Jenny and Nat - Aussiehome

Jenny and Nat - Aussiehome

Jenny and Nat - Aussiehome

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Investor | profile<br />

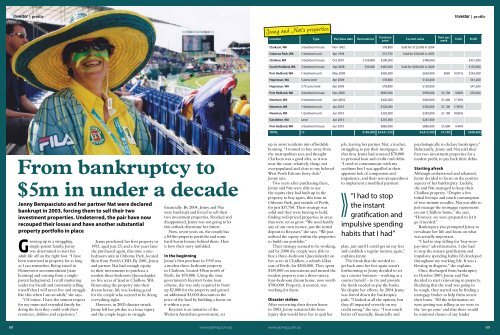

<strong>Jenny</strong> <strong>and</strong> <strong>Nat</strong>’s properties<br />

Location Type Purchase date Renovations<br />

Purchase<br />

price<br />

Current value<br />

Rent per<br />

week<br />

Investor | profile<br />

Yield<br />

Profit<br />

Clarkson, WA 3-bedroom house Nov 1992 $78,800 Sold for $125,000 in 2004<br />

Osborne Park, WA 1-bedroom unit Apr 1994 $37,750 Sold for $58,000 in 2003<br />

Chidlow, WA 3-bedroom house Oct 2001 $159,000 $200,000 $780,000 $421,000<br />

South Hedl<strong>and</strong>, WA 2-bedroom house Sep 2008 $30,000 $465,000 Sold for $630,000 in 2009 $135,000<br />

Port Hedl<strong>and</strong>, WA 1-bedroom unit May 2009 $405,000 $650,000 $850 10.91% $245,000<br />

Hopetoun, WA 5 acres l<strong>and</strong> Apr 2009 $78,800 $120,000 $41,200<br />

Hopetoun, WA 3.75 acres l<strong>and</strong> Apr 2009 $78,800 $120,000 $41,200<br />

Port Hedl<strong>and</strong>, WA 4-bedroom house Dec 2009 $895,000 $950,000 $1,700 9.80% $55,000<br />

Newman, WA 2-bedroom unit Jun 2010 $420,000 $420,000 $1,400 17.30%<br />

Newman, WA 1-bedroom unit Jun 2010 $320,000 $320,000 $1,100 17.85%<br />

Newman, WA 1-bedroom unit Jun 2010 $320,000 $320,000 $1,100 18.85%<br />

Geraldton, WA L<strong>and</strong> Jun 2010 $247,000 $247,500<br />

Port Hedl<strong>and</strong>, WA 3-bedroom house Jun 2010 $885,000 $885,000 $1,600 9.40%<br />

TOTAL 13 $189,000 $4,431,150 $4,812,500 $7,750 $938,400<br />

From bankruptcy to<br />

$5m in under a decade<br />

<strong>Jenny</strong> Bempasciuto <strong>and</strong> her partner <strong>Nat</strong> were declared<br />

bankrupt in 2003, forcing them to sell their two<br />

investment properties. Undeterred, the pair have now<br />

recouped their losses <strong>and</strong> have another substantial<br />

property portfolio in place<br />

Growing up in a struggling<br />

single-parent family, <strong>Jenny</strong><br />

was determined to start her<br />

adult life off on the right foot. “I have<br />

been interested in property for as long<br />

as I can remember. Being raised in<br />

Homeswest accommodation [state<br />

housing] <strong>and</strong> coming from a singleparent<br />

background, I recall muttering<br />

under my breath <strong>and</strong> constantly telling<br />

myself that I will never live <strong>and</strong> struggle<br />

like this when I am an adult,” she says.<br />

“Of course, I have the utmost respect<br />

for my mum <strong>and</strong> extended family for<br />

doing the best they could with their<br />

resources, abilities <strong>and</strong> experience.”<br />

<strong>Jenny</strong> purchased her first property in<br />

1992, aged just 23, <strong>and</strong> a few years later<br />

she purchased again, this time a onebedroom<br />

unit in Osborne Park, located<br />

8km from Perth’s CBD. By 2001, <strong>Jenny</strong><br />

<strong>and</strong> partner <strong>Nat</strong> had enough equity<br />

in their investments to purchase a<br />

modest three-bedroom Queensl<strong>and</strong>er<br />

on five acres of l<strong>and</strong> in Chidlow, WA.<br />

Renovating the property into their<br />

dream home, life was looking good<br />

for the couple who seemed to be doing<br />

everything right.<br />

However, in 2003 disaster struck.<br />

<strong>Jenny</strong> left her job due to a knee injury<br />

<strong>and</strong> the couple began to struggle<br />

financially. By 2004, <strong>Jenny</strong> <strong>and</strong> <strong>Nat</strong><br />

