Nab Online Retail Sales Index - Business Research and Insights ...

Nab Online Retail Sales Index - Business Research and Insights ...

Nab Online Retail Sales Index - Business Research and Insights ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NAB <strong>Online</strong> <strong>Retail</strong> <strong>Sales</strong> <strong>Index</strong><br />

Indepth report – October 2012<br />

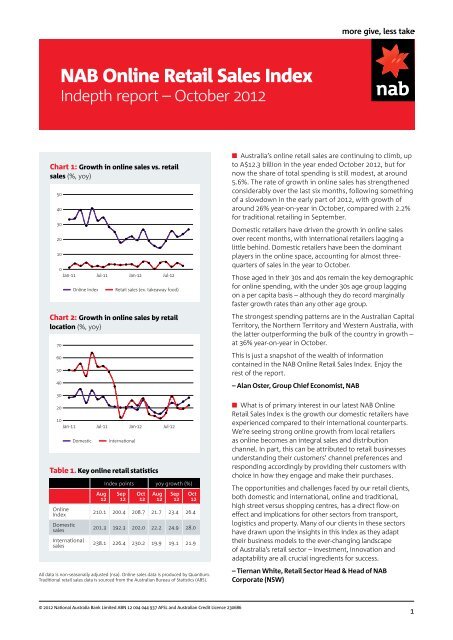

Chart 1: Growth in online sales vs. retail<br />

sales (%, yoy)<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Jan-11 Jul-11 Jan-12 Jul-12<br />

<strong>Online</strong> <strong>Index</strong><br />

<strong>Retail</strong> sales (ex. takeaway food)<br />

Chart 2: Growth in online sales by retail<br />

location (%, yoy)<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

Jan-11 Jul-11 Jan-12 Jul-12<br />

Domestic<br />

International<br />

Table 1. Key online retail statistics<br />

<strong>Online</strong><br />

<strong>Index</strong><br />

Domestic<br />

sales<br />

International<br />

sales<br />

Aug<br />

12<br />

<strong>Index</strong> points yoy growth (%)<br />

Sep<br />

12<br />

Oct<br />

12 Aug<br />

12<br />

Sep<br />

12<br />

© 2012 National Australia Bank Limited ABN 12 004 044 937 AFSL <strong>and</strong> Australian Credit Licence 230686<br />

Oct<br />

12<br />

210.1 200.4 208.7 21.7 23.4 26.4<br />

201.3 192.3 202.0 22.2 24.9 28.0<br />

238.1 226.4 230.2 19.9 19.1 21.9<br />

All data is non-seasonally adjusted (nsa). <strong>Online</strong> sales data is produced by Quantium.<br />

Traditional retail sales data is sourced from the Australian Bureau of Statistics (ABS).<br />

n Australia’s online retail sales are continuing to climb, up<br />

to A$12.3 billion in the year ended October 2012, but for<br />

now the share of total spending is still modest, at around<br />

5.6%. The rate of growth in online sales has strengthened<br />

considerably over the last six months, following something<br />

of a slowdown in the early part of 2012, with growth of<br />

around 26% year-on-year in October, compared with 2.2%<br />

for traditional retailing in September.<br />

Domestic retailers have driven the growth in online sales<br />

over recent months, with international retailers lagging a<br />

little behind. Domestic retailers have been the dominant<br />

players in the online space, accounting for almost threequarters<br />

of sales in the year to October.<br />

Those aged in their 30s <strong>and</strong> 40s remain the key demographic<br />

for online spending, with the under 30s age group lagging<br />

on a per capita basis – although they do record marginally<br />

faster growth rates than any other age group.<br />

The strongest spending patterns are in the Australian Capital<br />

Territory, the Northern Territory <strong>and</strong> Western Australia, with<br />

the latter outperforming the bulk of the country in growth –<br />

at 36% year-on-year in October.<br />

This is just a snapshot of the wealth of information<br />

contained in the NAB <strong>Online</strong> <strong>Retail</strong> <strong>Sales</strong> <strong>Index</strong>. Enjoy the<br />

rest of the report.<br />

– Alan Oster, Group Chief Economist, NAB<br />

n What is of primary interest in our latest NAB <strong>Online</strong><br />

<strong>Retail</strong> <strong>Sales</strong> <strong>Index</strong> is the growth our domestic retailers have<br />

