India Monetary Policy Review – June 2013 - Business Research ...

India Monetary Policy Review – June 2013 - Business Research ...

India Monetary Policy Review – June 2013 - Business Research ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

International Economics > <strong>India</strong> 20 <strong>June</strong> <strong>2013</strong><br />

<strong>India</strong> <strong>–</strong> <strong>Monetary</strong> <strong>Policy</strong> <strong>Review</strong><br />

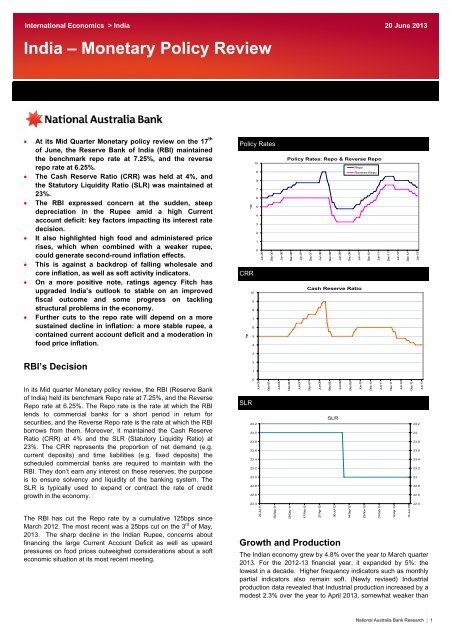

• At its Mid Quarter <strong>Monetary</strong> policy review on the 17 th<br />

of <strong>June</strong>, the Reserve Bank of <strong>India</strong> (RBI) maintained<br />

the benchmark repo rate at 7.25%, and the reverse<br />

repo rate at 6.25%.<br />

• The Cash Reserve Ratio (CRR) was held at 4%, and<br />

the Statutory Liquidity Ratio (SLR) was maintained at<br />

23%.<br />

• The RBI expressed concern at the sudden, steep<br />

depreciation in the Rupee amid a high Current<br />

account deficit: key factors impacting its interest rate<br />

decision.<br />

• It also highlighted high food and administered price<br />

rises, which when combined with a weaker rupee,<br />

could generate second-round inflation effects.<br />

• This is against a backdrop of falling wholesale and<br />

core inflation, as well as soft activity indicators.<br />

• On a more positive note, ratings agency Fitch has<br />

upgraded <strong>India</strong>’s outlook to stable on an improved<br />

fiscal outcome and some progress on tackling<br />

structural problems in the economy.<br />

• Further cuts to the repo rate will depend on a more<br />

sustained decline in inflation: a more stable rupee, a<br />

contained current account deficit and a moderation in<br />

food price inflation.<br />

<strong>Policy</strong> Rates<br />

%ge<br />

CRR<br />

%ge<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Jun-05<br />

Dec-05<br />

Jun-06<br />

<strong>Policy</strong> Rates: Repo & Reverse Repo<br />

Repo<br />

Reverse Repo<br />

Dec-06<br />

Jun-07<br />

Dec-07<br />

Jun-08<br />

Dec-08<br />

Jun-09<br />

Dec-09<br />

Jun-10<br />

Dec-10<br />

Jun-11<br />

Cash Reserve Ratio<br />

Dec-11<br />

Jun-12<br />

Dec-12<br />

Jun-13<br />

3<br />

RBI’s Decision<br />

2<br />

1<br />

In its Mid quarter <strong>Monetary</strong> policy review, the RBI (Reserve Bank<br />

of <strong>India</strong>) held its benchmark Repo rate at 7.25%, and the Reverse<br />

