents”.<br />

In order to achieve this, the Company invests significantly in<br />

safe working conditions, safe working methods and continuous<br />

training of employees in health & safety matters. In recent years new<br />

innovative tools aiming at a “behavior-based” approach to safety<br />

have also been introduced, complementing and reinforcing the<br />

classical practices.<br />

In <strong>2008</strong>, particular emphasis was given to investigating the causes<br />

and designing appropriate mitigation measures of “traffic” related accidents<br />

that involve mobile equipment; to this end implementation<br />

and monitoring of the “Safe Drive” training program was reinforced<br />

and extended over a two-year period.<br />

The Frequency Index from all our operations in Greece was recorded<br />

at an all time low of 2.01 (as compared to 3.9 in 2007), but the Severity<br />

Index rose to 112.05 (as opposed to 36.1 in the previous year), due<br />

to many working days lost mainly from one incident. A total of 3 incidents<br />

occurred, as opposed to 6 in 2007, but the working days lost<br />

increased to 167 in comparison to 55 last year.<br />

All efforts and lessons learned are applied towards our corporate target of “zero<br />

accidents”<br />

Historical data show a continuous improvement of Safety Indicators<br />

28 S&B Industrial Minerals S.A.

Environment<br />

Always mindful of its impact on the environment S&B works systematically<br />

and effectively to improve efficiency in the use of natural resources,<br />

to protect, preserve and restore affected areas and to<br />

mitigate the environmental footprint of its operations. To this end, advanced<br />

environmental management practices and methods are applied,<br />

adopting state of the art technology across the entire spectrum<br />

of activities (mining, industrial processing and product transportation).<br />

Moreover, new innovative products are developed that improve both<br />

the environmental performance of the Company’s processes and<br />

those of its customers.<br />

In <strong>2008</strong>, further emphasis was given in enhancing the Environmental<br />

Impact Assessments required for the permitting of Company installations<br />

and activities, in collaboration with specialized external associates.<br />

Our rigorous monitoring and performance systems established<br />

already for a number of years allow us to evolve the quality and rigor of<br />

our Assessments continuously. Moreover, in line with our primary concern<br />

for the efficient management of our mineral resources and exploitation<br />

of by-products, this year we focused our efforts on the<br />

optimization of the perlite production on Milos towards reduction and<br />

exploitation of perlite ‘fine’ rejects.<br />

Facilities producing 84% of the Group’s products apply a certified environmental<br />

management system according to ISO 14001<br />

86% of the Group's mining area "in use" is located in Greece; 47.7% of that<br />

has been reclaimed, while another 46% is used for current extractive activities<br />

95 different plant species are currently being used for reclamation works<br />

in Fokida & Milos, the majority of which are reproduced in the local Company<br />

nurseries, and more than 90% of them are native to these areas or Greece<br />

Socioeconomic Contribution<br />

S&B is continuously striving to gain the respect of the local communities<br />

of its interest, through its professional and responsible conduct,<br />

through continuous dialogue, systematic work and investments, in a<br />

model of cooperation and synergy with them, focused on:<br />

• Promoting the sustainable and balanced development of these local<br />

communities<br />

• Ensuring the compatibility of S&B’s activity with other local economic<br />

activities<br />

To this end, S&B’s social contribution practices in Greece (Milos island<br />

& Fokida region), where the company’s extractive operations are<br />

mainly located, are directed in:<br />

• Creating and operating works of cultural infrastructure, like the<br />

“Milos Mining Museum”, the “Milos Conference Center” and the<br />

“Vagonetto-Fokis Mining Park”<br />

• Providing financial, technical and other support to local organizations<br />

and initiatives of high interest and acceptance, as well as local<br />

infrastructure works<br />

• Developing initiatives and activities that promote these regions and<br />

contribute to their balanced development<br />

• Supporting the local populations with educational, cultural and other<br />

activities<br />

• Developing institutionalized forms of engagement with local communities<br />

such as the ‘Fokida Initiative’ and the ‘MILOS Initiative’<br />

In <strong>2008</strong>, the inauguration of the Milos island wastewater management<br />

facility was celebrated as the first work of the common development<br />

company ‘MILOS Initiative’, co-founded in 2007 by S&B Industrial Minerals<br />

S.A. and the Milos Municipality. This important infrastructure project,<br />

fully financed by S&B, solves a long-standing problem of Milos and<br />

was built according to state-of-the-art modern technology. Moreover,<br />

S&B continued to invest in the local communities of its interest through<br />

the established institutionalized partnerships and infrastructure works,<br />

but also on various other initiatives and local activities.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