experienced compared to their international counterparts.<br />

We’re seeing strong online growth from local retailers<br />

as online becomes an integral sales <strong>and</strong> distribution<br />

channel. In part, this can be attributed to retail businesses<br />

underst<strong>and</strong>ing their customers’ channel preferences <strong>and</strong><br />

responding accordingly by providing their customers with<br />

choice in how they engage <strong>and</strong> make their purchases.<br />

The opportunities <strong>and</strong> challenges faced by our retail clients,<br />

both domestic <strong>and</strong> international, online <strong>and</strong> traditional,<br />

high street versus shopping centres, has a direct flow-on<br />

effect <strong>and</strong> implications for other sectors from transport,<br />

logistics <strong>and</strong> property. Many of our clients in these sectors<br />

have drawn upon the insights in this <strong>Index</strong> as they adapt<br />

their business models to the ever-changing l<strong>and</strong>scape<br />

of Australia’s retail sector – investment, innovation <strong>and</strong><br />

adaptability are all crucial ingredients for success.<br />

– Tiernan White, <strong>Retail</strong> Sector Head & Head of NAB<br />

Corporate (NSW)<br />

1

NAB <strong>Online</strong> <strong>Retail</strong> <strong>Sales</strong> <strong>Index</strong><br />

2<br />

At a glance<br />

Traditional vs online (nsa, October yoy)<br />

Growth in traditional<br />

retail sales (September)<br />

5.6%<br />

2.2%<br />

Growth in online<br />

retail sales<br />

26%<br />

<strong>Online</strong> purchases hit A$12.3bn or<br />

5.6% of the size of traditional retailing<br />

Share of total online spend by sector <strong>and</strong> age group<br />

Share of spend (%)<br />

All<br />

ages<br />

<strong>Online</strong> <strong>Retail</strong> <strong>Sales</strong> <strong>Index</strong><br />

continues to trend higher<br />

The NAB <strong>Online</strong> <strong>Retail</strong> <strong>Sales</strong> <strong>Index</strong> has continued<br />

to trend upwards in recent months, to 209 points<br />

in October 2012 (chart 3).<br />

During the 12 months to October 2012, Australia’s<br />

online retail spending totalled around A$12.3 billion.<br />

When compared with traditional bricks & mortar<br />

retail sales, the level of online spending remains<br />

quite modest. For the year to September 2012,<br />

traditional retail sales* totalled A$221 billion –<br />

indicating that online sales are equivalent to<br />

around 5.6% of the traditional sector.<br />

As detailed on page 4, the composition of<br />

traditional <strong>and</strong> online retail sales differs notably.<br />

When food & beverages are excluded from both<br />

series, online retail sales increases to almost 9.1%<br />

of total non-food spending (up from 8.7% in July).<br />

<strong>Online</strong> sales record a pickup<br />

in growth rates – up 26% yoy<br />

in October<br />

The rate of growth in online sales has strengthened<br />

considerably over the last six months, following a<br />

slowdown in the early part of 2012.<br />

In October, online retail sales grew by around 26%<br />

year-on-year, compared with the low point of just<br />

14% year-on-year in May (chart 4).<br />

Growth rates for the traditional retail sector are<br />

far more modest – coming off a considerably larger<br />

base – with an increase of 2.2% year-on-year in<br />

September (on a non-seasonally adjusted basis).<br />

When seasonal factors are included, growth rates<br />

for the traditional sector have eased slightly in<br />

recent months, back to around 3% year-on-year<br />

in October.<br />

* Traditional retail sales exclude cafés, restaurants <strong>and</strong> takeaway food to create a<br />

like-for-like comparison.<br />

Chart 3: <strong>Online</strong> index vs. retail sales<br />

(nsa, monthly)<br />

240<br />

200<br />

160<br />

120<br />

80<br />

Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12<br />

50<br />

40<br />

30<br />

20<br />

10<br />

<strong>Online</strong> <strong>Index</strong><br />

ABS retail sales (ex. takeaway food)<br />

Chart 4: Growth in online sales vs. retail<br />

sales (%, yoy)<br />

0<br />

Jan-11 Jul-11 Jan-12 Jul-12<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