Repo rate at 6.25%. The Repo rate is the rate at which the RBI<br />

lends to commercial banks for a short period in return for<br />

securities, and the Reverse Repo rate is the rate at which the RBI<br />

borrows from them. Moreover, it maintained the Cash Reserve<br />

Ratio (CRR) at 4% and the SLR (Statutory Liquidity Ratio) at<br />

23%. The CRR represents the proportion of net demand (e.g.<br />

current deposits) and time liabilities (e.g. fixed deposits) the<br />

scheduled commercial banks are required to maintain with the<br />

RBI. They don’t earn any interest on these reserves; the purpose<br />

is to ensure solvency and liquidity of the banking system. The<br />

SLR is typically used to expand or contract the rate of credit<br />

growth in the economy.<br />

The RBI has cut the Repo rate by a cumulative 125bps since<br />

March 2012. The most recent was a 25bps cut on the 3 rd of May,<br />

<strong>2013</strong>. The sharp decline in the <strong>India</strong>n Rupee, concerns about<br />

financing the large Current Account Deficit as well as upward<br />

pressures on food prices outweighed considerations about a soft<br />

economic situation at its most recent meeting.<br />

SLR<br />

0<br />

24.2<br />

24.0<br />

23.8<br />

23.6<br />

23.4<br />

23.2<br />

23.0<br />

22.8<br />

22.6<br />

22.4<br />

Jun-05<br />

22-Jul-11<br />

Dec-05<br />

30-Sep-11<br />

Jun-06<br />

Dec-06<br />

09-Dec-11<br />

Jun-07<br />

Dec-07<br />

Jun-08<br />

Dec-08<br />

SLR<br />

Growth and Production<br />

17-Feb-12<br />

27-Apr-12<br />

06-Jul-12<br />

The <strong>India</strong>n economy grew by 4.8% over the year to March quarter<br />

<strong>2013</strong>. For the 2012-13 financial year, it expanded by 5%: the<br />

lowest in a decade. Higher frequency indicators such as monthly<br />

partial indicators also remain soft. (Newly revised) Industrial<br />

production data revealed that Industrial production increased by a<br />

modest 2.3% over the year to April <strong>2013</strong>, somewhat weaker than<br />

Jun-09<br />

Dec-09<br />

14-Sep-12<br />

Jun-10<br />

23-Nov-12<br />

Dec-10<br />

Jun-11<br />

01-Feb-13<br />

Dec-11<br />

12-Apr-13<br />

Jun-12<br />

17-Jun-13<br />

Dec-12<br />

24.2<br />

24<br />

23.8<br />

23.6<br />

23.4<br />

23.2<br />

23<br />

22.8<br />

22.6<br />

22.4<br />

Jun-13<br />

National Australia Bank <strong>Research</strong> | 1

<strong>India</strong> Update 20 <strong>June</strong> <strong>2013</strong><br />

the 3.4% over the year to March <strong>2013</strong>. Mining was particularly<br />

weak once again, contracting by -3%; manufacturing was also<br />

muted, rising by 2.8%. One somewhat bright spot was the 4.2%<br />

rise in electricity production, the highest since January <strong>2013</strong>. By<br />

use, the volatile capital goods production showed a marked<br />

slowdown: increasing by 1% c.f. the 9% expansion in March. The<br />

RBI highlighted these figures as evidence of ‘damped investment<br />

demand’. Intermediate goods, a sort of leading indicator of<br />

downstream production, rose by 2.4%, in line with the overall<br />

average. Consumer goods production rose to 2.8% (from 1.8% in<br />

March), driven largely by an increase in production of nondurables.<br />

This could indicate a tentative improvement in<br />

consumer confidence, but it’s still way too early to say much<br />

definite with passenger car sales falling by -6.6% over the year to<br />

May <strong>2013</strong>.<br />

Prices<br />

Wholesale price inflation continued its downtrend in May: it rose<br />

by 4.7% over the year to May <strong>2013</strong>, below the 4.9% outcome<br />

recorded in April. Moreover, core inflation too trended lower: it<br />

increased by 2.5% over the year to May <strong>2013</strong>, well below recent<br />

outcomes. These results could indicate a lack of pricing power<br />

among <strong>India</strong>n businesses. However, prices remain elevated with<br />