were bankrupt <strong>and</strong> forced to sell their<br />

two investment properties. Shocked <strong>and</strong><br />

disappointed, <strong>Jenny</strong> was not going to let<br />

this setback determine her future.<br />

Now, seven years on, the couple has<br />

a $4.8m property portfolio <strong>and</strong> some<br />

hard-learnt lessons behind them. Here<br />

is how their story unfolded.<br />

In the beginning<br />

<strong>Jenny</strong>’s first purchase in 1992 was<br />

a modest three-bedroom property<br />

in Clarkson, located 43km north of<br />

Perth, for $78,800. Using the state<br />

government’s Keystart home loan<br />

scheme, she was only required to front<br />

up $2,000 for the property <strong>and</strong> gained<br />

an additional $3,000 discount on the<br />

price of the l<strong>and</strong> by building a home on<br />

it within a year.<br />

Keystart is an initiative of the<br />

Western Australian government, set<br />

up to assist residents into affordable<br />

housing. “I wanted to buy away from<br />

the metropolitan area <strong>and</strong> thought<br />

Clarkson was a good idea, as it was<br />

near the coast, relatively cheap, not<br />

overpopulated <strong>and</strong> close to my beloved<br />

West Perth Falcons footy club,”<br />

<strong>Jenny</strong> says.<br />

Two years after purchasing there,<br />

<strong>Jenny</strong> <strong>and</strong> <strong>Nat</strong> were able to use<br />

the equity they had built up in the<br />

property to buy again, this time in<br />

Osborne Park, just outside of Perth,<br />

for just $37,750. Their strategy was<br />

solid <strong>and</strong> they were buying to hold,<br />

finding well-priced properties in areas<br />

that were set to grow. “We used hardly<br />

any of our own money, just the initial<br />

deposit to Keystart,” she says. “We just<br />

utilised the equity within the properties<br />

to build our portfolio.”<br />

Their strategy seemed to be working,<br />

<strong>and</strong> by 2000 the couple were able to<br />

buy a three-bedroom Queensl<strong>and</strong>er on<br />

five acres in Chidlow, a suburb 42km<br />

east of Perth, for $200,000. They spent<br />

$159,000 on renovations <strong>and</strong> turned the<br />

modest property into a three-storey,<br />

four-bedroom dream home, now worth<br />

$780,000. Property, it seemed, was<br />

working for them.<br />

Disaster strikes<br />

After renovating their dream home<br />

in 2003, <strong>Jenny</strong> sustained the knee<br />

injury that would force her to quit her<br />

job, leaving her partner <strong>Nat</strong>, a teacher,<br />

struggling to pay their mortgages. At<br />

that time <strong>Jenny</strong> had amassed $70,000<br />

in personal loan <strong>and</strong> credit card debts.<br />

“I tried to communicate with my<br />

creditors but I was appalled at their<br />

apparent lack of compassion <strong>and</strong><br />

impatience, <strong>and</strong> their non-preparedness<br />

to implement a modified payment<br />

“I had to stop<br />

the instant<br />

gratification <strong>and</strong><br />

impulsive spending<br />

habits that I had”<br />

plan, just until I could get on my feet<br />

<strong>and</strong> establish a regular income again,”<br />

explains <strong>Jenny</strong>.<br />

The break that she needed to<br />

get back onto her feet again wasn’t<br />

forthcoming so <strong>Jenny</strong> decided to set<br />

up a courier business – working as a<br />

courier herself – to try <strong>and</strong> provide<br />

the funds needed to pay the banks.<br />

Yet despite her efforts, by 2004 <strong>Jenny</strong><br />

was forced down the bankruptcy<br />

path. “I looked at all the options, but<br />

they all impacted severely on my<br />

credit rating,” she says. “I was much<br />

better off mentally, financially <strong>and</strong><br />

psychologically to declare bankruptcy.”<br />

Reluctantly, <strong>Jenny</strong> <strong>and</strong> <strong>Nat</strong> sold their<br />