<strong>Online</strong> <strong>Index</strong><br />

<strong>Retail</strong> sales (ex. takeaway food)<br />

Chart 5: Growth in online sales by retail<br />

location (%, yoy)<br />

10<br />

Jan-11 Jul-11 Jan-12 Jul-12<br />

Domestic<br />

Indepth report – October 2012<br />

International<br />

3

NAB <strong>Online</strong> <strong>Retail</strong> <strong>Sales</strong> <strong>Index</strong><br />

4<br />

Chart 6: <strong>Online</strong> index by retail location<br />

(nsa, monthly)<br />

240<br />

200<br />

160<br />

120<br />

80<br />

Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12<br />

0.80<br />

0.75<br />

0.70<br />

0.65<br />

Domestic<br />

International<br />

Chart 7: Share of online sales by retail<br />

location (nsa, monthly)<br />

0.60<br />

Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12<br />

Domestic (LHS)<br />

International (RHS)<br />

Chart 8: <strong>Online</strong> index by category<br />

(nsa, monthly)<br />

240<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12<br />

Sector 1 Sector 2 Sector 3 Sector 4<br />

0.40<br />

0.35<br />

0.30<br />

0.25<br />

0.20<br />

Domestic retailers driving<br />

growth, with international<br />

marginally softer<br />

Recent months have seen a steady increase in the<br />

growth rates for domestic sales, while international<br />

online retail sales have lagged marginally. This is in<br />

contrast to the period between November 2011 <strong>and</strong><br />

July 2012, when there was a close relationship between<br />

the two series (chart 5).<br />

Domestic sales increased by 28% year-on-year in<br />

October 2012, while international sales increased<br />

by 22% year-on-year.<br />

As we have previously noted, the large divergence<br />

in growth rates in the first half of 2011 was related<br />

to a one-off surge in international sales in late 2010.<br />

International index more volatile in<br />

2012, <strong>and</strong> a little softer since August<br />

The international index has been far more volatile over<br />

the last six months – reflecting the relatively subdued<br />

growth rates for most of this period (compared with<br />

domestic), along with the spike in growth in July.<br />

Since August, the trend for international sales has been<br />

comparatively softer. The international index was at 230<br />

points in October, compared with 202 points for the<br />

domestic sales index (chart 6).<br />

Domestic retailers continue to<br />

control the majority of sales<br />

Domestic retailers – defined in our index as those that<br />

are Australian for tax purposes – control the majority<br />

of online retail sales in Australia. From late 2010, the<br />

share of domestic sales has trended around 73%,<br />

reflecting the similar trends in growth rates for both<br />

series (chart 7). In recent months, it has edged slightly<br />

higher – to 74%.<br />

“Traditional toy sale peaks for<br />

discount department stores are now<br />

mirrored in their online trade.”<br />

Tony Davis, Quantium

Growth in Toys & Media has slowed<br />

significantly, while Household<br />

Goods & Electronics lags<br />

Share of total spend in 12 months to October 2012<br />

% Sector 1. <strong>Online</strong> Auctions, Department<br />

48 Stores, Fashion, Cosmetics, Variety Stores.<br />

% Sector 2. Home, Furniture, Appliances,<br />

19 Electronics.<br />

% Sector 3. Recreation, Toys, Games &<br />

21 Hobbies, Music, Movies, Books.<br />

% Sector 4. Groceries, Liquor &<br />

13 Specialised Food.<br />

Note: Totals may not sum to 100% due to rounding<br />

We continue to observe some divergent trends between<br />

the individual categories of online sales (chart 8).<br />

Growth rates for Sectors 1 (Auctions, Department Stores<br />

& Fashion), 3 (Toys & Media) <strong>and</strong> 4 (Food & Beverages)<br />

have exhibited relatively low levels of volatility over the<br />

last year – ranging between 15% <strong>and</strong> 35% year-on-year.<br />

In contrast, Sector 2 (Household Goods & Electronics)<br />

has been far more volatile – with this sector recording<br />

year-on-year declines in individual months over the past<br />

year (chart 9).<br />

Compared with somewhat divergent trends in 2011,<br />

there has been a convergence in the growth rates for<br />

Sectors 1, 3 <strong>and</strong> 4, with Sector 3 recording the most<br />

significant slow down. For the first half of 2011, this<br />

sector recorded the strongest rates of growth, before<br />

slowing sharply in October 2011.<br />

By age group, there remain some notable differences<br />

in spending by category – with the under 30s having<br />

a larger than average share of spending in Sectors 1<br />

<strong>and</strong> 3, while being notably below average in Sector 4.<br />

The profiles for those aged in their 30s, 40s <strong>and</strong> 50s<br />

are closer to the national average, while those aged 60<br />

<strong>and</strong> over have a larger than average spend in Sector 4<br />

(infographic page 2).<br />

60<br />

40<br />

20<br />

0<br />

Indepth report – October 2012<br />

Chart 9: <strong>Online</strong> index growth by category<br />

(%, yoy)<br />

-20<br />

Jan-11 Jul-11 Jan-12 Jul-12<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Sector 1 Sector 2 Sector 3 Sector 4<br />

Chart 10: Share of spending by age group<br />

(year to October 2012)<br />

Under<br />

30<br />

30s 40s 50s 60+ Under<br />

30<br />

Under 30 consists of of ages 18 18 to to 30.<br />

30s 40s 50s 60+<br />

Share of spend (%) Per capita (index)<br />

Chart 11: Growth of spending by age group<br />

(%, yoy)<br />

60<br />

40<br />

20<br />

0<br />

Jan-11 Jul-11 Jan-12 Jul-12<br />

Under 30 30s 40s 50s 60+<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

5

NAB <strong>Online</strong> <strong>Retail</strong> <strong>Sales</strong> <strong>Index</strong><br />

6<br />

Chart 12: Share of spending by state<br />

(year to October 2012)<br />

40<br />

30<br />

20<br />

10<br />

0<br />

NSW<br />

VIC<br />

QLD<br />

WA<br />

SA<br />

TAS<br />

ACT<br />

NT<br />

NSW<br />

VIC<br />

QLD<br />

WA<br />

SA<br />

TAS<br />

ACT<br />

NT<br />

Share of spend (%) Per capita (index)<br />

Chart 13: Growth of spending by state<br />

(%, yoy)<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Nov-11 Apr-12 Sep-12<br />

WA NT QLD SA<br />

Chart 13B: Growth of spending by state<br />

(%, yoy)<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Nov-11 Apr-12 Sep-12<br />

VIC NSW TAS ACT<br />

140<br />

120<br />

100<br />

80<br />

60<br />

Per capita spending remains<br />

dominated by the 30s <strong>and</strong> 40s<br />

The share of spending by age group has<br />

remained quite stable since we commenced tracking<br />

online retail sales. In an absolute sense, those in their<br />

40s <strong>and</strong> younger account for the majority of sales – at<br />

around 23% for each group in the year to October<br />

2012 (chart 10). However, on a per capita basis, the<br />

bulk of spending is recorded among those in their 30s<br />

<strong>and</strong> 40s – with the under 30s age group recording<br />

below average spending – likely a reflection of their<br />

relative lack of purchasing power.<br />

Compared with some notable divergence in growth<br />

rates in 2011, trends in growth rates by age group have<br />

been much more uniform over the last year – although<br />

the under 30s have recorded marginally stronger<br />

growth rates than other age groups for much of this<br />

time (chart 11).<br />

Per capita spending strongest<br />

in the ACT, NT <strong>and</strong> WA<br />

At a state level, online spending is dominated by the<br />

largest states – with New South Wales (NSW), Victoria<br />

(VIC) <strong>and</strong> Queensl<strong>and</strong> (QLD) accounting for 76% of<br />