respect to food (13.9%) and electricity (27.9%) as the<br />

Government allows an increase in cost recovery from electric<br />

utilities. In the food category, prices for cereals (rice, bajra and<br />

wheat) and protein based foods (fish and meat) remain<br />

particularly high.<br />

Headline and Core Inflation<br />

GDP<br />

12<br />

<strong>India</strong>n WPI: Core and Headline<br />

12<br />

Real GDP: Factor Cost<br />

10<br />

Headline<br />

Core<br />

8<br />

10<br />

6<br />

8<br />

4<br />

%ge YOY<br />

6<br />

4.8%<br />

2<br />

0<br />

4<br />

-2<br />

2<br />

0<br />

-4<br />

May-05<br />

Nov-05<br />

May-06<br />

Nov-06<br />

May-07<br />

Nov-07<br />

May-08<br />

Nov-08<br />

May-09<br />

Nov-09<br />

May-10<br />

Nov-10<br />

May-11<br />

Nov-11<br />

May-12<br />

Nov-12<br />

May-13<br />

Mar-08<br />

Sep-08<br />

Mar-09<br />

Sep-09<br />

Mar-10<br />

Sep-10<br />

Mar-11<br />

Sep-11<br />

Mar-12<br />

Sep-12<br />

Mar-13<br />

WPI Components<br />

Industrial Production: Sectoral<br />

Industrial Production: Sectoral<br />

30<br />

IP<br />

25<br />

Mfg<br />

Mining<br />

Electricity<br />

%ge YOY<br />

30.00<br />

25.00<br />

20.00<br />

<strong>India</strong>n WPI: Components<br />

Core<br />

Food<br />

Electricity<br />

20<br />

15.00<br />

15<br />

10.00<br />

%ge YOY<br />

10<br />

5<br />

5.00<br />

0.00<br />

0<br />

-5.00<br />

May-05<br />

Nov-05<br />

May-06<br />

Nov-06<br />

May-07<br />

Nov-07<br />

May-08<br />

Nov-08<br />

May-09<br />

Nov-09<br />

May-10<br />

Nov-10<br />

May-11<br />

Nov-11<br />

May-12<br />

Nov-12<br />

May-13<br />

-5<br />

-10<br />

-15<br />

Apr-07<br />

Oct-07<br />

Apr-08<br />

Oct-08<br />

Apr-09<br />

Oct-09<br />

Apr-10<br />

Oct-10<br />

Apr-11<br />

Oct-11<br />

Apr-12<br />

Industrial Production <strong>–</strong> Use Based<br />

Industrial Production: Use-Based<br />

Oct-12<br />

Apr-13<br />

Retail inflation (measured by the CPI) edged lower to 9.3%, the<br />

second successive month it has remained below 10%. The<br />

relatively higher weight for food in the CPI basket helps account<br />

for the differential between the WPI and CPI measures more<br />

broadly.<br />

WPI and CPI<br />

80<br />

60<br />

Basic<br />

Inter<br />

Capital<br />

Consumer<br />

%ge YOY<br />

18<br />

16<br />

WPI<br />

New CPI<br />

<strong>India</strong>n Inflation: WPI vs CPI<br />

40<br />

14<br />

12<br />

Industrial Workers<br />

CPI<br />

%ge YOY<br />

20<br />

10<br />

8<br />

0<br />

6<br />

4<br />

-20<br />

2<br />

0<br />

-2<br />

-40<br />

Apr-07<br />

Oct-07<br />

Apr-08<br />

Oct-08<br />

Apr-09<br />

Oct-09<br />

Apr-10<br />

Oct-10<br />

Apr-11<br />

Oct-11<br />

Apr-12<br />

Oct-12<br />

Apr-13<br />

May-05<br />

Nov-05<br />

May-06<br />

Nov-06<br />

May-07<br />

Nov-07<br />

May-08<br />

Nov-08<br />

Whilst the RBI would be encouraged by the moderation in<br />

wholesale and core inflation, it would like to see further downward<br />

pressure on food prices as well as consumer prices.<br />

May-09<br />

Nov-09<br />

May-10<br />

Nov-10<br />

May-11<br />

Nov-11<br />

May-12<br />

Nov-12<br />

May-13<br />

20 <strong>June</strong> <strong>2013</strong> National Australia Bank <strong>Research</strong> | 2

<strong>India</strong> Update 20 <strong>June</strong> <strong>2013</strong><br />

External Situation<br />

The RBI’s hand has been stayed primarily due to external events,<br />

the most notable being the sharp fall in the Rupee. Between 22 nd<br />

of May and the 11 th of <strong>June</strong> the rupee depreciated by 6%. It is<br />

currently trading around INR58/USD. Comments by the Federal<br />

Reserve Chairman, Ben Bernanke, about possibly ‘tapering’ the<br />

USD85 billion/month Quantitative Easing program has set off<br />

alarm bells in financial markets, triggering a sharp sell-off in<br />

emerging market currencies, including the <strong>India</strong>n Rupee.<br />

<strong>India</strong>n Rupee to US Dollar<br />

Current Account Deficit<br />

%ge<br />

15.0<br />

10.0<br />

5.0<br />

0.0<br />

-5.0<br />

-10.0<br />

Components of the Current Account: Ratio to GDP<br />

30<br />

INR/USD<br />

30<br />

-15.0<br />

Services<br />

Trade<br />

Transfers<br />

Income<br />

-20.0<br />

35<br />

35<br />

Jun-09<br />

Sep-09<br />

Dec-09<br />

Mar-10<br />

Jun-10<br />

Sep-10<br />

Dec-10<br />

Mar-11<br />

Jun-11<br />

Sep-11<br />

Dec-11<br />

Mar-12<br />

Jun-12<br />

Sep-12<br />

Dec-12<br />

40<br />

45<br />

50<br />

55<br />

Depreciation<br />

40<br />

45<br />

50<br />

55<br />

A significant development has been the decision by ratings<br />

agency, Fitch to upgrade <strong>India</strong>’s outlook to Stable from Negative.<br />

The contained fiscal deficit, as well as progress made in removing<br />

structural bottlenecks had been cited as Fitch as factors<br />

supporting the upgrade. Moreover, the Finance Minister, P<br />

Chidambaram is expected to announce measures around the end<br />

of <strong>June</strong> to spur foreign investor interest including relaxing limits on<br />

FDI participation in various sectors.<br />

60<br />

21-Jul-09<br />

11-Dec-09<br />

04-May-10<br />

22-Sep-10<br />

10-Feb-11<br />

A weakening rupee could generate import price inflation.<br />

Moreover, it could also weaken the allure of holding <strong>India</strong>n assets<br />

among overseas investors, as the Rupee depreciates and<br />

becomes more volatile. Foreign Institutional Investors have pulled<br />

out nearly USD3.8bn from the <strong>India</strong>n debt market during <strong>June</strong> 3-<br />

<strong>June</strong> 17. Were this trend to be sustained over a longer period, it<br />

could generate some problems as <strong>India</strong> has a high Current<br />

Account Deficit (CAD). The CAD came in at 6.7% of GDP during<br />

the December quarter, 2012. For the 2012-13 financial year, it is<br />

anticipated to be in excess of 5% of GDP.<br />

01-Jul-11<br />

25-Nov-11<br />

19-Apr-12<br />

07-Sep-12<br />

28-Jan-13<br />

18-Jun-13<br />

60<br />

Volatility Index<br />

%ge Index<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

Volatility: NIFTY VIX<br />

More recent trade data too hasn’t been very encouraging: <strong>India</strong>’s<br />