29

Corporate Governance<br />

The Corporate Governance System aims<br />

at doing business through a fair, sound and effective<br />

management system, in compliance with regulations<br />

and professional conduct and ethics.<br />

S&B’s Corporate Governance System is an evolution of business<br />

principles that were formulated already since the 1980s, in order to<br />

replace the traditional management system of a family-owned business.<br />

Following the edition of the “OECD Principles of Corporate<br />

Governance” in 2000, S&B readily adopted them and transformed<br />

its Corporate Governance Principles accordingly. As a result, the first<br />

codified edition of “S&B Principles of Corporate Governance” was<br />

published in 2001, the first of its kind in Greece.<br />

The “S&B Principles of Corporate Governance” reflect the Group’s<br />

conduct towards its Stakeholders, comprising not only the Company’s<br />

legal and statutory obligations, but also its self-commitments<br />

that stem from the Group’s Credo.<br />

The main objective of S&B Corporate Governance System is the<br />

long-term development of the Company, dictated by an equal and<br />

fair defence of the interests of all Shareholders with no exception,<br />

as well as by the demands of social responsibility and public acceptance.<br />

Accordingly, the Company is concerned with:<br />

• safeguarding the Principles and Values of the Group<br />

• clarifying the authority and duties of the various bodies involved in<br />

Corporate Governance<br />

• evaluating entrepreneurial threats / opportunities and taking calculated<br />

risks (risk management)<br />

• ensuring the effective utilization of the available resources<br />

• monitoring and efficiently controlling the Company’s Management<br />

activities<br />

• safeguarding the transparency of corporate activities<br />

• safeguarding and providing assistance in exercising the rights of<br />

the Shareholders<br />

• promoting the effective and consistent implementation of Corporate<br />

Social Responsibility<br />

• safeguarding efficient application of the Group’s Environmental,<br />

Health & Safety Policy<br />

• protecting the rights of the Stakeholders<br />

The above objectives are fulfilled by:<br />

• Transferring the management of the Group to professional managers,<br />

who, as a rule, have no family connection with those who<br />

control the majority of the Company's equity,<br />

• Securing an effective corporate operational control, consisted of<br />

independent internal and external auditing bodies, and<br />

• Establishing an active Board of Directors, which acts as the top<br />

guiding body towards an effective safeguarding of the interests of<br />

the Company and all the shareholders, as well as those of the<br />

Stakeholders in general.<br />

Our Corporate Governance System continuously evolves to keep abreast of wider<br />

socio-economic developments ensuring alignment with international best practices.<br />

The third and most recent revision to our standards occurred in 2007 placing emphasis<br />

on transparency and on our risk management processes, in response to the<br />

globally unstable business environment.<br />

30 S&B Industrial Minerals S.A.

<strong>2008</strong> Board of Directors<br />

The Board of Directors acts as the trustee of our Corporate Governance principles<br />

Board composition and responsibilities<br />

Our Board is currently comprised of 15 members out of which, only 2 are<br />

executives of the company. Mr. Ulysses Kyriacopoulos is Chairman of<br />

the Board and Mr. Efthimios O. Vidalis is Chief Executive Officer. Of the<br />

13 non-executive Directors 7 independent Directors have been appointed<br />

as defined by Greek legislation on Corporate Governance (law<br />

2016/2002).<br />

The non-executive members are entrusted with the monitoring and controlling<br />

of Management’s activities. They are professionals selected<br />

among successful business and academic individuals with rich domestic<br />

and international experience, on the basis of educational level and<br />

social status. Their role is to provide an unbiased, clear and non-executive<br />

perspective within the Board and express objective opinion on company<br />

matters.<br />

A unique and uncommon characteristic of the S&B Board is that it measures<br />

its effectiveness on a yearly basis, by self-assessment through a<br />

questionnaire answered by all of its members, related to its activities in<br />

the preceding year. Processing of the answers results in an overall evaluation<br />

of the Board’s performance and this is used as a guide for matters<br />

requiring increased attention in the year to follow.<br />

The Board meets at regular intervals on matters for its full consideration.<br />

Board members are provided in advance with all necessary and relevant<br />

information to enable them to carry out their responsibilities. Duties<br />

of the Board include among others the approval, review and integration<br />

of Group policies and principles, implementing mid- and long-term strategic<br />

imperatives through goal setting and approval of annual budgets,<br />

ensuring an efficient risk analysis system and risk taking framework, ensuring<br />

transparency, credibility and integrity of publicized financial statements,<br />

safeguarding the effective implementation of the Group’s<br />

Environmental Policy.<br />

<strong>2008</strong> Board of Directors<br />

Kitty Kyriacopoulos Honorary Chairman Ulysses Kyriacopoulos Chairman Emmanuel Voulgaris Vice-Chairman Efthimios Vidalis Chief Executive Officer Stelios Argyros Member Iakovos Georganas Member Michael Karamihas Member John Karkalemis Member Florica Kyriacopoulos Member Raphael Moissis Member Nikos Nanopoulos Member Calypso-Maria Nomicos Member John Economopoulos Member Eleni Papaconstantinou Member<br />

•<br />

Alexandros Sarrigeorgiou Member<br />

•<br />

• • • Executive Members Non-Executive Members Independent Non-Executive Members<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 31