first two investment properties for a<br />

modest profit, to pay back their debts.<br />

Starting afresh<br />

Although embarrassed <strong>and</strong> ashamed,<br />

<strong>Jenny</strong> decided to focus on the positive<br />

aspects of her bankruptcy. Luckily,<br />

she <strong>and</strong> <strong>Nat</strong> managed to keep their<br />

Chidlow property. “Despite a few<br />

initial hiccups <strong>and</strong> much consumption<br />

of two-minute noodles, <strong>Nat</strong> was able to<br />

just manage the mortgage repayments<br />

on our Chidlow home,” she says.<br />

“However, we were prepared to let it<br />

go if needed.”<br />

Bankruptcy also prompted <strong>Jenny</strong> to<br />

reevaluate her life <strong>and</strong> focus on what<br />

was actually important.<br />

“I had to stop falling for ‘buy-nowpay-later’<br />

advertisements. I also had<br />

to stop the instant gratification <strong>and</strong><br />

impulsive spending habits I’d developed<br />

throughout my working life. It was a<br />

blessing in disguise,” she explains.<br />

Once discharged from bankruptcy<br />

in October 2007, <strong>Jenny</strong> <strong>and</strong> <strong>Nat</strong><br />

decided to start reinvesting in property.<br />

Realising that the road was going to<br />

be tough, they started out by finding a<br />

mortgage broker to help them secure<br />

their loans. “All the information we<br />

were getting was telling us we were in<br />

the ‘no-go zone’ <strong>and</strong> that there would<br />

be minimal chance of any lender<br />

68 www.yipmag.com.au<br />

www.yipmag.com.au<br />

69

Investor | profile<br />

Investor | profile<br />

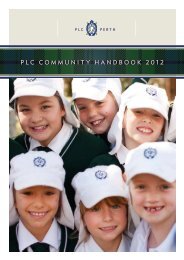

<strong>Nat</strong> <strong>and</strong> <strong>Jenny</strong><br />

considering <strong>and</strong> approving any further<br />

property investment loans, for at least<br />

another two years,” <strong>Jenny</strong> explains.<br />

“Even our mortgage broker was<br />

sceptical <strong>and</strong> required convincing to<br />

place an application for us.”<br />

However, thanks to their stable<br />

government jobs <strong>and</strong> consistent<br />

mortgage repayments, the couple<br />

were finally accepted by Bankwest<br />

for a $515,000 loan in 2008. “We had<br />

equity in our Chidlow property – due<br />

to the boom, our house was valued<br />

at $720,000 – <strong>and</strong> therefore we were<br />

able to finance the purchase without<br />

the injection of any further funds <strong>and</strong><br />

without any mortgage insurance,”<br />

<strong>Jenny</strong> says.<br />

Re-entering the market<br />

The first property <strong>Jenny</strong> <strong>and</strong> <strong>Nat</strong><br />

purchased after being discharged from<br />

bankruptcy was a three-bedroom<br />

fibro ex-Homeswest residence in<br />

South Hedl<strong>and</strong>, WA, for $465,000.<br />

“We completed extensive research on<br />

various areas <strong>and</strong> decided that South<br />

Hedl<strong>and</strong> was the next little sleeper<br />

town. It was predominantly a mining<br />

area for large companies like BHP<br />

<strong>and</strong> Woodside <strong>and</strong> was achieving an<br />

excellent rental yield of around 11%,”<br />

says <strong>Jenny</strong>.<br />

Overall, the property was in a<br />

dilapidated state <strong>and</strong> in need of<br />

a complete refurbishment. Once<br />

purchased, the couple gutted the<br />

property, spending $30,000 on<br />

renovations. “It was a mess, <strong>and</strong> at<br />

times we questioned our decision<br />

to renovate the property, especially<br />

since South Hedl<strong>and</strong> was a twohour<br />

plane ride north of Perth,” says<br />

<strong>Jenny</strong>. However, they ploughed on,<br />

completing the project in a short<br />

timeframe by using local tradespeople<br />

where possible. Once completed, the<br />

property was rented for $1,000 a week<br />

– more than covering the interest-only<br />

repayments <strong>and</strong> providing a positive<br />

cash flow of almost $500 per week.<br />

Then, using the equity from their<br />

PPOR in Chidlow <strong>and</strong> their newlyrenovated<br />

South Hedl<strong>and</strong> property,<br />

<strong>Jenny</strong> <strong>and</strong> <strong>Nat</strong> soon purchased a<br />