trade deficit in the month of May rose to USD20.1bn, up from<br />

USD17.8bn in April. It is expected that the trade and Current<br />

account position will gradually improve over the course of the<br />

<strong>2013</strong>-14 financial year. The main reason is the expected decline<br />

in gold imports due to policy changes by the Government and the<br />

RBI: import duties on gold have risen to 8%; it is more difficult for<br />

banks and trading houses to import gold; and there are<br />

restrictions on bank lending against gold.<br />

The significance of the high CAD and weakening rupee in<br />

determining the RBI’s decision can be summarised by the<br />

following comment by Duvvuri Subbarao, RBI’s Governor: ‘Shifts<br />

in global market sentiment can trigger sudden stop and reversal<br />

of capital from a broad swath of emerging markets, swiftly<br />

amplifying risks to the outlook. <strong>India</strong> is not an exception’.<br />

0<br />

18-Jul-11<br />

26-Sep-11<br />

05-Dec-11<br />

13-Feb-12<br />

23-Apr-12<br />

The <strong>India</strong> VIX (Volatility Index), an indicator of expected market<br />

volatility over the ensuring 30 days, rose in the aftermath of<br />

tensions in currency markets. It appears that some of the volatility<br />

has spilled over into equity markets. The index reached a high of<br />

19.49% on the 11 th of <strong>June</strong>, the day the <strong>India</strong>n rupee plunged to<br />

its lowest level. The index has since eased somewhat, but<br />

remains high relative to levels in the early part of <strong>2013</strong>.<br />

John Sharma<br />

Economist <strong>–</strong> Sovereign Risk<br />

john.sharma@nab.com.au<br />

Tom Taylor<br />

Head of International Economics<br />

02-Jul-12<br />

10-Sep-12<br />

19-Nov-12<br />

28-Jan-13<br />

08-Apr-13<br />

17-Jun-13<br />

Tom_Taylor@national.com.au<br />

20 <strong>June</strong> <strong>2013</strong> National Australia Bank <strong>Research</strong> | 3

<strong>India</strong> Update 20 <strong>June</strong> <strong>2013</strong><br />