Board Committees<br />

Four Board Committees, consisting mainly of non-executive members, have been set up, their mission being to<br />

assist the Board in monitoring the actions of the Group's executive staff and propose to the Board decisions to<br />

be taken.<br />

Audit Committee<br />

Chairman: E. Voulgaris<br />

Members: I. Georganas, J. Karkalemis, E. Papaconstantinou<br />

The Audit Committee meets four times a year and is comprised of<br />

three to five non-executive Directors. It has authority for,<br />

• unrestricted access to management,<br />

• overseeing and instructing the Internal Audit Services accordingly,<br />

• recommending the appointment of external auditors and overseeing<br />

their work<br />

• engaging independent advisors as it deems appropriate to carry<br />

out its duties<br />

The Committee operates under a written charter with the following duties:<br />

• Considers whether recommendations made by the internal and<br />

external auditors have been discussed and appropriately acted<br />

on by Management.<br />

• A quarterly review of the Internal Auditors’ findings and reporting<br />

to the Board in compliance with the prevailing laws concerning<br />

Corporate Governance.<br />

• Reviews the interim and annual financial statements and submits<br />

the same to the Board for approval before they are made public,<br />

provided it has been convinced of their credibility and integrity.<br />

• Reviews the findings of inspections made by the Regulatory<br />

Agencies of the State.<br />

• Deals with any confidential or anonymous information or accusation<br />

of financial nature, irrespective of origin, including those coming from<br />

members of the Group personnel.<br />

• Reviews, on an annual basis, the degree of independence and<br />

the performance of the external auditors, and makes recommendations<br />

to the Board for the continuation or termination of their<br />

appointment. In case of termination, it supervises the selection<br />

process and recommends to the Board a new appointment.<br />

• Reviews the proposed yearly external audit plan in the light of the<br />

Group's current requirements and other business environment<br />

circumstances.<br />

• Supervises the activities, resources and organizational structure<br />

of the Internal Audit Services and ensures its unrestricted operation.<br />

• Reviews the proposed internal audit plan for the coming year and<br />

ensures that it addresses the key areas of risk. It ensures that<br />

there is appropriate coordination with the external auditor’s auditing<br />

plan.<br />

• Assesses the performance of the Internal Audit Services and its<br />

head.<br />

• Participates in the decision-making process for the appointment<br />

or dismissal of the Internal Audit Services head, as well as for<br />

his/her compensation.<br />

• Regularly provides updated information to the Board concerning<br />

the Committee’s activities.<br />

• Reviews the Corporate Governance Principles as well as the present<br />

Charter and proposes to the Board any required changes.<br />

Nomination Committee<br />

Chairman: Ul. Kyriacopoulos<br />

Members: K. Kyriacopoulos, S. Argyros, R. Moissis, J. Economopoulos, A. Sarrigeorgiou<br />

Assists the Board in ensuring continuity and normal succession for Board<br />

membership and the CEO position, as well as, for the top-level management<br />

development and succession. This Committee may be, partly<br />

or in its totality, identical with the Human Resources Committee.<br />

32 S&B Industrial Minerals S.A.

Human Resources Committee<br />

Chairman: S. Argyros<br />

Members: K. Kyriacopoulos, Ul. Kyriacopoulos, R. Moissis, C. Nomicos<br />

• Evaluates the performance of the CEO and the top management<br />

members and submits proposals to the Board regarding their compensation.<br />

• Submits proposals to the Board concerning the management development<br />

of executives.<br />

• The committee also submits to the Board proposals related to the<br />

annual general salary policy for the Group’s personnel, as well as<br />

efficient reward and benefit systems. Within this framework, compensation<br />

packages for each executive are determined on the basis<br />

of their role in the Company and consist of the following elements:<br />

- base salary, the amount of guaranteed cash, which is linked to the<br />

results of the executive’s annual evaluation and is based on an internationally<br />

recognized salary system;<br />

- short term incentives, based on preset performance goals of the individual,<br />

the unit and the company over a period of one year;<br />

- senior management long term incentives, where the reward is earned<br />

over a period of more than one year and is linked to the performance<br />

of the business through equity related rewards.<br />

Pension Plan Committee<br />

Chairman: Ul. Kyriacopoulos<br />

Members: I. Georganas, E. Papaconstantinou, F. Kyriacopoulos<br />

Its objective is to evaluate and select the best alternatives of investing the funds of the Pension Plan for the Group’s personnel.<br />

Internal Audit Services<br />

They are headed by a high-level management member supervised by the<br />

Audit Committee. The Internal Audit performs its duties guided by its<br />

Charter, which is authorized by the Audit Committee and the CEO. The<br />

internal audits are conducted following international professional practices,<br />

codified in the "Manual of Internal Audit Standards". The Internal<br />

Audit Services have the following responsibilities:<br />

• To monitor the implementation and continuous compliance with the<br />

Internal Regulation and the Articles of Association of the Company,<br />

as well as with all the regulations relevant to the Company, particularly<br />

the financial and corporate legislation.<br />

• To report to the Board of Directors cases of conflict between interests<br />

of Board or Management members and interests of the<br />

Company, which it detects while performing its duties.<br />

• To notify the Board of Directors in writing at least quarterly of the<br />

results of the audits performed.<br />

• To attend the General Shareholder Meetings.<br />

• To collaborate with the statutory Supervising Authorities, assisting<br />

them in every possible way for performing their supervising and<br />

audit responsibilities and disclosing –with the approval of the Board<br />

of Directors– any information requested by them in writing.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />