Section B â The Financial Framework - Government Accounting

Section B â The Financial Framework - Government Accounting

Section B â The Financial Framework - Government Accounting

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

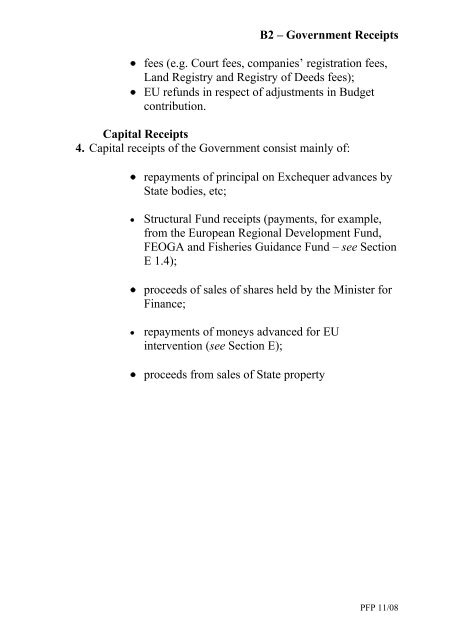

B2 – <strong>Government</strong> Receipts<br />

• fees (e.g. Court fees, companies’ registration fees,<br />

Land Registry and Registry of Deeds fees);<br />

• EU refunds in respect of adjustments in Budget<br />

contribution.<br />

Capital Receipts<br />

4. Capital receipts of the <strong>Government</strong> consist mainly of:<br />

• repayments of principal on Exchequer advances by<br />

State bodies, etc;<br />

• Structural Fund receipts (payments, for example,<br />

from the European Regional Development Fund,<br />

FEOGA and Fisheries Guidance Fund – see <strong>Section</strong><br />

E 1.4);<br />

• proceeds of sales of shares held by the Minister for<br />

Finance;<br />

• repayments of moneys advanced for EU<br />

intervention (see <strong>Section</strong> E);<br />

• proceeds from sales of State property<br />

PFP 11/08