one-bedroom unit in Port Hedl<strong>and</strong><br />

for $405,000 which they rented out<br />

immediately for $850 a week. With a<br />

positive cash flow of $900 per week<br />

from their two new investment<br />

properties, the couple were able<br />

to purchase two l<strong>and</strong> packages in<br />

Hopetoun, WA, for $78,800 each.<br />

“We decided to seize this<br />

opportunity <strong>and</strong> due to the unfortunate<br />

mine closure by BHP, the acreage<br />

was priced at rock-bottom. There was<br />

considerable infrastructure already<br />

invested in the small seaside town<br />

<strong>and</strong> we were sure that some company<br />

would realise its potential,” says <strong>Jenny</strong>.<br />

Sure enough, Galaxy <strong>and</strong> Tectonics<br />

bought the mine <strong>and</strong> have commenced<br />

operations. The properties are now<br />

worth $120,000 each <strong>and</strong> the couple<br />

expect their value will continue to rise<br />

when the mine is fully operational.<br />

By the end of 2009, just two years<br />

after their bankruptcy had cleared,<br />

<strong>Jenny</strong> <strong>and</strong> <strong>Nat</strong> had an impressive five<br />

investment properties in their portfolio,<br />

including a property in Port Hedl<strong>and</strong><br />

that they purchased in December<br />

of that year for $895,000 using<br />

the $90,000 profit they gained from<br />

selling the South Hedl<strong>and</strong> property.<br />

“We were aware that property prices<br />

within the Port Hedl<strong>and</strong> region were<br />

going to double within the next two<br />

years, due to sewerage construction <strong>and</strong><br />

rezoning, so we were keen to purchase<br />

near the ocean,” <strong>Jenny</strong> explains.<br />

Securing a property located<br />

50 metres from the ocean <strong>and</strong><br />

200 metres from the yacht club, the<br />

property is currently tenanted at $1,700<br />

a week by a government department on<br />

a three-year lease <strong>and</strong> offers great scope<br />

for development.<br />

“The development opportunity was<br />

too good to refuse. Once the l<strong>and</strong> is<br />

rezoned to R80 we can place up to six<br />

dwellings at 125m 2 each on the block,<br />

or sell it to another developer for a<br />

sizeable profit,” says <strong>Jenny</strong>.<br />

Gravy train<br />

In a few months <strong>Jenny</strong> <strong>and</strong> <strong>Nat</strong>’s<br />

property portfolio will be valued close<br />

to $5m. Their own home in Chidlow<br />

has been fully paid off <strong>and</strong> the couple<br />

will soon be receiving a positive cash<br />

flow bonus of close to $4,000 per<br />

month, after interest-free mortgage<br />

repayments are deducted. That’s not<br />

bad – especially for a couple who have<br />

only been discharged from bankruptcy<br />

for three years.<br />

<strong>Jenny</strong>’s strategy is based on<br />

calculated risk. “Some people are not<br />

comfortable with debt <strong>and</strong> believe<br />

terrible things are going to happen<br />

<strong>and</strong> that things will go wrong,”<br />

says <strong>Jenny</strong>. “I can underst<strong>and</strong> why;<br />

however, if you change your thinking<br />

patterns into a positive mindset <strong>and</strong><br />

focus on the future, I believe you can<br />

achieve anything, no matter what your<br />

background,” she says.<br />

The couple’s recent success has<br />

been based on a strategy of buying<br />

properties that will yield at least a 10%<br />

return using interest-only repayments.<br />

“This will ensure you have positive<br />

cash flow properties while maximising<br />

your tax advantages,” says <strong>Jenny</strong>. By<br />

using the extra money they gained<br />

from rent payments to pay off extra on<br />

their home loan, the couple managed<br />

to unlock equity faster, helping<br />

them towards purchasing even more<br />

investment properties.<br />

<strong>Jenny</strong> also likes to choose investment<br />

properties near the coast that will<br />

have strong dem<strong>and</strong>, where there is<br />

weak supply <strong>and</strong> good prospects for<br />

future developments <strong>and</strong> growth.<br />

“Most properties double [in value]<br />

within seven to 10 years. As long as<br />

the rental income more than meets the<br />

repayment, you are in front,” she says.<br />

In addition to using resources such<br />

as RP Data, property investment<br />

magazines <strong>and</strong> council websites, the<br />

couple also build relationships with<br />

local agents <strong>and</strong> agencies before they<br />

buy. “Ryan Crawford from Crawford<br />

Realty helped us get started in Hedl<strong>and</strong>,<br />

<strong>and</strong> I have bought all investment<br />

properties in Hedl<strong>and</strong> with his agency,”<br />

explains <strong>Jenny</strong>.<br />

“We like to buy in little sleeper areas<br />

that may be set to boom, such as mining<br />

or port areas which are due to open<br />

in the future, or those that are already<br />

established <strong>and</strong> have strong future<br />

dem<strong>and</strong>. Once we locate those areas we<br />

make sure that they have at least a 10%<br />

rental return <strong>and</strong> identify rezoning <strong>and</strong><br />

development opportunities that we can<br />

take advantage of.”<br />

Money matters<br />

Despite facing some difficulties after<br />

their bankruptcy, <strong>Jenny</strong> <strong>and</strong> <strong>Nat</strong> did<br />