Global Markets <strong>Research</strong><br />

Group Economics<br />

Peter Jolly<br />

Global Head of <strong>Research</strong><br />

+61 2 9237 1406<br />

Australia<br />

Economics<br />

Rob Henderson<br />

Chief Economist, Markets<br />

+61 2 9237 1836<br />

Spiros Papadopoulos<br />

Senior Economist<br />

+61 3 8641 0978<br />

David de Garis<br />

Senior Economist<br />

+61 3 8641 3045<br />

FX Strategy<br />

Ray Attrill<br />

Global Co-Head of FX Strategy<br />

+61 2 9237 1848<br />

Emma Lawson<br />

Senior Currency Strategist<br />

+61 2 9237 8154<br />

Interest Rate Strategy<br />

Skye Masters<br />

Head of Interest Rate Strategy<br />

+61 2 9295 1196<br />

Rodrigo Catril<br />

Interest Rate Strategist<br />

+61 2 9293 7109<br />

Credit <strong>Research</strong><br />

Michael Bush<br />

Head of Credit <strong>Research</strong><br />

+61 3 8641 0575<br />

Ken Hanton<br />

Senior Credit Analyst<br />

+61 2 9237 1405<br />

New Zealand<br />

Stephen Toplis<br />

Head of <strong>Research</strong>, NZ<br />

+64 4 474 6905<br />

Craig Ebert<br />

Senior Economist<br />

+64 4 474 6799<br />

Doug Steel<br />

Markets Economist<br />

+64 4 474 6923<br />

Mike Jones<br />

Currency Strategist<br />

+64 4 924 7652<br />

Kymberly Martin<br />

Strategist<br />

+64 4 924 7654<br />

UK/Europe<br />

Nick Parsons<br />

Head of <strong>Research</strong>, UK/Europe,<br />

and Global Co-Head of FX Strategy<br />

+ 44 207 710 2993<br />

Gavin Friend<br />

Markets Strategist<br />

+44 207 710 2155<br />

Tom Vosa<br />

Head of Market Economics<br />

+44 207 710 1573<br />

Simon Ballard<br />

Senior Credit Strategist<br />

+44 207 710 2917<br />

Derek Allassani<br />

<strong>Research</strong> Production Manager<br />

+44 207 710 1532<br />

Alan Oster<br />

Group Chief Economist<br />

+61 3 8634 2927<br />

Tom Taylor<br />

Head of Economics, International<br />

+61 3 8634 1883<br />

Rob Brooker<br />

Head of Australian Economics<br />

+61 3 8634 1663<br />

Alexandra Knight<br />

Economist <strong>–</strong> Australia<br />

+(61 3) 9208 8035<br />

Vyanne Lai<br />

Economist <strong>–</strong> Agribusiness<br />

+(61 3) 8634 0198<br />

Dean Pearson<br />

Head of Industry Analysis<br />

+(61 3) 8634 2331<br />

Robert De Iure<br />

Senior Economist <strong>–</strong> Property<br />

+(61 3) 8634 4611<br />

Brien McDonald<br />

Economist <strong>–</strong> Industry Analysis<br />

+(61 3) 8634 3837<br />

Gerard Burg<br />

Economist <strong>–</strong> Industry Analysis<br />

+(61 3) 8634 2778<br />

John Sharma<br />

Economist <strong>–</strong> Sovereign Risk<br />

+(61 3) 8634 4514<br />

James Glenn<br />

Economist <strong>–</strong> Asia<br />

+(61 3) 9208 8129<br />

Tony Kelly<br />

Economist <strong>–</strong> International<br />

+(61 3) 9208 5049<br />

Equities<br />

Peter Cashmore<br />

Senior Real Estate Equity Analyst<br />

+61 2 9237 8156<br />

Jenny Khamphet<br />

Senior Real Estate Equity Analyst<br />

+61 2 9237 9538<br />

Important Notice<br />

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice<br />

contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting<br />

on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances. NAB<br />

recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making<br />

any decision about a product including whether to acquire or to continue to hold it.<br />

20 <strong>June</strong> <strong>2013</strong> National Australia Bank <strong>Research</strong> | 4

<strong>India</strong> Update 20 <strong>June</strong> <strong>2013</strong><br />

Important Notices<br />

Disclaimer: This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice contained<br />

in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this<br />

document, NAB recommends that you consider whether the advice is appropriate for your circumstances. NAB recommends that you obtain and<br />

consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to<br />

acquire or to continue to hold it. Products are issued by NAB unless otherwise specified.<br />

So far as laws and regulatory requirements permit, NAB, its related companies, associated entities and any officer, employee, agent, adviser or<br />

contractor thereof (the "NAB Group") does not warrant or represent that the information, recommendations, opinions or conclusions contained in this<br />

document ("Information") is accurate, reliable, complete or current. The Information is indicative and prepared for information purposes only and does<br />

not purport to contain all matters relevant to any particular investment or financial instrument. The Information is not intended to be relied upon and in<br />

all cases anyone proposing to use the Information should independently verify and check its accuracy, completeness, reliability and suitability obtain<br />

appropriate professional advice. The Information is not intended to create any legal or fiduciary relationship and nothing contained in this document will<br />

be considered an invitation to engage in business, a recommendation, guidance, invitation, inducement, proposal, advice or solicitation to provide<br />

investment, financial or banking services or an invitation to engage in business or invest, buy, sell or deal in any securities or other financial<br />

instruments.<br />

The Information is subject to change without notice, but the NAB Group shall not be under any duty to update or correct it. All statements as to future<br />

matters are not guaranteed to be accurate and any statements as to past performance do not represent future performance.<br />