total online retail spending (chart 12). However, on<br />

a per capita basis, the ACT has the strongest level of<br />

spending, followed by the Northern Territory (NT) <strong>and</strong><br />

Western Australia (WA).<br />

Growth trends for NSW, VIC, South Australia (SA) <strong>and</strong><br />

the ACT have been relatively uniform in 2012 – <strong>and</strong><br />

in line with the national average (chart 13). Generally,<br />

growth has been marginally stronger in QLD <strong>and</strong> also<br />

stronger than average in the NT – although these<br />

rates have been highly volatile, due in part to the<br />

small population. In terms of growth, WA continues to<br />

outperform the bulk of the country – at 36% year-onyear<br />

in October.<br />

“The Group Buying sector of online<br />

continues to see rapid decline, but<br />

we are bound to see other new<br />

online formats emerge in 2012.”<br />

Tony Davis, Quantium

Regional Western Australia<br />

strongly above average in per<br />

capita spending<br />

Regional Australia continues to record stronger<br />

growth rates for online spending than its<br />

metropolitan peers – resulting in a gradually<br />

diminishing distinction between the two groups on<br />

a per capita basis (chart 14). Metropolitan residents<br />

account for the majority of total spending – 71% in<br />

the year to October 2012 – but the per capita share<br />

for this period dipped to 102.3 points (compared<br />

with 102.5 points in July).<br />

Trends in the metropolitan/regional split remain<br />

divergent around the country – with the spending<br />

of regional WA continuing to increase – up to 126<br />

points (previously 123) – <strong>and</strong> regional spending<br />

outpacing metropolitan WA.<br />

In October 2012, regional sales increased by 30%<br />

year-on-year, compared with 25% year-on-year for<br />

metropolitan sales. Growth rates were higher in<br />

regional WA – at around 45% year-on-year (chart 15).<br />

Trends for the under 30s softer<br />

in WA – likely lacking mining<br />

revenue<br />

While growth in WA online spending has been<br />

considerably stronger than the national average,<br />

there have been notable divergences by age group<br />

(chart 16).<br />

Among the under 30s, there is relatively little<br />

distinction in the year-on-year growth rates over<br />

the last year between WA <strong>and</strong> the rest of the<br />

country. Under 30s in WA recorded average growth<br />

rates of 28% over the last year, against 23% for<br />

Australia excluding WA. On average, under 30s<br />

in WA are less likely to benefit from high mining<br />

incomes – either lacking the qualifications or<br />

experience of older age groups.<br />

Growth rates diverge with the other age groups, as<br />

the under 30s has the lowest growth rate in WA, but<br />

the highest overall for the rest of Australia. n<br />

Chart 14: Share of spending by region<br />

(year to October 2012)<br />

130<br />

120<br />

110<br />

100<br />

90<br />

80<br />

50<br />

40<br />

30<br />

20<br />

WA NSW* AUS QLD VIC Other<br />

Metro (per capita)<br />

Regional (per capita)<br />

Chart 15: Growth of spending by region<br />

(%, yoy)<br />

10<br />

Jan-11 Jul-11 Jan-12 Jul-12<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Indepth report – October 2012<br />

*Note: Metropolitan NSW includes the ACT in this series.<br />

Metro Regional<br />

Chart 16: Average annual growth rate by<br />

age group (% yoy)<br />

To discuss this report in more detail please speak with your<br />

NAB Relationship Manager, visit nab.com.au/onlineretailsales or contact:<br />

Alan Oster<br />

Group Chief Economist<br />

National Australia Bank<br />

+61 (0) 3 8634 2927<br />

Alan.Oster@nab.com.au<br />

Important notice.<br />

Tiernan White<br />

<strong>Retail</strong> Sector Head & Head of<br />

NAB Corporate NSW/ACT<br />

+61 (0) 2 9237 1041<br />

Tiernan.White@nab.com.au<br />

DISCLAIMER: While care has been taken in preparing this material,] National Australia Bank Limited (ABN 12 004 044 937) does not warrant or represent that<br />

the information, recommendations, opinions or conclusions contained in this document (“Information”) are accurate, reliable, complete or current. The<br />

Information has been prepared for dissemination to professional investors for information purposes only <strong>and</strong> any statements as to past performance do not<br />

represent future performance. The Information does not purport to contain all matters relevant to any particular investment or financial instrument <strong>and</strong> all<br />

statements as to future matters are not guaranteed to be accurate. In all cases, anyone proposing to rely on or use the Information should independently<br />

verify <strong>and</strong> check the accuracy, completeness, reliability <strong>and</strong> suitability of the Information <strong>and</strong> should obtain independent <strong>and</strong> specific advice from appropriate<br />

professionals or experts.<br />

To the extent permissible by law, the National shall not be liable for any errors, omissions, defects or misrepresentations in the Information or for any loss<br />

or damage suffered by persons who use or rely on such Information (including by reasons of negligence, negligent misstatement or otherwise). If any law<br />

prohibits the exclusion of such liability, the National limits its liability to the re-supply of the Information, provided that such limitation is permitted by law<br />