manage to borrow again – thanks to<br />

their diligence in paying their mortgage<br />

on time. They currently have split loans<br />

with Westpac <strong>and</strong> Bankwest due to<br />

differing valuations, <strong>and</strong> to date have<br />

only used the equity in their properties<br />

to increase their portfolio.<br />

Due to their strategy of buying cashflow<br />

positive properties with interestonly<br />

loans, the couple find that rising<br />

interest rates aren’t too troublesome for<br />

them. “Interest rates would have to rise<br />

to around 12–13% to break even with<br />

the interest-only repayments for our<br />

properties. Even then, if we do fall a<br />

little behind, the extra rental funds that<br />

we have placed against our residence<br />

can be drawn on for that period,”<br />

explains <strong>Jenny</strong>.<br />

Riding out the financial crisis<br />

relatively unscathed, the couple found<br />

that the only major inconvenience was<br />

having to wait to rent out their South<br />

Hedl<strong>and</strong> property. “After renovating<br />

the South Hedl<strong>and</strong> property we had<br />

to wait a little to rent it out, but after<br />

two months it was obtaining $1,000<br />

per week in rent. Before the GFC, we<br />

probably could have achieved $1,200 a<br />

week – but aside from that there were<br />

no other issues,” <strong>Jenny</strong> explains.<br />

As for their most successful<br />

transaction, the couple currently has a<br />

unit for sale in Port Hedl<strong>and</strong> that will<br />

realise a profit of over $200,000 in little<br />

under 12 months when it is sold. While<br />

the proposed mining tax has slowed<br />

business down for <strong>Jenny</strong> <strong>and</strong> <strong>Nat</strong> this<br />

year, they are currently working on<br />

strategies that will enable them both to<br />

work part-time in 2011.<br />

Bright future<br />

It’s been a hard road for <strong>Jenny</strong> <strong>and</strong><br />

<strong>Nat</strong>, who have been together now for<br />

16 years, yet their future looks bright.<br />

The couple have three off-the-plan<br />

apartments in Newman, WA, now<br />

ready to be purchased, as well as a<br />

beach block in Geraldton that they plan<br />

to build on for their future retirement.<br />

“We’d like to create a bed-<strong>and</strong>breakfast<br />

on the Chidlow property<br />

for when we semi-retire. We’re also<br />

planning to transport the home on the<br />

development block in Port Hedl<strong>and</strong> to<br />

“We like to buy in little sleeper areas<br />

that are set to boom, such as mining or<br />

port areas which are due to open in the<br />

future, or those that are already established”<br />

Hopetoun to have a seaside retreat,”<br />

<strong>Jenny</strong> says.<br />

“Once the other properties<br />

appreciate <strong>and</strong> obtain capital growth,<br />

we can afford to build approximately<br />

four to six townhouses or units on the<br />

development blocks in Port Hedl<strong>and</strong><br />

<strong>and</strong> live off the rental income that they<br />

provide. This will allow us to have<br />

the freedom to travel, assist family<br />

members financially <strong>and</strong> pursue other<br />

ventures that inspire <strong>and</strong> motivate us,”<br />

she explains.<br />

Yet while bankruptcy seems to<br />

have provided the couple with a<br />

happy ending, <strong>Jenny</strong> believes that an<br />

alternative option would have been<br />

better. “Although my circumstances<br />

appeared dire, I probably would not<br />

have sold my first house in Clarkson<br />

<strong>and</strong> the unit in Osborne Park.<br />

However, I am a firm believer in fate<br />

<strong>and</strong> creating your own destiny <strong>and</strong><br />

believe that if I hadn’t gone bankrupt<br />

I probably wouldn’t have learned<br />

valuable lessons in life,” she says.<br />

“You’ll always come across<br />

roadblocks <strong>and</strong> cul de sacs; however,<br />

if you maintain your focus <strong>and</strong> exhibit<br />

genuine excitement <strong>and</strong> enthusiasm,<br />

you’ll find an alternative route, no<br />

matter how long it takes.”<br />

70 www.yipmag.com.au<br />

www.yipmag.com.au<br />

71