The NAB Group takes various positions and/or roles in relation to financial products and services, and (subject to NAB policies) may hold a position or<br />

act as a price-maker in the financial instruments of any company or issuer discussed within this document, or act and receive fees as an underwriter,<br />

placement agent, adviser, broker or lender to such company or issuer. The NAB Group may transact, for its own account or for the account of any<br />

client(s), the securities of or other financial instruments relating to any company or issuer described in the Information, including in a manner that is<br />

inconsistent with or contrary to the Information.<br />

Subject to any terms implied by law and which cannot be excluded, the NAB Group shall not be liable for any errors, omissions, defects or<br />

misrepresentations in the Information (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether<br />

direct or indirect) suffered by persons who use or rely on the Information. If any law prohibits the exclusion of such liability, the NAB Group limits its<br />

liability to the re-supply of the Information, provided that such limitation is permitted by law and is fair and reasonable.<br />

This document is intended for clients of the NAB Group only and may not be reproduced or distributed without the consent of NAB. The Information is<br />

governed by, and is to be construed in accordance with, the laws in force in the State of Victoria, Australia.<br />

Analyst Disclaimer: The Information accurately reflects the personal views of the author(s) about the securities, issuers and other subject matters<br />

discussed, and is based upon sources reasonably believed to be reliable and accurate. The views of the author(s) do not necessarily reflect the views<br />

of the NAB Group. No part of the compensation of the author(s) was, is, or will be, directly or indirectly, related to any specific recommendations or<br />

views expressed. <strong>Research</strong> analysts responsible for this report receive compensation based upon, among other factors, the overall profitability of the<br />

Global Markets Division of NAB.<br />

United Kingdom: If this document is distributed in the United Kingdom, such distribution is by National Australia Bank Limited, 88 Wood Street,<br />

London EC2V 7QQ. Registered in England BR1924. Head Office: 800 Bourke Street, Docklands, Victoria, 3008. Incorporated with limited liability in<br />

the State of Victoria, Australia. Authorised and regulated by the Australian Prudential Regulation Authority. Authorised in the UK by the Prudential<br />

Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority.<br />

Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request.<br />

USA: If this document is distributed in the United States, such distribution is by nabSecurities, LLC. This document is not intended as an offer or<br />

solicitation for the purchase or sale of any securities, financial instrument or product or to provide financial services. It is not the intention of<br />

nabSecurities to create legal relations on the basis of information provided herein.<br />

Hong Kong: In Hong Kong this document is for distribution only to "professional investors" within the meaning of Schedule 1 to the Securities and<br />

Futures Ordinance (Cap. 571, Laws of Hong Kong) ("SFO") and any rules made thereunder and may not be redistributed in whole or in part in Hong<br />

Kong to any person. Issued by National Australia Bank Limited, a licensed bank under the Banking Ordinance (Cap. 155, Laws of Hong Kong) and a<br />

registered institution under the SFO (central entity number: AAO169).<br />

New Zealand: This publication has been provided for general information only. Although every effort has been made to ensure this publication is<br />

accurate the contents should not be relied upon or used as a basis for entering into any products described in this publication. To the extent that any<br />

information or recommendations in this publication constitute financial advice, they do not take into account any person’s particular financial situation<br />

or goals. Bank of New Zealand strongly recommends readers seek independent legal/financial advice prior to acting in relation to any of the matters<br />

discussed in this publication. Neither Bank of New Zealand nor any person involved in this publication accepts any liability for any loss or damage<br />

whatsoever may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise,<br />

contained in this publication. National Australia Bank Limited is not a registered bank in New Zealand.<br />

Japan: National Australia Bank Ltd. has no license of securities-related business in Japan. Therefore, this document is only for your information<br />

purpose and is not intended as an offer or solicitation for the purchase or sale of the securities described herein or for any other action.<br />

20 <strong>June</strong> <strong>2013</strong> National Australia Bank <strong>Research</strong> | 5