<strong>and</strong> is fair <strong>and</strong> reasonable. The National, its affiliates <strong>and</strong> employees may hold a position or act as a price maker in the financial instruments of any issuer<br />

discussed within this document or act as an underwriter, placement agent, adviser or lender to such issuer.<br />

UK Disclaimer: So far as the law <strong>and</strong> the FSA Rules allow, National Australia Bank Limited (“the Bank”) disclaims any warranty or representation as to the<br />

accuracy or reliability of the information <strong>and</strong> statements in this document. The Bank will not be liable (whether in negligence or otherwise) for any loss<br />

or damage suffered from relying on this document. This document does not purport to contain all relevant information. Recipients should not rely on its<br />

contents but should make their own assessment <strong>and</strong> seek professional advice relevant to their circumstances. The Bank may have proprietary positions in<br />

the products described in this document. This document is for information purposes only, is not intended as an offer or solicitation nor is it the intention of<br />

the Bank to create legal relations on the basis of the information contained in it. No part of this document may be reproduced without the prior permission<br />

of the Bank. This document is intended for Investment Professionals (as such term is defined in The Financial Services <strong>and</strong> Markets Act 2000 (Financial<br />

Promotion) Order 2001) <strong>and</strong> should not be passed to any other person who would be defined as a private customer by the rules of the Financial Services<br />

Authority (“FSA”) in the UK or to any person who may not have experience of such matters. Issued by National Australia Bank Limited A.C.N. 004 044 937, 88<br />

Wood Street, London EC2V 7QQ. Registered in Engl<strong>and</strong> BR1924. Head Office: 500 Bourke Street, Melbourne, Victoria. Incorporated with limited liability in the<br />

state of Victoria, Australia. Regulated by the FSA in the UK.<br />

U.S DISCLAIMER: This information has been prepared by National Australia Bank Limited or one of its affiliates or subsidiaries (“NAB”). If it is distributed in<br />

the United States, such distribution is by nabSecurities, LLC which accepts responsibility for its contents. Any U.S. person receiving this information wishes<br />

further information or desires to effect transactions in any securities described herein should call or write to nabSecurities, LLC, 28th Floor, 245 Park Avenue,<br />

New York, NY 10167 (or call (877) 377-5480). The information contained herein has been obtained from, <strong>and</strong> any opinions herein are based upon, sources<br />

believed to be reliable <strong>and</strong> no guarantees, representations or warranties are made as to its accuracy, completeness or suitability for any purpose. Any opinions<br />

or estimates expressed in this information is our current opinion as of the date of this report <strong>and</strong> is subject to change without notice. The principals of<br />

nabSecurities, LLC or NAB may have a long or short position or may transact in the securities referred to herein or hold or transact derivative instruments,<br />

including options, warrants or rights with securities, or may act as a market maker in the securities discussed herein <strong>and</strong> may sell such securities to or buy<br />

from customers on a principal basis. This material is not intended as an offer or solicitation for the purchase or sale of the securities described herein or for<br />

any other action. It is intended for the information of clients only <strong>and</strong> is not for publication in the press or elsewhere.<br />

© 2012 National Australia Bank Limited ABN 12 004 044 937 AFSL <strong>and</strong> Australian Credit Licence 230686<br />

Tony Davis<br />

Director<br />

Quantium<br />

+61 (0) 2 9292 6400<br />

Tony.Davis@quantium.com.au<br />

About Quantium<br />

Quantium is Australia’s leading data analytics <strong>and</strong> marketing strategy firm. Quantium has worked<br />

with NAB for more than 4 years, assessing de-identified transaction data to derive insights, trends <strong>and</strong><br />

shopping habits of different customer groups. The resulting analysis forms Market Blueprint <strong>and</strong> is<br />

used by NAB <strong>and</strong> other businesses to drive innovation <strong>and</strong> business performance through customer,<br />

distribution <strong>and</strong> marketing strategies. www.quantium.com.au